KEY POINTS:

- Oil rises on OPEC+ optimism

- OPEC+ talks to resume alongside reported progress

- Fed’s Kaplan leans against changing bond buying program

- US ISM-services likely weakened

- US jobless claims to further inform trend

- Light overnight releases

TODAY’S NORTH AMERICAN MARKETS

The resumption of OPEC+ talks and a pair of US labour market readings will be the main focal points overnight through tomorrow alongside whatever fresh spin on close-but-far Brexit headlines and far-but-talking-again US stimulus headlines we may get. There may have been progress in the oil talks as Russia has apparently agreed to taper the production cuts through Q1. That popped oil a bit higher today, but it remains unclear whether broader agreement will be achieved in the postponed meeting.

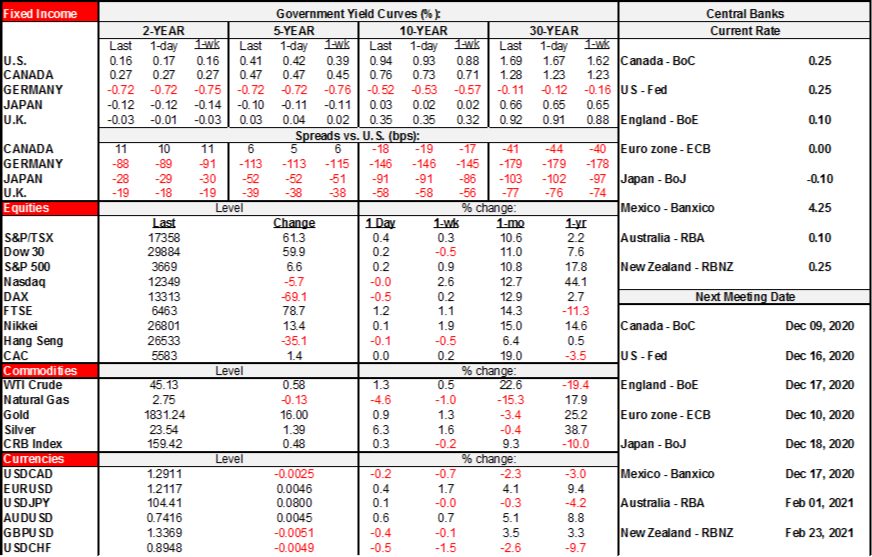

- Stocks were mixed to close North American and European sessions. The S&P500 was up a smidge along with the DJIA as the Nasdaq exchange was flat. Toronto closed ¼% higher with diversified gains except for GICS like industrials (12% weight), utilities (5%) and real estate (3%). European indices saw London close 1¼% higher alongside sterling weakness, but mixed results across other exchanges.

- Sovereign curves bear steepened led by the long-ends in N.A. as US 30s were up 2bps and Canada’s 30 year bond was up 4bps.

- Oil prices were up by about 1½% on OPEC+ optimism.

- The USD very slightly depreciated but mostly against currencies not named sterling. The A$, euro, CAD and Mexican peso were among the leaders.

Dallas Fed President Kaplan (voting 2020) stated today that he does not favour increasing bond buying or changing the composition of purchases at the December 16th meeting. He reasoned that it wouldn’t help address risks in the next 3–6 months while the outlook beyond that has improved. His full quotes are worth considering:

“When you have this kind of situation, where you’ve got a three- to six-month issue, but over the horizon we expect strong growth—I think dealing with that may be more suited to fiscal policy. I don’t know that increasing the size or extending maturities of our bond purchases would help address the situation I’m concerned about in the next three to six months. I would not want to do that at this point. I’ll go into the December meeting with an open mind but I think we’ve got very accommodative financial conditions.”

Fed Chair Powell did not broach the topic in his second round of testimony today. Other recent FOMC speakers like St. Louis President Bullard (nonvoting 2020) also remarked about a week ago that “I do think we have a robust program in place right now and I don’t see any reason to change it.” Around that same time, NY Fed President Williams emphasized that financial conditions “are quite favourable.” In general, the comments back the tone of the remarks in the minutes to the November meeting that stated ““While participants judged that immediate adjustments to the pace and composition of asset purchases were not necessary, they recognized that circumstances could shift to warrant such adjustments.”

OVERNIGHT MARKETS

Overnight macro reports will be light and include the following:

- China’s private Caixin services and composite PMIs for November (8:45pmET).

- India PMIs for November likely face downside risk (12amET). The already released manufacturing PMI fell by 2.6 points to a still expansionary 56.3. The services PMI will probably follow suit.

- Eurozone PMI revisions for November will incorporate Spanish and Italian readings (4amET).

- Eurozone retail sales for October (5amET) may face upside risk to earlier consensus expectations for a 0.7% m/m gain given we already know that some countries posted better than expected results such as Germany.

TOMORROW’S NORTH AMERICAN MARKETS

The resumption of OPEC+ talks at about 8amET and a pair of US labour market readings will be the main focal points alongside whatever fresh spin on close-but-far Brexit headlines and far-but-talking-again US stimulus headlines we may get. There may have been progress in the oil talks as Russia has apparently agreed to taper the production cuts through Q1. That popped oil a bit higher today but it remains unclear whether broader agreement will be achieved in the postponed meeting.

US ISM-services for November (10amET) is expected to soften as the so-called stringency index of COVID-19 measures tightened over the past few weeks. Weekly initial jobless claims (8:30amET) won’t really matter to nonfarm expectations given they will cover last week and hence after the November reference period, but any deviation from the stalled trend over the past five weeks or so could be informative.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.