KEY POINTS:

- Headline rollercoaster ends with equities flat

- Bring on nonfarm payrolls

- Markets over-reacted to a vaccine headline

- OPEC+ tapers production cuts

- Brexit talks get snitty again

- Canadian & US economies continue to dissave

- Canadian jobs guesswork

- Inflation ties the RBI’s hands

- Other macro releases

TODAY’S NORTH AMERICAN MARKETS

Mixed developments basically cancelled themselves out over the course of the day to drive roughly flat equities ahead of nonfarm payrolls.

Things were humming along quite nicely in markets until Pfizer’s headlines hit near the close (see WSJ piece here). Rather, it was the market’s over-reaction and overly sensational headlines that spoiled it all. Pfizer announced that it would only be able to deliver about 50 million doses of its vaccine this year instead of 100 million as previously guided. Perhaps they should’ve stuck with the original guidance in the press release that announced the vaccine trials when they said 50 million (here). In any event the company guided that the 50 million short fall to its revised guidance would be made up in 2021 when they still plan to produce 1.3 billion doses. Global guidance from the four companies that have provided production figures continues to point to over 6 billion doses to vaccinate 3.6 billion people between now and the end of next year.

There were several constructive developments before the Pfizer headlines. One was that OPEC+ agreed on a middle ground solution to gradually taper production cuts into early 2021. Instead of raising production by two million barrels per day in January they will raise 500k and then revisit each month.

Second, there was a whiff of traction toward a new US fiscal stimulus deal centered upon a US$908 billion bipartisan proposal as more GOP members of Congress supported it. It remains unclear whether House Majority Speaker McConnell and Trump will support it. There is a case for targeted near-term aid but my definition of targeted is roughly in keeping with Dallas Fed President Kaplan’s remark the other day (3–6 months) until we get to vaccines. Bear in mind that two of the biggest dissaving countries in the world are the US and Canada. The two countries are running large twin deficits, but only one of them gets bailed out by its reserve currency. There is no prize for guessing the one that does not benefit from reserve currency status (charts 1, 2).

I mention this because of the completely false but at times popular argument that Canada is sitting atop a mountain of idle savings that are just waiting for the government to spend. It is not. Instead, Canada faces competitiveness challenges and a massive bias toward current consumption at the expense of longer-term investing. It’s a populist and divisive disservice to the debate to mislead Canadians into believing there are untold fortunes lying beneath rocks just waiting to be tipped over. Target the few pockets where there is saving—or temporarily so given legitimate reason to have a precautionary saving bias this year—and the country is likely to hardwire bigger structural twin deficits.

Sterling, however, didn’t share in any good tidings as Brexit talks stumbled again. UK negotiators charged that the EU side shifted the goal posts at the last minute, partly as the French threatened veto rights, but negotiators still guide that a deal is possible through the weekend.

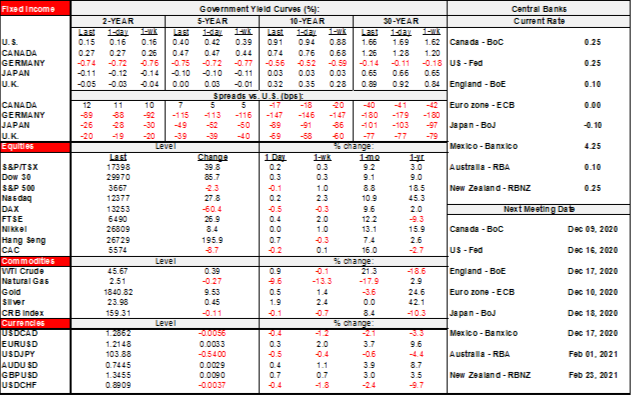

- The S&P500 ended flat with the TSX closing 0.2% higher. European indices were mixed with London up by almost ½%, Milan up a touch and the rest down by as much as ½% (Dax).

- Sovereign debt curves bull flattened with 10 year yields down by 2–3bps across North America and Europe.

- Oil rallied by about 1% in terms of both WTI and Brent.

- The USD weakened primarily against the euro, A$, Mexican peso and CAD but sterling fell again.

OVERNIGHT MARKETS

Overnight calendars should merely pass the time ahead of tomorrow’s nonfarm payrolls with nothing material on the docket.

October German factory orders will be released at 2amET but are backward looking and likely to prove to be of little consequence. Factory orders have been an impressive bright spot of the German economic recovery. Orders have seen growth for five consecutive months and are expected to register a very healthy 2.5% m/m gain in October as both domestic and external pent-up demand is unwound. Reimplemented containment measures in Q4 have been targeted in nature—weighing on hospitality services—which could allow the manufacturing recovery to remain on track through the winter months.

The Reserve Bank of India (RBI) will announce their monetary policy decision at 1:15amET. We expect the RBI to maintain its Repurchase Rate at 4.00% while maintaining a dovish stance on future policy accommodation. Temporary rises in food prices and supply shocks from COVID-19 have persisted longer than anticipated and have led to inflation overshoot. Headline inflation was 7.6% in October —well above the central banks 2–6 percent target range—and has prevented them from providing additional monetary stimulus since May. We expect the RBI to deliver a 50bps cut in February—the first meeting of 2021—as food prices normalize and negative supply chain shocks has some time to alleviate.

November inflation data will be released by Philippines and Thailand (8pmET & 8:30pmET respectively). Bangko Sentral ng Pilipinas looked past October’s rise in inflation at their November meeting because they viewed it as influenced by typhoon effects on food prices.

TOMORROW’S NORTH AMERICAN MARKETS

Nonfarm payrolls and wages will be updated for November at 8:30amET. Consensus expects +475k with Scotia at 400k and most estimates are clustered in a 300k to 600k range. That includes the so-called ‘whisper’ number on Bloomberg at 505k, although I’m never clear on whether that’s made up of economists gaming it to their calls or traders sticking a wet finger in the air. Wage growth is expected to cool again (4.2% consensus, 4.3% Scotia, 4.5% prior) as lower wage earners continue to come back into the workforce and drag down what had been the earlier artificial rise in wage growth.

Canada updates jobs for November (8:30amET). The median guesstimate is for a gain of 20k within a range from -50k from a masked marauder to +60k.

For further arguments on both job calls see last night’s Closing Points (here) and the Global Week Ahead (here).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.