KEY POINTS:

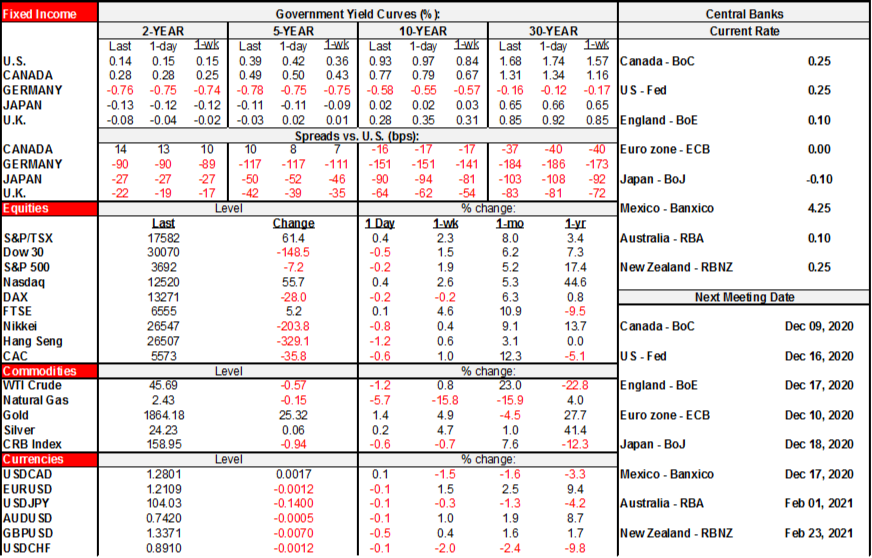

- Sovereign curves flatten to start the week

- Brexit talks in a state of suspended animation

- US to pass continuing resolution to delay shutdown risk

- Chile’s CB stays on hold as expected

- Will European ZEW confidence register vaccine optimism?

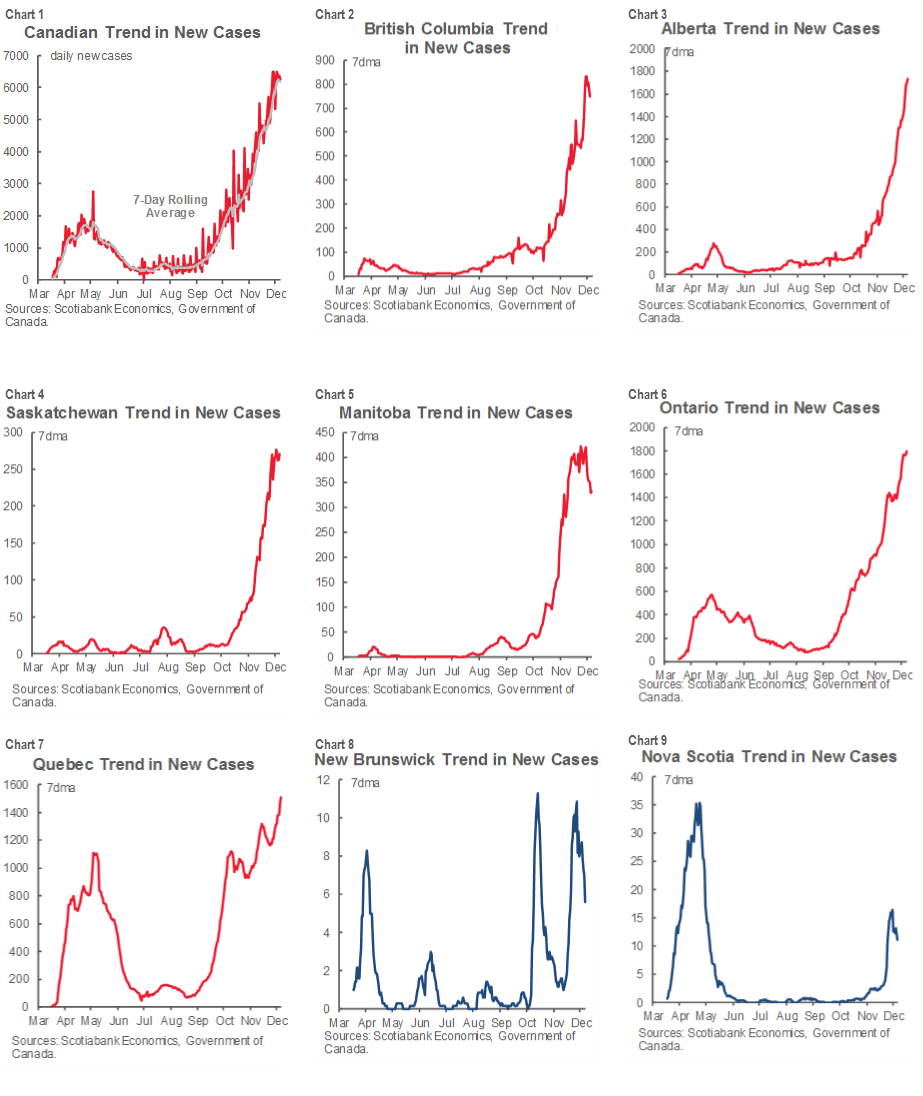

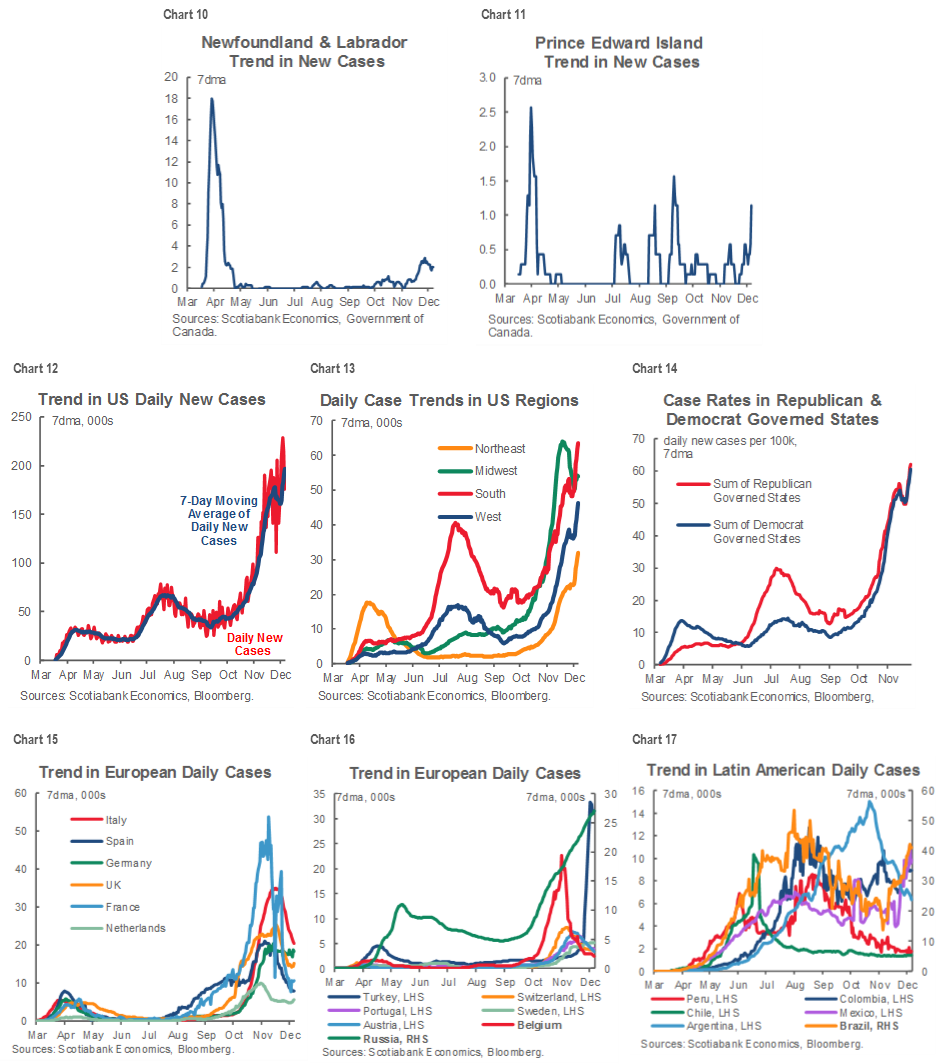

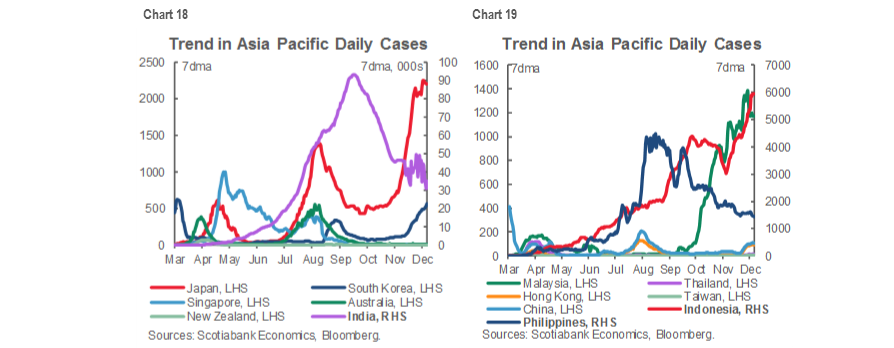

- Global charts tracking COVID-19

TODAY’S NORTH AMERICAN MARKETS

A lot of talk, tweets and high drama went nowhere in Brexit negotiations today. Again. Talks are transitioning toward the leader level as UK PM Johnson and EC President Ursula von der Leyen will meet in coming days and ahead of the EU Leaders meetings on Thursday and Friday.

On this side of the pond, US Senate Majority Leader McConnell said that the Senate will pass a one-week stopgap funding bill tomorrow that postpones risk of a shutdown to next week as they continue to negotiate a funding agreement alongside a stimulus agreement as explained in the Global Week Ahead (here).

- The S&P500 fell by about ¼% with the Nasdaq closing up by ½%. Toronto and London bucked the selling with small gains while the rest of Europe sagged by between ¼% and ½%.

- Sovereign bond curves bull flattened during the risk-off moves. US and Canadian 10s rallied about 3–4bps. The whole gilts curve shifted down by 4–7bps in a flattening move. EGB 10s rallied 2–3bps.

- Oil slipped by about 1% as gold gained about 1%.

- The USD was little changed as gainers offset depreciating crosses led by sterling and the Mexican peso with the euro and CAD little changed.

Chile’s central bank unanimously agreed to keep its policy rate unchanged at 0.5% for “much of the two-year monetary policy horizon” while maintaining bank bond holdings at around US$8 billion for the next six months while reinvesting coupons. See the accompanying statement here. The more interesting development today was the move by Chile to roll back reopening plans to phase 2 for the region including the capital city of Santiago.

OVERNIGHT MARKETS

There is exceptionally little on the overnight docket through to tomorrow’s calendar. Tape bombs on US stimulus/funding talks and Brexit negotiations may pose random risk.

The EC ZEW investor expectations survey (5amET) kicks off another month’s round of sentiment surveys (IFO, PMIs next week). It had already plunged by about 20 points in the last reading that was released on November 10th due to rising covid-19 cases. The survey was released only one day after Pfizer’s vaccine trial announcement and production plans followed by Moderna’s and then Astra’s. Therefore, if most of the sample period was skewed to before positive vaccine news then it’s possible we might get a better reading for the expectations component.

TOMORROW’S NORTH AMERICAN MARKETS

There are no US or Canadian releases on tap tomorrow.

The usual weekly suite of global COVID-19 case charts is provided on the ensuing pages. In general, US and Canadian cases continue to trend upward, multiple European countries have seen cases decline, Latin America is mixed and Asia-Pacific countries trade off declining trends in India and Philippines against rising cases in Japan, South Korea, Indonesia and Malaysia.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.