KEY POINTS:

- Markets continue to price Bidenomics and a ‘blue sweep’…

- …which means positioning is way offside if Trump wins…

- …that may spark a violent undershoot

- Trump simply didn’t offer a platform for markets to price

- A Biden scenario could fan reflation and recovery trades...

- ...by reinforcing higher inflation expectations….

- …curve steepeners…

- …higher equity valuations…

- …including financials…

- …while benefits of higher oil prices would flow abroad

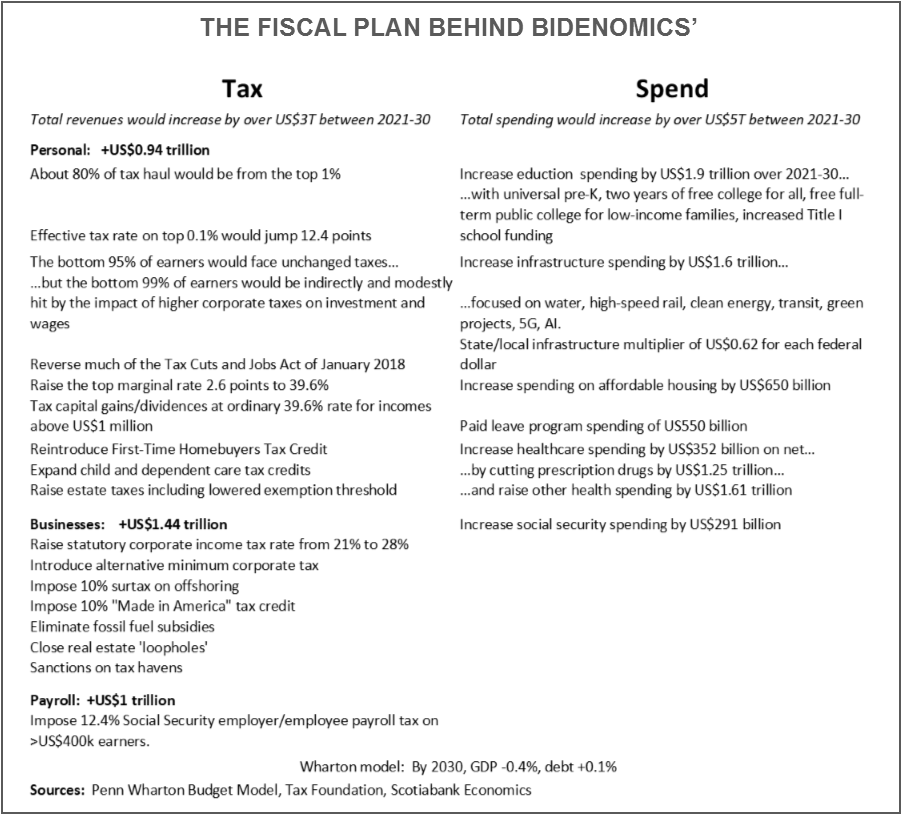

- The fiscal pledges behind Bidenomics would front load big spending while postponing tax hikes in the pandemic

- Light overnight releases focused on PMI revisions

- US ADP to tease nonfarm expectations

TODAY’S NORTH AMERICAN MARKETS

If you saw market participants showing unusual interest in blowing dust off their keyboards and cleaning up their in-boxes today, well then, chart 1 offers one explanation for why that was the case. Ahead of the US election, trading volumes on the S&P500 hit their lowest since New Year’s Eve last year. That’s saying a lot, since that day is usually more about making sure you have enough champagne and Tylenol, or at least it was before the pandemic struck. Such thin volumes counsel caution when interpreting today’s market moves, at least in terms of magnitudes.

Still, what I saw was pretty consistent market evidence in favour of pricing in a ‘blue sweep’ scenario in the US election. I hope they’re right, at least for the market’s sake. I think so, as this would be a spectacular failure by a pretty much unanimous chorus of pollsters and election forecasters ranging from fivethirtyeight.com to The Economist and Allan Lichtman’s uninterrupted track record. Anything different from that could magnify rapid position covering and potentially rather violently so. As in 2016, however, be mindful toward the prospects for the evening to offer up a rollercoaster ride by starting the same way as election night did four years ago with Trump victories in states that are likely to still back him solidly before we get into a greater mixture of results including ‘blue’ states. As for the market moves:

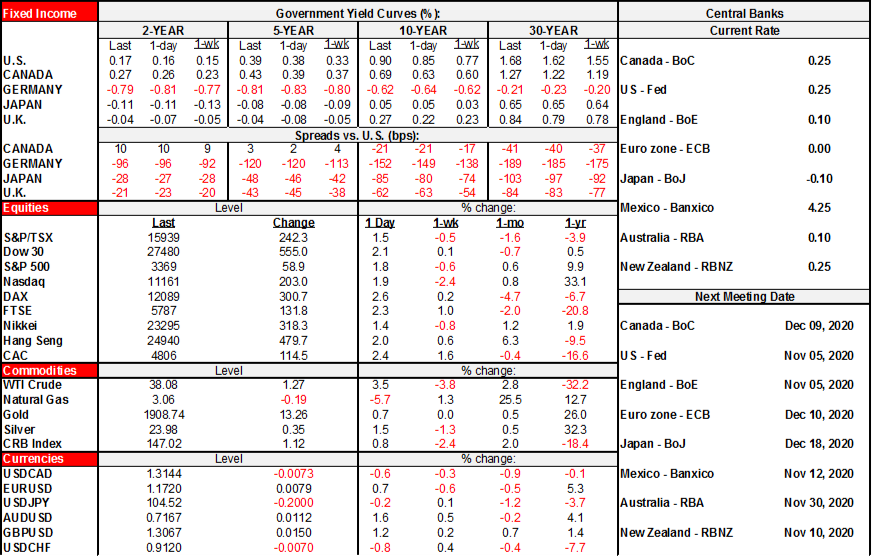

- The Fed’s preferred five-year forward breakeven inflation rate has moved up by about 20bps over the past 5–6 weeks (chart 2). It has risen by about 75bps since the low on March 19th in the early depths of the pandemic shutdowns. Biden’s policies are reflationary and could fan this momentum further yet.

- The Treasuries curve steepened on quicker growth and issuance expectations. The US 2 year yield was up 1bp with 10s and 30s up by about 5. This continues the steepening that has been in place for over a year now (chart 3) as the bond market has been pricing a stimulus-fed economic expansion that was only relatively briefly interrupted by the ongoing pandemic. The bond market is strongly suggesting that a solid continued expansion lies ahead.

- Steeper curves helped to drive banks to lead the S&P500 sectors today notwithstanding potential regulatory risk. Banks also benefit from stronger medium-term growth expectations if we get more aggressive spending plans for some time. Obviously, Biden’s tax plans are unfavourable, but spending probably gets emphasized first and front-loaded while the costed expenditures amount to over US$5 trillion by 2030 versus the costed revenues of just over US$3T over the same time frame. The implication is two-fold: a) what goes into the economy through spending will exceed what is taken out through tax revenues, and b) furthermore, spending is likely to arrive first given the pandemic focus and the greater difficulty dealing with changes to tax policy.

- Energy stocks were the only losing sector on the S&P500 that gained 1¾% as they fell by about ¾%. This is no doubt partly due to Biden’s plans (e.g. fracking), yet oil prices moved up by 2–3% as his plan may be more restrictive to supply, Biden’s overall stimulus plans are more favourable to domestic and world growth and Biden’s trade policies may be less antagonistic toward China and hence its demand for oil.

- The dollar’s safe-haven appeal continues to lessen in the shorter term in favour of stronger world growth that is lifting other currencies.

I’ll now expand upon Trump versus Biden by also repeating some content from the Global Week Ahead and the accompanying slide deck. First off, markets don’t really know what to make of a second Trump term because he essentially failed to show up for this campaign. For whatever reason, we never got a coherent, holistic election platform from Trump this time around. He had one in 2016 whether one agreed with all or part or none of it, but this time his camp either ran out of ideas or couldn’t effectively spell them out. Markets have little to price other than the uncertainty presented by no plan.

Biden, by contrast, has a coherent election platform that markets can price. You may not agree with all or part or any of it, but it’s a much more thoroughly (but not thorough) contrived offering. The bullet points below summarize key differences between Biden’s offerings and Trump’s general policy bias to date. The table on the next page summarizes the key elements of Biden’s fiscal plans. Biden’s plan is unambiguously reflationary at least in the near– to medium-term if executed given its emphasis upon net fiscal stimulus. It looks rather like it would take two terms to deliver all of it and there are steep barriers to major parts of it (e.g. ever seeing an infrastructure deal) but a blue sweep scenario could increase the probability of achieving a great deal if energy on election night carries through to governing. Longer term uncertainties would stem in part from whether Biden would follow through on all or part of his tax pledges and carbon tariffs.

- Trump’s tax policies are unambiguously more favourable to markets mostly because he wouldn’t do what the Democrats are doing and may seek modest additional cuts that are not well laid out.

- Biden’s spending and immigration plans would be more stimulative to growth which could also benefit markets. The trade off between Biden and Trump may be top line revenue versus EAT/EBT.

- Trump is an isolationist who has withdrawn America, but Biden is no globalist and has his own ‘made in America’ restrictive policies.

- Trump would further raise trade frictions with similar erratic and combative tactics. He would probably escalate tensions with China and perhaps Europe & harm global growth.

- Biden would likely improve trade and broader relations with allies, return to the WTO, but probably retain tariffs on China and seek a globally coordinated effort to address China issues. TPP would not be a priority.

- Biden’s protectionist carbon tariff/border adjustment would invite retaliation.

- Both candidates would face fiscal pressures over time as the US deficit is recklessly unsustainable.

- Biden in a ‘blue sweep’ would probably mean front-loaded spending first (US$3T?) to boost near-term growth. A back-loaded tax haul would neutralize most longer term effects. Tax hikes in a pandemic are likely a no-go so to repeat, it’s about spending first.

- Biden’s immigration policies are more favourable to growth. He would restore historically low immigration to pre-Trump levels and transition undocumented immigrants to lawful permanent resident status over ten years with immediate work permits.

- Biden’s sector policies could negatively impact energy (fracking, Keystone XL), pharma.

OVERNIGHT MARKETS

Not that any of it will matter one bit, but for what it’s worth, here’s the (very brief) run down of overnight releases.

- US vehicle sales are pending for October this afternoon.

- New Zealand updates Q3 jobs (4:45pmET). Another drop of about -0.7% q/q is expected.

- China private services and composite PMIs for October (10:45pmET).

- Eurozone services and composite PMI revisions for October (4amET). They will incorporate first estimates from Spain and Italy into what Germany and France had already released.

- UK PMI revisions for October (4:30amET).

TOMORROW’S NORTH AMERICAN MARKETS

Tomorrow’s releases will be very light and inconsequential compared to the (possible) election outcome. US ADP payrolls are due out at 8:15amET and consensus has a cooler rise of 650k pencilled in (Scotia 500k). To matter to nonfarm we have to start getting into being well off expectations in either direction and then play the historical probabilities on the odds of a comparable miss or beat for nonfarm to that which might occur to ADP.

Canada and the US release updated trade figures for September (8:30amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.