KEY POINTS:

- OPEC+ dysfunction rattles markets

- Are taxes the sleeper risk in Canada’s budget update?

- Canadian Budget winners & losers...

- ...include mixed signals for housing

- Why relative rates are only one part of the attractiveness of Canadian government bonds to international investors

- OECD to update forecasts

- RBA expected to stand pat

- Eurozone PMI revisions to incorporate Italy, Spain

- Eurozone CPI will arrive before Lagarde speaks

- Canada to update GDP; risk focused on October guidance

- US ISM-mfrg expected to decelerate

- US construction spending, vehicle sales due out

- Will China’s Caixin manufacturing PMI confirm the state’s reading?

- Fed’s Powell will likely offer more upbeat assessment to Congress

TODAY’S NORTH AMERICAN MARKETS

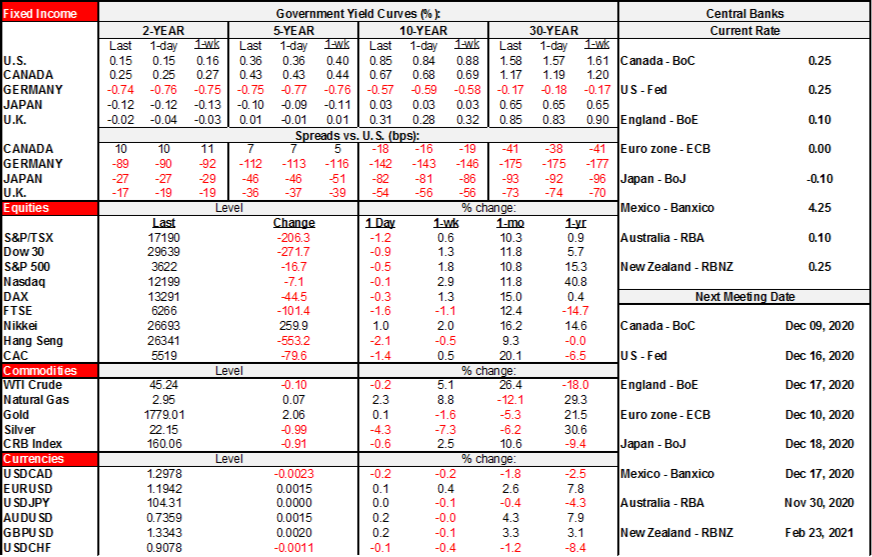

Risk appetite fell today in large part because of OPEC+ dysfunction as a meeting was postponed when talks got a little heavy. Month-end rebalancing likely contributed to some of the tone. Overnight calendars through tomorrow will be focused on a heavy line-up of macro releases. I’ve provided initial thoughts on Canada’s fiscal update below.

- Stocks closed lower with the S&P500 down ½%, Toronto’s TSX off by about 1 ¼% as energy led decliners, while European markets fell by between ¼% (Dax) and 1 ½% (London, energy down 5 ½%).

- Oil fell by about 50 cents per barrel for WTI and a similar amount for Brent on continued OPEC+ uncertainty (see this morning’s note). OPEC+ meetings were delayed by two days today due to difficulty in striking agreement to extend production curbs beyond the end of this year.

- The USD appreciated against almost all major crosses except sterling. CAD also outperformed bigger dips in other crosses. The Mexican peso was among the weakest currencies.

- Sovereign bonds were little changed. US 10s were roughly flat. Canada 10s rallied by about 1bp compared to Friday but about 2bps compared to the peak this morning, after which yields steadily fell.

OVERNIGHT MARKETS

The two main risks through overnight markets will be the publication of revised OECD forecasts and when ECB President Lagarde speaks following Eurozone CPI and ahead of the December 10th policy meeting.

China follows up the state PMIs with the private Caixin manufacturing PMI tonight (8:45pm ET). Throughout the pandemic, manufacturing industries have fared better in response to restrictions and physical distancing measures than service-based industries. While lockdowns and increased restrictions were reintroduced across many of China’s trading partners, their targeted nature should also lead to a reduced drag on economic activity. We expect the export focused PMI to remain roughly inline with October’s print of 53.6.

The Reserve Bank of Australia (RBA) delivers another monetary policy decision tonight (10:30pm ET). With a substantial increase to monetary accommodation delivered in November, we don’t expect any policy changes at this meeting—holding the cash rate target and the 3-year yield target at 0.10%. With strict lockdown measures lifted, the bank will focus on supporting a robust labour market recovery as a means of stoking inflationary pressure over the coming year.

The OECD will deliver fresh forecasts in its Economic Outlook publication at 5amET. One would expect downward revisions to nearer term growth and upward revisions thereafter.

The preliminary estimate for Eurozone CPI in November arrives at 5amET. CPI is expected to remain sub-zero in November—consensus expects -0.3% y/y— largely due to Germany’s temporary reduction of the VAT tax. However, ECB meeting minutes released last week suggested that the inflation outlook is edging towards the bank’s severe scenario. All eye’s will be on the December 10th ECB meeting where President Lagarde has stated that the bank will “recalibrate all its instruments.” She speaks again tomorrow at 12pmET. This is expected to lead to an increase to the Pandemic Emergency Purchase Program (PEPP) and some alterations to bank lending programs. The announcement will also come with a refresh of September’s economic projections, which should reflect the recent deterioration in near term growth.

The Eurozone manufacturing PMI for November will be revised at 4amET after the initial reading fell to 53.6 (54.8 prior) to signal weaker growth. This update will incorporate first estimates from Italy and Spain.

TOMORROW’S NORTH AMERICAN MARKETS

The main North American market risks may be focused upon a more upbeat sounding Fed Chair Powell and ISM-manufacturing to see if US momentum wanes as it has in Europe with tightened restrictions. Canada updates GDP but the best before date has expired as rising COVID-19 cases and tightening restrictions with the promise of vaccines to come deserve the forward-looking emphasis.

Fed Chair Powell testifies before the Senate Banking Committee tomorrow (10amET). His opening remarks were released this afternoon (here). It was the most direct acknowledgement to date from the Fed that vaccines offer new information to the outlook as he remarked they are “very positive for the medium term” notwithstanding nearer terms uncertainties surrounding their roll-out. I doubt we’ll hear hints at expanding QE or lengthening purchase horizons. Expect discussion surrounding Treasury Secretary’s withdrawal of US$455B of funding from Fed facilities following this morning’s announcement to extend facilities that were unaffected by the decision (here).

Canada will release GDP figures for September and Q3 plus October guidance (8:30amET). Canada is expected to register a 47% q/q annualized gain in Q3—following up a 38.7% q/q annualized decline in Q2—which includes an estimated 0.8% m/m gain in September. Consumers returning to pre-pandemic purchasing habits—as seen by the recovery in retail sales—should contribute to the rebound. Like other countries, Canada is seeing a reintroduction of containment measures as new cases rise. This will inevitably weigh on Q4 growth and particularly the pace of recovery in service-based industries.

US ISM-manufacturing for November arrives at 8:30amET. With October’s reading rising to its highest point in over two years, the regional Fed surveys for November suggest that the ISM gauge may soften slightly this month. Despite restrictions, we expect manufacturing output to continue to expand over the near term as plants have adapted well to the new COVID era working environment.

Other US releases will include construction spending (10am ET) and vehicle sales (end of day). We expect construction spending to rise 0.8% m/m, driven by homebuilders rushing to replenish the sharp drawdown of housing inventory. Vehicle sales should remain steady around 16 million units annualized. The lack of refreshed fiscal supports could contribute to the downside risks in the coming months.

CANADA’S BUDGET

The full budget update is available here. Scotia’s Rebekah Young will offer her detailed thoughts in a note this evening. For now, I’ve summarized some impressions below.

Budget highlights:

- The FY2020–21 deficit was revised to C$382 billion from $302 billion which was less than many anticipated with estimates stretching well over C$400B.

- Table A1.3 on page 123 summarizes the changes that were introduced today versus the prior update. From a baseline of C$302B, the deficit then adds $54.5B to account for actions since the last update but not including today. Then it adds today's C$25B in new measures for FY20–21 to get to $382B.

- Ottawa guided that another C$70–100 billion in spending over the next three fiscal years is in the works but offered no details other than loose guidance it is working toward a childcare program.

- Before incorporating this extra spending, the baseline deficit then falls to $121B the next year, $50.7B after that, $43B after that...and never zero but gets to a low of $25B deficit in FY2025–26. To repeat, the extra spending was not incorporated into these numbers.

- While there was loose guidance provided on spending plans to add another C$70–100B in spending over the next three fiscal years, there was no guidance toward how Ottawa would pay for it which leaves the door open to speculation that it could be deficit-financed or financed through new revenue measures or expanding existing ones. Watch taxes as the sleeper risk into the Winter budget and I suspect that if they go there, then upper income earners will be targeted with a fairness spin. They took a gentle step in that direction with stock options today (see below). If Ottawa goes the route of funding through debt issuance then it would add more than three percentage points above the 51.6% baseline estimate of debt-to-GDP by FY23–24.

- Further to the taxation issue, section 3.3.2.8 further elaborates upon carbon taxes, or a tax on imports from countries without carbon pricing. Ottawa remains in discussion with other countries on carbon border taxes. Recall that Biden’s platform favoured carbon levies and border adjustments. I remain of the view that they risk being treated as tariffs and invite retaliation and hence risk dampening hopes for a recovery in world trade.

- The overall aim of providing further spending stimulus was billed as closing the output gap, or the sum total of measured spare capacity in the Canadian economy that has arisen due to the pandemic. Ottawa says targeting 3–4% of GDP cumulatively over the next three years will be oriented toward closing spare capacity. That means the output gap would close sooner than later, but this depends in part upon how it is financed and the overall net stimulus provided.

- Such a policy aim is material new information to the forecasts in that bringing forward the closure of spare capacity may bring with it earlier inflation pressures, higher short-term and longer-term borrowing costs and CAD appreciation that dents private industry competitiveness. Ottawa invites private sector forecasts before revealing its intentions such that forecasters may be left to reconsider their longer run views on CAD and rates. The output gap estimates also appear to be derived from the BoC’s October MPR forecasts that were presented before material new information on vaccines; vaccines may drive quicker recoveries and less spare capacity sooner than expected.

- Ottawa is also hanging its hat on overshooting stimulus requirements with the argument that a global mistake coming out of the GFC was to undershoot. That’s why monetary and fiscal policy was so aggressive around the world and particularly in Canada, but this view spawns debate over whether what we are going through in future will be similar by way of forward-looking risks. The GFC was a massive deleveraging hit through a balance sheet and credit-induced recession. The pandemic carries balance sheet implications but they are the symptom, not the cause and the effects may be more transitory with a different solution through vaccines.

On specific initiatives:

- First-time home buyers get added incentives in some of the biggest and priciest markets. In Toronto, Vancouver and Victoria starting in "Spring 2021" (no exact date), the limit will be increased to buy a home up to 4.5 times household income instead of 4.0 times. The eligible buyer's income threshold is being raised by $30k to $150k in these markets. They figure this will raise the maximum eligible house price to $722k from $505k. Raising immigration rates and offering added inducements to first-time homebuyers offset the foreign buyers tax plan and represent material new stimulus to housing markets.

- Foreign homebuyers tax: There will be a nationwide non-resident housing tax applied “over the coming year.” Section 4.8.2.2 on page 114 of the update spells out some loose information. I'm not a fan of these efforts to tax the capital account and there may be a rush by some foreign investors to get out before they implement the tax and for domestic investors to perhaps do likewise in anticipation of the effects on foreign buyers. The effects will cut unevenly across neighbourhoods and some types of housing over others. Recall StatsCan tends to estimate that foreign buyers account for a low single digit share of homebuying in Canada. Domestic buyers driven by the domestic economy and policy account for the vast majority of housing activity.

- Modest childcare stimulus may help those in need but poses no material impact on our growth forecasts. C$2.4 billion will be spent on C$1,200 cheques in calendar 2021 for each child under 6 for low- and middle-income families who get the CCB benefit defined as incomes under C$120k/yr. Payments will go out quarterly payments. Earners above $120k/yr get half that amount. This distribution only amounts to 0.2% of total 2020 consumption. Ottawa will also spend C$420 million in FY21–22 to attract and retain early childhood education workers.

- A small amount of C$2.6 billion over 7 years will be spent to fund 700,000 home retrofit grants of up to $5k per homeowner.

- There is a new work from home benefit, but be careful about taking the bait as the attractiveness depends upon your expenses and record keeping. Ottawa will give a deduction of up to C$400 based on the amount of time working from home without having to track expenses with no form T-2200.

- Ottawa will change the way it taxes stock options starting with those granted on or after July 1st 2021 (see section 4.8.2.1).

- Ottawa will apply the 5% federal sales tax against digital companies. There is partly based on tax fairness given that sales tax is not charged, but it will probably be paid by Canadian consumers through tax incidence effects in a sector with pricing power.

CAD and Canadian Debt Attractiveness

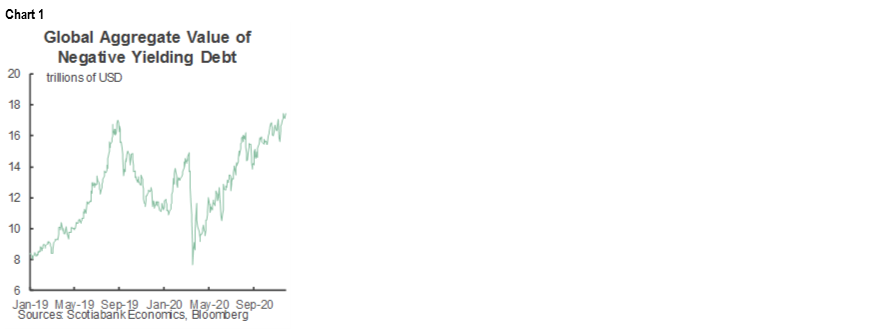

As an aside, is it fully correct to argue that international investors will pick up Canadian government bonds simply because of a yield advantage over the US$17.4 trillion of global dent that is negative yielding (chart 1)?

One caution toward this view is that the real market test of rising government debt to GDP may come in subsequent negative shocks that take it higher if steps are not taken to repair the books beforehand. For example, Canada knew it had problems well before the US-Canada 10s spread really blew out to +300bps into the recession about three decades ago.

A second caution is that international comparisons of rates need to be considered alongside FX markets and not in isolation. Local yields are significantly determined by local accounts with the majority of Government of Canada debt owned domestically with benchmarking against indices that can drive a misleading impression of the quality of the credit. International investors are freer to choose where to invest, don’t spend much time on little ol’ Canada relative to the very modest weighted reward in their portfolios and exact a premium when uncertainty rises and can do so through what they express in currency markets.

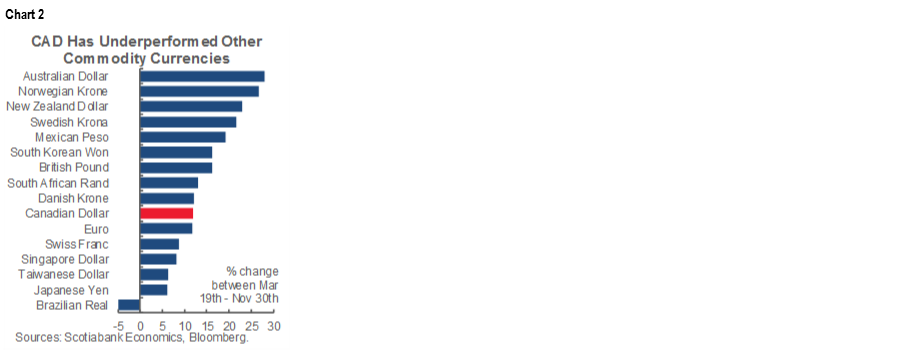

Despite Canada’s yield advantage, CAD has appreciated to the USD by substantially less than other peer currencies since the low for broad market risk appetite in March (chart 2). It’s up by around 15 cents to the dollar since March on broad risk appetite, but it has underperformed other peer commodity plays (A$, NOK, NZ$, SEK, MXN).

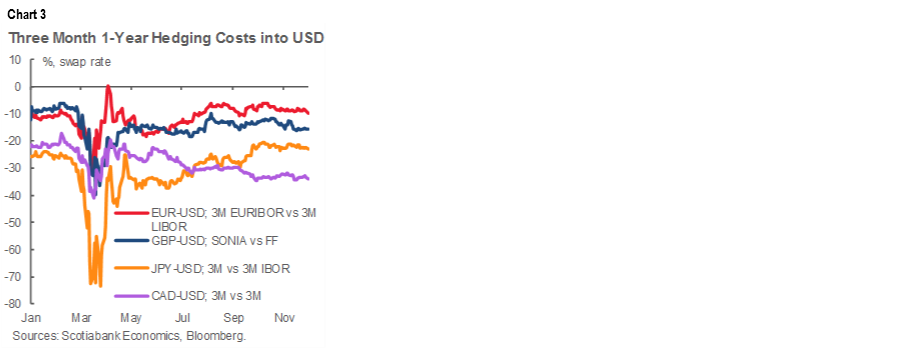

Further, the cross-currency basis comparisons across major currencies suggest that the cost of hedging out of USD into CAD are higher (more negative basis) than for other currencies (chart 3). That signals that while appetite for USD out of CAD has diminished since March, it has done so by less than appetite for USD has diminished relative to those other currencies. The trend has also been toward rising hedging costs for CAD since around June. The cost of hedging out of USD into CAD remains higher than the cost of hedging out of USD into other crosses like yen, sterling, euro.

That is also consistent with the net short position in CFTC positions shown in chart 4.

Why CAD has underperformed other commodity crosses, while hedging costs have risen alongside net short positions in the currency isn’t entirely clear. Maybe the market is less convinced that Canada’s basket of commodities is as attractive as elsewhere including N.A. energy policy risk (domestic and US). Maybe the market is thinking Canada overshot on growth earlier relative to some others and face relatively less sustainable growth going forward and in part because Canada overshot on stimulus more than some others. Maybe markets look at our bigger deficits relative to others and so with market pricing at the margin driven by flows more than stock comparisons they’re exacting more of a discount to lend to Canada through the currency. I’m sure there are other plausible explanations.

My general point is basically to consider that in an interest parity framework, we need to consider relative nominal yields and what currency markets signal is necessary to equilibrate swap flows across currencies. To just point to, say, Canada’s 10 year GoC being, say, 125bps over 10 year German bunds exaggerates the relative attractiveness of Canadian dollar debt. In theory, basis shouldn’t exist as it’s the residual on a covered interest parity framework, but it does, and Canada’s is wider (more negative) to the USD than others.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.