KEY POINTS:

- Stocks rally on Trump, data, stimulus talks

- Curves steepen as US 10yr yield approaches four-month high

- Trump’s curious covid-19 message...

- …could backfire…

- …while the CDC revises distance guidance

- Have US fiscal stimulus odds gone up?

- So far, ISM-services disproves the slowing hypothesis…

- …that alt-data distorts

- RBA may tee up future stimulus ahead of budget

- Fed’s Powell, ECB’s Lagarde & Lane on tap

- Light overnight releases

TODAY’S NORTH AMERICAN MARKETS

Well, stocks believe Trump has recovered, but not all of the credit goes to his possible health status. The literature shows that the length of a covid-19 hospital stay is anywhere from four to 21 days outside of China (here). The President did it in three; two days, if his doctor’s remark that he could have gone home yesterday is on the mark. Hallelujah, it’s a miracle!!

Or not. You see, not everyone has the President’s health care and access to medication that is not yet approved for the rest of us. Or their very own hospital wing at home in the White House. Or a private armed helicopter with escort detail to whisk them away if needed. Maybe the army food sucked at the Walter Reed hospital. Regardless, I’m not sure the message that Trump feels better than he did 20 years ago and for people not to let it “dominate your life” while going about their regular business will resonate in ways that lessen the spread of second wave risks. Wear your masks? Trump didn’t and he survived. Socially distance yourself? Trump didn’t and it was no big deal for him. Limit crowd gatherings especially indoors? Pffft, our pal Trump says ‘meh’. This posture might lead forecasters to become more concerned about evolving second and ensuing waves as New York took further rollback steps today. That’s especially after the politicized CDC finally fessed up that the literature has been leaning toward a spread radius of over 6 feet in indoor settings for months now (here).

In any event, short-term markets are taking this news and ongoing US fiscal stimulus talks somewhat positively to start the week even as the virus spread through the White House including the press secretary and the housekeeping staff who you know are just loving the folks they’re serving right about now. The implications for fiscal stimulus are uncertain but a combination of a) Trump being well down in the polls, and b) his own personal experience with the virus might lend itself to higher odds of a deal with Pelosi and Mnuchin to continue talks this evening into tomorrow. My hunch is that developments are pulling the White House closer toward the Dems’ price tag.

This morning’s ISM-services reading also helped the market tone (see below) as it was immediately followed by a jump in the S&P500. Maybe last night’s positive revisions to Eurozone and UK PMIs also got second assists. Cheers to your health Mr. President, but there’s a bit more to it all and there will be overnight into tomorrow as well when Powell & Lagarde take the stage.

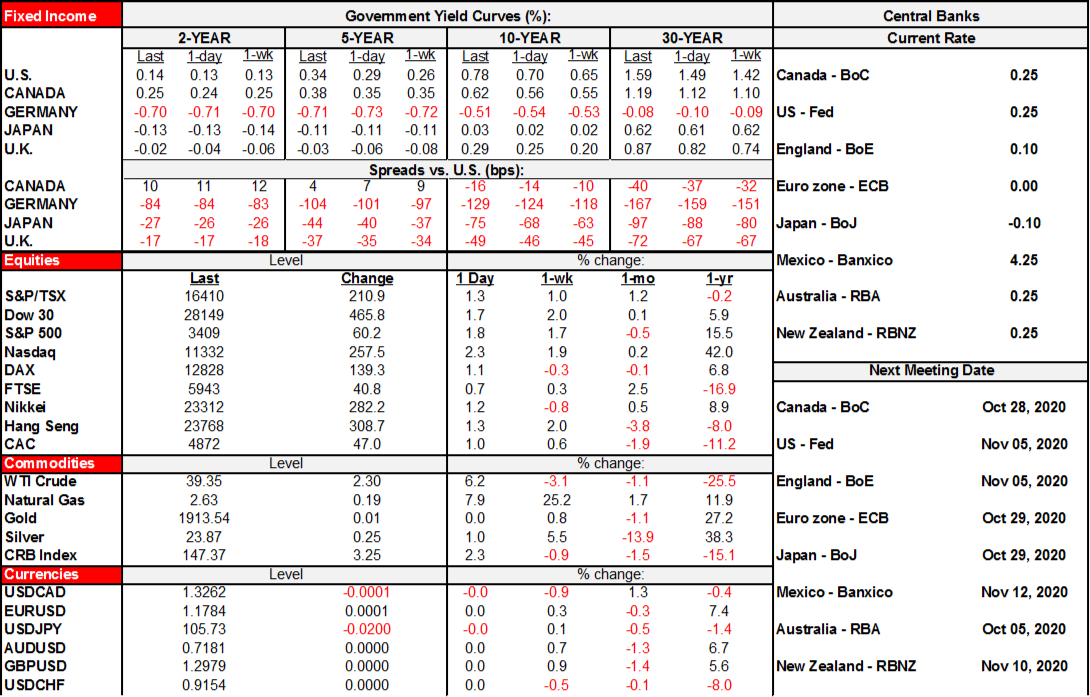

US equities ended up by 1 ¾% to 2 ¼%. The TSX closed 1 ¼% higher. European markets ended up by ¾% to 1 ¼% but closed before the Trump-go-home headlines.

Sovereign bonds weren’t feeling the love today. Good news was bad news for them as the US 10 year note jumped 8bps and the 30 year yield was up 10bps. That’s the highest 10 year US yield since <drum roll…..> June 9th. Yippee, our forecast steepeners are back on track, for now. Gilts and Canadas also bear steepened but somewhat underperformed the US. EGBs performed likewise but generally less so.

Oil prices ended about 6% higher in terms of WTI and Brent. Gold was up by under ¾%.

The USD depreciated against most crosses except for the yen. CAD underperformed other major crosses while some Scandies, the Mexican peso and real led the pack.

So much for the hypothesis that the US service sector must be slowing as reopening gets rolled back in some areas and sectors. We’ll see next month. For now, ISM-services beat expectations and came in higher than about 5% of consensus expected. Each of the new orders (61.5, 56.8 prior) and employment subindices (51.8, 47.9 prior) registered improvements.

US ISM-services index, SA, September:

Actual: 57.8

Scotia: 56.0

Consensus: 56.2

Prior: 56.9

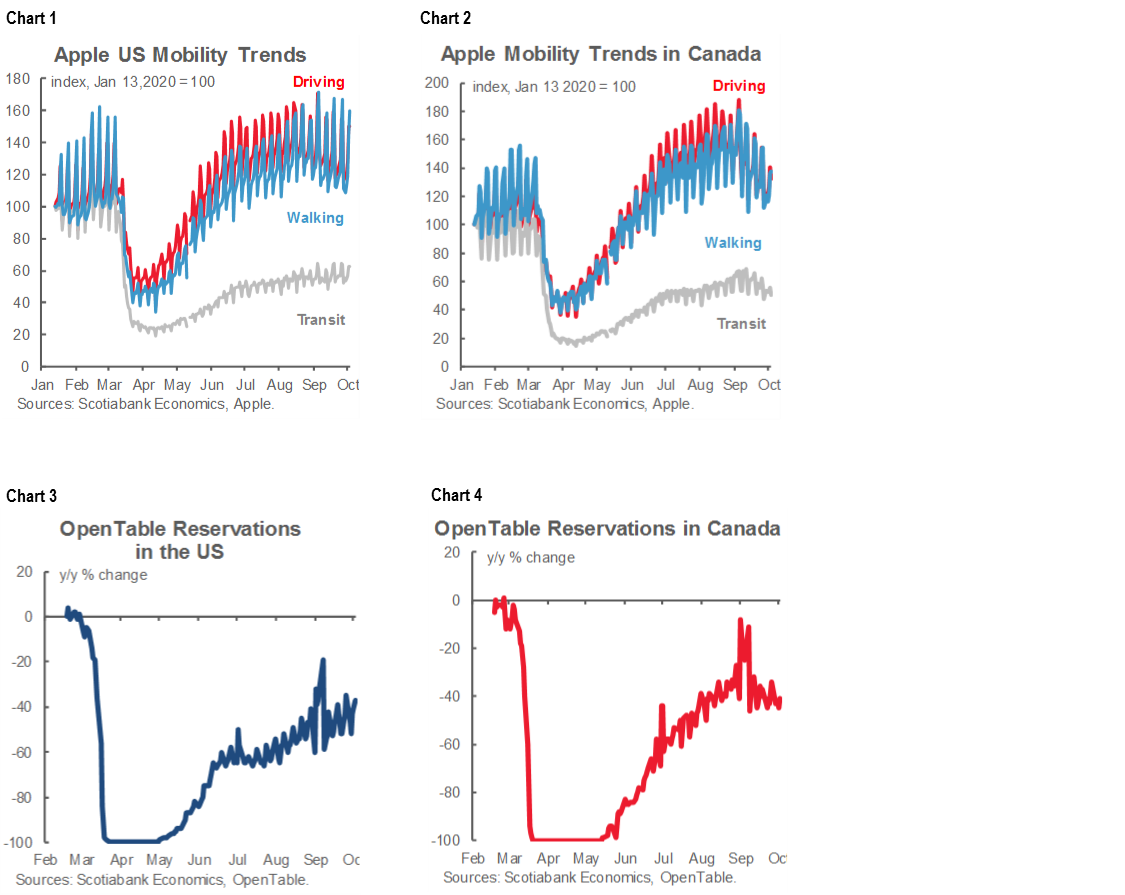

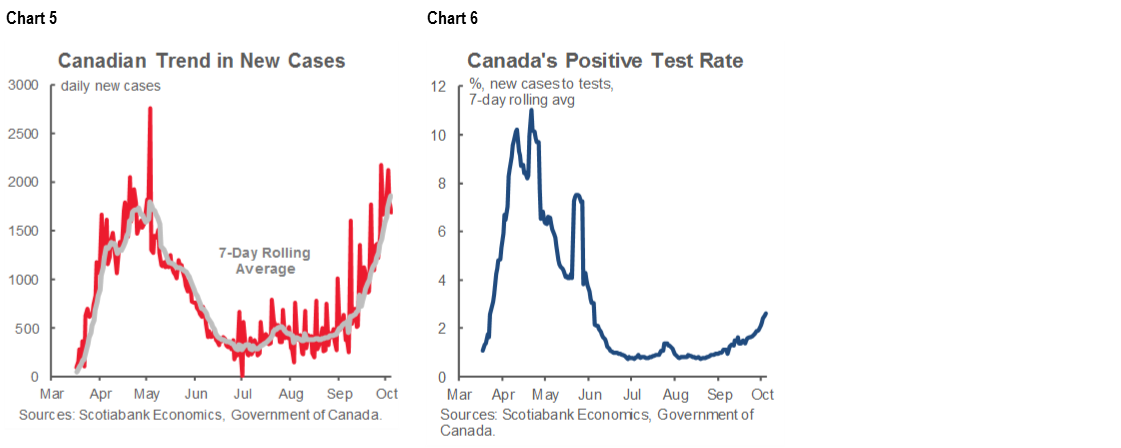

Will such evidence prove durable? That’s unclear. High frequency alt-data like mobility readings are weakening (charts 1–2 for the US and Canada), but they’re not seasonally adjusted which is problematic since, for example, some activities like driving might settle down after summer. Restaurant bookings remain on a mild recovery trend but Canada has been faltering (charts 3–4).

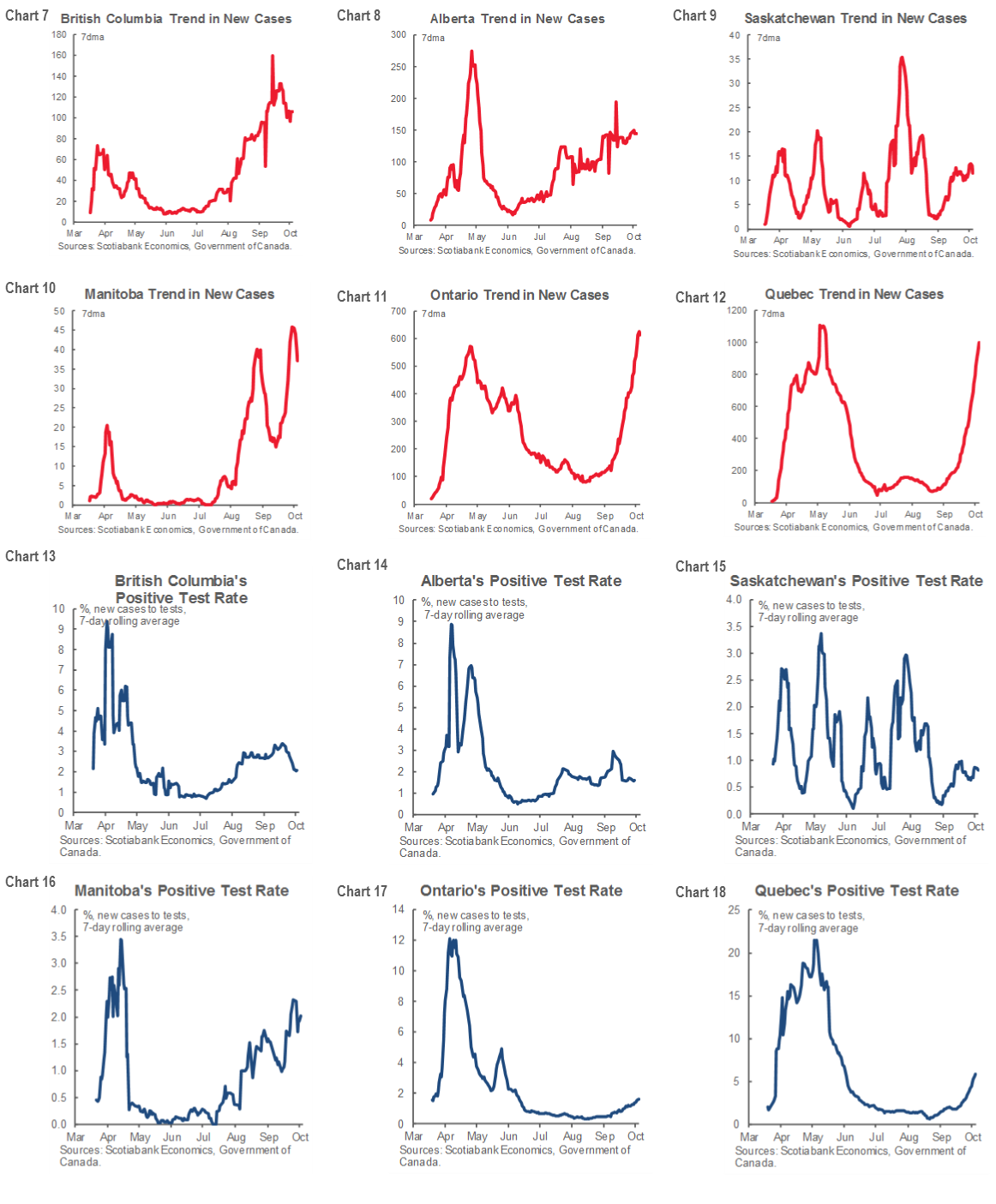

Given that covid-19 and its effects served as the dominant market drivers today, it’s a suitable to kick off the week with a full suite of updated global charts. Charts 5–6 start by showing Canada’s new cases are still trending higher and so is the rate at which tests are turning up positive. To repeat the caution, we can’t compare the positive rate to wave 1 since the earlier sample was much more likely to be biased to people afflicted by the illness. We also can’t really tell if the current rise in the positive rate during wave 2 is genuine or if the sample is becoming distorted again toward those who are more likely to think they’ve got it and who stick it out in line-ups versus the tourists.

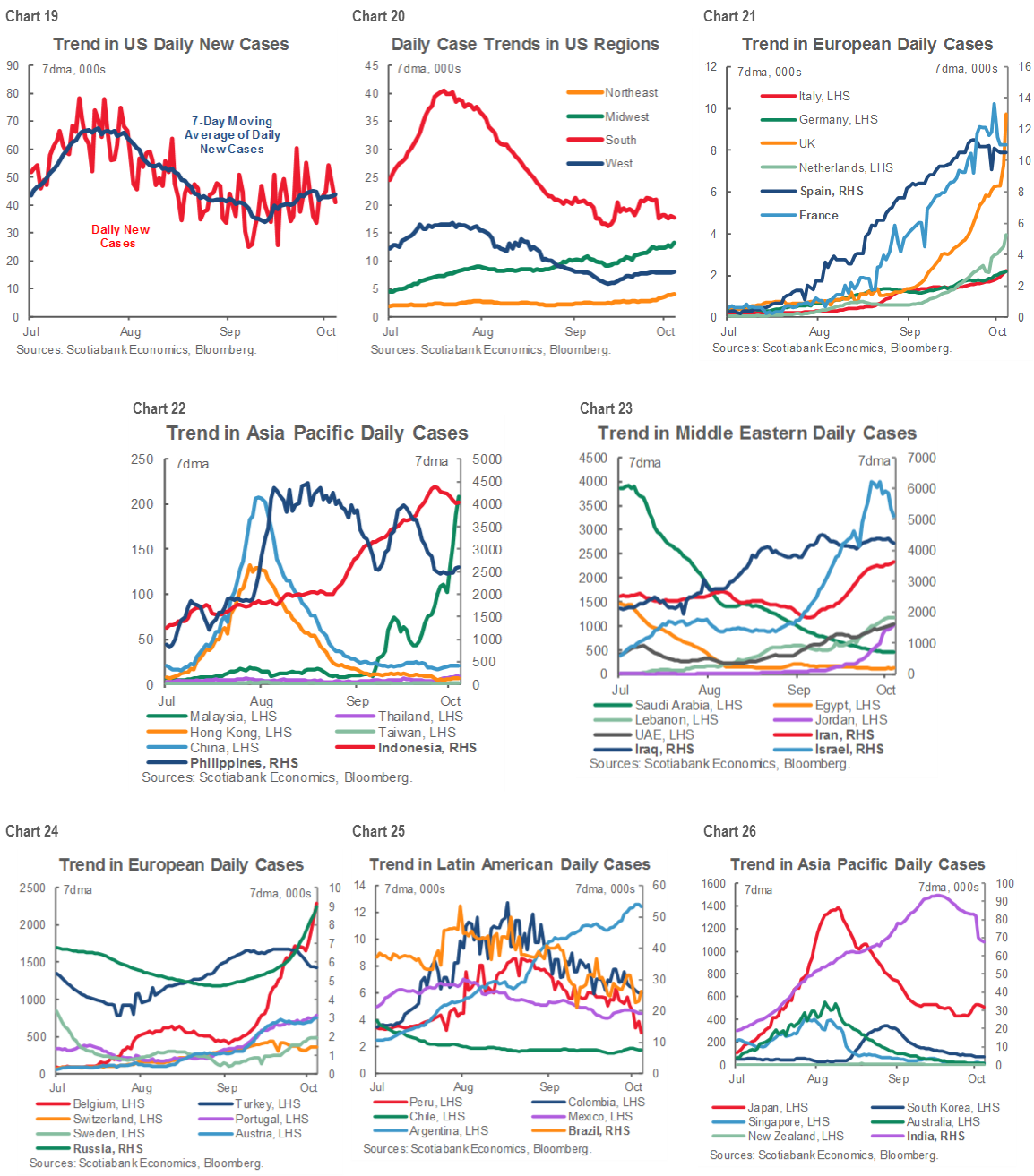

Charts 7–18 depict case trends (red) and positive rates (blue) for all Canadian provinces.

Charts 19–26 depict case trends internationally. Let’s see, a picture is worth a thousand words, so that’s 26,000 I just spared you from having to read.

OVERNIGHT MARKETS

The main focal points overnight will be remarks offered by ECB President Lagarde and Chief Economist Lane early tomorrow morning. Before that, the focus will be ‘down under’ where the RBA could take further steps to tee up future stimulus measures ahead of the Australian budget that is expected to add fiscal stimulus, as well as German factory orders.

South Korea updates CPI for September (7pmET). Higher food prices may will buoy a continued drag from energy prices on the headline inflation reading.

Colombia also updates CPI (8pmET). Our team in Bogota expects inflation to slow a tenth to 1.8% y/y which is still below the 2–4% target range for inflation. Slack and lower inflation could keep alive further BanRep easing.

The Reserve Bank of Australia delivers another policy decision (11:30pmET): We don’t expect any shifts in policy during this announcement — maintaining the Cash Rate Target at 0.25%. The principal point of concern will be the containment measures in place in the state of Victoria and its effect on Australia’s recovery momentum. There is potential for further easing at future meetings should the RBA deem the strength of the recovery is at risk. Markets began pricing in a cut to the Cash Rate Target at end of August. Also note that the Australian Federal Budget will be released at 4:30amET tomorrow.

Germany updates factory orders, but for back in August (2amET). They are expected to reflect the general improvement in global demand. Despite the sharp initial recovery from the April low, factory orders remain 8.2% below pre-pandemic levels. Consensus expects an increase of 2.8% m/m, equivalent to the growth seen in July.

ECB President Lagarde speaks twice in the morning. At 4:35amET she will deliver a pre-recorded message at the WSJ’s online CEO Council Summit and then at 9amET she will speak on a panel on economic and monetary union. The ECB’s Chief Economist Lane also speaks at NABE’s annual meeting (11:30amET). That’s a lot of time from heavy hitters if they have nothing to say…

TOMORROW’S NORTH AMERICAN MARKETS

Fed-speak could figure prominently in the morning. Fed Chair Powell will deliver an economic outlook at NABE’s annual meeting (10:40amET). The last top Fed officials to deliver speeches that were focused upon the economic outlook were Governor Quarles (September 23rd) and Governor Brainard (July 14th) so an update may be helpful. Fed-speak will also bring out Philly Fed President Harker (11:45amET), Atlanta Fed President Bostic (2pmET) and Dallas Fed President Kaplan (6pmET).

Data risk should be subdued. Canada and the US update trade figures for August (8:30amET) that are highly unlikely to materially impact markets, given their lagging nature against forward looking risks and given we already known the merchandise part of the US figures. Also keep an eye on US JOLTS job openings, but here too it’s an August reading (10amET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.