KEY POINTS:

- Stocks fall as US stimulus talks collapse

- Trump orders an end to stimulus negotiations

- Was it Trump, or has he lost the confidence of the GOP?

- Tightened financial conditions and a confidence blow add downside risks to US, world growth

- US stimulus likely on hold until well into 2021

- Powell warns, but holds back

- FOMC minutes will likely do the same

- Light overnight European releases

- Canada’s all-economy PMI on tap

TODAY’S NORTH AMERICAN MARKETS

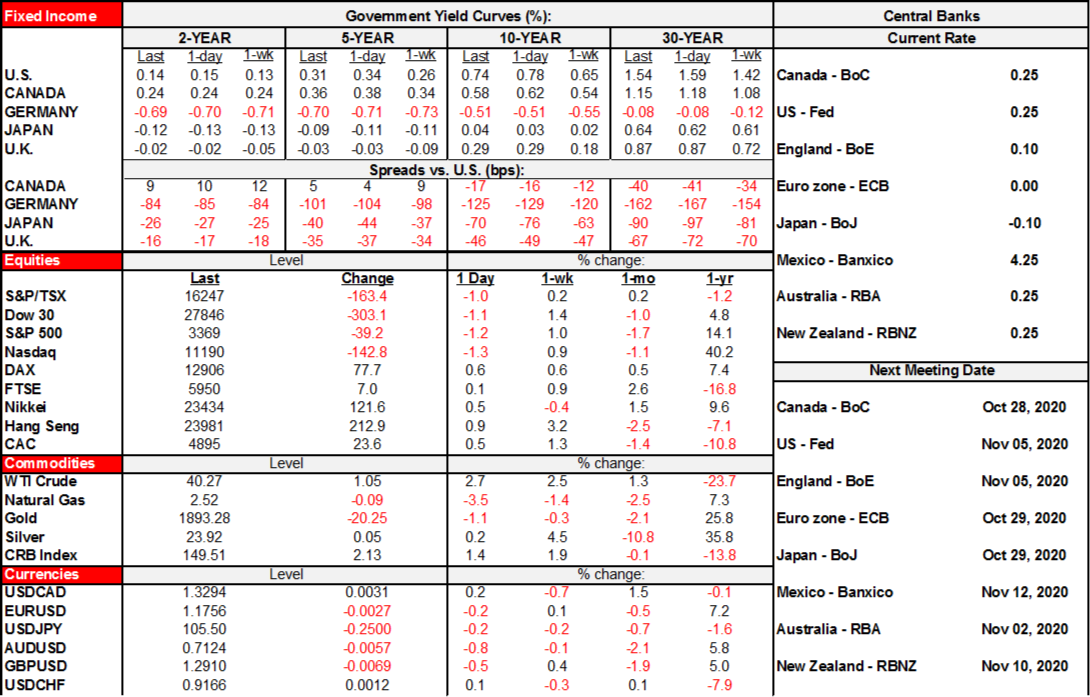

Stocks fell as US fiscal stimulus talks fell apart (see more below). Fed Chair Powell’s speech was largely shaken off by markets. Tomorrow’s FOMC minutes are likely to be treated the same way as stale. The release calendar is light through the overnight into tomorrow. Any risk catalysts may be derived from US fiscal stimulus talks that were practically dead quiet today but that post after-market risk.

- US stocks fell by about 1% across exchanges after the talks fell apart. European bourses closed up before the headlines by as little as 0.1% in London and as much as ¾% to 1 ½% in Italy and Spain, but expect a risk-off tone to catch-up to US stimulus headlines overnight.

- Oil pared some of its earlier gains but is still tracking a gain of just over 2%. Gold shed US$20/oz to under US$1900 in part on dollar strength.

- Sovereign bonds reacted to the stimulus headlines with bull flatteners that drove 10 year yields down by about 4bps in the US and Canada. European markets will play catch up.

- The USD shot upward on the headlines and is gaining on most currencies except for against other safe havens like the yen and to a lesser extent the Swiss franc.

The US fiscal stimulus talks fell apart after President Trump ordered fiscal stimulus talks to end until after the US election. It is not clear whether this is his choice or whether he has lost the confidence of his party if the GOP balked at going any further toward meeting the Dems demands despite Trump’s earlier support for a larger package. If it was Trump himself who pulled the plug without coercion from the GOP, then I’m surprised because I had figured his polling, debate performance and illness might have driven him more aggressively toward a stimulus bill. That’s why I’m inclined to think this was more about the GOP leaders and the party rank and file opposing further stimulus (notwithstanding they were the ones complicit to driving the pre-pandemic deficit upward). Have they seen the polls and abandoned their President? It’s also unclear that Pelosi was setting up Trump in that her numbers and timeline kept drifting lower.

Either way, that leaves the economy more vulnerable than we had judged. Our forecasts had not directly included additional stimulus, but they had also not yet incorporated a further incremental tightening of financial conditions or confidence shock like we are tentatively seeing now.

The length of stimulus pause is likely to be considerably beyond the US election at a minimum. The Fed is handicapped likely until the November 5th meeting and probably beyond and it isn’t even clear what more monetary policy can do here. After the election is the ensuing lame duck session of Congress. A new Congress convenes on January 3rd. The Presidential inauguration will be on January 20th. Any new administration is likely going to need time to get to a new stimulus package if deemed necessary at that point. Depending on election outcomes in both the executive and legislative branches, that could leave the US economy entirely vulnerable to rising covid-19 cases, expiring stimulus and with nothing waiting in the wings until well into 2021 after negotiation and then implementation.

Fed Chair Powell’s speech (here) had a dovish overall tone but contained no incremental policy information. Powell noted that it’s better to overshoot on policy than undershoot especially given second wave considerations, that the US fiscal deficit is unsustainable but now is not the time to worry about that, and renewed recession risk is material. His most direct quote on the direction of risks was the following:

"The expansion is still far from complete. At this early stage, I would argue that the risks of policy intervention are still asymmetric. Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses. Over time, household insolvencies and business bankruptcies would rise, harming the productive capacity of the economy, and holding back wage growth. By contrast, the risks of overdoing it seem, for now, to be smaller. Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods."

OVERNIGHT MARKETS

Germany (2amET) and Spain (3amET) will update industrial output figures for August. Both countries are expected to register mild gains, but Spain might be more challenged in this regard after a much larger 9.3% m/m rise in July. Italy will update retail sales for August (4amET) and a rebound from the prior month’s 2.2% drop is widely expected.

TOMORROW’S NORTH AMERICAN MARKETS

Minutes to the September 16th FOMC meeting will be the main development but they’re likely to be stale on arrival. That’s because they will arrive post-Powell today, after we have more evidence of climbing covid-19 cases and as fiscal stimulus talks have not (yet?) made tangible progress. This was the meeting that brought out two voting dissenters, so one question relates to the breadth of dialogue across voting and nonvoting members if we don’t already know that through their individual communications since then.

In terms of off-calendar risk the main thing continues to be US fiscal stimulus talks. In the background continues to be efforts to firm up expectations for the start of the US Q3 earnings season next week that will bring out 32 S&P500 firms including the usual focus upon financials to kick it off.

Canada will update its all-economy (private and public sectors) Ivey PMI for September (10amET). No market effect is ever likely. The August reading was looking toppish toward levels that were still around a two and a half year high (chart 1).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.