KEY POINTS:

- Equities fooled by Trump?

- Why were equity gains broad based with only airline aid in play?

- FOMC participants are probably more dovish now than the minutes conveyed, which may tee up further stimulus

- ‘Several’ on the FOMC have a problem with the adopted form of forward guidance…

- …which suggests that an actual inflation overshoot would test the committee’s resolve…

- ...and possibly just as the bond market is getting antsy

- FOMC minutes suggest changing bond purchase language…

- …but that does not necessarily mean changing purchase flows

- BoC’s Macklem speech will be his last before the blackout

- BoE’s Bailey, ECB minutes unlikely to be impactful

- Canada’s Ivey PMI plunges

- Peru’s CB expected to stand pat

- German export recovery intact?

- Mexican inflation stabilizing?

TODAY’S NORTH AMERICAN MARKETS

Fool me once, shame on you. Fool me twice in one day, shame on me. Markets might wind up adopting the second expression after the morning’s risk-on rally that followed Trump’s tweets carried through to the North American close. Recall that Trump partly reversed yesterday’s decision to shut down stimulus talks by tweeting he still wants support for airlines, US$1200 stimulus cheques and increased funding for the paycheque protection program for small businesses. House Speaker Pelosi held a call with Treasury Secretary Mnuchin about a stand-alone airline bill and told him to go back and review the DeFazio bill that the GOP rejected on Friday and that would have extended expiring aid to airlines. There did not appear to be discussion about other policy options and it seems unlikely we’ll get a broader stimulus package. Nevertheless, the breadth of the equity gain was much greater than just an impact upon airlines. One plausible explanation is that bad news for fiscal policy could be good news for monetary policy stimulus.

- With US stimulus and Brexit tape bombs omnipresent, calendar-based risk into tomorrow shifts to the BoC. There is little by way of other risk overnight through to tomorrow.

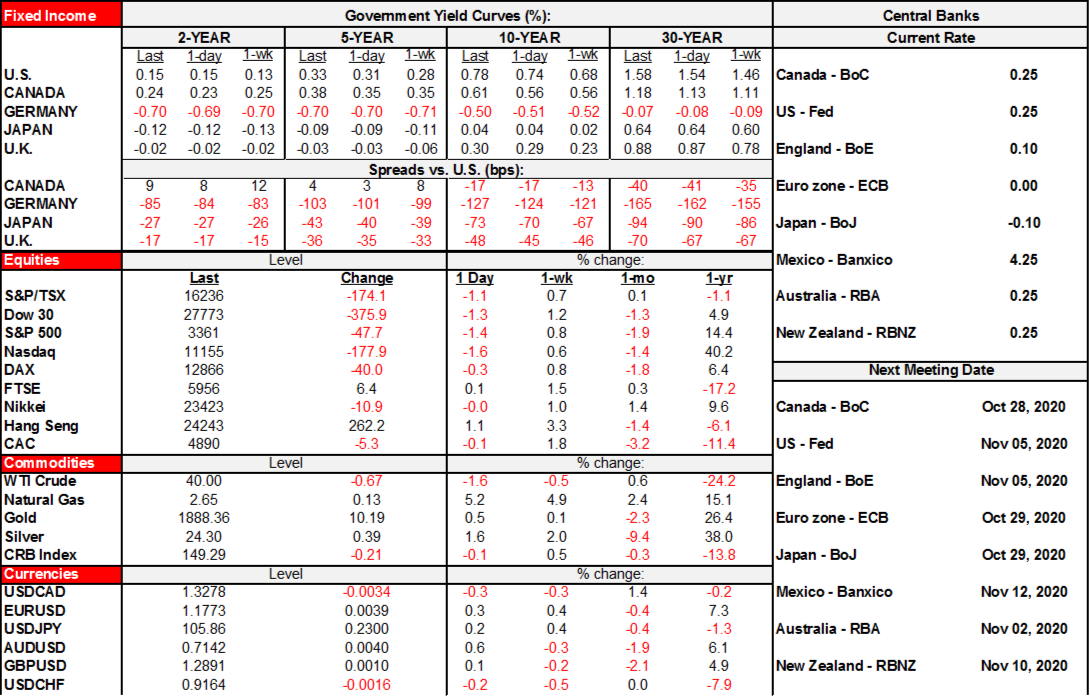

- Sovereign bond yields shot higher with the US 10 year up 5bps to 0.78% and Canada’s 10 year up 6bps to 0.62%. European yields closed 1–2bps higher across most major countries.

- US stocks closed almost 2% higher across exchanges. European markets were less impressed and generally closed little changed on average. On the S&P500, airlines were up by 3.4% but carry only a 0.23% weight. Why every other sector would have strongly rebounded as well is somewhat intriguing.

- The USD depreciated with the strongest crosses being the Mexican peso, some Scandies, the A$ and CAD. Sterling and the euro also gained. The yen lost ground and the Swiss franc also underperformed in terms of safe haven appeal.

- Oil prices fell by about 1 ½% on average in terms of WTI and Brent.

Several points stood out from the minutes to the September 15th–16th FOMC meeting (here). On balance, the FOMC members are probably more dovish now than they were at that meeting which counsels treating them as stale. There were multiple FOMC members who did not quite sign onto the way in which forward guidance was strengthened (not just the voting dissenters…). They also hinted at altering the language around the bond purchase program but did not at all specify how they might do so. One should not leap to the conclusion that Treasury and MBS purchases will be increased, though it’s possible.

- There were more than just the voting dissenters on the FOMC who had an issue with the form of forward guidance that was adopted in the revised goals statement that came out of Jackson Hole.

- The minutes said “Some participants also noted that in future meetings it would be appropriate to further assess and communicate how the Committee’s asset purchase program could best support the achievement of the Committee’s maximum employment and price-stability goals.”

- “Many” participants assumed there would be additional fiscal stimulus forthcoming and that in the absence of such stimulus “the pace of the recovery could be slower than anticipated.” Translation? Expect downward revisions to FOMC forecasts at the December 15th–16th meeting given that broader stimulus seems to be out of the picture.

- The minutes noted that, in general, “participants remained concerned about the possibility of additional virus outbreaks that could undermine the recovery.” Well, now that many regions of the world are in second waves suggests that the committee would be more dovish now.

- “Some” participants are worried about downside risk to nonfarm payrolls as job gains through reduced temporary layoffs give rise to permanent layoffs. I saw signs of that in Friday’s nonfarm payrolls where I had warned that renewed job losses could arise (here).

Further to the first bullet point, the discussion on forward guidance on page 11 of the minutes is insightful. It says that the forward guidance they delivered was not unconditional. The minutes also expanded the number of opposing voices to the form by which guidance was strengthened in the revised goals statement that came out of Jackson Hole to more than just the voting dissenters which lessens confidence in the guidance that the Fed will tolerate an inflation overshoot for some time before hiking. The minutes did this by noting that “several” had a different form of guidance in mind. Recall that the Fed’s language goes from one, two/couple, a few, some, several, etc. and so ‘several’ conveys more than just the number who dissented in the statement.

So, not only do we have cause to doubt the cohesion on the FOMC when time comes to possibly pulling the trigger, I’m also still of the view that the bond market might ultimately force the Fed into hiking if they prove successful at raising inflation above 2%. It will be a grand experiment to see how 10s and 30s would respond in curve steepener fashion to a sustained overshoot and whether the Fed may have to contain a bond market sell-off when the time comes by raising the policy rate in an attempt to contain escalating market perceptions of inflation risk. That would hardly be the first time the bond market’s thousands of agents who are constantly incorporating new information have led a central bank—including the Fed—into tightening or easing regardless of what they say to us now.

You could counter-argument this point by saying that if the Fed deems it to be suitable policy, they could increase LSAPs to contain a steeper curve. It’s not clear this would work, given evidence that successive QE rounds tended to result in diminishing evidence of downward pressure on term premia and given the relatively wide trading ranges for bond yields even as successive rounds of QE were being implemented. The narrative that central banks will be in the driver’s seat in bond markets is hardly a foregone conclusion.

As for how the Fed could further assess and communicate around its asset purchase program, this does not necessarily mean adjusting purchase flows in aggregate like the US$120B of monthly bond purchases including US$80B of Treasuries and US$40B of MBS. It could also mean:

- simply expanding upon the motive to buying “to sustain smooth market functioning and help foster accommodative financial conditions” to something more explicit by way of language that conveys purchases involve providing net stimulus and are not just about repairing markets. I doubt that such a step would have much influence as Powell basically said in the September presser that the FOMC already has broader purchase motives in mind.

- altering purchase terms and focal points along the curve.

Canada’s Ivey PMI fell by 13.5 points to 54.3 in September. That unwinds two prior months of gains. Inventories shifted toward significantly contracting while prices picked up, supplier deliveries fell and job growth cooled. It’s a difficult gauge to read, however, because it combines private and public sector purchasing managers unlike other global PMIs.

OVERNIGHT MARKETS

Nothing calendar wise should pose material risk to global markets overnight.

Peru’s central bank is expected to maintain the Reference Rate at 0.25%—its effective lower bound—and reiterate their commitment to maintaining accommodative policies for an extended period of time (7pmET). While inflation has surprised to the upside in recent months, it remains in the bottom half of the central bank’s 1 to 3 percent inflation target range.

BoE Governor Bailey is on a panel (here) on “the impact of the covid-19 crisis” with six participants for 55 minutes (3:25amET), I don’t expect much as he’ll be lucky to get time to say ‘good morning’. Ditto for the ECB minutes to the meeting at which they didn’t do anything (7:30amET).

Germany will update exports for the month of August with consensus expecting a rise of 1.5% m/m (2amET).

TOMORROW’S NORTH AMERICAN MARKETS

BoC Governor Macklem will give a speech titled “The Global Risk Institute and the evolution of risks during a pandemic” tomorrow with highlights and the speech available at 8:30amET. There will be audience Q&A but no media availability which might downplay any surprise factor. This is, however, Macklem’s last scheduled appearance before the black out on the 20th ahead of the 28th statement and MPR including fresh forecasts. Deputy Governor Lane speaks before then (15th) but is unlikely to rock the boat. Before the statement, however, we’ll get the next Business Outlook Survey and consumer survey on the 19th.

Canada is likely to see housing starts pull off August’s reading that was the highest since September 2007 (8:15amET).

US data risk should be low with just initial and continuing claims due out at 8:30amET. Consensus expects claims to slip to 820k from 837k.

Mexico will update CPI for September (7amET). Inflation has rebounded sharply after bottoming out at 2.15% y/y in April. The headline NSA August reading came in a touch higher than Banxico’s upper target at 4.15% y/y. Our team in Mexico City believe inflation will remain level in September with a risk of transitory year-over-year effects pushing inflation modestly higher. Earlier this month, Banxico released the results from its September economic survey with the 2020 inflation forecast rising a tenth to 3.9% y/y. Banxico will also release the minutes from the September meeting tomorrow at 10amET, where they unanimously voted to cut the overnight rate by 25 basis points to 4.25%. Our team in Mexico sees the overnight rate remaining on hold until at least the end of 2021 and further increases to future inflation should reinforce that view.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.