KEY POINTS:

- US stimulus talks may get kickstarted into the Asian open

- ECB’s Lane smacks dollar bears

- Draghi’s sensible stimulus advice

- US ISM-mfrg beats as new orders hit 16+ year high

- Light overnight releases

- Tomorrow: US ADP, factory orders, Beige Book

TODAY’S NORTH AMERICAN MARKETS

Three developments are sparking interest in markets. One concerns developments in US stimulus negotiations that may prove to be positive and worth monitoring this evening as a potential influence into the Asian market open. Second is that the ECB took a first step toward smacking down the euro. Three is that US macro data was generally positive today.

US Treasury Secretary Mnuchin and House Speaker Pelosi will speak at 5:30pmET about stimulus prospects, but the pattern to date has been more about finger pointing over substance.

Overnight releases are unlikely to influence global markets while tomorrow’s US-focused calendar will just pass the time until nonfarm.

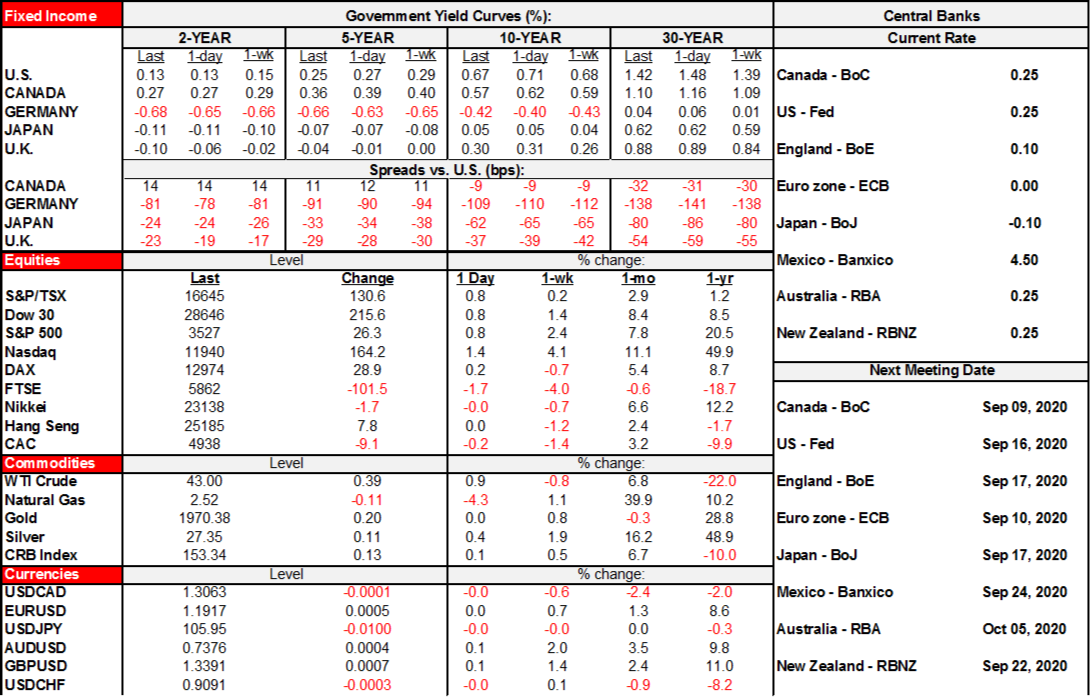

- US equities popped higher following ISM-manufacturing figures that beat expectations (see below). They might get a further lift pending stimulus developments. The S&P500 closed up ¾% with the Nasdaq leading gainers at +1.4%. Toronto was up ¾%.

- The USD slightly appreciated on a DXY basis over the course of the day and partly due to Lane’s remarks. The euro, euro-related crosses and CAD were among the underperformers.

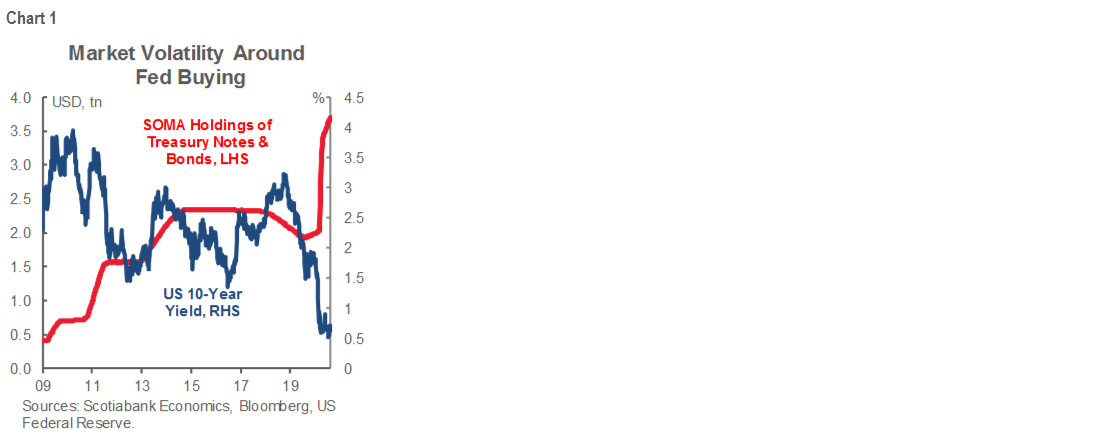

- Sovereign bonds rallied with a solid curve flattener in the US leading the way as the 30 year yield fell by 5bps. Canada’s 30 year fell 6bps. Whether it’s durable in the face of a potential US stimulus agreement requires monitoring into the overnight and tomorrow following Fed purchases in the 20–30 year section of the Treasury curve today. Further, as chart 1 shows, wide ranges in 10s yields can co-exist with aggressive bond buying and an elevated stock of holdings.

Commodities generally rallied with oil up by 1% (Brent) or a little less for WTI. Gold was little changed.

Dollar bears were given a sharp shove backward today as ECB Chief Economist Philip Lane gets the day’s prize for market influence. His remarks knocked the euro down and took euro-related crosses with it. It’s consistent with what I’ve written about how other central banks are not likely to take a prolonged unidirectional period of dollar weakness lying down (here). Lane’s remarks were the first formal acknowledgement that dollar weakness is sparking some concern at the ECB with respect to the inflation target and the role played by the eurozone’s high trade dependency. He said:

- “The euro-dollar rate does matter.”

- “We have an inflation mandate and we care about the overall performance of the European economy.”

- “We’ve seen a repricing in recent weeks.”

- “It will be important to recognize that the euro-dollar rate is also endogenous to monetary policy.”

US stimulus talks may be shifting into higher gear. US Treasury Secretary Mnuchin was sounding more conciliatory ahead of a 5:30pmET meeting with House Speaker Pelosi. He says he supports more funding for state/local governments and there will be an announcement on an eviction moratorium later today. Mnuchin also indicated that the Trump administration is now open to a US$1.5T stimulus package and enhanced jobless benefits and tax incentives to hire while seeking approval from Congress on a tax deferral plan.

The prize for most sensible remarks goes to former ECB President Mario Draghi when he favoured a shift in stimulus toward new post-pandemic jobs over preserving old ones and indicated “subsidies have to go down but at the same time jobs will be created.” Advocating enhanced stimulus until we return to where things were in March risks making all of us sound like luddites. Amidst the upheaval and understandable anxiety associated with change, policy should arguably—at least in part—ease the adjustments, but view the pandemic as something that expedited changes that were already afoot if not creating entirely new ones. Economies that capitalize upon the shift rather than fighting it will be the most prosperous ones in future.

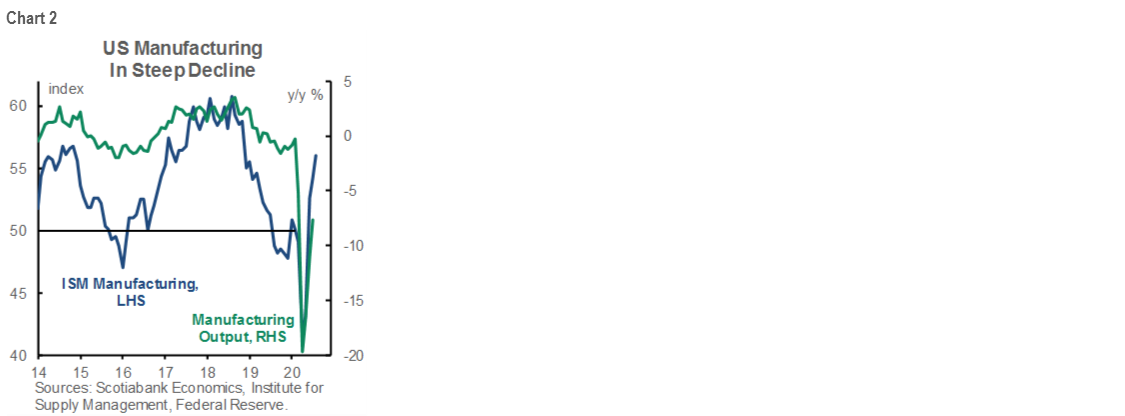

A pair of US releases saw one beat (ISM) and one miss (construction spending) but the beat counts for more in terms of forward-looking signals. The solid overshoot by ISM was backed by firm underlying details. New orders climbed to 67.6 (61.5 prior) which is the highest reading since January 2004. Employment improved to 46.4 from 44.3 which is good for a small share of Friday’s nonfarm payrolls report, but the sub-50 contractionary reading has been against three months of manufacturing jobs gains to date so treat it accordingly. The improvement in ISM points toward another gain in manufacturing output (chart 2).

US ISM-mfrg, SA, August:

Actual: 56.0

Scotia: 55.0

Consensus: 54.8

Prior: 54.2

US construction spending, July, m/m % change, SA:

Actual: 0.1

Scotia: 1.1

Consensus: 1.0

Prior: -0.5 (revised from -0.7)

OVERNIGHT MARKETS

Light overnight releases may affect local markets but carry low risk to global asset classes. South Korean inflation in August (7pmET) is expected to be little changed from the prior month’s 0.6% y/y core reading. Australian Q2 GDP (9:30pmET) will simply confirm the bleak round of figures many other countries have released by now; a non-annualized contraction of 6% q/q is expected with a consensus range around -5% to -8% for the most part.

How are European consumers faring? Germany will be the latest to answer this question with July retail sales figures (2amET). A rebound from the prior month’s 1.6% drop is expected. This would follow a small gain in French consumer spending (0.5% m/m) during July after a large upwardly revised 10.3% gain in June.

TOMORROW’S NORTH AMERICAN MARKETS

Tomorrow’s releases will be US-focused and just teasers ahead of payrolls on Friday.

ADP payrolls in August (8:15amET) may inform nonfarm expectations but it’s doubtful. The 167k ADP rise in July was way off the 1.46 million rise in private nonfarm payroll positions.

US factory orders during July (10amET) should follow the already known 11.2% m/m rise in durable goods orders but in more modest fashion as nondurable goods orders are expected to rise more slowly.

The Fed’s Beige Book of regional economic conditions will be released at 2pmET. Anecdotes on covid-19 effects and reopening efforts may garner some attention.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.