KEY POINTS:

- Stocks sink late into the North American session

- Trump Organization must submit financial records to NY A.G. before election

- Canada’s throne speech shaken off by markets

- Will Banxico continue to ease?

- Norges, SNB and Turkey expected to hold

- German business confidence faces downside risk

- US claims, new home sales on tap

TODAY’S NORTH AMERICAN MARKETS

Stocks turned sour late into the North American session. A specific catalyst is unclear. One candidate is that the NY Attorney General succeeded in having Eric Trump testify under oath by October 7th on matters concerning the finances of his family’s business. That will require the Trump organization to submit financial records just ahead of the election as part of a civil fraud investigation.

Canada’s throne speech was shaken off by financial markets which is probably the appropriate response at least for now (see below).

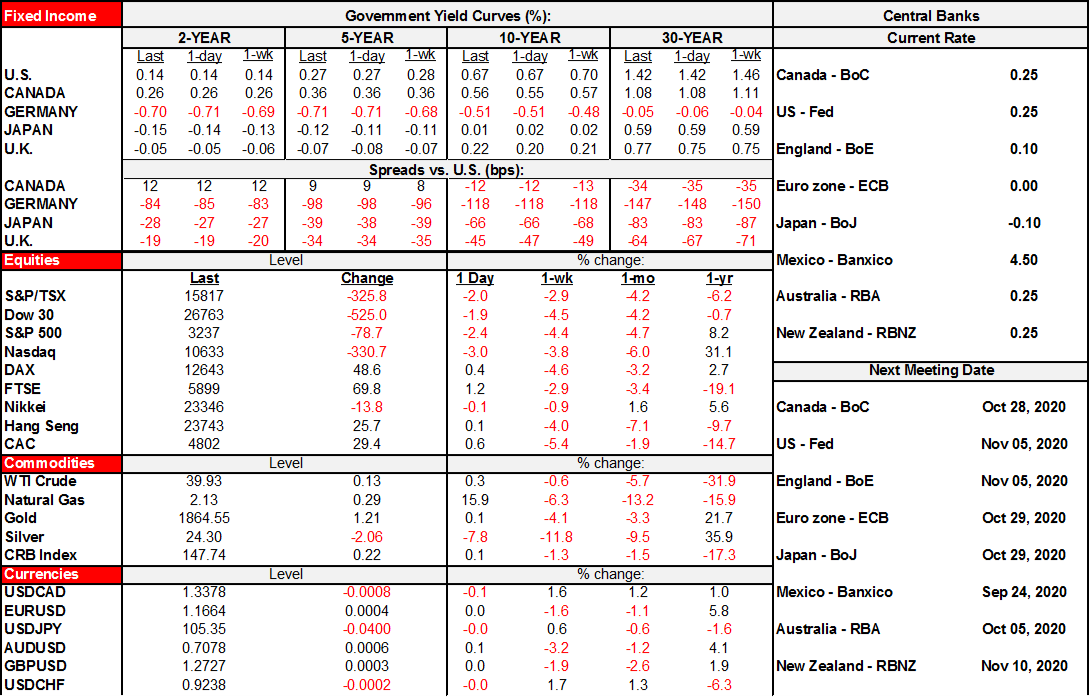

- Stocks fell in North America after European cash indices closed higher. The US S&P500 fell 2.4% with the Nasdaq off 3% while the TSX fell by 2%. All sectors on the S&P were lower with tech and energy leading.

- Sovereign bond yields were little changed across most major markets. The Canada 10 year bond’s relative performance into the throne speech and coming out of it was similar to the US 10 year yield.

- The USD appreciated on the day against almost all major currencies except for little change in sterling. CAD depreciated against the USD but was a middle of the pack performer and performed similarly to, say, the euro into and out of the throne speech.

- Oil prices fell by under ¾% and gold fell by about US$35/oz.

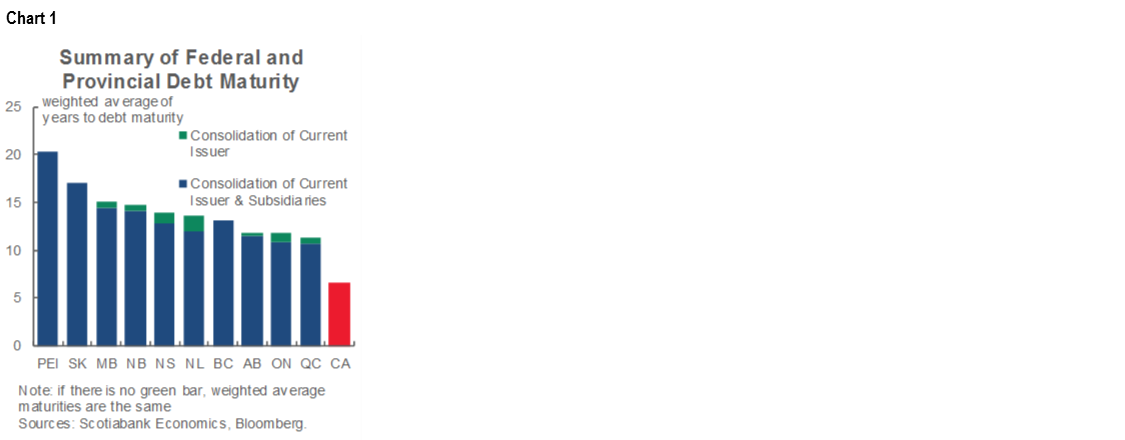

Pending PM Trudeau’s press conference at approximately 6:30pmET, a tentative overall impression of the throne speech (text here) is that it shouldn’t fuss the markets. Scotia’s Rebekah Young will offer a full note this evening. For now, I think it implicitly emphasized near-term fiscal flexibility which may be needed given the threat of a surge in covid-19 cases that could drive a deterioration in finances. Such a potential deterioration could sharply raise incremental issuance requirements alongside the rollover of existing debt given the debt maturity profile of the Federal government compared to the provinces (chart 1). In that sense, the speech is about buying time.

It did this in two main respects. One relates to what is not in the speech that could have been very costly. Two is that there were few specifics surrounding actual pledges and deferred actions that, while not uncommon in a throne speech, lessens any sense of immediacy on the path to the uncertain date of a Fall budget update. The net outcome seems to be consistent with a deliberate attempt to see what second wave risk does to Ottawa’s finances over the weeks and months ahead without committing to pre-spending on costly initiatives at this point. For now, the concern over incremental debt issuance is postponed and we’re back to monitoring the spread of covid-19 and what actually shows up in the Fall statement. PM Trudeau’s press conference and the risk of additional announcements may further inform this view.

What was not in the speech included zero reference to basic income or living wage concepts, nothing material for climate change, no increase in health transfers and no extension of CERB payments. Several other potentially big-ticket items were deferred or subject to further study such as a national pharmacare program and a task force to address ways to help more women get into the workforce including an unclear plan to make “a significant, long-term, sustained investment to create a Canada-wide early learning and childcare system.” An extension of the Canada Emergency Wage Subsidy for around another half year could add up to C$40 billion. Details are needed to evaluate other proposals such as a vague pledge to create one million jobs “using a range of tools,” enhanced Canada Emergency Business Account (aka ‘rent relief’), enhanced First-Time Home Buyer Incentive, a boost to Old Age Security and CPP survivor’s benefit, a Disability Inclusion Plan and what revenues may be recouped from socking it to the ‘wealthy’ and digital companies.

The NDP’s support is critical, but Jagmeet Singh’s pledge to “study before deciding support” coupled with reference to the throne speech being “just words on paper and this PM has shown us that his actions don’t match his empty words” will require monitoring to evaluate whether there is more than just tough talk here by way of support and probably low election risk. The Conservatives and BQ already said they would not support the speech in a vote to be scheduled at some point over the coming weeks.

OVERNIGHT MARKETS

Three central bank decisions are unlikely to materially change policy and are even more unlikely to impact global markets while there is only one macro release on tap.

- SNB (3:30amET): no change expected

- Norges Bank (4amET): no change expected

- German IFO Sept (4amET): German business confidence might face downside risk if it follows PMIs.

- Turkey’s CB (7amET): no change is expected with the small (given Erdogan…) risk of a hike on lira weakness.

TOMORROW’S NORTH AMERICAN MARKETS

Tomorrow’s developments will include the following:

- US initial jobless claims (8:30amET): A mild decline is expected with consensus and Scotia at 840k (860k prior).

- US new home sales (10amET): A small dip is expected in August’s reading.

- CB’s Lane (9amET)

- BoE’s Bailey (10amET)

- More Fed-speak tomorrow will include Fed Chair Powell along with Treasury Secretary Mnuchin for round 2 of CARES Act testimony that will likely be a repeat of round 1. Regional Presidents Kaplan, Bullard, Evans, Barkin (twice), Williams and Bostic will also speak, but the novelty of hearing regional Fed heads post-FOMC is wearing off.

- Banxico (2pmET): Most (17 of 23 forecasters) expect a smaller -25bps rate cut. One expects another -50bps cut. Four—including Scotiabank’s Mexico City based economists—expect a surprise hold. The bias will also matter at least as much as the immediate action.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.