KEY POINTS:

- Risk-on as month-end approaches

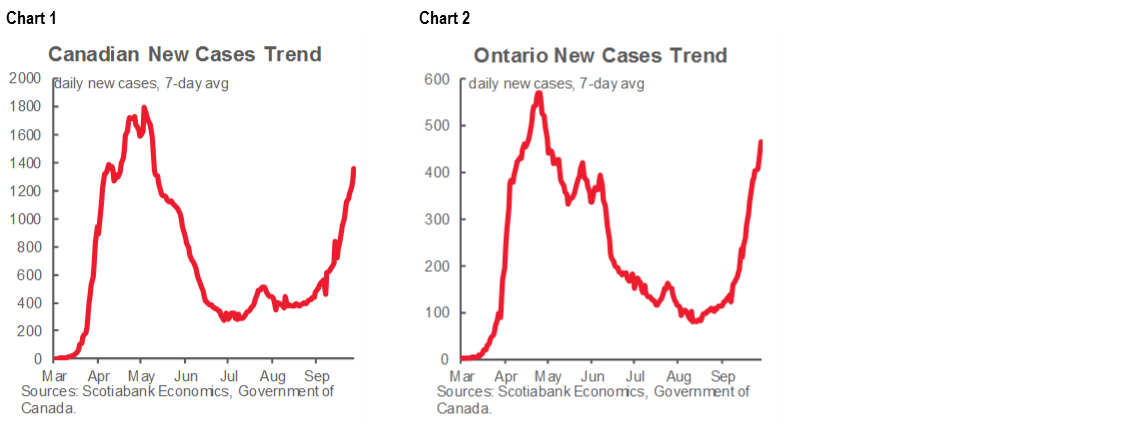

- Canada’s second wave is among the world’s worst

- Will US consumer confidence follow UoM higher…

- …and provide a clue to where nonfarm may land?

- German, French, Tokyo inflation due out

- US Presidential debate 9pmET tomorrow night

TODAY’S NORTH AMERICAN MARKETS

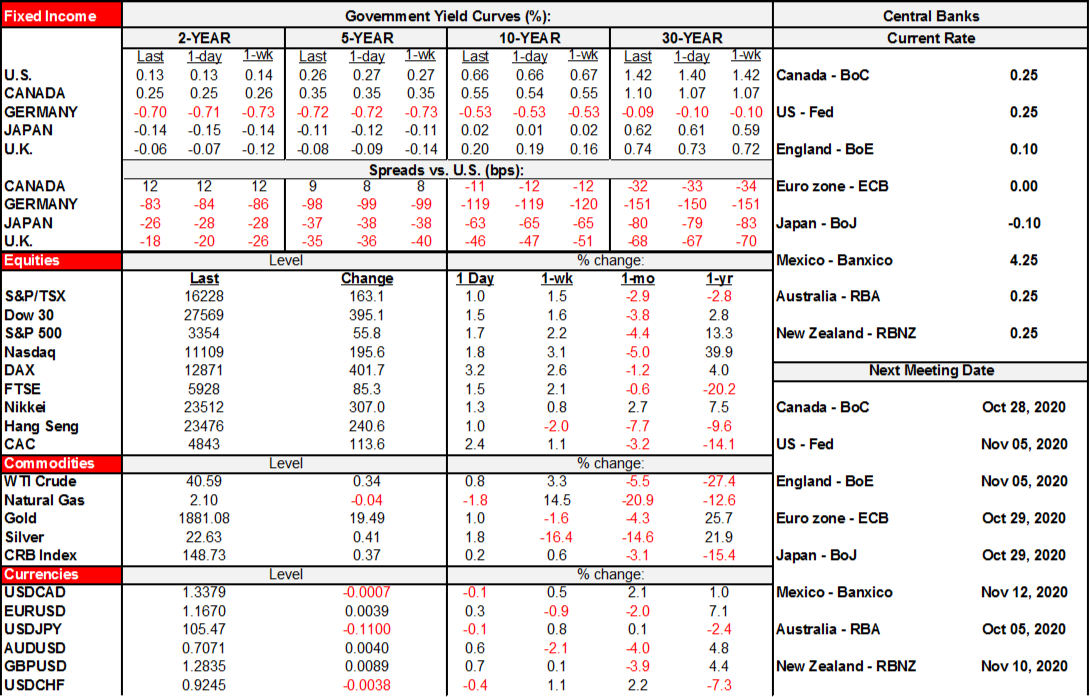

Credit month-end rebalancing? Maybe, but I can’t think of another compelling reason for the sudden snapback in equities after things were looking fairly negative earlier this morning. The month’s correction in equities may have created an opportunity to pivot back toward risk at cheaper entry points. Pure speculation toward Brexit negotiations is as yet little informed by material visible progress. Covid-19 case trends are diverging globally.

- Stocks rallied pretty much everywhere today. The strongest gains were in Frankfurt (3.2%) with other European exchanges up by over 2% except for London’s 1 ½% rise. US equities were up by 1 ¾% with Toronto up by about 1%. Rallies were marked by significant breadth.

- Sovereign bonds were little changed except for cheapening concentrated at the long ends in the US and Canada (+2–3bps). The gilts curve also cheapened a touch on earlier morning guidance against negative rates from BoE Deputy Governor Ramsden and reported progress in Brexit negotiations.

- Oil prices were up by either side of 1% with gold up 1%.

- The USD depreciated a touch and mainly versus European crosses as CAD and the Mexican peso underperformed.

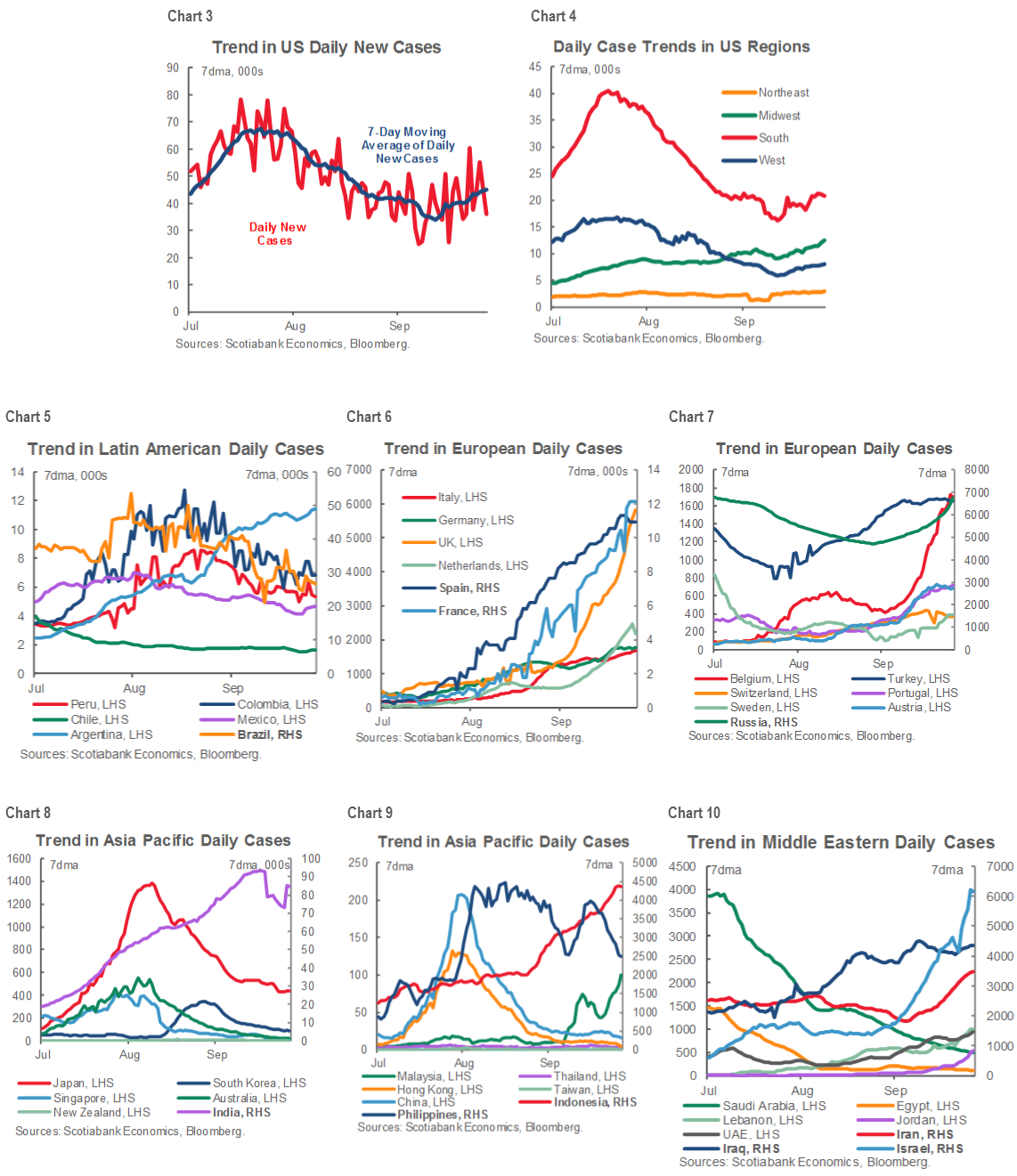

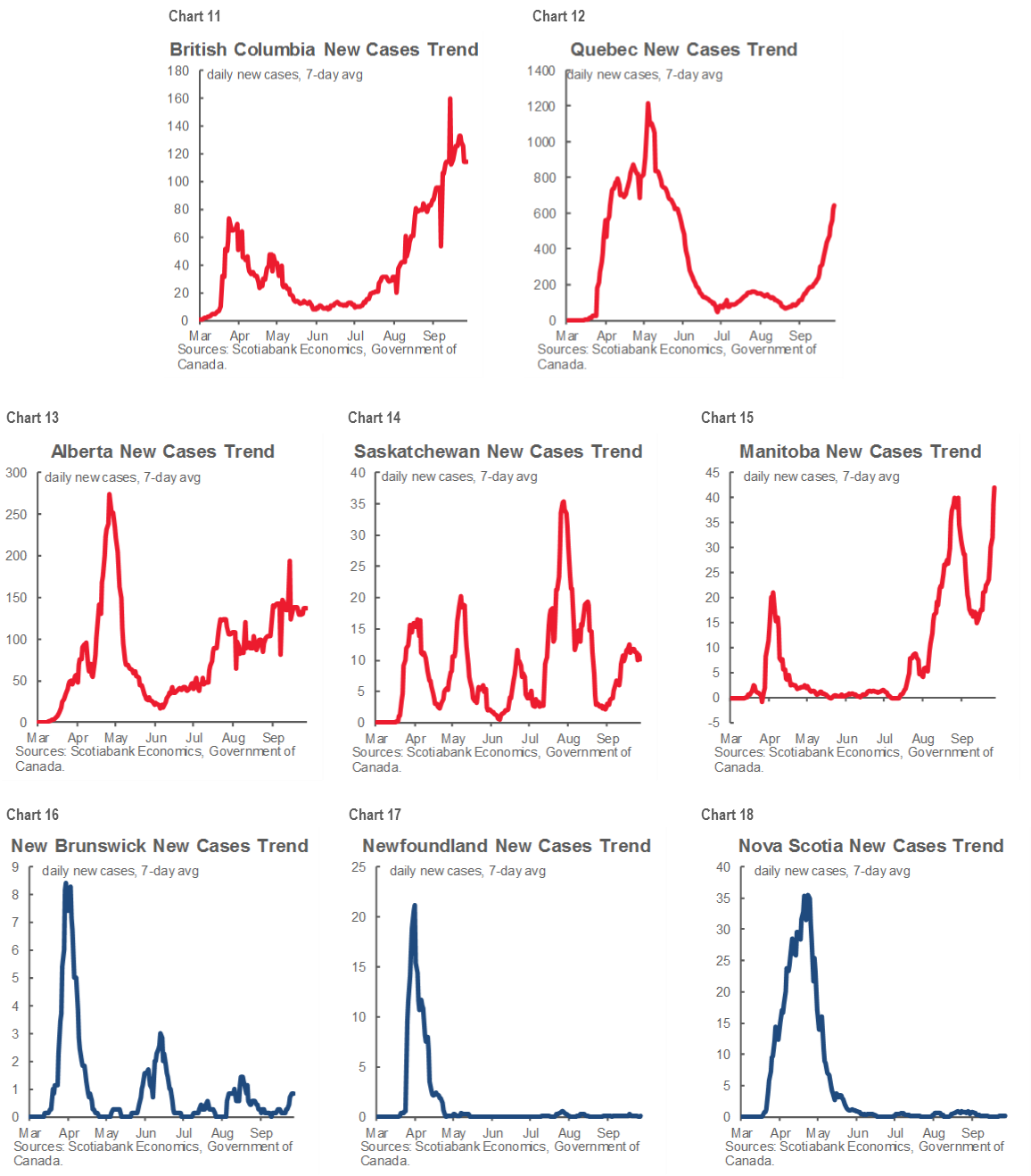

Canada is definitely in the grips of a second wave of covid-19 cases that ranks among the worst as the country appears to have prematurely lowered its guard. Charts 1 and 2 depict the increases. Geniuses like the unmasked folks at the Wasaga Beach event in Ontario this past weekend (go ahead and google some pics) are ensuring that further outbreaks will continue which should make every unemployed Canadian and business that’s struggling for its survival thoroughly outraged for their callousness. This merits enhanced emphasis upon scenarios and contingencies. See the updated charts at the back of this note for global covid-19 cases as well as a breakdown of Canada’s covid-19 case trends by province. Ontario hit a single-day record of 700 cases today which took its seven day smoothed moving average even closer to the peak in May. Canada’s renewed outbreak is among the world’s worst as cases in Latin American subside with the exception of Argentina, US cases are trending upward but at a cooler pace than in Canada, several large European countries are trending upward and Asia’s experience is mixed thus far.

OVERNIGHT MARKETS

There is nothing due overnight that is likely to roil markets rather than to perhaps incrementally inform ECB risks.

Japan updates the September print for Tokyo CPI tonight (7:30pm ET). This is a precursor to nationwide CPI which isn’t released until late October and tends to follow Tokyo inflation. Headline Tokyo CPI is expected to slow two tenths to 0.1% y/y, which is approximately where the gauge was during the height of the pandemic. Core CPI is expected to remain disinflationary at -0.3% y/y. While the Japanese government is beginning to ease travel and recreational restrictions, inflation is not likely to rebound in Q4. Beginning in October, Tokyo will be included in the Government’s Go To Travel campaign, which is aimed at spurring on the recovery to Japan’s tourism industry. There will likely be a transitory drag on travel prices moving forward as the initiative offers heavy subsidies to tourists.

The path to Friday’s Eurozone inflation numbers that might inform ECB risks starts overnight. Germany updates September CPI (3am–8am ET). Regional inflation indicators will be released starting at 3am and concluding with the nationwide and EU harmonized inflation (HICP) figures at 8am. Germany’s HICP is expected to remain at -0.1% y/y as registered in August. As part of Germany’s stimulus package, the government cut the VAT by 3 percentage points for regular goods and 2 percentage points for food items. The VAT cut will be in place until the end of the year is expected to weight on German inflation through the incentive’s duration.

September Spanish CPI will also be released (3amET). Inflation is expected to remain at -0.5% y/y as energy prices and travel prices will provide most of the disinflationary pressure.

TOMORROW’S NORTH AMERICAN MARKETS

One of tomorrow’s US macro releases may further inform expectations for Friday’s nonfarm payrolls report while it’s difficult to imagine what else Fed speakers may have to say that would matter to markets at this juncture. All of this may be a warm-up to the first Presidential debate tomorrow night at 9pmET.

Are jobs more plentiful or harder to find in September compared to the prior month? The answer to this question may matter in terms of expectations for Friday’s nonfarm payrolls report and it will be contained within the Conference Board’s measure of consumer confidence. If the improvement in the University of Michigan’s sentiment survey (78.9, 74.1 prior) was any indication, then the mid-month reading could portend a follow-up gain in the Conference Board’s measure at 10amET.

Otherwise, the rest of the calendar will be pretty light with just the US advance merchandise trade balance for August (8:30amET), US repeat home sale prices for July (9amET) and several Fed speakers. Each of NY Fed President Williams (9:15amET, 1pmET), Philly Fed President Harker (9:30amET), Vice Chair Clarida (11:40amET) and Vice Chair Quarles (1pmET, 3pmET) will speak.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.