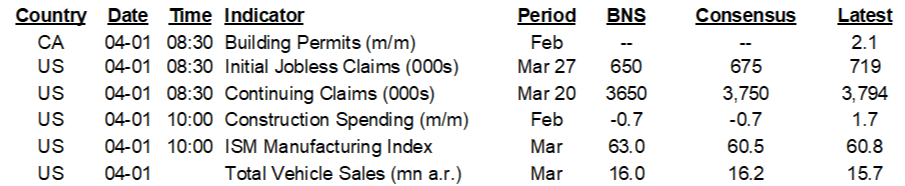

ON DECK FOR THURSDAY, APRIL 1

KEY POINTS:

- Curves flatten on nonfarm’s eve

- US ISM-mfrg: a nearly 4 decade high?

- Revisions drove US claims even lower between nonfarm reference periods

- Canada’s booming manufacturing sector hits post-GFC record

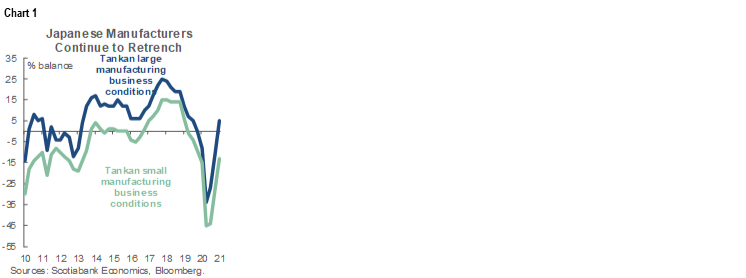

- Japan’s manufacturing sector rebounds

- China’s private manufacturing PMI undershoots the state’s

- German retail sales disappoint

- US construction spending may fall, vehicle sales likely to rise

- Ottawa’s housing rhetoric is heating up

- Taxing home equity is awful policy advice

INTERNATIONAL

There is little new information to inform market direction ahead of tomorrow’s payrolls. The main focal points will be ISM-manufacturing and a possible risk in a Canadian housing announcement. Canada’s bond market shuts early at 1pmET today but there is no early close in equities. There is also no early close in the US bond or stock markets and Treasuries will trade for a half day tomorrow given nonfarm’s release.

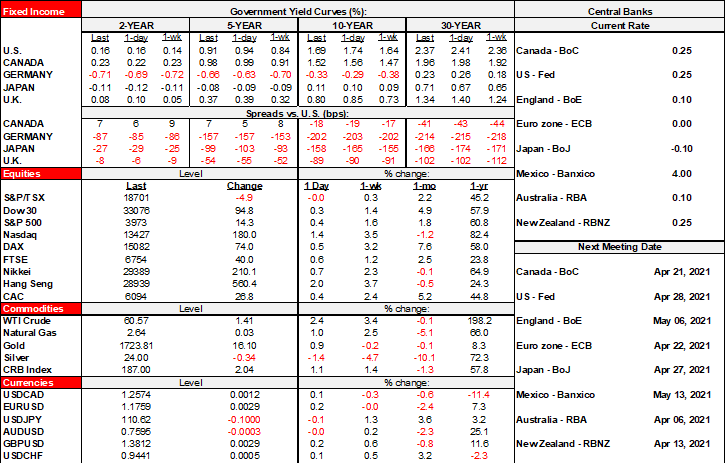

- The USD is little changed.

- Sovereign curves are slightly dearer with the US Treasury curve bull flattening by about 4bps. Canadian yields are also lower by 3–4bps at the longer end. 10s in the UK and across EGBs are down by 3–4bps.

- Stocks have a small bid on average with US futures are by between ¼% and just over 1% for the Nasdaq, Toronto futures are up by over ½% and European cash markets are mostly up by about ½%.

Japan’s Q1 Tankan surveys generally beat expectations overnight (chart 1). The large manufacturers’ index climbed 15 points to +5 (-1 consensus) for the strongest reading since September 2019. The small manufacturers’ index improved but not by as much as it climbed to its best reading since Q1 last year. The yen largely ignored it.

China’s private manufacturing PMI did not confirm the improvement in the state’s version. The Caixin reading was little changed at 50.6 (50.9 prior) versus the state manufacturing PMI’s 1.3 points climb to 51.9. The state version is more skewed toward SOEs whereas the private version is more skewed toward smaller export-oriented firms especially along the main coastal regions.

German retail sales disappointed mainly on revisions. First, January’s 4.5% m/m volume drop was revised to a worse 6.5% decline. Second, the 1.2% rise in February’s volumes fell shy of consensus expectations for a 2% rise. Food sales fell and pharma sales were little changed as offsets to large gains in other categories like clothing/shoes, IT and furniture.

CANADA

Canada’s Markit manufacturing PMI climbed by 3.7 points to 58.5 in this morning’s March reading (here). That was described by the Markit folks as the “highest reading in over ten years of data collection.” New orders, production and inflation signals all increased as order backlogs rose. The job gauge climbed to its strongest in three months.

Canada will make a ‘major’ housing announcement at 1pmET today. It’s unclear what it will be, but it’s not the Minister of Finance doing it and so I’m skeptical toward how ‘major’ we’re talking. Past bouts of material tightening on the macropru side of things, for instance, have always been announced by the MoF. Instead, it will be the minister responsible for the cmhc and families who will be doing the delivery. They’ve been making regional announcements on things like affordable housing etc and so it’s unclear that this will be significant. All ministers are beating the trails aggressively now on the path to the Federal budget on the 19th.

Having said that, Ottawa’s rhetorical tone on housing markets is shifting in a significant manner and on the path toward the Federal budget. We saw that in yesterday’s remarks by BoC Governor Macklem. Recall that until now he has tended to say they would only worry when there are extrapolative conditions (ie: people expect rapidly rising prices and are driven by FOMO) and that such evidence is lacking. He is no longer saying that and remarked that “There certainly are some signs of extrapolative expectations." Macklem also flagged that "you are seeing, on average, the loan-to-value ratios are getting higher, particularly in the uninsured space. That suggests that Canadians are stretching and that is worrying." The BoC will release its quarterly Survey of Consumer Expectations on April 12th and given the long lag between data collection and the report’s release, Macklem would already have the data in hand and so he is probably giving us a sneak peak at the survey’s findings. In any event, note the gradual evolution of the BoC’s thinking on housing in that Macklem dismissed housing worries last Fall. Then earlier this year he pointed to exuberance. Now he's saying house price expectations and leverage are changing. This follows remarks by Finance Minister Freeland last week when she said they are watching housing markets closely.

The BoC’s role in driving hot housing has to be fairly emphasized as more than just an innocent bystander. While it’s probably true (notwithstanding the Fed’s role in the mid-2000s’ housing frenzy) that monetary policy should not tighten only because of housing with about 600,000 still unemployed from the pandemic (probably lower after next Friday’s release) and inflation below target, the debate for some time now has been over whether the BoC over-promised on the length of a rate hold by repeatedly telling Canadians that they can count on no rate hikes for years to come. That guidance may have been suitable in the early stages of the pandemic before vaccines, before heavy US and Canadian fiscal stimulus, before the proven resilience of the Canadian economy to the second wave etc etc. It is less defensible now. I would prefer to see this guidance significantly shortened to incorporate information learned about the outlook since the pledge was first made or to hear more balanced reference to policy rate risks and for the BoC to be advising borrowers to consider debt sustainability at higher rates in the relatively near term of their amortization periods.

These remarks are being delivered about 2½ weeks ahead of the Federal budget on April 19th. They indicate growing unease toward the extent that stimulus is driving very strong housing markets and keep the risk of macropru measures on the table as guided long ago. Such macropru measures have had little if any sustained success over the past decade-and-a-half as low rates have overwhelmed their influence while supply has only gotten tighter. That might caution against relying upon them yet again especially as supply is the issue.

One thing that should be given no consideration is taxing home equity. I think that’s a very unlikely policy outcome, but a minority of policy proponents think this is needed in order to shock households’ price expectations and wipe out the FOMO component of housing demand. Here are some of the reasons why it would be poor policy if Ottawa essentially enacted a measure that would be akin to installing an ATM on the sides of your homes to fund its heavy spending ambitions. Note that among the themes is that both first-time buyers and folks at a more advanced stage of life could be equally hurt.

- Lenders should probably know this (ahem…) but in case anyone out there is unaware, lenders generally assess home equity estimates of collateral when deciding whether to approve a loan or not. If government takes a portion, then maybe lenders would adjust the terms to compensate for higher risk, or perhaps they would lower the amount they are willing to lend or they may just refuse loans especially for high ratio mortgages. Yeah, that’ll help first-time home buyers who are among the most likely to have relatively little to put down on a home purchase. Taxing home equity could drive regressive outcomes.

- Bond markets would likely have the same reaction to such a policy measure especially in terms of insured mortgage bonds. The market could demand a wider mortgage bond spread over Canadas to compensate for higher risk of reduced equity backing a portfolio of bonds. The potentially wider spread would influence what mortgage borrowers pay especially the higher ratio mortgages of first-time buyers which, again, would be a regressive outcome. Ottawa’s overall funding costs through its crown corporation could rise.

- Bond yields and mortgages rates are already rising and the BoC’s policy rate is likely to begin rising next year. It could be that the housing market will cool naturally over time as bond yields and other market drivers continue to reset higher from the lows set during the pandemic. An abrupt shock like taxing capital gains layered onto what may be a naturally cooler market over time could incite a harsher than desired outcome.

- Reverse mortgages would be made less attractive with government taking a slice and that would hit some retirees who wish to stay in their homes. If they could still qualify, they might secure a lower financing limit as a sudden shock to their retirement lifestyles.

- It could work against increasing housing supply as the biggest challenge facing housing markets by scaring off investment capital.

- Then there is the issue of triple taxation extending its reach into your savings. You pay taxes on income, on consumption and on non-sheltered savings. The last thing left is for government to steal your retirement savings and taxing home equity could be the thin edge of the wedge in that regard. What next, TFSAs? Change RRSP terms? The knock on effects to confidence in retirement savings vehicles could be damaging and out of the control of politicians short-term words against ever possibly thinking of doing such things after setting a precedent.

- It would be a shock to many folks' retirement plans since many rely upon their home as a retirement nest egg. Even if grandfathered, house prices would adjust and adversely affect everyone. The shock could be rather acute given the sheer number of retiring boomers in an aging population.

- Housing is already heavily taxed so let’s abandon the myth that there is room for more. Tens of thousands of dollars within an average home’s price is accounted for in development charges, land transfer taxes, property taxes, taxes on inputs, estate settlement taxes, transactions taxes, taxes on renovations etc.

- If house prices collapsed, governments would bleed more at the worst time because of tax losses. This makes it rather curious to hear about taxing home equity when the CMHC is still running around warning of impending doom for house prices albeit after being wrong on the guidance for a lengthy period and given the possibility that Ottawa is perhaps using forecasts to jawbone against housing demand. On the assumption that taxing housing’s capital gains would be symmetrical policy as in other cases, capital losses could amplify procyclical risks to government finances and blow-out deficits even more during downturns. Wouldn’t it be amusing if the policy was, oh, let’s say introduced at the peak of the fervor only to run a greater risk of capital losses bleeding government revenue over coming years? Think back to coming off the late 1980s boom after which it took many years into the 2000s for Toronto house prices to recover; fiscal deficits were already running at a high level and would have been made worse for a long time if capital losses could have been written off by taxpayers. Rating agencies might have questions for why the Federal government would begin taxing capital gains at a time when its housing agency is forecasting a decline in house prices.

- The housing stock could fall into disrepair by damaging investment in upkeep if government gets a part. Think rent-controlled housing where government action ruined the market.

- Who is to say governments will make good use of what they take from home equity? Installing an ATM on the side of your home would offer a blank cheque to governments absent any discipline over what they do with the funds. Taxing gains would be a structural long-term policy option that would fan expectations that Ottawa is seeking longer-lived spending pledges than it currently guides.

- Some say that because the US taxes capital gains on a principal residence over US$500k that Canada should do so. First off, anything that starts with how US tax policy is a model for the world is probably immediate cause for skepticism! In this case, it’s just plain wrong. The US treats housing kind of like how Canada treats RRSPs. In the US, capital gains are taxed, but you get to write-off mortgage interest and SALT deductions including property taxes so you can't double dip by subsequently not paying it back later. It's a deferred tax bill on housing in the US, like Canada’s RRSPs. Canada is very different. You don't generally (some do) get those deductions, so you shouldn't be taxed later.

- The baker’s dozen bonus: It’s possibly an election year. Pick your battles, with the battle over home equity likely a doozy.

UNITED STATES

US weekly jobless claims picked up a bit last week but remain on a downward trend. Initial claims increased to 719k from a downwardly revised prior week that is now estimated at 658k instead of 684k. Since nonfarm payrolls capture job changes during the reference period that is the pay period including the 15th of each month, the downward revision to 658k for the week of the 15th may reinforce expectations for a strong payrolls reading tomorrow morning; weekly claims fell by about 190k roughly between the middles of February and March.

Three more releases are on tap for today with the main focus upon ISM.

ISM manufacturing (10amET) should follow regional surveys and an expected rebound in vehicle sales higher. In fact, it’s feasible that we hit the highest level for ISM since 1983. Also watch for greater evidence of price pressures after the prior report indicated widespread guidance across industries. Otherwise, it will be on to the next day’s US nonfarm payrolls and a half day of trading Treasuries on Friday. Here's hoping it's a great Friday and not just a good one.

Construction spending likely fell in February (10amET) given housing starts declined that month partly on harsher than usual weather effects.

US vehicle sales during March are expected to post a significant rebound late in the day partly due to improved weather conditions and after February was hit by Texas power grid issues.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.