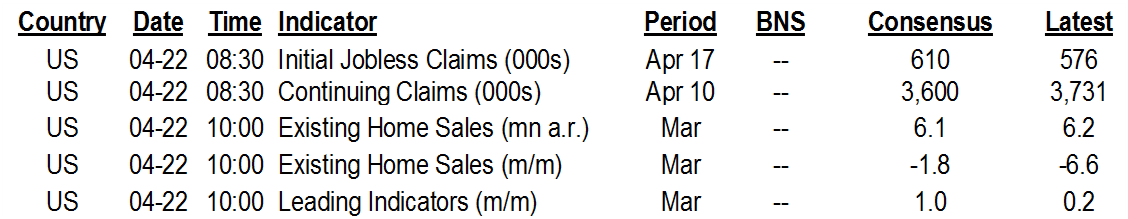

ON DECK FOR THURSDAY, APRIL 22

KEY POINTS:

- Little market follow-through on BoC communications

- ECB sticks to script

- Will US claims preserve a bullish nonfarm signal?

- US home resales on tap

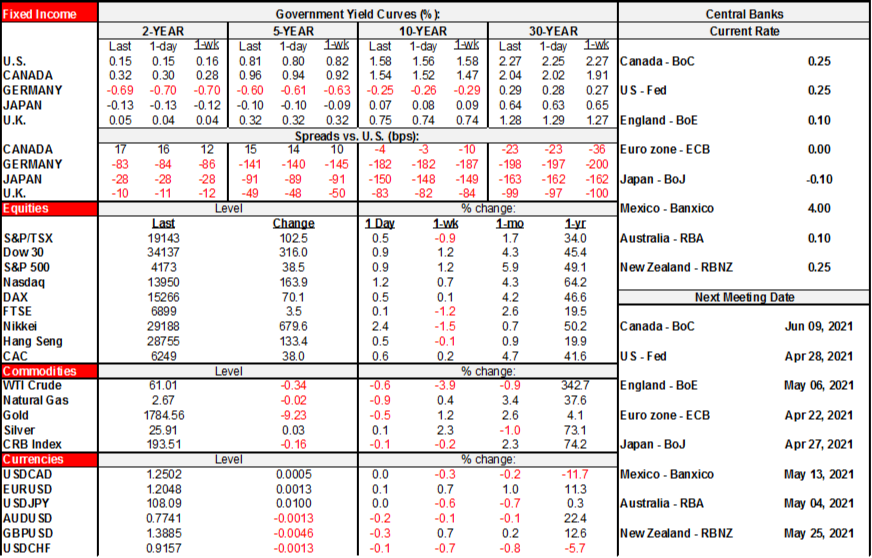

Global asset classes are mostly little changed so far this morning and calendar-based risk should be fairly light, barring an unexpected surprise from the ECB press conference following no change in the statement itself. CAD is hanging onto yesterday’s post-BoC gains (yesterday’s recap here) while the US and Canadian sovereign curves are cheapening and steepening a bit further so far. European stocks are a little higher with North American futures little changed to slightly red, perhaps more pink than crimson.

No major policy changes were delivered in the ECB statement (here). Key was retention of the following line:

“the Governing Council expects purchases under the PEPP over the current quarter to continue to be conducted at a significantly higher pace than during the first months of the year.

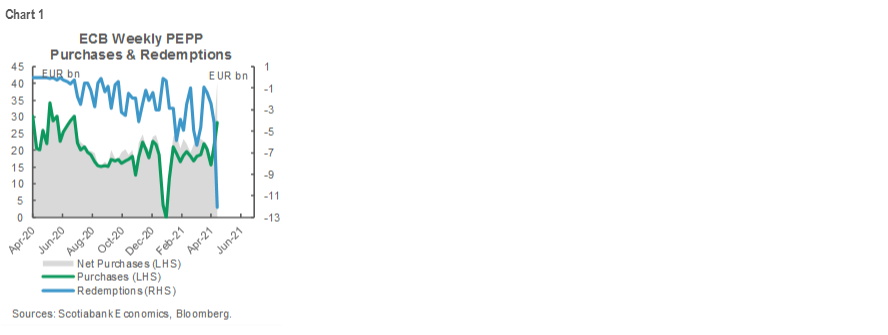

The debate around the 8:30amET press conference surrounds how confident Lagarde will sound regarding PEPP purchase guidance as prior upward pressure on bond yields has abated somewhat. That’s a bit of a chicken-and-egg argument in that she might just say the reason why this pressure has abated has all been because of them. Of course, that’s a stretch, but it’s likely premature for her to say mission accomplished on accelerated purchases. In any event, net purchases have gone up over the past couple of weeks in keeping with the stance at the March meeting to bring them forward as a containment measure against higher yields. That, however, has been slightly more due to lower redemptions than it has been to higher gross purchases. See chart 1.

UNITED STATES

Consensus guesstimates for US weekly jobless claims (8:30amET) point to a slight reversal from the big prior drop, but it’s only a guess. Today’s estimate for last week will push into the nonfarm reference period that is the pay period including the 12th day of each month. If anything close to the decline to 576k during the prior week is retained today then it will be a rather bullish signal for payrolls in terms of the change in claims between reference periods.

US existing home sales during March (10amET) probably slipped; pending home sales have dropped by over a dozen points in the first two months of the year and mostly turn into completed resales within 30–90 days. Recall the US records resales at the point of closing whereas Canada reports them at the point of signing, so the US home sale figures tend to lag current selling conditions.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.