ON DECK FOR FRIDAY, APRIL 23

KEY POINTS:

- Curve steepening returns

- US, UK, Australia lead the world on growth signals…

- ...but PMIs in the Eurozone and Japan also posted slight gains

- US new home sales are trending around 2006 highs…

- ...but this time there is a total absence of vacant homes on spec

- The UK just demonstrated how eager global consumers are to return to spending once vaccinated

- How Biden’s soak-the-rich taxes will hit the middle class

- The BoC is forecast to hike 6 times…

- ...and a middle solution between tightening too soon or too late

INTERNATIONAL

Europe is catching up to yesterday afternoon’s US ‘news’ on capital gains taxation but US markets are showing a bit more stability this morning. US equities are gaining after yesterday afternoon’s sell off, but European cash markets are edging lower. The catalyst was the ‘news’ that the Biden administration plans a sharp rise in capital gains taxes which has been known for ages now but pops up sporadically from time to time and appears to surprise folks each and every time it does! Biden will poke the bear on the topic again next Wednesday. A decent round of global PMIs is helping to stabilize conditions somewhat. The USD is broadly lower and US Treasuries are leading curve steepening.

PMIs across all major regions came in better overnight with the UK and Australia leading the gains. Global manufacturing continues to outpace services hands down across all regions, but services are picking up to varying degrees. See charts 2–5 for the links between PMIs and GDP growth; they serve as more upbeat nearer term guides to overall growth as the global economy transitions toward a better Q2.

- The UK composite PMI jumped by 3.6 points to 60.0, so further above the 50 dividing line between expansion and contraction and signalling quickening growth on a burst of vaccine-led reopening effects. Services led the way, up nearly four points to 60.1, but manufacturing also gained almost two points to 60.7.

- The Australian composite PMI picked up 3.3 points to 58.8, led by similar increases in both the services and manufacturing PMIs.

- the Eurozone composite PMI edged up half a point to 53.7 on both a seven-tenths rise in the services PMI that crawled above the 50 mark but with an assist from manufacturing that was up eight-tenths to 63.3. Germany is growing faster than France, but at the margin the improvement was focused upon France the German composite PMI slipped a bit because of softer German service sector growth.

UK retail sales volumes demolished expectations last month. They were up 5.4% m/m (consensus 1.5%) with minor revisions. Ex-fuel sales were up 4.9% (consensus 2%). Whoops. Massive gains were clocked across all major subcomponents including clothing (+17.5% m/m), household goods (+3.7%), ‘other’ stores (+13.4%) etc etc. If you need proof that antsy consumers with serious cases of cabin fever are chomping at the bit to get out and spend once the curtain rises, then there’s your proof.

Russia’s central bank hiked by more than expected. The key rate was raised 50bps to 5% (consensus 4.75%). Two-thirds of consensus expected a quarter point but one-third got it right. Guidance indicated there is more to come. Inflation is the fear and if you keep poking your nose into other folks’ affairs and sparking trouble around the world then sanctions and the effects on the ruble might make it more of a cause for hiking! Back at ya Putin, market style.

UNITED STATES

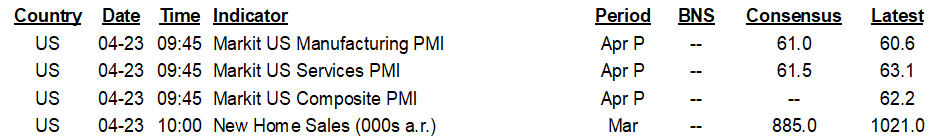

The US Markit composite PMI increased to 62.2 from 59.7 in April over March. The services PMI increased by nearly three points to 63.1 with the manufacturing PMI up by 1.5 points to 60.6. The US Markit gauges are second or third fiddle to the ISM measures, consensus is too thin for their guesses to matter much and the Fed only really cares about the ISM measures anyway since they speak to the domestic economy mandate whereas the Markit gauges are a hodgepodge of multinational operations.

US new home sales ripped higher after the prior month’s weather-induced plunge. They climbed by 20.7% m/m, or enough to blow your PJs right off this morning. Yesterday’s drop in existing home sales likely had an awful lot to do with the lack of product to purchase. Chart 6 shows how resale inventory remains at record lows as housing supply remains challenged across North America. It also shows record low home vacancies which indicates how different this market is from pre-GFC conditions when folks once thought it was appropriate to blow on birthday cakes. Back then, the rate soared to triple that level and driven by folks often of moderate means who were leveraging themselves to their eyeteeth while flipping an abundant number of homes on spec.

As an aside, the Biden administration has said they only want to raise taxes on the super-wealthy while leaving middle-income earners unscathed. They say this is a matter of social justice and we must absolutely listen, or something like that, I wasn’t really paying attention. Anyway, good luck with that. As noted previously, this argument is a total ruse in part due to the (false) assumption that no one in the middle-class owns any equities that could be hard hit by dramatic increases to capital gains taxation along the lines of what Biden is planning. Chart 1 begs to differ way back on the cover page as the chart du jour.

Yes equity ownership in overall aggregate terms is concentrated in the hands of relatively upper-income earners, but it’s wrong to assume that a trivial amount of equities is held relative to the incomes of others. The chart uses the most recently available survey of consumer finances done by the Federal Reserve. Earners in the 60th–80th percentile of income distribution held equities equivalent to almost 150% of their income with a median before-tax family income level for this group of just under US$100k; perhaps somewhat comfortable, but definitely not super rich. I doubt they’d be indifferent to such holdings. Earners in the 80th–90th percentile are also maybe comfortable, but hardly rich, with a median before-tax family income of about US$150k and their equity holdings are almost three times their level of income.

The ‘left’ assumes that by targeting higher capital gains taxes on folks earning over US$1 million that no one else will be affected. The point is that’s not so if equity valuations fall or are held back on tax plans and hit the middle class on direct effects as well as indirect effects by tightening overall financial conditions and risking financial instability. Any government that tells the middle class they are not vulnerable to tax policy changes applied to the stock market would risk facing a flood of voters stepping forward to show them their 401ks, RRSPs, nonregistered accounts etc and wondering how it is that politicians can’t relate to a basic understanding of their finances and their overall lot in life. Compartmentalizing ‘Wall Street’ might make for good attack ads, but if translated into policy action it risks ignoring the obvious connection right back to mainstreet both in terms of facts and the folklore surrounding the important of the stock market to everyday Americans.

CANADA

There are no major developments on tap in Canada today.

Six hikes, one per quarter, starting in 2022Q3 through the end of 2023. That’s our revised assumption on the Bank of Canada. Two of those hikes in 2022 are shown in our 2021–22 print forecast that was distributed yesterday following the convention to print a forecast two years at a time. There is a decent chance there could be more and possibly earlier hikes than that within the print horizon. The other hikes are embedded within the forecasts for 2s and 5s through to the end of next year that rely upon assumptions toward where the overnight rate will go thereafter. Prior to this point the forecast for BoC moves had for a long time been ahead of consensus and markets on the starting point, but the forecast was still cautious on the pace. What has changed in our forecasts now is conviction toward the pace.

Even by the end of 2023—two and a half years from now—our forecast for a 1.75% target rate still falls at the bottom end of the BoC’s neutral rate range that they estimate to be between 1.75–2.75%. In fact, I still worry that we may be too light on the pace.

In terms of drivers, while we’ve all wished for faster progress on vaccines for an extended time now, Canada is catching up and proving correct the narrative that it would do so rapidly. 11 million doses have now been administered to an over-15 adult population of about 32 million for about one-third coverage to date (38 million including kids). I get my AstraZeneca jab tomorrow and oh what a wonderful way to spend a Saturday morning that will be. Much of the commentary on this issue has been so politicized that it has been caught flat footed by the long anticipated upward march in chart 7. Canada will be vaccinated by later summer, though like most others the uncertain challenge that remains ahead will be focused upon kids.

If this were a past cycle, the BoC would be at 1.75 by the end of next year if not earlier, not the end of 2023. They would have acted in anticipation, not at or after hitting goals. This forecast for a lagging reactionary move in the policy rate is a monetary policy catch-up narrative partly in keeping with the times.

I'm personally deeply skeptical of the prevailing narrative during these times. While the BoC has seen inflation undershoot its target throughout the past decade and perennially forecast inflation to land too high—though it has been much less open toward acknowledging this compared to the Fed—they've arguably turned inflation agnostic at precisely the worst moment in time.

Even if we gloss over the debate over the legitimacy surrounding make-up strategies, there is a strong case to be made for how inflation drivers going forward may be very different from what drove low readings over the past decade. On make-up strategies, one argument for this is to enforce the symmetrical credibility of the target. One argument against a make-up strategy is the water under the bridge perspective that involves letting bygones be bygones. Financial system and financial stability considerations adapted to the reality of that undershoot and by now attempting to shock that prior regime and make up for past inflation undershoots by engineering an overshoot the results could be destabilizing.

More important is that I don't think the arguments behind why inflation undershot over the 2010–now period are as portable to the future as central bankers are conveying. The GFC was a harder hitting and longer lasting balance sheet drag on the world and domestic economies and fiscal policy was a fair weather friend throughout it all. The pandemic is a transitory one-year shock solved by science and fiscal policymakers are positively giddy. Instead of fighting contractionary fiscal policy with expansionary monetary policy and not even doing anywhere nearly as much of the latter through the post-GFC era, this cycle should be about withdrawing monetary policy in order to neutralize a fiscal overshoot. Not taking steps to do so makes monetary policy look uncomfortably close to fiscal policy aims.

There is an alternative that is not too late to embrace. It is one that aims toward a middle ground on not being too pre-emptive while also not acting too late and dropping one’s guard toward upside risk to future inflation. Instead of making binary bets that monetary policy should not be at all pre-emptive while abandoning forecast faith in favour of waiting to see the so-called whites of the eyes of inflation, there is a strong case to be made to manage inflation risk in more gradual fashion by staggering policy adjustments in a mixture of pre-emptive and reactionary ways. That’s kind of like the approach that Carney took in 2010 when he basically said the emergency has passed, we’re not out of the woods yet on an uncertain outlook, but the need for extreme monetary policy stimulus has passed so let’s get off the lower bound toward 1% while still remaining well below neutral rate estimates and then take a breather to see what unfolds afterward. Expediting the path to shutting down the balance sheet and starting hikes would still mean net stimulus is being provided by hanging out below any definition of neutral alongside an overstuffed BoC balance sheet. It would be a better way of managing the risks to inflation to hear the Governor say at this future point that his aim is to quickly get toward a halfway point to neutral and then communicate very clearly that a pause to assess may ensue if he lacks the conviction to keep going in the context of future developments. If you’re wrong, then hang out below neutral for a while. But, not budging one bit until all spare capacity has been eliminated across very conceivable measure including distributive gauges that should be much less of the focus of central bankers versus politicians and until inflation is upon us is a 100% binary bet that risks courting disaster. Governor Macklem has said they don’t want to count their chickens before they’ve hatched which may be prudent to a degree; the offsetting risk to waiting too late for any adjustment is that once hatched they’ll have immediately flown the coup on runaway risk. I still have some faith that after engaging in a partial reset the other day, will step further toward a more moderate middle ground in the manner described.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.