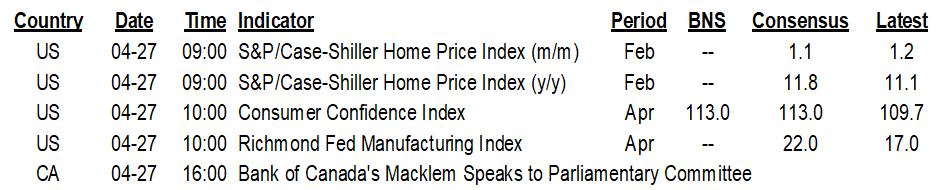

ON DECK FOR TUESDAY, APRIL 27

KEY POINTS:

- Global markets little changed

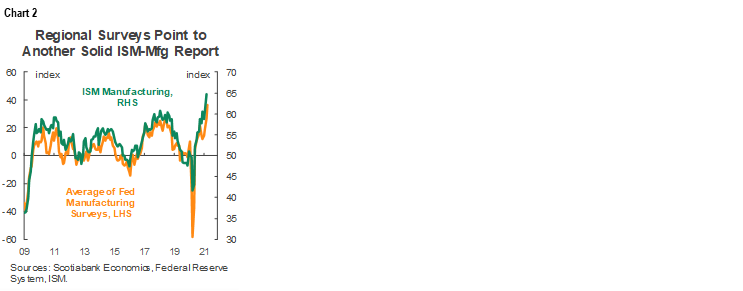

- It’s looking good for ISM-mfrg ahead of Richmond

- US consumer confidence to offer a nonfarm clue

- BoC’s Macklem to testify after markets close…

- ...and should be grilled further about inflation overshooting

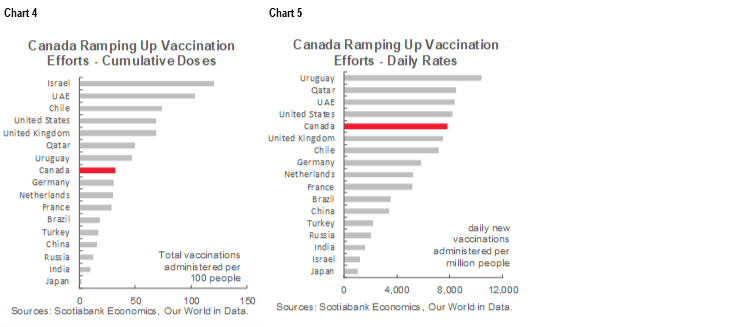

- Canada is rapidly climbing the vaccine rankings

- Yen, JGBs shake off BoJ

- Krona slips on Riksbank caution, for now

- China’s profits soared entirely on base effects

- Won gains as Korean GDP beats

INTERNATIONAL

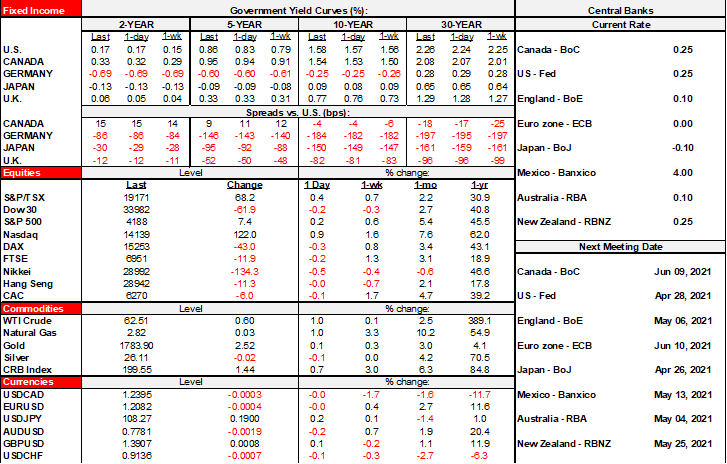

Global market moves are pretty limited across asset classes. The US$ is flat overall, longer dated sovereigns are slightly cheaper, stocks are little changed in Europe and N.A. futures and oil is bouncing back a bit. Overnight calendar-based risk offered no surprises while US earnings roll in from companies like GE, UPS, 3M etc. So far this season, 76% of S&P firms have beaten analysts’ earnings expectations and 75% have been revenue expectations. The main risk remains focused on the Fed and Biden’s not-SOTU speech tomorrow night.

The BoJ kept policy on hold and indicated no bias toward future changes while upgrading growth forecasts somewhat. All of that was as expected and so the yen and JGBs shook it off.

Sweden’s Riksbank also kept all policy measures on hold while indicating it would exhaust its current bond buying program by the end of 2021, reinvest until at least the end of 2022 and it forecast no change in its policy rate through 2024. The krona took it slightly dovishly compared to what was priced in advance. I think the Governor’s remark to the effect that while better times may be ahead, they didn’t want to prematurely weigh in by rocking the boat on an altered bias since, as he put it, it could mean having to start all over again from scratch if such expectations prove to be wrong. Many central banks are likely in this camp which basically says that should conditions evolve broadly in line with expectations, then prepare for a bias shift later in the year and into 2022.

China’s industrial profits soared by 92% y/y in March which was entirely base-effect driven. Profits would have been up by 91% if the only thing that had changed would have been the rebasing to last March.

The won is among the strongest performers this morning because Q1 GDP handily beat expectations. It was up 1.6% q/q SA (1.1% consensus), or about 6½% annualized.

UNITED STATES

On this side of the pond, watch the US Conference Board’s consumer confidence reading (10amET) specifically in terms of the jobs availability reading for a nonfarm clue given the correlations (chart 1). I would expect it to rise again in sync with the declines in initial claims.

The Richmond Fed’s manufacturing gauge will help to firm up expectations for ISM-manufacturing that is due out on Monday. We already know that Empire, Philly, KC and Dallas registered solid gains and the Markit measure was mildly higher. ISM was already at the highest reading since December 1983 and so far the average of the regional surveys points toward another ISM gain (chart 2).

We’ll also get repeat sales home prices for back in February (9amET) and the reading is likely to approach 12% y/y in no small part due to tight inventories.

CANADA

Bank of Canada Governor Tiff Macklem testifies before the House of Commons Finance Committee at 4pmET. There will be an opening statement available right off the mark. Then fasten your seatbelt for spellbinding interaction. Or not…

Personally, I think the main risk—which is likely small—would be any further elaboration upon what Macklem means to convey when forecasting a sustained overshoot of the 2% mid-point of the BoC’s 1–3% flexible inflation target range. The guidance on that topic has been somewhat lacking consistency in my opinion.

For instance, Macklem said during last Wednesday’s press conference that the forecast overshoot was a function of the extraordinary forward guidance the BoC has provided. In other words, the pledge to stay on hold until spare capacity is shut and inflation on target—versus acting more pre-emptively in the past—would mean the BoC would be playing catch-up to inflation risk as the economy slipped into excess demand in their forecasts. If that’s the case, then the inference is that inflation should be coming back down to target if they were to print a forecast into 2024+.

Then in his weekend interview in the Globe and Mail, Macklem intimated that the BoC would be content with working the flexible range and allowing a run hotter bias for a time after inflation ran under target over the past year. That tone implied that a make-up strategy is being adopted at the BoC and communicated to markets ahead of the conclusion and formal communication of the results of its strategic review that are due later this year. By corollary, maybe Macklem has in his head a bias toward above 2% inflation for a period extending beyond 2023.

The two approaches are not necessarily inconsistent to one another but in order to be able to square the circle we need to know more about Macklem’s bias and so he should be pressed further on this topic. One additional avenue to pursue would be accounting for the evidence behind a sustained undershooting of the BoC’s inflation target for the whole post-GFC period. Recall chart 3 that shows this prolonged undershoot; in general, the Fed has been much more open about its inflation misses than the BoC has been and so is that because of a different approach to possibly addressing this or is it a reflection of a more defensive central bank in terms of its record over the past number of years? Recall that since 2010, headline CPI inflation has been below 2% two-thirds of the cumulative number of months and core inflation has been below 2% a whopping 95.5% of the time. That’s not just a one-year pandemic-era undershoot. What we need to hear—and soon, given where markets are going—is whether Macklem is of the bygones-be-bygones bias with a slight and short-lived overshoot bias, or whether he is adopting a mindset that seeks a more sustained overshoot in order to ensure that market participants believe the BoC will operationalize its symmetric 2% target over time or continue to operationalize it essentially as a ceiling which has been the case for many years now. They say it is symmetrical, but the evidence on persistent undershooting says otherwise.

On a separate note, Macklem should be encouraged by charts 4–5. Once the laughing stock on vaccine doses delivered, Canada has shot up the rankings in terms of cumulative doses per capita (chart 4) and the daily rate of doses delivered per capita (chart 5) and will probably rise further over the months ahead.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.