ON DECK FOR MONDAY, APRIL 19

KEY POINTS:

- CAD underperforming ahead of Canada’s budget

- Expectations for today’s Canadian Federal budget

- Canadian housing starts temporarily smash all-time records

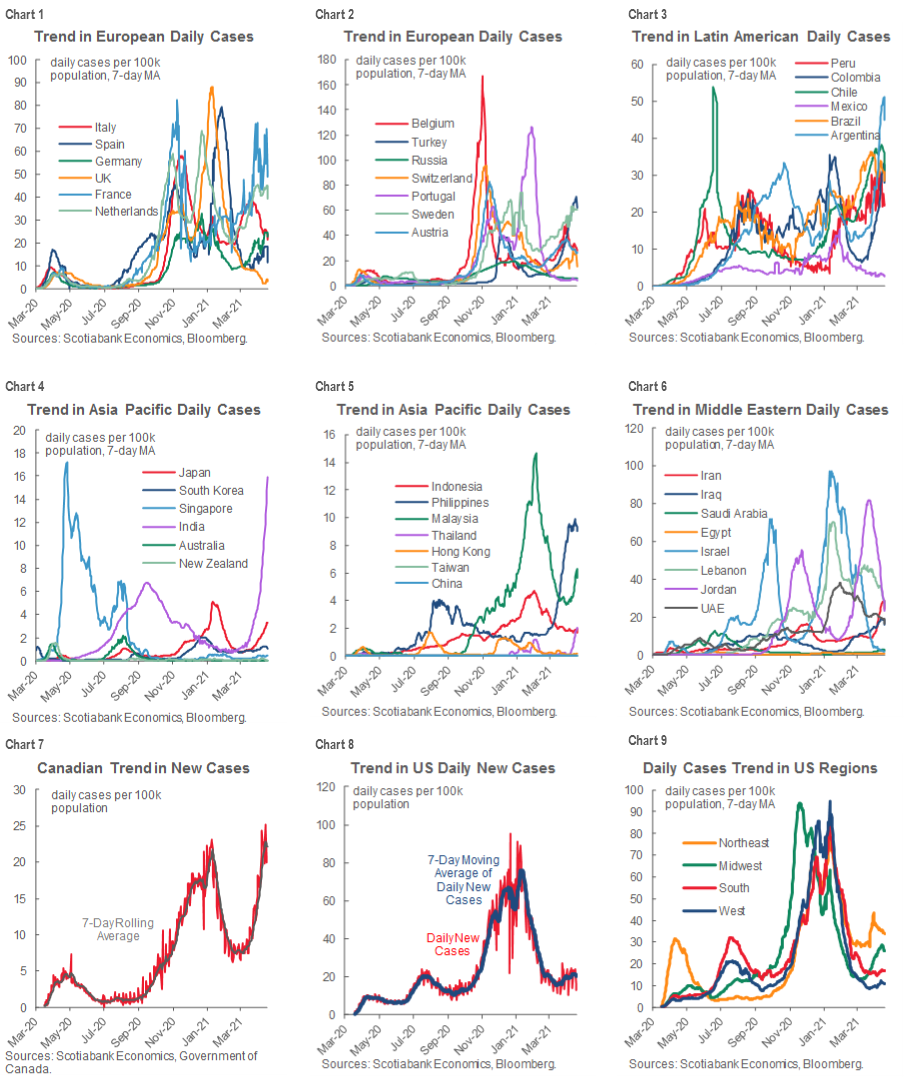

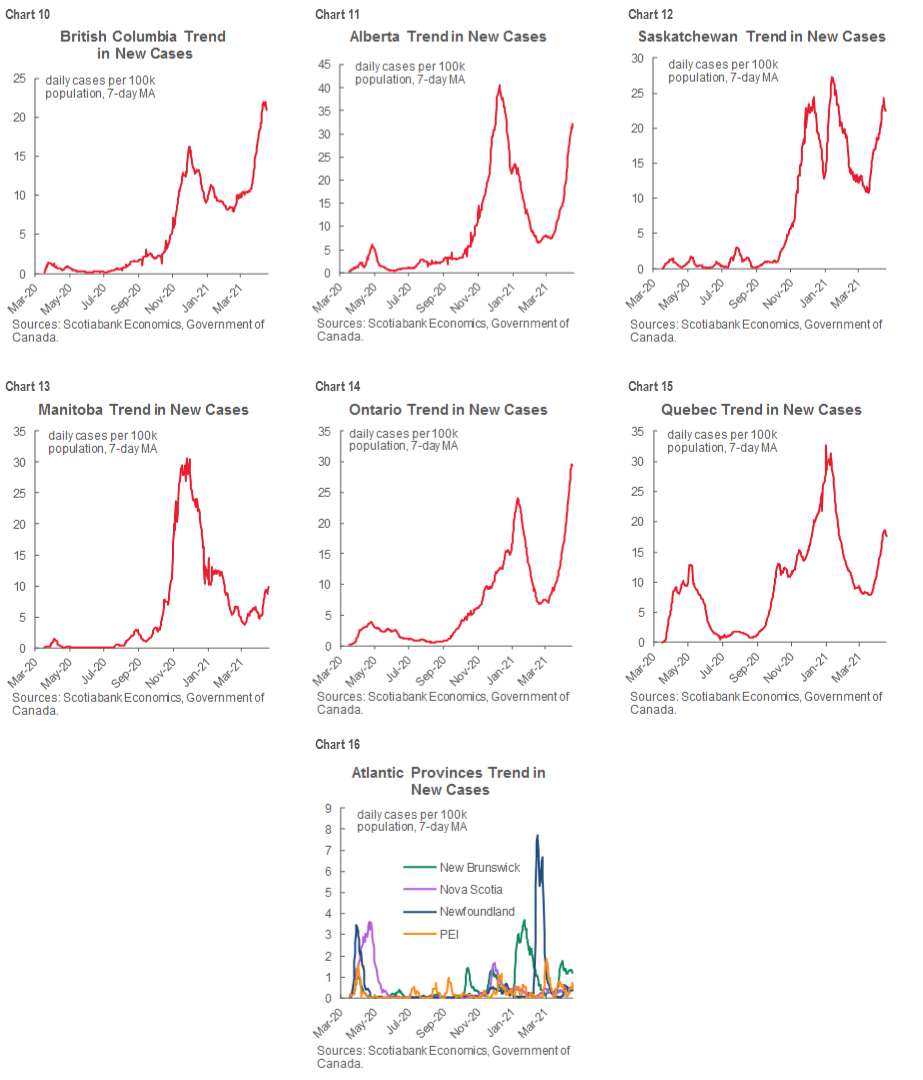

- Global COVID-19 cases in pictures

INTERNATIONAL

Risk appetite is mixed across asset classes. There are no real calendar-based forms of incremental risk to inform developments. A quiet global calendar will make Canada’s federal budget stand out perhaps a little more than would otherwise be the case. Also see the accompanying suite of charts depicting daily new COVID-19 case trends by country and Canadian province.

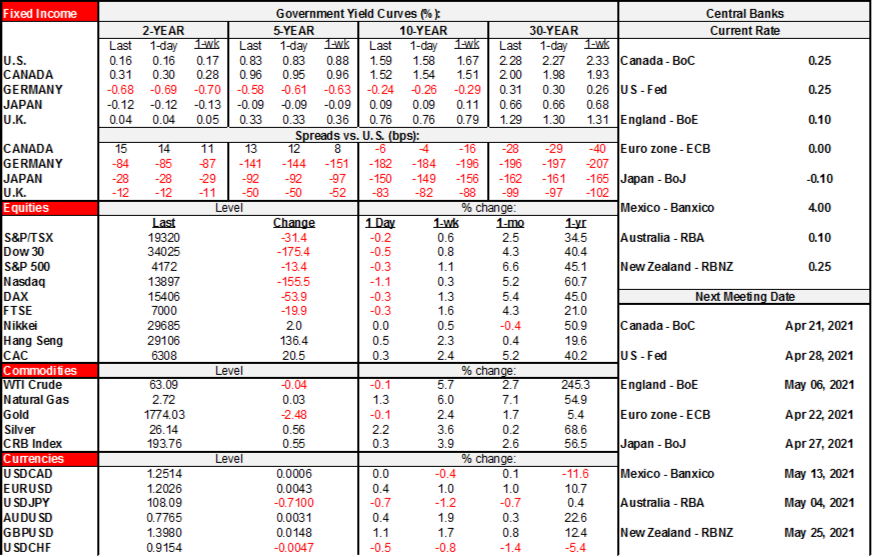

- The USD is broadly weaker against all major crosses with one notable exception being that the Canadian dollar is flat ahead of the budget. CAD is underperforming by not joining the pack of other currencies appreciating to the USD.

- Sovereign yield curves are generally bear steepening across Europe and N.A. but with Canada somewhat outperforming through 10s.

- Stocks are under slight downward pressure across the US and Europe except for Paris and Madrid. The largest move downward is on the Nasdaq (-¾%).

CANADA

Canadians will watch Federal budget headlines unfold after 4pmET today when Minister Freeland stands in the largely empty House of Commons. Sloganeering under ‘build back better’ plans is a common feature within US and Canadian fiscal plans and today will be no exception. Advance plants and/or leaks by the usual anonymous officials who manage the messaging through the media indicate that the Liberals will go to the very upper end of the $70–100B in added stimulus over three years that was signalled in the November update, but it doesn’t sound like they will be going over that range despite the possible enticement offered by the Biden administration’s massive stimulus plans. While there is little guidance that would inform the distribution of that added $100B in spending over the three years, more of it is likely to be front-loaded in the first 1–2 years given the current spending nature of many of the initiatives.

It seems like the FY20–21 budget deficit will be kept under $400 billion but higher than the $382B that was projected in the November 2020 update and higher than the PBO’s estimated $363B. For a reminder of what was included in the Fall update including deficit projections see table 4.1 on page 104 here. That table provided deficit estimates under alternative scenarios involving extended and escalated restrictions. Escalated restrictions like ones we have seen since last November were expected to drive the deficit to just under $400B which is likely the dominant driver of the guidance offered through the press. Curiously, however, the economy has smashed expectations since November and proven itself to be highly resilient to the second into the third waves of COVID-19 cases and restrictions. Projections for subsequent years did not include the extra stimulus that we will see being incorporated today into deficit estimates for FY21–22 onward.

On that note, today’s nearer term economic projections for 2021–22 are likely to be considerably rosier than indicated by the reliance upon private sector forecasts in the November update following polling of economists several weeks ahead of the update. Back then, consensus expected real GDP growth of 4.8% in 2021 and 3.2% next year. Our last published forecast anticipated growth of 6.2% this year and 4.0% next year and we will soon be publishing another update to incorporate more US and Canadian fiscal stimulus effects that will take the GDP projections higher yet. That, in turn, will make today’s private sector consensus forecasts continue to look stale on arrival which would be one modest positive in terms of nearer term prudence backing near-term deficit projections. Forecasts for the government’s cost of funding will also be materially higher than back in the November update when the private sector consensus forecast for the 10 year GoC yield was 0.9% this year and 1.2% next year; our last forecast anticipated ending this year at 1.65% and next year at 1.85% with a current bias to go higher in our next update. Over the longer-term, the argument that bond yields and neutral policy rates will be lower than in the past and hence justify added government spending financed by deficits ignores the main reason why those interest rates are expected to be lower than in the past: lower long-run potential GDP growth than during past cycles as a revenue driver.

Limited additional highlights based up unofficial communications through the press appear to include:

There will be a three-month extension of wage and rent subsidies through September at a cost of $12 billion in FY2021–22. This reflects ongoing pandemic effects into a third wave with tightened restrictions that will likely weaken employment numbers into at least April and probably May before we may see an easing of restrictions and a hiring rebound thereafter.

- A new Canada Recovery Hiring Program will be established to offer hiring incentives starting with the program’s planned launch in June. This would offer inducements to either hire new workers or increase the hours of existing employees. It would cover up to $1100 in pay per employee per month. We’ll need to see the details and costing estimates in the Budget. If, say, 100,000 workers were to be hired under such a program then it would cap out at a cost in the low single digit billions of dollars for a full year. What adds to uncertainty, however, will be details around how to compensate companies for adding hours worked by existing employees. I’m unsure how government will be able to monitor and enforce this component and by how much hours worked will increase from June onward independently of this program. If you want to question the data accuracy around may be reported, then start by comparing how many hours you work per week to what your payslip or StatsCan says you worked…

- Much of the $100B of new stimulus spending is likely to be focused upon housing, transit and ‘green’ programs. Again, we need costing and details across components. Among the initiatives will be new first-time homebuyer benefits; we’ll need details but adding to the demand side of the picture probably won’t help affordability and could well worsen it.

- We will watch for details around the announcement last November 30th that the government will apply the HST to non-resident registration of digital products and services provided to Canadian consumers as of Canada Day this year, plus the implementation of a new corporate income tax on companies offering digital services effect January 1st 2022.

- There will be a venture capital fund set up for the green tech, manufacturing and innovation sectors. Details are necessary, but my starting bias is to view the track record of governments running VC programs very skeptically.

- Further steps toward a national childcare program are expected to be taken. It starts slowly at a modest (unofficial) stipend of about $2B to be implemented over 12–18 months. The loose plans appear to be calling for a $10/day childcare program but it would require provinces to sign on to the plans which has been among the challenges since the Liberals first announced such plans nearly three decades ago. Baby steps for baby care. Negotiations will clearly need to be monitored. I would view such an initiative as a backdoor way toward achieving a means-tested program through just over a modest $220/month childcare plan at roughly 22 weekdays per month. Details on the quality of care and the qualifications of the individuals leading the care will be assessed by those with varying means for alternative levels of care and with potentially very different effects on the choices facing various income levels.

- A luxury tax on big ticket purchases is likely. This is more about optics than securing material revenue dollars as it will make for tax-the-rich headlines. Stock option deductions for employees at large corporations are expected to be lowered which could distort the compensation playing field relative to smaller sizes of firms and add a barrier to growth.

- After announcing a foreign buyers’ tax in the November update, it’s unclear whether today will implement a transaction tax or—more likely—a tax on vacant properties held by foreigners. That’s not really going to address the supply side in a material way in my view and it won’t cool demand that is mostly driven by domestic buyers anyway. Plus there will be material enforcement and monitoring issues.

- Advance guidance has generally downplayed the risk of other more aggressive forms of tax policy changes at least for now and potentially until after an election. Biden can announce tax plans at the start of a four-year mandate, but Canada may face an early election as soon as later this year.

- Given the emphasis upon added stimulus over the next three years that will likely be front-loaded, the implications for debt management strategy will be monitored but are likely to skew issuance requirements toward the nearer term as opposed to further increases to structural deficits than what is already expected.

In my personal view, this amount of stimulus is changing the mixture between fiscal policy and monetary policy in a way that the BoC will need to partly neutralize. A first step will likely be to taper GoC bond purchases on the path to shutting down the program this year followed be reinvestment for a time before commencing a hiking cycle next year. They should even tighten monetary policy at a quicker pace than that in my view. Today’s budget risks being a stimulus overshoot with a full employment recovery, full recovery of GDP and closure of spare capacity expected in the very early stages of the three-year plan for additional stimulus. Elections tend to do that.

What we won’t see in today’s plan—but I think we should see—will be a clearer plan toward budgetary balance and material outright reductions in the debt-to-GDP profile over the five-year projection period. I’m not a believer in the Ottawa consensus that simply targeting a flat profile over the long-term is good enough. The November update projected that the net debt-to-gdp ratio would hold around 50% in the fifth year from now and from 50.7% in FY20-21 pending today’s revision. The deficit would remain at a projected $25B in the fifth year. Apart from the issue of what measure should be relied upon at a crisis point—gross or net debt, with government unlikely to be able to access the financial assets at sinking and sovereign wealth funds in a crisis—the issue is that when the long-range plan only calls for stability in this ratio, it faces the risk of repeatedly spiking higher into the next and subsequent recessions. If Canada emerges from the next recession with the same guidance to simply target a flat debt-to-gdp ratio over the long-term and gets surprised by another subsequent shock that economists rarely forecast until it’s too late, then this becomes the path toward a secular long-run rise in debt-to-GDP and perma-deficits. Canadians recall this path being set in motion in the 1970s and it worked until the music stopped and fiscal policy had to retrench at the worst point through the nasty early 1990s recession. Targeting a plateau in the debt-to-gdp ratio assumes a steady state outlook for continued long-run growth, when, in reality, recessions often surprise. Not repairing the books during the good times amounts to running pro-cyclical fiscal policy that engineers a path toward a secular long-run rise in the debt-to-GDP ratio in response to subsequent adverse economic shocks.

Enough of the Budget. We also got some interesting numbers this morning. Housing starts soared to a record high 335,000 units last month at a seasonally adjusted and annualized pace. They were also revised higher for February to 276k from 246k. Pretty much all of the surge last month was due to the multiples component that jumped 32% higher while single-detached housing starts increased by 2.9%. BC (+62% m/m) and Ontario (+50%) drove most of the nationwide gain in total starts. Apart from volatility, there may have been some front-running of anticipated restrictions behind the numbers for March, as well as some pent-up activity due to earlier restrictions and weather effects. Whatever the exact mixture of causes, the imposition of restrictions in April against nonessential construction activities in Ontario will likely drive a sharp correction lower in the next batch of figures.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.