ON DECK FOR MONDAY, DECEMBER 20

KEY POINTS:

- Markets start the week defensively positioned with lighter volumes

- New week, same COVID-19 uncertainties

- Manchin’s tactics may be deplorable…

- …but the US economy and markets can live without BBB

- The PBOC’s tiny rate cut: why bother?

- Chilean peso drops on election results

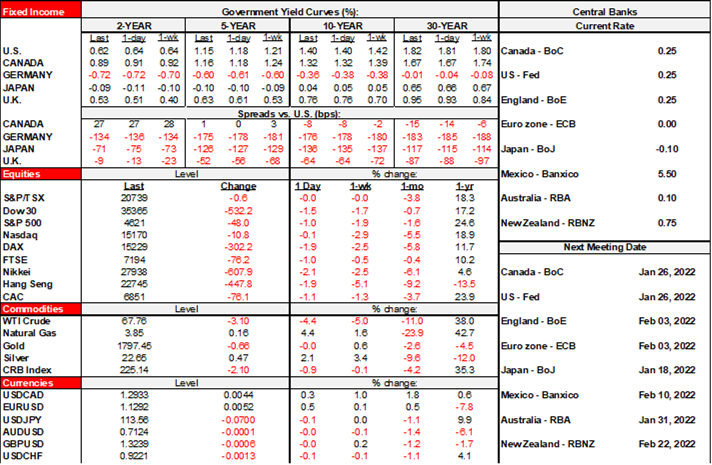

A light week is starting off defensively with risk-off sentiment dominating. US equity futures are down by over 1% with TSX futures not far behind, while European markets are down by 1–2% across the exchanges. Sovereign curves are mixed with US Treasury yields bull steepening and led by a 2bps decline in 2-year yields. The USD is slightly softer on balance and oil is off by ~3–4%.

Lighter holiday trading may be a contributor; FTSE equity volumes are the lightest for this day in decades. COVID-19 developments are nevertheless dominating market sentiment with an assist from the fact it looks like additional US stimulus is either dead or faced with further curtailment, something I view as an eminently survivable outcome!

US Senator Manchin pulled support for the Biden administration’s US$1.75 trillion “Build Back Better” fiscal stimulus package. There is a case for doing so, although his tactics are rather deplorable. The volatile senator had appeared to be supportive of the reduced price tag but then seemed to suddenly pull his support in grandstanding fashion on Republican-friendly Fox News TV without warning, while citing Republican estimates for the cost of the Biden package and while being unreachable by the White House. Um, whose team are you on?? One can perhaps understand why his colleagues among the Democrats are incensed. Manchin’s weak defence seemed to center around concern that additional debt would hamper the US ability to fight the omicron variant and address tensions with Russian and China.

Tactics aside, I think the US economy can do without additional fiscal stimulus at this point. I don’t personally disagree with several of the types of spending given evidence on longer run outcomes for kids with respect to things like preschool spending and childcare, although there is still a fair debate over the best means to achieve this—such as whether big government should be doing it—and how to pay for it. It’s just that further fiscal stimulus at this point in the cycle is tilted more toward higher risk than higher reward from an inflation and stability standpoint. The US economy recovered the pandemic hit by the end of the second quarter. By early 2022, the output gap will be shut. Thereafter, the US economy begins pushing into excess aggregate demand and a second leg of inflationary pressure arises when damaged supply chains are combined with Phillips curve arguments. Our forecast for 4.2% real GDP growth in 2022 and then 3.2% in 2023 is far above estimates of the noninflationary potential growth rate of the US economy and would only be modestly dented if BBB is dead, or perhaps to be scaled back. Now, as a forecaster aligned toward financial markets, you could choose to showboat for the press with headlines on the negative effects on growth—or point to how it may mean marginally less pressure on inflation and broader stability into 2022–23. I’d choose the latter.

In any event, some of this morning’s media headlines about a loss of Fed and fiscal support for the US economy are laughably extreme. The real policy rate by any yardstick is more stimulative than ever before, the Fed will continue adding stimulus through to March and then only pivot toward a slow pace of mostly priced rate hikes that still leave the policy rate below most estimates of neutral. The Fed is anything but hawkish after having slept walk through the burst of inflation and much of what has been delivered through fiscal stimulus to date is still logjammed on household balance sheets via their massive increase in cash positions through the pandemic. So, add more? Keep spending?? I hear the argument that we have to think long-term and enact child friendly initiatives when they can be achieved, but I also see the argument on how the inflation tax harms the lower to lower-middle income households with young kids who are the very ones that could benefit the most from such spending.

China’s 1-year Loan Prime Rate was cut 5bps to 3.8% overnight with the 5-year LPR unchanged at 4.65%. No joke. The best China can do for world growth is a thoroughly meaningless rate cut. The reduction was a surprise to markets because normally China cues up such a move through other measures in advance, such as a reduction to the 1-year Medium-Term Lending Facility Rate that it left unchanged on the 14th. I suppose the symbolism of the move matters a bit, given that authorities had long opposed additional monetary stimulus despite mounting downside risks to the economy, but 5bps cynically addresses this criticism absent any meaningful implications unless it starts a series of moves.

The Chilean peso is depreciating by about 3% so far in early trading and stocks will probably sharply decline after the left-wing candidate convincingly won yesterday’s election. Gabriel Boric is the new President and draws upon his roots as a young leftist student protestor while emphasizing a more redistributive policy agenda. Boric’s policies are generally unfriendly to markets including higher taxes on wealthy individuals and copper mining plus a fourth round of massive and untargeted pension withdrawals that are depleting the nation’s private pension reserves. After an initial reaction, markets will shift toward assessing what he may reasonably accomplish in a highly divided Parliament.

There is nothing material on tap for release into the North American session.

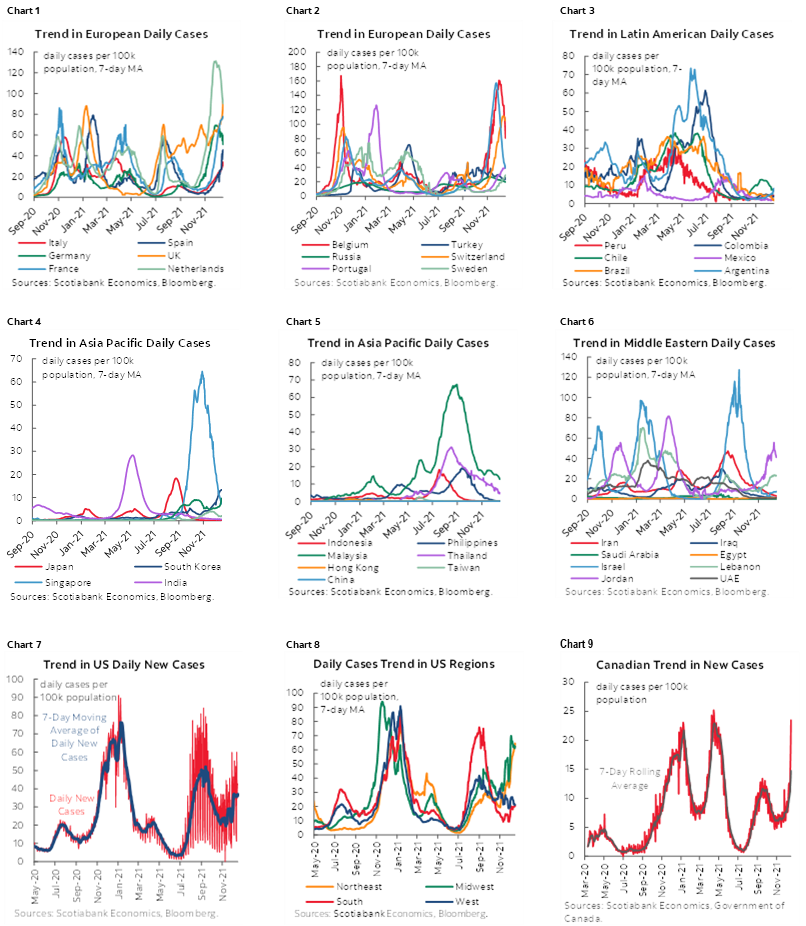

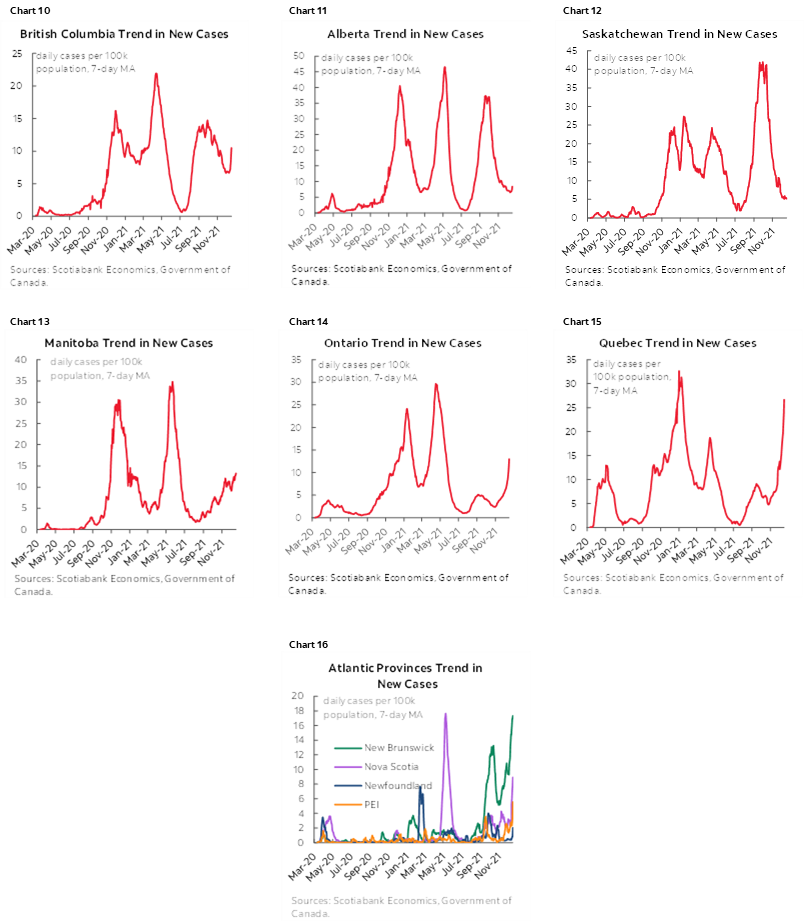

COVID-19 developments are focused upon rapidly rising cases across more parts of the world, while Moderna’s booster tests point toward as much success in countering omicron’s hit to antibody levels as the earlier results for the Pfizer booster. We’re still left with little evidence on severity of omicron cases at this stage. Early evidence on severity seems to be cautiously optimistic, but it’s highly premature to draw overly strong conclusions in that regard given the recency of developments. We’ll need to wait until into January before having more information on severity. The usual Monday round-up of global COVID-19 cases is provided in the collection of ensuing charts.

- Europe: Cases continue to climb in several major economies but may be ebbing in some of the smaller ones, although data quality is likely a strong caution across all of the charts in terms of the speed of developments, testing and reporting.

- US: Cases continue to climb especially in the Midwest and Northeast.

- Canada: Cases are rapidly rising. Quebec is leading the climb, but material increases are also occurring in Ontario, BC, Manitoba, New Brunswick and Nova Scotia.

- Latin America: Cases remain low across the main countries.

- Asia-Pacific: Cases keep falling Singapore from outlier levels and are generally well behaved across most regions except for mildly rising cases in South Korea.

- Middle East: Jordan and Lebanon continue to witness upward trends while others are seeing generally few cases.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.