ON DECK FOR WEDNESDAY, APRIL 28

KEY POINTS:

- Dollar gains, curves steepen

- Biden outlines US$1.8T ‘American Families Plan’…

- …that raises his wish list to US$4T of additional spending

- Four US packages since December total nearly US$7T, one-third of US NGDP

- Powell won’t bomb his boss’s speech hours after the FOMC…

- …so don’t look for material shifts at the data-watching Fed

- Aussie rates dip on weaker than expected core CPI

- Canadian retail sales gain precedes tighter restrictions

The most anticipated day of the week has now arrived and the focus is squarely upon the US. Rather, the focus is squarely upon how US fiscal policy is arguably going totally off the deep end. Trump’s populism that drove deficits higher to begin with is now giving way to Biden’s embrace of the ‘woke’ Davos reset agenda.

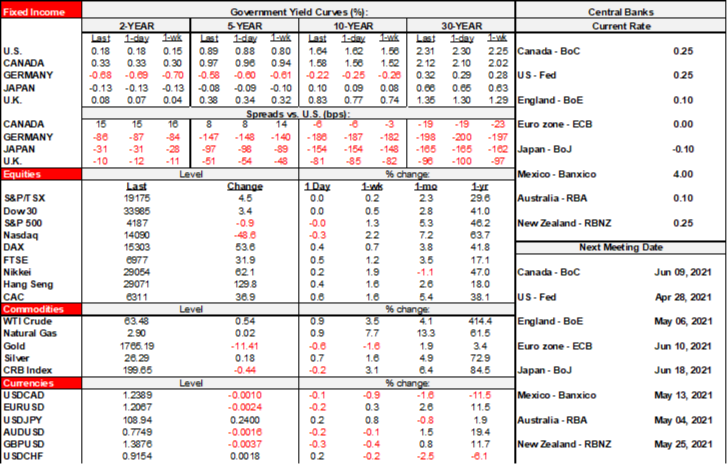

- Sovereign yield curves are steepening. The gilts curve is steepening the most on ongoing assessment of taper risk. The Australian curve is outperforming on the back of CPI. US and Canadian curves are slightly steeper.

- The USD is slightly firmer on balance with the group of petro-currencies among the exceptions on the back of a 1% rise in oil.

- US equity futures are little changed to very slightly lower on average and European cash markets are up to ½% higher in London.

The White House released the outline of the American Families Plan earlier this morning ahead of President Biden’s State of the Union style speech tonight. The 7,827 word cutely named ‘fact sheet’ here formed the basis for various media outlets’ summaries of what it contains. The details are broadly in line with Biden’s campaign platform. The numbers are staggering so have a seat.

After a US$900B bill was passed last December and after Biden’s US$1.9T American Recovery Act that was passed in March, he is now targeting another US$4 trillion in spending. That US$4 trillion is split between the previously announced US$2¼ trillion American Jobs Plan that was focused upon infrastructure funded by higher corporate taxes plus todays’ US$1.8 trillion plan that includes US$1 trillion in program spending and US$800B of tax expenditures all funded by soak-the-stock-market taxes. The AJP and AFP targets are opening bids and we’ll have to see what Democrat Senator Manchin and his like-minded Democrats in the Senate will support. Biden has said he wants material progress by Memorial Day and passage by summer which may be a tall order against the expectation that a gruelling debate with a lot of horse trading lies ahead.

Still, sit back and digest the magnitude of the ‘woke’ agenda that’s in keeping with the Davos reset crowd’s goals that are firmly in charge here. In four packages since last December, just under US$7 trillion of spending is being targeted split between just under US$3 trillion having already been delivered and another US$4 trillion on the wish list. A crude benchmark is to point to that being equal to one-third of present nominal GDP with about 14 percentage points already passed and the remainder in negotiation on amounts to be spent over multiple years. There was a time when central bankers wished for some fiscal support. Behind the scenes they have got to be thinking they should have perhaps been more careful about what they wished for especially during a transitory shock (a very bad one mind you…) that is being solved by science. The US is already a heavy spender with a serious addiction while running large twin deficits funded by its reserve currency status but the question for the bond market and USD is how far they can push that status without paying a rising price.

So now imagine you are Fed Chair Powell. This time it’s just a 2pmET statement followed by his hour-long press conference starting at 2:30pmET. Don’t look for Powell—whose term is up for renewal next February—to bomb his boss’s appearance a few hours later with anything remotely resembling tightening talk. This is the equivalent of a State of the Union Address, but it can’t be called that in the first year of a new term. It would actually be pretty darn comical if he dropped even the remotest of hints on tapering and rocked markets before his boss’s speech. Nah. Progress is being made, but there are still too many unemployed and we need actual not forecast inflation to spook us; that’ll be his rinse repeat party line again, for now, until we get more numbers, until we rapidly get back to full capacity with recovered jobs and higher inflation within the Fed’s policy horizon. He’ll be asked about how proposing to spend US$4T on direct spending and tax expenditures affects the Fed but will answer with some combination of saying it’s up to Congress to guided fiscal policy and how he needs to see jobs and inflation.

I don’t expect much else from the Fed after the full suite of updates last month and before we get considerably further dual mandate progress. Data will drive the Fed shifts and heaven help the bond market if payrolls truly rip next Friday. There is no real need to tweak language on current conditions as they already describe indicators as having “turned up recently.” I doubt they change the IOER spread to FF but it’s a modest risk; if they weren’t convinced to do it at prior meetings and they opted for the $50B increase in overnight reverse repo counterparty limits to $80B as an alternative for now then it’s doubtful much has changed to merit hiking IOER. The risk will remain as Treasury’s redeployment of its account at the Fed on distribution of stimulus proceeds continues to influence overall market liquidity and excess reserves.

On overnight Australian CPI, I thought the main takeaway was that the quarter-over-quarter core measures were relatively tame. Trimmed mean was up 0.3% q/q which was a tick lower than the prior quarter, a couple of ticks beneath consensus and half the top end of consensus. Weighted median CPI was up 0.4% q/q, a tick beneath the prior and consensus. Other than base effects, the softer price pressures at the margin measured in q/q terms through the core measures restrained inflation. The question is whether this will remain the case with Australia having pretty much fully recovered lost jobs to the pandemic.

CANADA

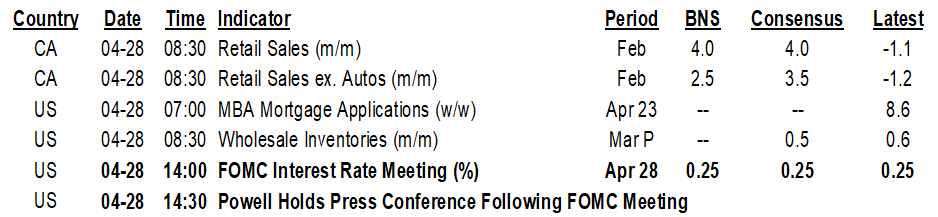

Canada updates retail sales this morning (8:30amET). First off, we’ll get the revised estimate and details for sales during February after StatsCan provided ‘flash’ guidance they were up 4% m/m. We’ll also get the agency’s flash reading for March based upon a partial sample sans details.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.