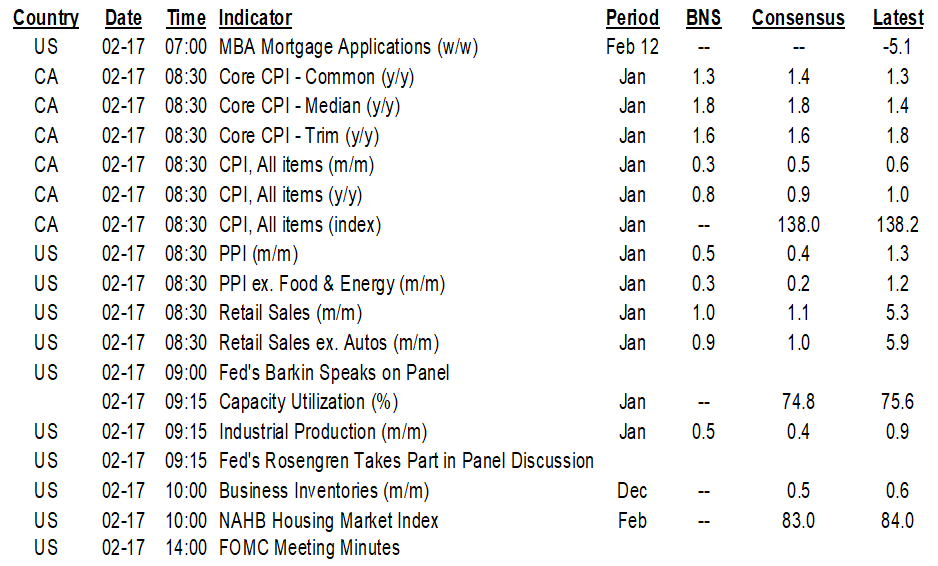

ON DECK FOR WEDNESDAY, FEBRUARY 17

KEY POINTS:

- Mild risk-off sentiment across global asset classes

- CDN core CPI still stuck around 1½%

- Fed minutes could sound a touch stale

- There was more to strong US retail sales than stimulus cheques

- US manufacturers propel industrial output higher

INTERNATIONAL

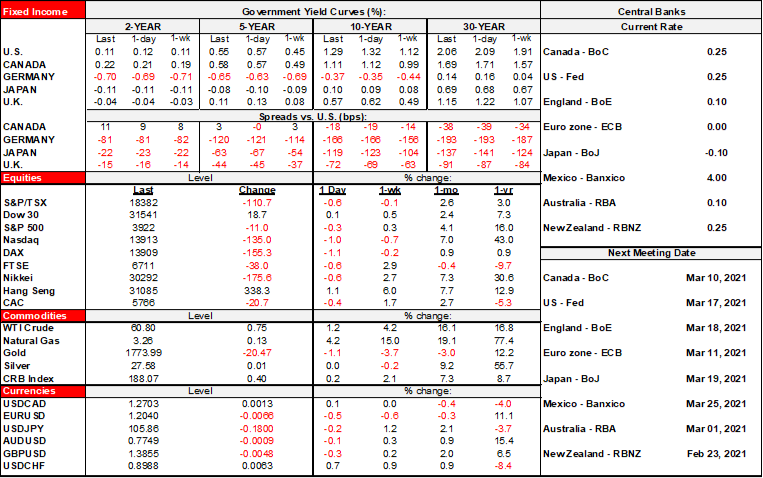

A slight risk-off tone is being applied across global asset classes. Stocks range from flat S&P futures to a ¾% in Germany. After the US 10s yield spiked higher by about 10bps since Friday it is down about 2bps this morning. Europe’s curves are little changed. The USD is broadly stronger with yen and CAD outperforming others. Oil is up by just over 1%.

- Sovereign debt curves are bull flattening while retaining much of yesterday’s rates sell-off. The US 10 year yield is down 4bps and Canada’s 10s are underperforming with a rally of about half that. Gilts are also outperforming as the 10s yield drops 5bps.

- Oil is up a few dimes but lower than earlier this morning on volatile headlines around OPEC+ production plans. Gold is off 1%.

- Equities are losing ground with the S&P down by about ½%, the TSX down by ¾% and European markets off by up to 1.1% in Germany.

- The USD is generally stronger so far, though little changed to CAD and the Mexican peso and slightly weaker to the yen.

Sterling largely ignored UK inflation this morning. Core CPI held firm in January at 1.4% y/y (consensus 1.3%) while headline ticked higher to 0.7% (0.6% prior and consensus).

UNITED STATES

US retail sales strongly beat expectations, but the potential drivers were much more complicated than simply pointing to stimulus cheques (recap here).

US industrial output was up 0.9% m/m in January which was another solid beat (consensus 0.4%) with some of that explained by the downward revision to the prior month’s 1.6% m/m rise (now 1.3%). Manufacturing output was up 1.0%.

As for FOMC minutes (2pmET), the overall tone should reinforce the improved optimism over the December and January meetings, but the minutes are likely to be stale. The scale and scope of US fiscal stimulus would have been further informed since then and vaccine developments have been more constructive. I’m not sure that nonfarm payrolls would have changed much by way of Fed thinking as most of the disappointment came through revisions to December and they are focused upon the medium-term. The minutes are likely to emphasize that the Fed will be patient and that it is premature to talk tapering. One risk is discussion around ‘substantial’ improvement in dual mandate as discussed in the Global Week Ahead.

CANADA

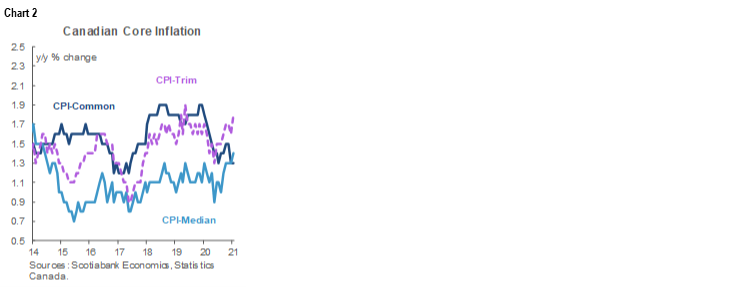

Canadian core CPI inflation climbed a tick to 1.5% y/y using the average of the three central tendency measures but remains range-bound around 1½% y/y for about the past five months (chart 1).

Still, while the combination of strong US retail sales and soft Canadian core inflation drove the Canadian dollar to slightly depreciate at first, this effect was subsequently unwound and the overall readings should have no bearing on the Bank of Canada that can’t do anything about backward inflation and has continued cause to look ahead to strong growth and upside risk to inflation.

Chart 2 breaks down the core measures to show their widened dispersion of late.

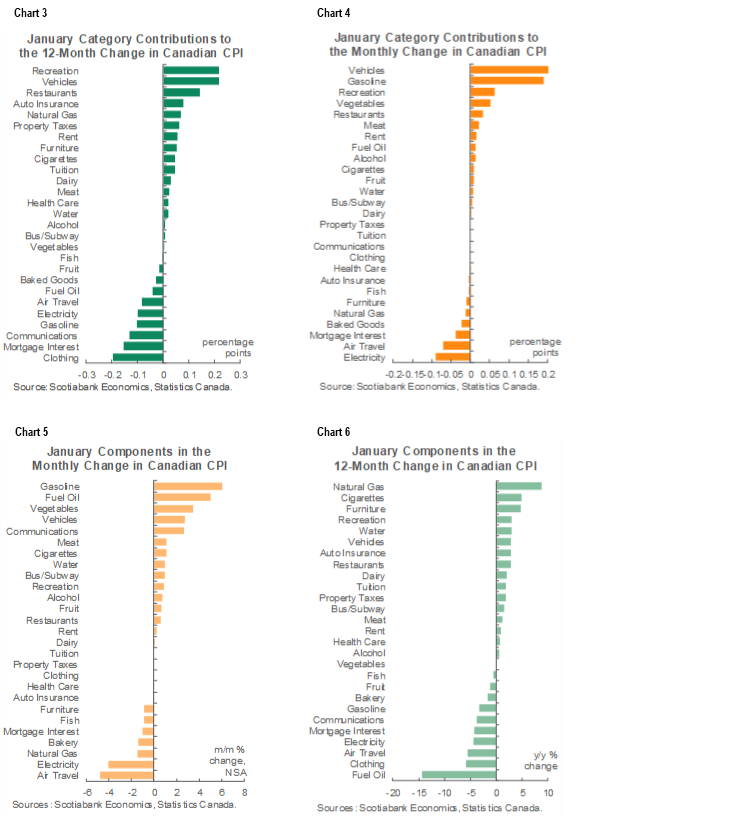

Charts 3 and 4 provide weighted contributions to overall inflation on a year-over-year basis (chart 3) and month-over-month basis (chart 4) in order to depict what categories drove the report. Unweighted changes in prices within the CPI basket are shown in charts 5 and 6.

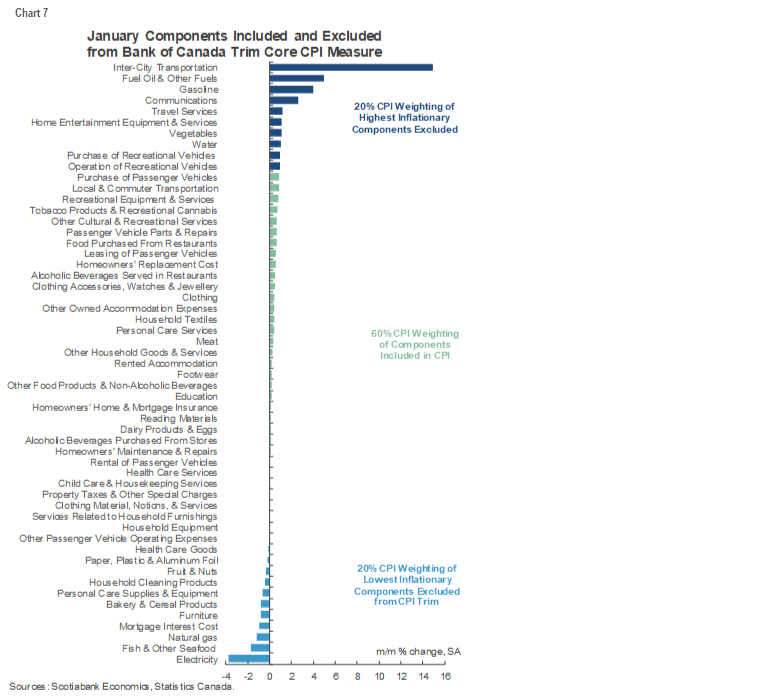

Finally, chart 7 breaks down what was included and what was excluded from the trimmed mean CPI measure that trims out the top 20% of prices and the bottom 20% of prices.

Canadian CPI, m/m / y/y %, January:

Actual: 0.6 / 1.0

Scotia: 0.3 / 0.8

Consensus: 0.5 / 0.9

Prior: -0.2 / 0.7

Canadian core CPI, y/y % change, January:

Average: 1.5 (prior 0.7%)

Weighted median: 1.4 (prior (1.3%)

Common component: 1.3 (prior 1.3%)

Trimmed mean: 1.8 (prior 1.6%)

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.