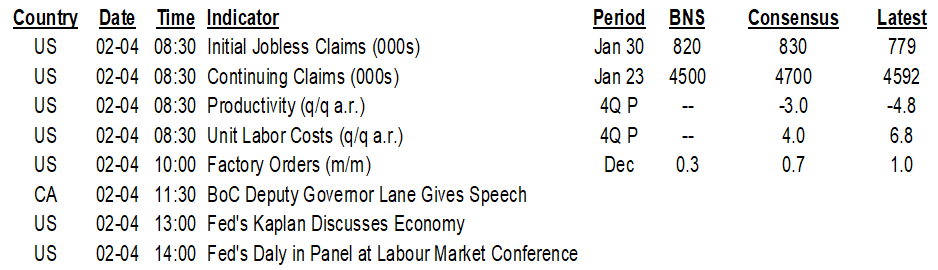

ON DECK FOR THURSDAY, FEBRUARY 4

KEY POINTS:

- USD & sterling outperform on relative central bank narratives

- BoE douses negative rate talk…

- …while pursuing futile preparedness…

- …but issuing incompatibly upbeat forecasts…

- …that point to quantitative tightening this year..

- ...as policy exits dominate further easing

- More positive US job market signals ahead of nonfarm payrolls

INTERNATIONAL

Sterling and the USD are driving strong gains against all major other currencies this morning. Sterling is strong and gilts are materially cheaper following Bank of England communications (see below). The USD is appreciating as part of a Fed narrative that taper talk into 2021H2 may well reinforce. Today’s US job market figures generally reinforce a positive data narrative as markets await tomorrow’s nonfarm payrolls report.

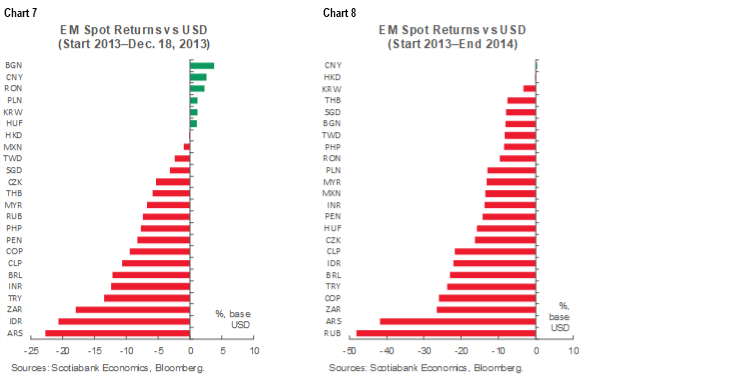

- The USD is up by between about ¼% and ¾% across all major currencies except for sterling that is up by ¼% to the USD and hence top of the class overall. I think that over time the USD appetite will come to be further bolstered when the Fed moves toward tapering which is something expected to occur by early next year following impactful advance communication over 2021H2. See the charts at the back of this publication for a reminder of the taper episode’s impact on EM currencies leading up to the first taper in 2013 and over the whole 2013–14 unwinding episode.

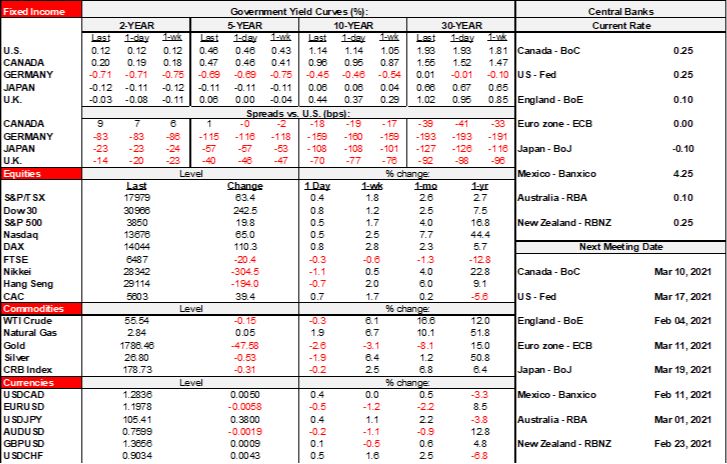

- Sovereign bonds are generally cheapening but the outsized movements are in the UK and Italy. The gilts curve is a little steeper with yields up by 5–7bps across the curve which makes it the worst performing bond market not named Australia this morning. Italy’s spread compression on the ’Super Mario’ speculative bet is continuing. Back to Australia, the RBA’s recent doubling of its bond purchases isn’t working so well at containing the curve; since the RBA’s actions, the Australian 10 year inflation break-even has jumped by about 9bps to 1.9% which leaves open the debate over how much is desired in the quest to get inflation higher, versus how much is too much.

- Equities are generally bid outside of London where the FTSE100 is marginally lower (-¼%). European bourses are up by ¾% to 1¼%. US stocks are richer by between ¼% for the Nasdaq and over ¾% for the S&P. The TSX is similarly higher.

- Oil is down a couple of dimes and gold is off by 2½%. Silver continues to drop from the US$30 peak on Monday to just over US$26/oz now.

The Bank of England carried more of a market effect than anticipated, but pleasantly so to those of us who think the global economy is transitioning toward a narrative that needs less of central banks. They're doing the right thing and taking the lead on a narrative that the Fed is likely to join later. Brace yourself over 2021.

First, what they did that I had expected was to leave all policy variables unchanged, reinforce steps toward developing the plumbing to be prepared for a negative Bank rate if needed, while not seriously entertaining such a move.

What they did that I hadn’t expected was more important. The forecast details were more aggressive and take over the narrative after the point at which the BoE says the financial system’s plumbing would be potentially ready for a negative rate, which effectively means it isn’t going to happen. The Bank reaffirmed its intent to end bond purchases this year and to soon slow the pace of purchases soon. If anyone was thinking that the RBA’s extension of bond purchases was a signal of what to expect across other CBs then the BoE isn’t playing along, albeit that the RBA was an outlier anyway because all they did was extend expiration of bond buying from April to September.

A further assessment of the BoE’s action is offered in three categories below. The Monetary Policy Summary and meeting minutes are available here and the Monetary Policy Report including forecasts is available here.

1. Forecasts

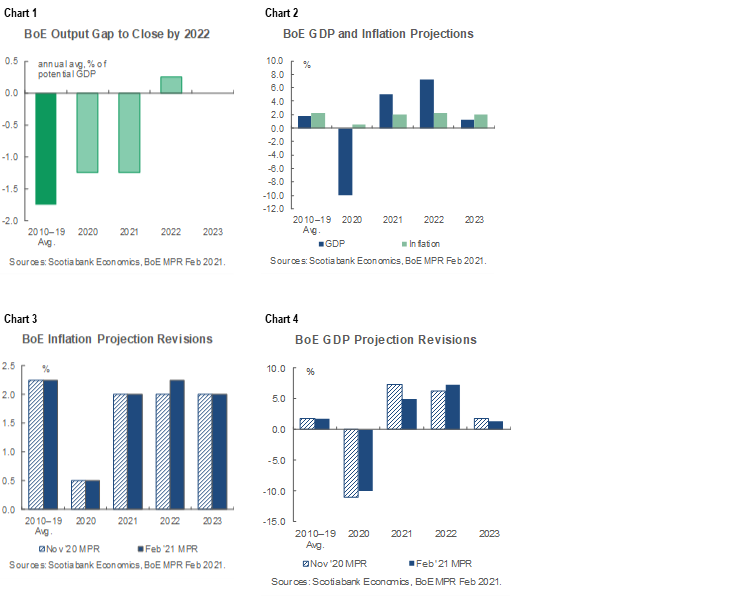

Like the Fed did in December, much of the BoE’s guidance was left to the numbers to do the talking. The BoE projects a return to balance in the output gap later this year and for the gap on a full year basis to move marginally into excess demand next year (chart 1). Headline inflation is projected to be durably on 2% from 2022-onward which indicates the BoE does not see a pick-up as just a transitory flash in the pan (chart 2). They also forecast GDP growth at +5% this year and 7¼% next year (chart 2 again). Chart 3 shows the upward revision to the inflation forecast while chart 4 does that for GDP. Overall, this is the stuff of guiding when to eventually tighten and is not the least bit consistent with further easing.

2. Taper talk

Deputy Governor Ramsden indicated during the press conference that the pace of gilts purchases is likely to slow. His full quote:

“When we embarked on this program back in November the MPC wanted to hit that target around the end of this year. We’re very much on track to complete this program at the end of the year. If we continued at the current pace, we would actually complete the program a little bit before the end of the year, so we do need to slow the pace somewhat.”

The difference, say, to the Fed is that the Fed is running an open-ended QE program that is flow-based whereas the BoE’s 150 billion asset purchase program was targeting year-end completion. Ramsden is just saying they expect to hit that earlier and so the implied pace of purchases if they stick to completing it by year-end would have to be slower.

3. Dousing negative rate talk

On negative rates, the meeting minutes generally indicated that the system would not be prepared for negative rates until at least six months from now while the option was downplayed as unlikely to be enacted in any event. Governor Bailey made it even clearer that all the BoE is doing is to develop the financial system’s plumbing and that "nobody should take any signal from this.”

Direct quotes are as follows:

"The PRA’s engagement with regulated firms had indicated that implementation of a negative Bank Rate over a shorter timeframe than six months would attract increased operational risks."

"The MPC therefore agreed to request that the PRA should engage with PRA-regulated firms to ensure they commence preparations in order to be ready to implement a negative Bank Rate at any point after six months."

"For some, the risk that the MPC requesting the commencement of such preparations for a negative Bank Rate would be misconstrued as a policy signal would be manageable with careful communication. There was, therefore, little reason not to request the beginning of those preparations now, thereby adding to the MPC’s toolkit at the earliest opportunity."

"While the Committee was clear that it did not wish to send any signal that it intended to set a negative Bank Rate at some point in the future, on balance, it concluded overall that it would be appropriate to start the preparations to provide the capability to do so if necessary in the future."

"On the one hand, such a request could be misconstrued as a signal that the MPC setting a negative Bank Rate was in prospect, or even imminent. This was a signal that the Committee did not wish to send."

Bank of Canada watchers can draw a parallel here to the much earlier efforts by the BoC to explore the financial system’s readiness for a potentially negative policy rate prior to the pandemic. It was never positioned by the BoC as something being imminently considered versus a prudent step given the downward movement of the neutral rate over time and the likely greater frequency with which the lower bound may be reached during cycles and hence how this may require central banks to be operationally ready to entertain more creative policy options if needed. The BoE is doing the same thing here, just a little later than the colony that sent them their last governor.

UNITED STATES

US job market signals were constructive this morning, but they were of the minor variety ahead of tomorrow’s nonfarm show.

Weekly initial jobless claims fell by more than guessed with positive revisions that indicate a slowing pace of filings (chart 5). Claims fell to 779k last week (consensus 830k, Scotia 820k) and were revised lower to 812k the week before (from 847k initially). Initial claims are now at their lowest since the week of March 20th. Continuing claims also fell to 4.59 million from a slightly upward revision at 4.785 million (from 4.77 million initially).

Also, the Challenge & Gray mass layoffs report showed little change last month. Mass layoffs tallied 79.55k last month (77k prior) and continue to cruise around the 65–80k range over the past four months which is the stuff of rounding errors in movements (chart 6). The pre-pandemic normal run-rate for mass layoffs was around 30–70k per month as there are always mass layoffs being announced at any given period in the job market. Today’s annualized run range is +/-300k higher than it was pre-pandemic which is an annualized pace of job layoffs that even a slow pace of hiring activity would be easily able to absorb in any given year. That says to me that while churn will be an issue, the mass layoffs story has stabilized at a range that is only slightly higher each month than the pre-pandemic rate and therefore other job market variables are likely to continue to dominate the outlook for US job growth such as recalls and incremental hiring that can continue to drive down ‘permanent’ layoffs.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.