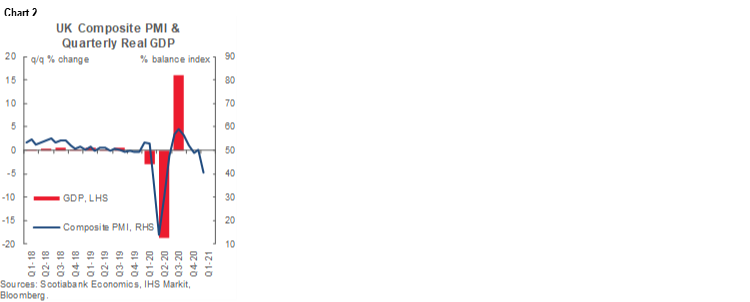

ON DECK FOR FRIDAY, JANUARY 22

KEY POINTS:

- Risk-off sentiment guides the end of the week

- Global PMIs are confirming a Q1 retrenchment…

- …led by the UK, as Australia continues to outperform

- Will US PMIs follow the trend lower?

- CDN retail sales, US home sales on tap

INTERNATIONAL

Well this is a pretty rude way to end the week, but markets are in risk-off mode that began before lousy data began to arrive. Warnings on extended lockdowns in Europe and transitory interruptions in vaccine availability are the likely culprits as the US debates stimulus.

- S&P futures are off by ¾% with TSX futures down by a little less. European cash markets are down by between ¾% (FTSE, Dax) and nearly 2% (Italy).

- Sovereign curves are mildly richer with global 10 year yields down by around 1–2bp on average.

- Oil prices are off by over a buck.

- The USD is mildly firmer as gains against most currencies are offset by a firm euro.

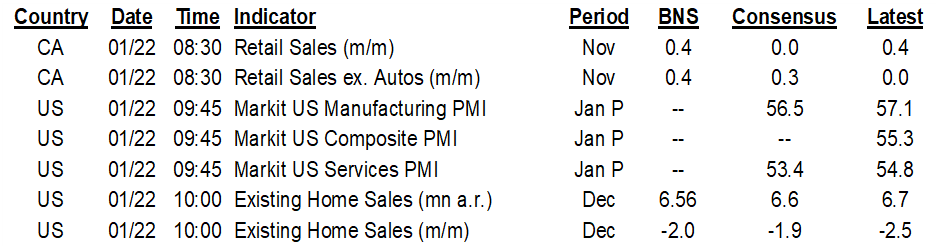

The Eurozone composite PMI signalled a deeper GDP dip by landing at 47.5 (49.1 prior, 47.6 consensus). Chart 1 indicates that the impact on GDP growth in Q1 is likely to be a lot milder than the first wave restrictions. Services fell the most as manufacturing expanded at a slightly softer pace. Germany’s composite fell to 50.8 (52 prior) but still signals slow growth unlike France’s composite PMI that fell by 2.5 points to 47.0 entirely due to services as manufacturing picked up a bit.

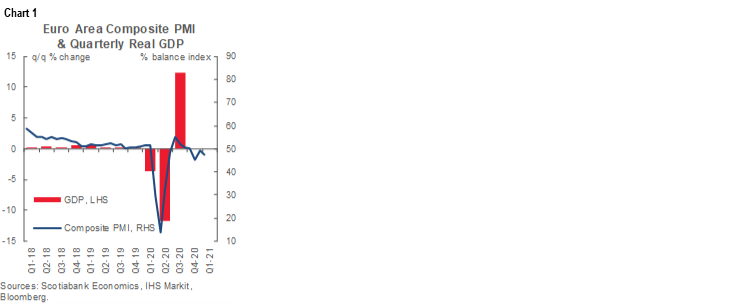

The UK composite PMI fell by almost 10 points to 40.6 (45.5 consensus) and was by far the biggest decline registered globally. That points to Q1 UK GDP facing arguably the most downside across major global economies into Q1 (chart 2). The services PMI fell by almost 11 points to 38.8 as manufacturing continued to expand but at a notably cooler pace.

Australia’s composite PMI slipped a touch but remained in solid growth territory (56.0 from 56.6) as both services and manufacturing cooled. Chart 3 demonstrates how the trend indicates solid GDP growth over Q4 transitioning into Q1. Australian retail sales also disappointed and fell by 4.2% m/m (-1.5% consensus, +7.1% unchanged prior).

Japan’s Jibun PMIs fell further into contraction with the composite at 46.7 (48.5 prior). Most of the softening was in services. Chart 4 indicates a soft connection between the metrics and GDP growth that nevertheless points to contraction. CPI fell to -1.2% y/y (-1.3% consensus) and core CPI fell to -1.0% (-1.1% consensus) which marks the first time since August 2010 that core inflation hit -1%.

UK retail sales were up by less than expected in December (+0.3% m/m, 1.3% consensus) with small negative revisions. Ex-fuel sales performed similarly.

CANADA

Canada updates retail sales to close out the Q4 holiday season (8:30amET). We’ll get November figures and details as well as Statistics Canada’s ‘flash’ estimate for December’s sales absent any material details. The agency had previously guided that November’s sales were tracking little changed, although there have been several times it has done that and the results wind up coming in better. This will be the last reading to plug into estimates for next Friday’s November GDP that should be accompanied by rough December guidance.

UNITED STATES

Relatively minor releases are on tap for this morning alongside little earnings risk while the FOMC remains in hush mode ahead of next Wednesday’s communications.

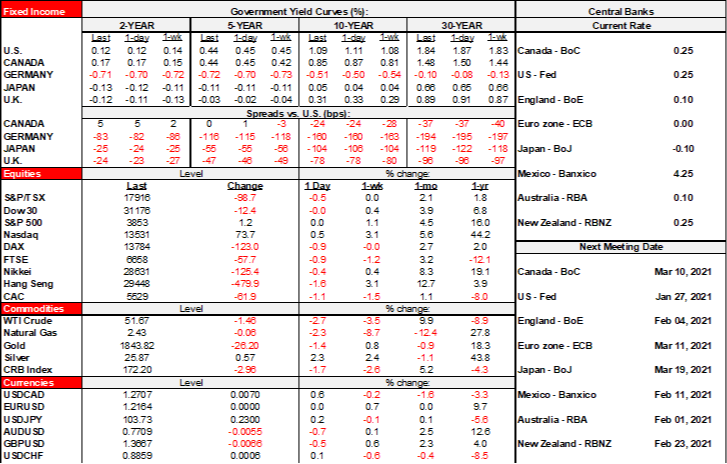

Markit’s PMIS for January are due out at 9:45amET and will be followed by for December 15 minutes later. Home sales likely slipped again given an ongoing deceleration in pending home sales over the prior three months that turn into complete

There is no meaningful consensus for the Markit gauges that are less widely followed than the ISM measures. Recall that one reason for this is that the Markit gauges include international operations of US companies but the Fed prefers ISM measures because they are a closer depiction of developments in the US economy. It’s too early to tell what ISM-manufacturing is looking like as we only have the small dip in Empire and the strong rise in the Philly gauge to go by so far.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.