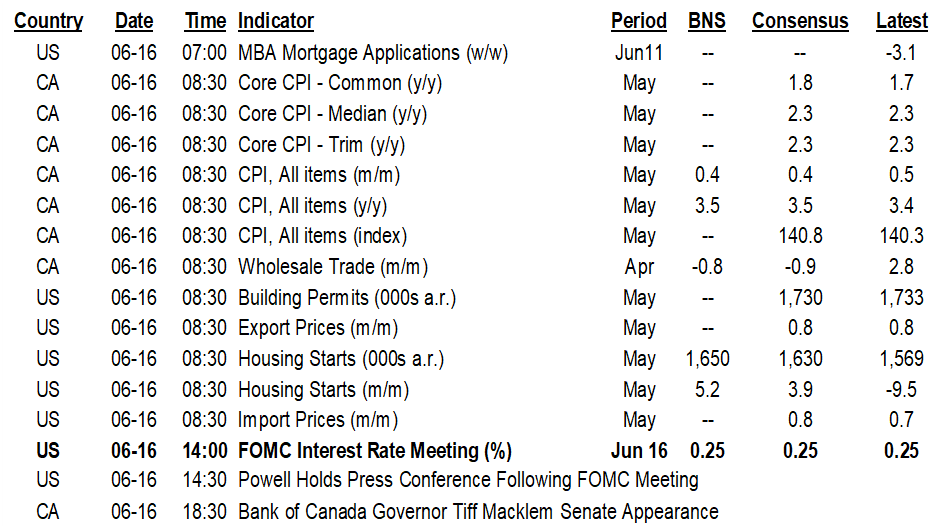

ON DECK FOR WEDNESDAY, JUNE 16

KEY POINTS:

- Global markets certainly feel like the Fed is coming up

- FOMC expectations in brief

- CDN CPI: will supply chains effects overwhelm lockdowns again?

- UK core CPI posts biggest monthly May gain on record

- Chinese momentum cools by more than expected

- Brazil expected to hike again

- US housing starts, CDN wholesale also on tap

INTERNATIONAL

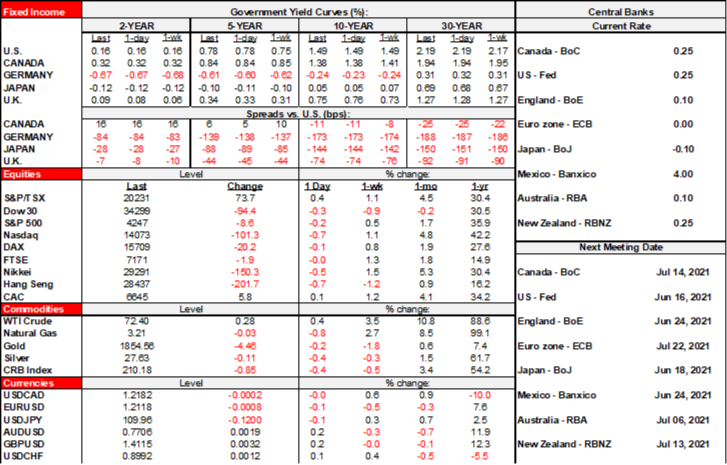

Well it sure feels like it’s Fed day in the markets with no one really sticking their necks out too far. Broad asset classes are little changed with curves slightly flatter, the dollar flat and equities little changed. There are a few other distractions to pass the time ahead of 2pmET but it’s mostly about the Fed today.

UK inflation spiked higher ahead of next week’s BoE meeting and took sterling up with it and it wasn’t just about base effects. Core CPI is suddenly smack on target at 2% (1.5% consensus, 1.3% prior). Headline CPI was up by 2.1% y/y (1.8% consensus, 1.5% prior). Core is rising by the most since August 2018. Base effects were a part of that, but like elsewhere, core CPI was up by more on a month-over-month seasonally unadjusted basis than a typical month of May (+0.8% m/m) and so that’s where the hotter y/y number came from compared to the known base effect. May core CPI m/m NSA was the hottest gain for a month of May since at least back to 1992 (chart 1).

Chinese macro reports disappointed overnight. Retail sales were up 12.4% y/y (14% consensus, 17.7% prior). Industrial output was up 8.8% y/y (9.2% consensus, 9.8% prior). Fixed investment grew by 15.4% y/y (17% consensus, 19.9% prior). But the jobless rate ticked lower to 5%.

Brazil’s central bank is expected to hike its Selic rate by another +75bps (5:30pmET).

UNITED STATES

The focus is on the FOMC statement at 2pmET along with the revised dots and Summary of Economic Projections followed by Chair Powell’s press conference at 2:30pmET for about an hour or so. Brief expectations are below and see the previously distributed Global Week Ahead here and other postings for more.

- Dots: Will the 2023 median shift to a hike? There is a fairly high bar to get 3 officials changing from a hold and Powell will likely downplay it anyway. Plus they may want to prime things with a taper discussion first and they’re not quite there yet. Seems to me you can’t really talk rate hikes until there is committee agreement on when to start getting out of bond buying.

- Taper talk: Nothing in the statement. The presser is likely to have Powell say they talked about talking about it, but ‘substantial further progress’ is a ways off yet. The minutes 3 weeks from now may be more revealing.

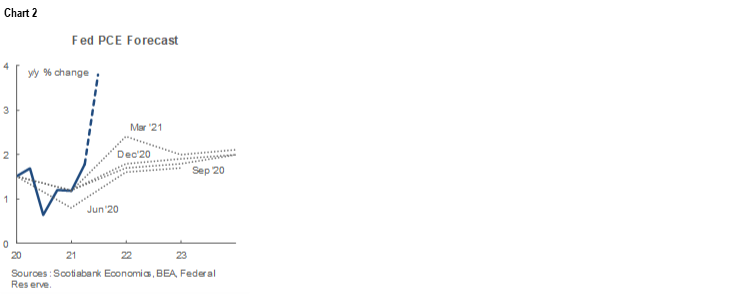

- Forecasts: GDP and inflation likely higher, but so may be the UR. Powell’s presser is likely to repeat that inflation’s burst is transitory in the absence of 8+ million more jobs needed which is debatable. If he talks about it all being base effects again then chart 2 is a reminder that when the FOMC knew the base effects in real time it failed to forecast the surge we’re getting now and that’s because the month-over-month pressures are the driving factor.

- IOER change: I doubt it personally but nobody can 100% rule it out. The NY Fed’s RRP facility is so far holding the fort against the wall of cash from the Treasury and keeping EFF positive. Powell’s presser will leave the door open to a change if needed. The FOMC has revealed a preference for using repo rather than tweaking IOER to date and I just don’t see why they’d change at this point versus jawboning further options. Past IOER changes were frankly not terribly durable influences upon EFF whereas the repo changes have generally had better effects. Watch for Powell to indicate he thinks pressures on the Fed’s s-t rate control, yields and cash flows should be transitory and wane by late July.

- Bond markets: Following on the IOER discussion, Powell *might* reference how bond markets in general are temporarily dealing with the wall of cash hitting markets and driving some reach for yield.

- Statement changes: Current conditions paragraph could strike out “turned up recently” and indicate moderation in terms of job growth while striking out “inflation continues to run below 2 percent” in favour of a reference to expected transitory factors. No change in third paragraph. Fourth paragraph is a awkward and in need of a change with “inflation running persistently below this longer-run goal.” No change in purchase language. Risk of dissenters is low given the ones most in favour of changing things up soon don’t vote this year.

US housing starts for May will be faded ahead of the Fed but are expected to rebound from the ~10% m/m drop in April (8:30amET)

CANADA

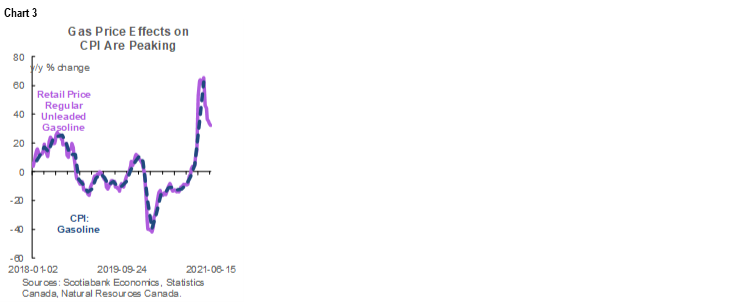

Canada updates inflation for May before the Fed. I went with +0.4% m/m NSA and +3.5% y/y for a slight up-tick in the annual pace. There should be less upward pressure on the year-over-year rate from base effects and gasoline prices are a waning effect (chart 3). May is usually a seasonal up-month for prices in a “normal” year that I’ve yet to see in my career so far, but the key uncertainty is whether we get a repeat of the seasonally abnormal spurt in price gains that we saw in April. Canada remained in lockdown mode during May due to the third wave of COVID-19 cases but the price gains in April occurred in the same context and were likely more about supply chain effects. See the week ahead, pp.4–6 for more including why the base effects argument is exaggerated.

Canada also updates wholesale trade for April with advance ‘flash’ guidance from StatsCan indicating a drop of -0.8% m/m in lockdowns (8:30amET).

BoC Governor Macklem delivers his postponed Senate testimony this evening (6:30pmET).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.