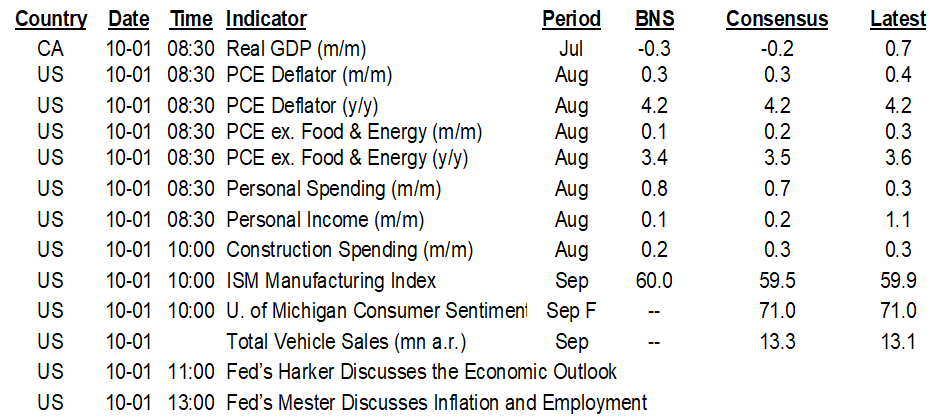

ON DECK FOR FRIDAY, OCTOBER 1

KEY POINTS:

- October starts off with mild risk-off sentiment

- Canadian GDP: start of the soft-patch rebound?

- US vehicle sales could drop to weakest since pandemic’s start

- US ISM-mfrg: more downside than upside

- US PCE inflation to follow CPI lower

- US income growth to shake off child benefit effect

- US consumption to follow retail sales higher

- Eurozone inflation landed on the screws

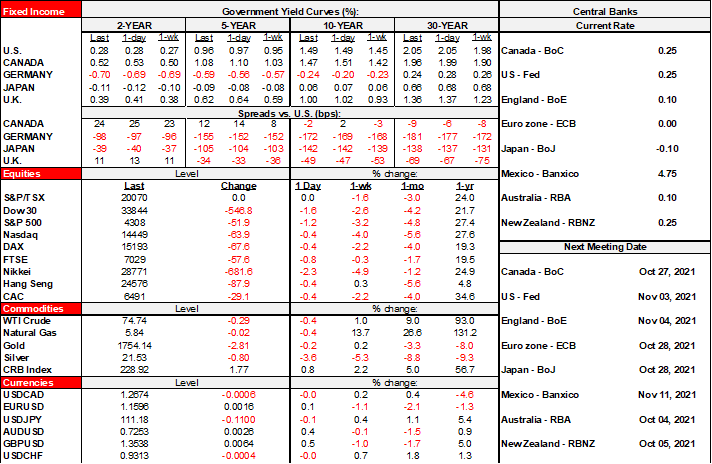

Happy Friday. Welcome to October. Markets are not such a happy place today mind you. Global market sentiment is in mild risk-off mode with mainland China and HK on holiday. S&P futures were down earlier but have clawed their way back to almost flat at the time of publishing while TSX futures are still in the red and European cash markets are down by either side of -½%. European and Canadian yields are outperforming US Ts this morning and across the board at that and partly as catch up to late yesterday’s US moves with Canada coming back from holiday. The most powerful moves are in EGB 10s where yields are down by 3–4bps, while 10 year gilts are 1–2bps lower. Front-ends are a tad richer as well across Europe. The USD is little changed overall.

As for specific catalysts, I don’t see anything fresh that stands out this morning. The same concerns are being recycled and overnight releases were relatively light. Take your pick of forward looking risks now with the US Congress still in turmoil around stimulus plans and only punting the issues down the road with a temporary funding agreement. China is entering an awkward period of silence with holidays through next Thursday in the context of Evergrande’s issues and a soft economy. Even though eurozone inflation didn’t surprise, it’s still running hotter than anyone anticipated and creating uncertainty toward its longevity and how the ECB may react over time. I think next Friday’s nonfarm payrolls face downside risk and will write about why in the week ahead later today.

Eurozone inflation was in the ballpark of expectations. 1.9% y/y for core that matched consensus and 3.4% y/y for headline (3.3% consensus) with total prices up 0.5% m/m and matching consensus.

German retail sales landed pretty much on the screws including revisions. They were up 1.1% m/m in August (1.5% consensus) and the prior month’s decline was revised to be a milder -4.5% m/m hit (from -5.1%).

CANADA

This morning we’ll get Canadian GDP for July but more importantly advance guidance for August (8:30amET). StatCan had advised that July fell by 0.4% m/m but most within consensus figure that the final estimate will land a touch better (less bad?). My estimate is -0.3%.

More important than a refresher on the July figures that also put details to the composition will be the first estimate for August GDP (sans details) that could be the start of a rebound. This is based upon tracking across a suite of preliminary indicators such as flash guidance for retail sales (+2.1% m/m), wholesale trade (+0.5% m/m), manufacturing sales (+0.5%), hours worked (+0.1%) and with only housing starts (-3.9%) and home sales (-0.5%) putting in soft numbers. Beyond that, mobility picked up along with indicators like restaurant reservations and so the services side of the picture could add upside.

UNITED STATES

There are several US releases on tap today. The new information will likely place the most emphasis upon fresh readings on supply chain issues across manufacturing and particularly autos. The consumption and inflation figures have enough advance through CPI and retail sales that they are unlikely to present the same risk of surprises.

PCE inflation during August (8:30amET) should largely follow what we already saw in the softer CPI print for August notwithstanding methodological differences and as only the first month we’ve seen milder inflation since the start of the year. Personal income growth (8:30amET) should largely shake off the prior month’s introduction of child benefit payments while consumer spending should follow higher the already known gain in retail sales.

ISM-manufacturing for September (10amET) is expected to soften a bit following mixed regional surveys (Empire and Philly up, Richmond, KC and Dallas down) and with ongoing supply chain issues particularly in transportation. As usual, watch the prices component.

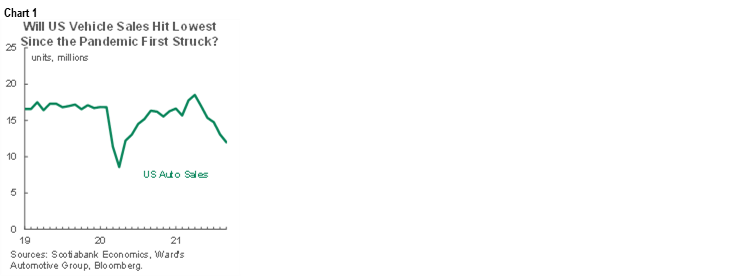

US vehicle sales will round it all out as company figures arrive throughout the day leading up to the industry tally toward day’s end. I wouldn’t be surprised to see a figure in the 11–12 million annualized range (consensus 13 million) based upon industry guidance. That risks taking us back to the weakest sales figures since April 2020 (chart 1) when the pandemic broke out with maximum effect but this time around it’s messed up supply chains that are to blame.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.