Colombia: October jobs data point to structural challenges; BanRep minutes highlighted the recovery

Mexico: Credit to private sector declined again in October; AMLO Government announced second investment plan

Peru: A new dawn in Peruvian politics? President Sagasti spars with the media as a subdued Congress approves the 2021 budget

COLOMBIA: OCTOBER JOBS DATA POINT TO STRUCTURAL CHALLENGES; BANREP MINUTES HIGHLIGHTED THE RECOVERY

I. Unemployment rates fell in October, but point to structural challenges

On Monday, November 30, DANE reported that in October, nationwide unemployment came in at 14.7% (October 2019 was 9.8%), while urban unemployment (i.e., across 13 cities) came in at 16.8% (October 2019 was 10.4%). The seasonally-adjusted series showed that the national unemployment rate improved to 15.7% in October versus 16.2% in September 2020, while the urban unemployment rate came down from 19.3% in September to 18.2% in October—the best figures we’ve seen during the pandemic (chart 1). DANE’s Director, Juan Daniel Oviedo, noted that October’s labour-market data clarified some of the structural losses that Colombia’s economy has experienced this year and pointed to some key areas on which public policy could focus to advance the economic recovery.

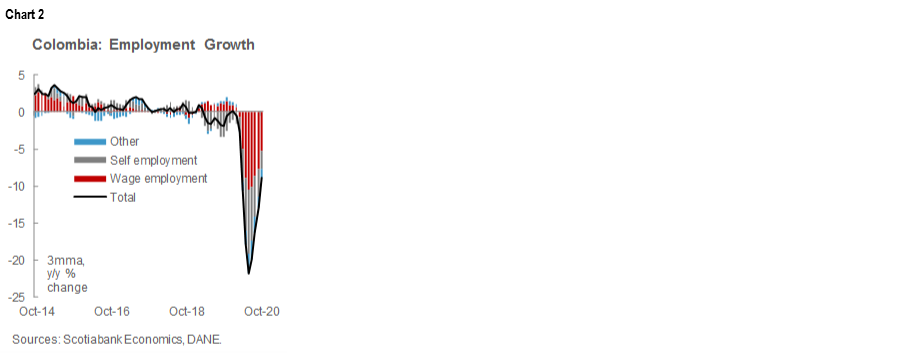

In October, the revival of the economy consolidated with 95% of activities open, according to government estimates, which helped to restore employment across sectors and regions. Job gains were greater than we saw in September: employment rose by 1.04 mn in October, bringing its total to 21.3 mn posts, down by only -6.7% y/y (chart 2, n.b. chart shows 3mma). That said, it is worth noting that October’s employment levels were equivalent to those last observed in 2011–12.

October’s labour-market results point to some inequalities in the recovery. The gender gap has widened: the unemployment rate for women deteriorated from 12.5% in 2019 to 20.1% in October 2020, while unemployment for men increased by a much smaller delta from 7.8% in 2019 to 10.7%. In the same vein, growth in formal jobs is lagging the overall employment recovery (chart 2, again). We attribute these dynamics to the informal economy’s flexibility, which has allowed people to return to work more quickly than in the formal market. Indeed, informality in urban areas increased by 2.6 ppts to 48.5% in October. These trends pose a considerable challenge for public policies related to tax collection, benefits provision, and economic development since they deepen longstanding structural problems.

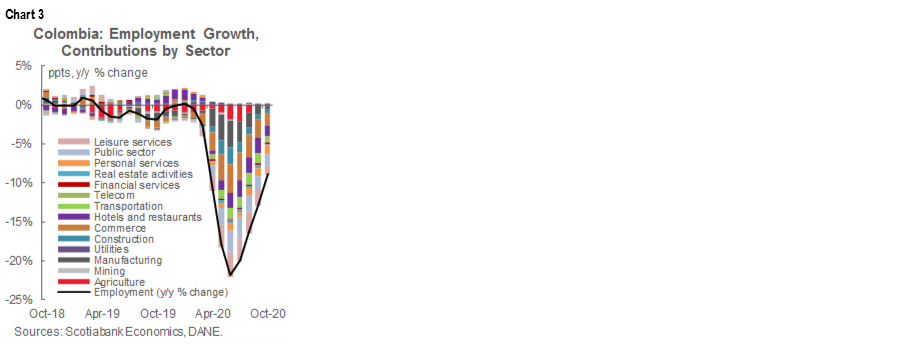

From a sectoral perspective (chart 3), year-on-year employment losses as of October were concentrated in the public administration and health sector (-254k), hotels and restaurants (-232k), and commerce (-224k), which together accounted for 46% of total employment contraction. It is worth noting that in the health sector, job losses were explained by reductions in COVID-19-related emergency personnel needs. Commerce-sector job losses were similar to those observed one year ago, which pointed to a relative normalization in the sector. Agriculture and industry reached employment levels close to those of the beginning of the year, which also implied some stabilization.

Other October data imply that job gains could slow in the coming months since the Colombian economy is operating below its installed capacity. The labour market remains the biggest concern for policymakers because it is opening negative gaps, and at some point, it could put a cap on domestic demand and slow the economic recovery, although we still expect the unemployment rate to come down to 15.5% by Q4-2020. October’s labour-market data and DANE’s comments on it point to the need to shift policy from an emergency response to the crisis toward deeper structural change.

II. BanRep minutes highlighted the economic recovery

On November 30, BanRep published the minutes of its Friday, November 27, monetary policy meeting where it kept its headline policy rate at 1.75% in a unanimous decision. The minutes were, again, very factual and pointed to a relatively favourable scenario where the economic recovery is going as expected. However, the Board re-emphasized its concerns about the labour market recovery since job gains have been concentrated in the informal sector, which is a structural issue to keep monitoring. One important difference from previous minutes was that the Board didn’t mention concerns regarding COVID-19 second waves in Colombia.

On the inflation side, the Board noted that inflation expectations for end-2021 remained close to the 3% y/y target. The Board further stressed that banking-sector credit has increased in the mortgage and commercial segments, and that cuts in the headline monetary-policy rate have been transmitted through the financial system to businesses and households.

All in all, the minutes re-affirmed the “wait and see approach” of the Board given the mixed situation of an ongoing recovery with still-significant challenges on the employment side. We maintain our call (see the November 28 Latam Weekly) that the monetary policy rate will remain on hold at 1.75% for the rest of the year and through the first half of 2021.

—Sergio Olarte & Jackeline Piraján

MEXICO: CREDIT TO PRIVATE SECTOR DECLINED AGAIN IN OCTOBER; AMLO GOVERNMENT ANNOUNCED SECOND INVESTMENT PLAN

I. Financial activity in October points to further demand weakness

Bank lending data for October, released on Monday, November 30, by Banxico showed that financing to the private sector continued its decline of recent months, with further pullbacks in both the business and consumer components. Meanwhile, financing for the federal public sector continued to increase, although at a slower pace than in September. Looking at the details:

- Commercial bank financing for the private sector declined further in both nominal and real terms. In real terms, it pulled back from a -1.9% y/y contraction in September to a deeper -2.8% y/y decline in October, versus a 2.5% y/y gain in October 2019 (chart 4). Direct financing slowed further, in real terms, from -2.0% y/y in September to -2.8% y/y in October, versus a rise of 2.5% y/y in October 2019. Within direct financing, business lending deepened its contraction from -0.1% y/y in September to -1.3% y/y in October, while consumer financing also continued to fall, this time from -10.8% y/y to -11% y/y. Growth in mortgage lending also moderated in real terms, from 5.1% y/y in September to 4.9% y/y in October;

- On the other hand, financing to the federal public sector continued to advance significantly, with an increase of 24.4% y/y in real terms in October; and

- Summing up, growth in total private and public credit from the financial sector slowed in annual, real terms in October, from 4.7% y/y the previous month to 3.3% y/y.

Turning to other developments in the financial sector’s balance sheets:

- Growth in total commercial bank deposits from non-bank institutions accelerated in real terms from 7.7% y/y in September to 8.3% y/y in October, compared with a rise of 1.2% y/y in October 2019 (chart 4, again). Growth in demand deposits increased from September’s 13.5% y/y to 15.0% y/y, while annual growth in time deposits declined from -0.7% y/y to -1.3% y/y; and

- Commercial banks’ loan portfolios dropped for a third consecutive month in real terms, deepening their contraction from -1.6% y/y in September to -2.5% y/y in October (versus a gain of 2.6% y/y at the same time the previous year). This reflected the decrease in credit to business in annual terms, which went from a flat 0.0% y/y in September to -1.2% y/y in October, and a further annual drop in consumer credit, from -10.0% y/y in September to -10.9% y/y. All of this was a testament to the weakness in Mexico’s domestic demand. Mortgage lending was the only possible bright spot, where housing credit growth accelerated slightly in real, annual terms from 4.6% y/y in September to 4.7% y/y in October, in response to low lending rates.

II. Government announced second investment plan

In his morning briefing, the President announced on Monday, November 30, a second investment plan that would amount to MXN 228.6 bn (USD 11.4 bn), equivalent to 1% of GDP. The plan contemplates 29 new projects, of which three are set to start in 2020, while the remaining 26 would begin in 2021. The projects are concentrated in energy, transport, roads, communications, and water. Combined with the AMLO Administration’s first investment plan that was announced on October 5, proposed new capital spending would amount to MXN 526 bn (USD 26.1 bn, or 2.3% of GDP). The arrival of the second plan signalled positive coordination between the public and private sectors and the resolution of some obstacles to moving forward. Nevertheless, the twin plans might still be insufficient to reverse the overall negative trend in investment that Mexico has experienced since 2019.

—Miguel Saldaña

PERU: A NEW DAWN IN PERUVIAN POLITICS? PRESIDENT SAGASTI SPARS WITH THE MEDIA AS A SUBDUED CONGRESS APPROVES THE 2021 BUDGET

Interim President Francisco Sagasti held a televised Q&A session with four members of the news media that was broadcast on the evening of Sunday, November 29. The format was novel and centered on key current issues rather than giving a broader account of government policy. However, it did provide a sense of how President Sagasti views his governing role. Pres. Sagasti stated that his selection by 97 members of Congress does not give him a mandate to implement reforms or undertake major changes. In particular, he opined that it does not give him the mandate, legitimacy, or time to change the constitution or promote its change. In another moment, Pres. Sagasti admonished Congress for continuing to promote a bill to “give back” public pension fund payments, stating that members of Congress are fully aware that this was not possible. The bill was vetoed by the Vizcarra Government, and Pres. Sagasti warned that if Congress overrides the veto, the government will take the issue to the Constitutional Court. Many of the media’s questions focused on COVID-19 and on last week’s purge of the top echelons of the police force, much of which was tainted by accusations of corruption and of ordering the violent handling of protests during the brief Merino Administration. Pres. Sagasti is an eloquent person and displayed a combination of empathy and clarity in his reasoning that could well bolster the support of public opinion and underpin the stability of the government.

Congress approved the 2021 budget in the amount of PEN 183 bn (USD 51 bn) on Monday, November 30. This represents a 3.2% increase over 2020. A positive sign is that Congress ceded in its demands to include spending initiatives that at one point represented a huge boost in expenditures. Instead, Congress and the Ministry of Finance negotiated the inclusion of 142 investment projects in the budget without a rise in the overall spending envelope. Monday, November 30 was the legal deadline for the approval of the budget, which added some urgency to the negotiations.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.