Central banks: Last headline rate decisions of 2020

Colombia: BanRep preview amidst anchored expectations

Peru: November employment and cement figures surprised to the upside; Fitch switched outlook to negative

CENTRAL BANKS: LAST HEADLINE RATE DECISIONS OF 2020

Today sees Banco de Mexico’s last scheduled monetary policy decision for 2020, followed by Colombia’s BanRep Board meeting on Friday, December 18. See our Banxico preview in our most recent Latam Weekly and our BanRep curtain-raiser below. Both consensus and our team in CDMX expect the Banco de Mexico’s Board bold to extend its “pause” and hold again at 4.25%; similarly, analysts and our team in Bogota anticipate that the BanRep Board will hold again at 1.75% in Gov. Exchavarria’s last rate decision before handing over the chair to new Governor Leonardo Villar.

—Brett House

COLOMBIA: BANREP PREVIEW AMIDST ANCHORED EXPECTATIONS

I. Inflation expectations remain anchored in the monetary policy horizon

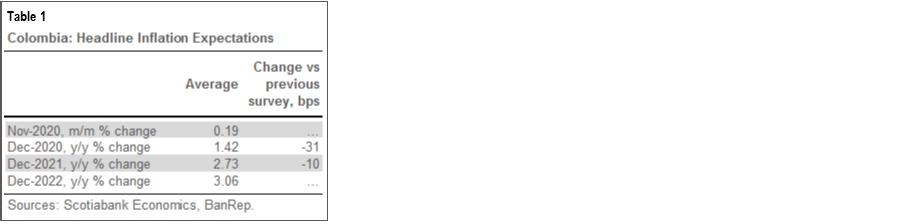

- According to December’s BanRep survey of macroeconomic expectations, analysts’ consensus expects inflation at 1.42% y/y for December 2020, -31 bps lower than last month (table 1). Inflation expectations (IE), for longer tenors did not change much. The 1Y tenor stood at 2.73% y/y, slightly below last month’s survey (2.8% y/y), and the 2Y was at 3.0% y/y (chart 1). Despite the recent downward surprises on October and November inflation, analysts see that as a reflection of temporary developments that should be reversed in the monetary policy horizon. We expect the CPI inflation to close at 1.42% y/y as well, while in 2021, the close would be around 2.8% y/y.

- On average, December’s monthly inflation is expected to come in at 0.19% m/m (in line with our projection), which would leave annual inflation at 1.42% y/y. In December, Colombia inflation should reflect upside pressures from foodstuff prices and the recently announced gasoline-price adjustment; education fees in schools will be revised and would partially offset other upside pressures.

- USDCOP forecasts for 2020-end stood at 3,481 (-61 pesos from the previous survey). For December 2021, respondents think (on average) that the COP will end at 3,480. We believe the USDCOP has already priced an improving macro-fundamental scenario and doesn’t have further room for appreciation. Debt monetization from the government would be a thing to keep an eye on in 2021; however, as in 2021, uncertainty remains and volatility should continue.

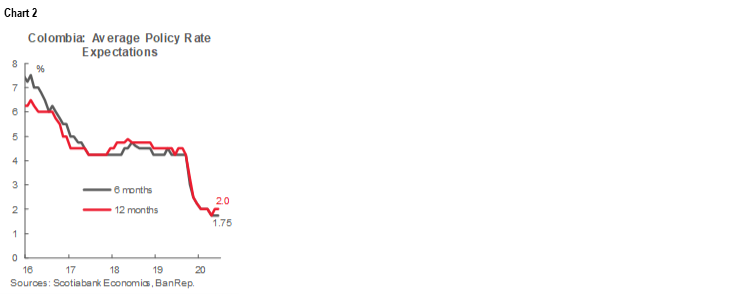

- BanRep’s repo rate is expected to close 2020 at 1.75% according to the median of the respondents, which means that market consensus is not anticipating further rate cuts. The first hike of 25 bps is projected to arrive by November-2021, later than the previous survey estimated. The monetary-policy rate is expected at 2.00% by the end of 2021 (chart 2), and at 3% by the end of 2022.

BanRep’s survey showed that the recent inflation surprise led to a downward revision in inflation expectations for December 2020. However, the general outlook remains anchored near the target of 3% y/y over the monetary policy horizon, similar to what we saw in the most recent Citi survey, which reinforce our call for future rate hikes as the economic recovery is also consolidating. December’s CPI inflation should be positive as foodstuff prices increase. We expect a partial reversal in some prices from the VAT holiday; however, school fees should again provide a negative contribution. All in all, risk balance tilts to a continuing gradual recovery in economic activity, and although inflationary pressures are low for now, expectations are close to the 3% target. As a result, we expect rate stability at the December 18 meeting and the first hike at the end of Q3-2021.

II. Preview for Friday’s BanRep meeting

On Friday, December 18, BanRep will hold its regularly scheduled Board meeting on monetary policy and we, along with the consensus of market analysts, expect the benchmark policy rate to be held at its record low of 1.75%. This meeting should be considered a transitional event since it is the last with Echavarría as Governor. At the Board’s previous meeting on November 28, the central bank kept the monetary policy rate unchanged in a unanimous vote. Governor Echavarría emphasized that future decisions will be based on standard Taylor Rule components: the output gap and the inflation gap. According to recent surveys, the market is pricing stability in the policy rate at 1.75% until Q4-2021, when one hike of 25 bps is anticipated. It is worth noting that in 2022 the normalization in the policy rate is expected to continue.

Since the last meeting, the November CPI inflation reading again surprised to the downside. The education sector posted a new decline in tuition fees, which, joined by VAT-holiday effects, led annual inflation to a record low of 1.49% y/y. Nevertheless, December’s economic surveys showed that inflation expectations remained close around 2.7%–2.8% y/y for end-2021 and closer to 3% y/y over the longer term. On the economic activity side, macroeconomic data has indicated that the recovery is proceeding in line with expectations; retail sales showed, for the first time since the COVID-19 crisis started, a positive year-on-year change; additionally, the industrial and services sectors improved. The labour market also strengthened in October, although informality remains a significant challenge.

Even with the downside surprise in November’s inflation reading, recent data add support to our call for a hold at Friday’s BanRep Board meeting. In 2021, expectations of rate hikes should consolidate as inflation starts to rebound and the economic recovery continues showing better numbers.

—Sergio Olarte & Jackeline Piraján

PERU: NOVEMBER EMPLOYMENT AND CEMENT FIGURES SURPRISED TO THE UPSIDE; FITCH SHIFTED OUTLOOK TO NEGATIVE

I. November positive jobs surprise

The unemployment rate in Lima fell to 15.1% in the September-November period, from 16.4% in the 3-month period ending in October, according to figures published by the National Statistics Institute, INEI, on December 15. Note that the INEI presents its date on a three-month rolling basis.

The improvement in November was a surprisingly large one, and renews our hopes of meeting our full-year 2021 forecast of 14% unemployment. Although the number of people employed in Lima was down a still hefty -16.5% y/y to November (representing 819,000 fewer jobs), this amounted to a solid rise from -21.5% y/y to October.

The total number of jobs to November, at 4.14 mn, was a sharp improvement from 2.2 mn during the lockdown (the period ending in June), and an increase in 270,000 jobs from October (chart 3). November jobs were even rather surprisingly close to the 5 mn jobs in Lima pre-COVID-19 (January). Note, however, that jobs gained do not seem to be of the same quality as those lost, and household income level are not rising quite as much.

II. Cement sales jumped again in November

Cement sales soared 18.6% y/y in November, according to reliable data from the Cement Producers Association, Asocem, released on December 15 (chart 4). While Asocem figures are not official, government data tend to mirror them closely. Therefore, we can expect November construction GDP to show very strong growth. Considering that public investment rose 28% y/y in November, construction GDP growth could border 20% y/y. Construction already led in GDP growth in October, when it rose 8.8% y/y. Public investment is adding to a booming real estate sector.

III. Fitch shifted outlook to negative

Fitch Ratings lowered its Outlook for Peru from neutral to negative on Wednesday, December 16. Fitch kept its rating unmoved at BBB+. We’ve been expecting a change in outlook by rating agencies for some time, in line with other countries in the region, so the change was not surprising. The markets also seemed to take the shift in stride. We also expect a one-notch decrease in rating at some point in coming months. Peru is, of course, just one more country to see its fiscal accounts deteriorate due to the COVID-19 lockdown and its aftermath; in its Market Action Commentary, Fitch mentioned the country’s “weakened government balance sheet” as a prime reason for the outlook downgrade. What was, perhaps, more unusual, albeit not really surprising given recent events, was the emphasis put on “populist measures” by Congress and the likelihood of continued tension in its relationship with the Executive. Given that the update was unsurprising, and that fiscal deterioration is a worldwide phenomenon and Peru remains being one of the lower-debt countries, we are not too concerned at this point. The key will be that the fiscal malaise does not turn into a structural issue over time, and this will depend crucially on the profile of the new government and Congress to be elected in 2021.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.