Argentina: November inflation stayed above 3% m/m

Colombia: December’s Citi survey showed inflation expectations remain anchored

Mexico: Moody’s warned of cuts to sovereign rating if central bank’s autonomy is infringed

Peru: October GDP growth—a slimmer contraction, in line with our full-year forecast

ARGENTINA: NOVEMBER INFLATION STAYED ABOVE 3% M/M

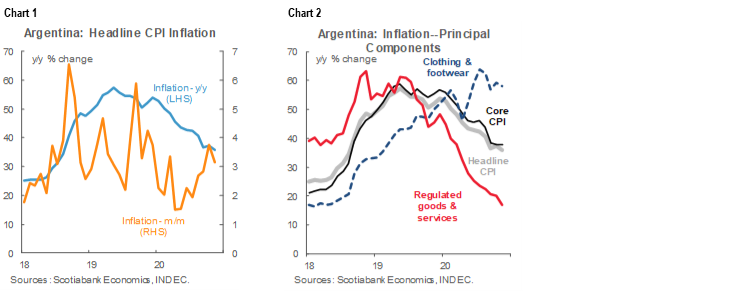

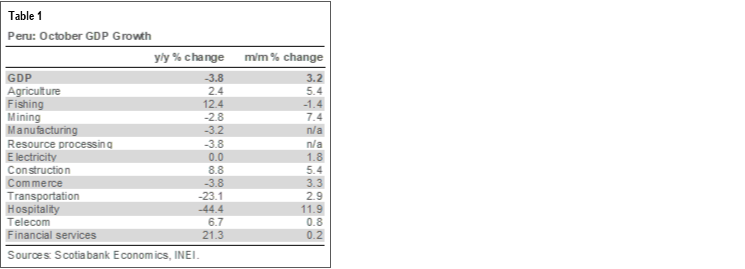

In national price data published by INDEC on Tuesday, December 15, monthly inflation slowed a touch, from 3.8% m/m sa in October to 3.2% m/m sa in November—just below the 3.5% m/m sa in both our forecast in the most recent Latam Weekly and the Bloomberg consensus (chart 1). This brought headline annual inflation down from 37.2% y/y in October to 35.8% y/y in November—the lowest rate since August 2018—versus the 36.25% y/y anticipated by analysts. Regulated prices, which are concentrated in the utilities and transportation segments, continued artificially to pull down headline inflation: at 16.9% y/y (1.2% m/m) in November, they ran well below price gains in the rest of the economy (chart 2). In contrast, core inflation at 37.8% y/y (3.9% m/m) remained above headline price gains. Tradable goods prices reflected pass-through effects from the weak Argentine peso: for instance, clothing and footwear prices were up 58.1% y/y (3.68% m/m) in November. November’s print keeps annual headline inflation on track to close 2020 at about 36% y/y—well below end-2019’s 53.8% y/y reading owing to base effects. We expect sequential monthly inflation to remain above 3% m/m sa deep into 2021.

—Brett House

COLOMBIA: DECEMBER’S CITI SURVEY SHOWED INFLATION EXPECTATIONS REMAIN ANCHORED

December’s Citi Survey, which BanRep uses as one of its measures of expectations of inflation, the monetary policy rate, GDP, and the COP, came out on Monday, 14 December.

Key points included:

- Growth forecasts were mildly revised. For 2020, a contraction of -7.20% y/y, -2 bps below last month’s survey reading of -7.18% y/y, is now expected. In 2021, the recovery is now forecast to hit a pace of 4.73% y/y, above the previous survey’s 4.54% y/y consensus. We expect -7.5% y/y in 2020 and a rebound to 5.0% y/y in 2021;

- Inflation expectations fell in 2020, but remained anchored in 2021. December’s monthly inflation rate is, on average, anticipated to be 0.20% m/m and 1.43% y/y; we forecast 0.19% m/m and 1.42% y/y on the back of deflation in education prices and increases in food prices, along with a partial normalization of prices after the third VAT holiday’s effects. For December 2021, the survey’s average projection for headline inflation is 2.74% y/y, lower than the previous survey’s expectation (2.80% y/y) due to November’s inflation downside surprise. Having said that, by December 2022, the survey looks forward to inflation hitting 3.18% y/y, just above the central bank’s target;

- Market consensus points to policy rate stability. A full 100% of analysts surveyed expect the BanRep’s key monetary-policy rate to be held at 1.75% at the December 18 meeting; in 2021, consensus projects one 25 bps hike; although analysts’ views are dispersed between stability and up to 125 bps in hikes (our call is for 100 bps), the mode is at 1.75%. In 2022, the mode is at 3.50% (chart 3); and

- The USDCOP forecasts point to a relatively stable currency through December 2021. On average, respondents expect a level of USDCOP 3,487 by the end of 2020 and USDCOP 3,497 by end-2021. In 2022, USDCOP is projected to reach 3,456.

—Sergio Olarte & Jackeline Piraján

MEXICO: MOODY’S WARNED OF CUTS TO SOVEREIGN RATING IF CENTRAL BANK’S AUTONOMY IS INFRINGED

On Wednesday, December 9, the Mexican Senate fast-tracked the approval of a bill that would modify the law that governs Mexico’s central bank, Banxico. The initiative would obligate Banxico to buy “excess” cash in foreign currency that domestic banks cannot place with correspondent banks abroad. The monetary authority and several analysts considered that this proposal would put the autonomy of the central bank at risk. Banxico has expressed its concerns about the proposed change, noting that it must absolutely avoid the risk of engaging in operations involving resources of illicit origin. The fear is that such exposure could affect, among other things, the free availability and control of the international reserves that it administers, to the detriment of Banxico’s objectives, and the country’s broader aims. The bill is now with the Chamber of Deputies (the lower house of Congress) for further discussion and a vote when Congress begins a new session in February 2021.

In a commentary posted late on Monday, December 14, Moody’s, the rating agency, warned that Mexico’s credit profile (issuer rating Baa1) could be at risk if Banxico’s autonomy is infringed through, inter alia, the passage of the bill under discussion. Furthermore, the measure could weaken Mexico’s compliance with international anti-money laundering standards by transferring the risk of handling cash whose origin may be unverifiable to the central bank, potentially exposing its balance sheet to litigation. Such a development could have negative implications for the financial system as a whole.

—Paulina Villanueva

PERU: OCTOBER GDP GROWTH—A SLIMMER CONTRACTION, IN LINE WITH OUR FULL-YEAR FORECAST

In data released by the INEI on Tuesday, December 14, GDP growth for October came in at -3.8% y/y, up from 6.9% y/y in September (chart 4). This is just above the range we were expecting (-4.5% y/y to -5.5% y/y). More importantly, the print is well aligned with our expectation of -3.3% y/y growth in Q4 2020 and, thus, with our full-year forecast of -11.5% y/y. We had been a bit anxious that the contraction in GDP during 2020 would go beyond our forecast, but the result for October has laid our concerns to rest. With 12-month growth to October at -10.8% y/y (chart 4, again), a feasible -3.0% y/y growth would be needed for November–December to hit our -11.5% y/y full-year forecast.

One pleasant surprise lay in agriculture, which was up 2.4% y/y in October (table 1), which marked a positive turn in annual growth for the first time in five months. Construction performed strongly, but this was expected. The 21.3% y/y increase in financial services was a reflection of the Reactiva program, but October will also be the last month with this magnitude of growth. All other sectors were either in line with, or mildly better than, expectations.

In sequential terms, October GDP was up 3.2% m/m, an acceleration from the 1.47% m/m pace recorded in September (table 1, again). Of particular note, all sectors except fishing (a seasonal anomaly) rose in month-on-month terms.

The figures for October basically tell us that GDP is rebounding as expected. October was a month in which most of the lockdown had been lifted, but consumers were still behaving cautiously. Perhaps

one-third of the year-on-year decline in October reflected that part of the economy still under restrictions of some sort (e.g., education and entertainment) and the remaining two-thirds would have been linked to weakened domestic demand coming out of the lockdown.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.