Colombia: Retail and manufacturing sectors continue recovering as new normal consolidates

Mexico: Formal jobs increase for a fourth month in November

COLOMBIA: RETAIL AND MANUFACTURING SECTORS CONTINUE RECOVERING AS NEW NORMAL CONSOLIDATES

On Monday, December 14, DANE released retail sales and manufacturing production data for October, and both sectors saw improvements in their year-ago comparisons as the “new normal” re-opening proceeded. Better dynamics were observed in segments associated with higher mobility and greater degrees of social interaction; still, employment remained a concern as net job destruction levels were significant at -6.5% y/y in retail and -6.7% y/y in manufacturing. Substantial structural challenges persist for both sectors.

I. October retail sales growth hit expectations

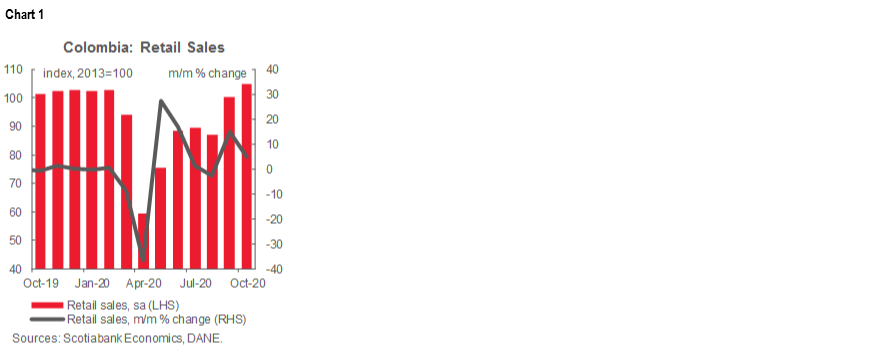

Retail sales were up 3.0% y/y in October, better than September’s -0.8% y/y, and spot-on the Bloomberg consensus. In seasonally-adjusted terms, total retail sales, ex other vehicles, rose by 4.8% m/m in October, a marked slow-down from September’s one-off burst of 15.1% m/m (chart 1). By sectors, foodstuffs (up 5.2% y/y), non-alcoholic beverages (30.9% y/y), alcoholic beverages and cigarettes (28.3% y/y), and clothing (31.4% y/y) were the best performing segments, while annual sales growth in retail sales of gasoline (-4.5% y/y), vehicles (-1.5% y/y), and other vehicles (-15.5%y/y) remained in negative territory. It is worth noting that in Bogota, retail sales, ex-fuel, contracted by -1.1% y/y, while activity was sufficiently strong in other regions to pull countrywide ex-fuel retail sales into positive territory.

Retail sales should post better numbers in November on the back of the year’s third VAT holiday.

II. Manufacturing recovery momentum cooled a bit

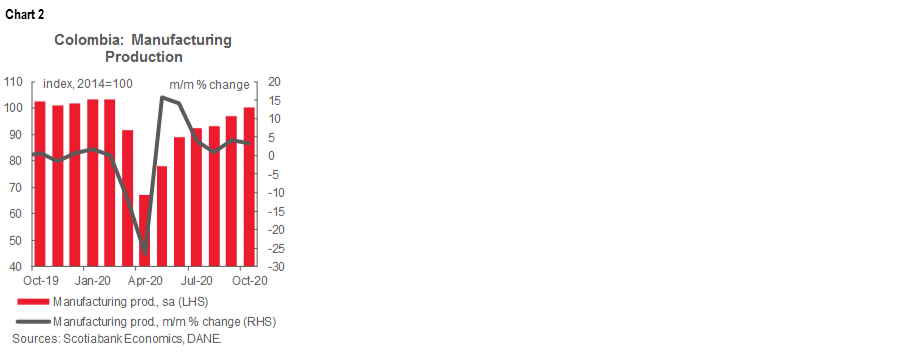

Annual growth in real manufacturing production improved a touch from -3.0% y/y in September to -2.7% y/y in October, but was still well off the Bloomberg consensus of -1.7% y/y. The pullback in sequential growth was softer than in retail sales, with a mild slowdown from 4.16% m/m sa in September to 3.30% m/m sa (chart 2). Manufacturing sales were below their October 2019 levels by -2.3% y/y, which implied a new drawdown in inventories during the month.

Breadth was poor, with 26 out of 39 segments down in year-on-year terms in October; for perspective, prior to the arrival of the “new normal” re-opening process that started in September, August saw 28 out of 39 segments below their levels from 12 months earlier. Four sectors accounted for around 80% of October’s annual contraction in real manufacturing production: oil refining (-8.9% y/y), clothing (-14.6% y/y), iron and steel industries (-16.7% y/y) and vehicle manufacturing (-29.6% y/y). On the positive side some new industries saw year-on-year gains as the re-opening consolidated, with sugar and bread production (up 21.8% y/y), electric equipment (15.2% y/y), pharma (5.2% y/y), and construction-related products (3.8% y/y) leading the gainers. By region, Bogota and Antioquia accounted for almost 80% of the manufacturing contraction, while Atlántico and Valle del Cauca firms increased their production.

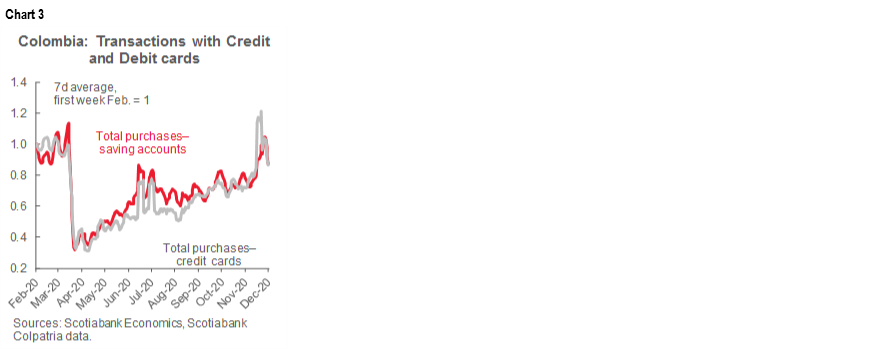

To sum up, October’s coincident retail and manufacturing indicators confirmed the improvement in economic activity that had been anticipated under Colombia’s new re-opening scheme, but the pace of marginal gains moderated. In November, we expect sequential growth to pick up again as the VAT holiday appears to have led to a strong pick-up in consumption (chart 3), but this December is likely to see a return to moderation—which leads us to maintain our forecast of a -7.5% y/y contraction in real GDP for all of 2020.

—Sergio Olarte & Jackeline Piraján

MEXICO: FORMAL JOBS INCREASE FOR A FOURTH MONTH IN NOVEMBER

According to data released by National Social Security Institute (IMSS) on the evening of Friday, December 11, formal jobs rose for the fourth straight month in November, with a gain of 148.7k positions to make for a total of 20.052 million workers affiliated to IMSS (i.e., in the formal sector) at the end of the month. However, the formal employment market continued to report its biggest losses on record for any rolling 12-month period (-752.1k jobs, chart 4) and for the first 11 months of the year (i.e., YTD -369.9K jobs, chart 4 again), despite recording the biggest increase for any November in the last 21 years. In annual terms, the total number of workers in the IMSS system was down for an eighth consecutive month, but more mildly so than in October, with a rise from -4.0% y/y to -3.6% y/y. This represents the longest run of annual contractions since 2008–09.

In November’s details:

- By sectors, November’s annual decline was concentrated in professional services (-9.6% y/y), construction (-7.0% y/y), extractive activities (-6.6% y/y), retail (-2.7% y/y), and processing (-1.1% y/y), which offset increases in agriculture (1.8% y/y), electricity (0.7% y/y), social services (0.2% y/y) and transport (0.1% y/y);

- Even with these declines in the number of formal jobs, growth in the nominal salaries of workers in the IMSS system accelerated from 7.7% y/y in October to 7.9% y/y in November; and

- The number of registered employers grew by 361 organizations in November to 1.003 million, which put the total down -0.1% y/y compared with a flat reading in October.

In line with November’s gains in the formal employment numbers, Banxico’s most recent Survey of Expectations showed that the average forecast for this year became less negative than in the October Survey. Consensus now anticipates a loss of -832k formal jobs this year versus -902k in the October survey, which is reflected in a lower expected unemployment rate for end-2020, down from 5.54% to 5.08%. In contrast, the expected upturn in job creation in 2021 softened from 377k to 360k, but the unemployment rate also pulled back from 4.87% to 4.74%.

—Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.