Colombia: Leonardo Villar elected as the BanRep’s new Governor

Peru: BCRP held at 0.25%, adjusted inflation forecast, and strengthened intervention in the FX market

COLOMBIA: LEONARDO VILLAR ELECTED AS THE BANREP’S NEW GOVERNOR

Leonardo Villar was selected as the new Governor-elect of the Banco de la República (BanRep) and will replace current Governor Juan José Echevarría on January 4, 2021. The initial appointment is for one four-year term, with the option of re-appointment for two subsequent four-year terms. Leonardo Villar currently serves as Colombia’s representative on the Executive Board of the International Monetary Fund (IMF), where Colombia is grouped in a single seat with Spain, Mexico, Venezuela, and several Central American countries. Mr Villar holds master’s degrees in economics from Universidad de los Andes and the London School of Economics.

Mr Villar has a long and diverse history in public life in Colombia. He previously served on the BanRep’s Board from 1997 to 2009, which spanned the introduction of inflation targeting and the response to the global financial crisis. Mr Villar then served during 2009 to 2012 as Chief Economist and Vice-President of Public Policy and Development Strategies at the Andean Development Corporation (CAF), and during 2012 to 2018 he was Executive Director of Fedesarrollo, one of Colombia’s leading research institutes focused on economic policy and social issues. Earlier in his career he was Technical Vice-Minister (i.e., lead public servant) of Finance and Public credit from 1994 to 1997, and Chaired Professor in economics at the Universidad de los Andes from 1988 to 2009. Leonardo Villar’s CV is available on the BanRep website and on LinkedIn.

We believe the Villar election reinforces the independence of the central bank. Leonardo Villar is a competent technician with strong training and wide-ranging experience in policymaking. Additionally, he is a clear communicator, which is essential during these difficult times.

Finally, it is worth noting that the Duque Government will have the opportunity to name two Board members next year, one of whom would replace Arturo Galindo, who resigned yesterday and will remain in office until mid-January. We expect appointments that will conserve the BanRep’s strong technical tradition and independence in its decision-making process.

—Sergio Olarte & Jackeline Piraján

PERU: BCRP HELD AT 0.25%, ADJUSTED INFLATION FORECAST, AND STRENGTHENED INTERVENTION IN THE FX MARKET

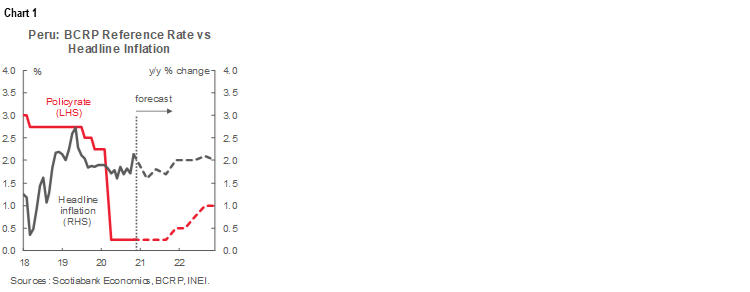

In its last scheduled monetary-policy meeting of 2020, the Board of the BCRP decided on Thursday, December 10, to keep its benchmark interest rate unchanged at 0.25%, where it has been since April 9, and to maintain its strongly expansionary stance, in line with market expectations (chart 1).

In its policy statement, the BCRP announced that it had adjusted its inflation forecast: in its November note, the Board indicated that it expected inflation in 2020 and 2021 to fall in the lower part of the 1–3% y/y target range (chart 2) owing to weak domestic demand; now, the Board anticipates that inflation will end 2020 at the centre of the target range as a result of transitory factors, in line with our 2% y/y end-2020 forecast, and then head back to the lower part of the range by end-2021 due to still-soft demand.

As the December statement noted, the BCRP’s forecasts remain in line with 12-month inflation expectations, which rose from 1.6% in October to 1.7% in November. Our forecast is that inflation will again be around the midpoint of the target range during 2021 (chart 1, again).

The most recent leading indicators reviewed by the BCRP showed a better performance than expected in the Bank’s existing forecast. It is probable that 2020’s contraction in real GDP, which the BCRP currently forecasts at -12.7% y/y, will be improved in its Inflation Report that will be out later this month, as announced by its President Julio Velarde in November.

Looking ahead, the BCRP Board kept its forward guidance unchanged from earlier meetings, noting that “The Board would consider it appropriate to maintain a strongly expansionist monetary posture for a prolonged period and so long as the pandemic’s negative effects on inflation and its determinants persist.” The Board also reiterated that “The central bank would remain ready to expand its monetary stimulus through various instruments”, implying that it would not be inclined to cut rates if the economy were to require further support.

The BCRP was also active in the FX market this week. It drew on its toolbox and placed repos to provide the market with dollars totaling USD 120 mn for a term of one week at a 0.47% interest rate. These repo operations were originally created in December 2013, but had not been carried out since August 2015. The FX market is showing an imbalance that exerts upward pressure on the USDPEN despite improving fundamentals. The relative scarcity of dollars in the spot market—reflected in a record deficit of USD 3 bn in the Bank’s spot position according to the BCRP—coexists with an oversupply of dollars in the derivatives market. We expect the BCRP to continue to inject dollar liquidity through this tool, at least until flows of dollars from the real sector are more visible.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.