Argentina: Vehicle-sector revival starts to hit some limits

Colombia: MoF drew on its IMF FCL and partially monetized it through the BanRep

Peru: Congress approved the new Cabinet even as political tensions rose; vehicle sales were strong in November

ARGENTINA: VEHICLE-SECTOR REVIVAL STARTS TO HIT SOME LIMITS

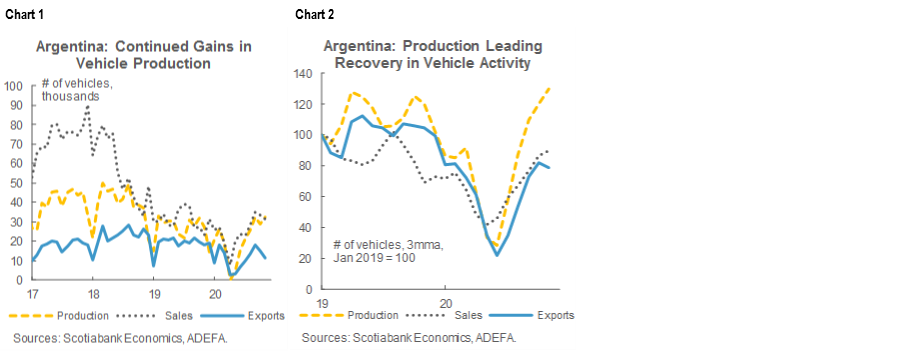

Argentina’s vehicle sector is in the midst of decade-long decline, but its revival has been leading the country’s manufacturing recovery since April’s comprehensive lockdowns. That revival seems to be reaching some of its limits. In November, vehicle production was up 13.5% m/m nsa, which put the level of output 20.2% y/y above November 2019’s levels (chart 1). In contrast, both sales and exports fell from October to November, but with widely divergent implications for comparisons with their respective levels a year ago: while sales were still up 37.3% y/y in November, exports were down -35.8% y/y. Looking at three-month moving averages, November marked a trend slowdown in production and sales, while the trend in exports pulled back (chart 2).

—Brett House

COLOMBIA: MoF DREW ON ITS IMF FCL AND PARTIALLY MONETIZED IT THROUGH THE BANREP

The Ministry of Finance announced the drawing of USD 5.4 bn under Colombia’s Flexible Credit Line (FCL) arrangement with the IMF. The remaining amount available stands at USD 12.2 bn; the Colombian authorities intend to treat this balance as precautionary while they work to strengthen the country’s international reserves position.

On the other side of the transaction, the BanRep announced that it had increased its reserves by USD 1.5 bn as it takes on holding part of the FCL drawing for the government. Monetization of the FCL disbursement is expected to continue in 2021, although the speed by which this proceeds will depend on the urgency of Colombia’s liquidity and financing obligations.

—Sergio Olarte & Jackeline Piraján

PERU: CONGRESS APPROVED THE NEW CABINET EVEN AS POLITICAL TENSIONS ROSE; VEHICLE SALES WERE STRONG IN NOVEMBER

In an unusual single session, Congress voted massively, with 111 yeas to 7 nays, to award the Violeta Bermúdez Cabinet its confidence on Thursday, December 3. The vote was to take place today, December 4, but members of Congress apparently decided that there was no reason to delay an already predetermined outcome and voted yesterday afternoon.

This was good news on the political front that contrasted with a wave of worrisome events this past week which, in general, do not augur well for the Sagasti Administration nor for political tensions in the country. The Government faced its first Cabinet resignation: Rubén Vargas left his post as Minister of the Interior and was replaced by Cluber Aliaga, a retired police general. Vargas tendered his resignation after the Government’s decision to clean up the police hierarchy through the removal of 18 highly-ranked officers, a move which ignited protests within and outside the institution. Perhaps more importantly, members of Congress had threatened to deny the new Cabinet a vote of confidence if Vargas were not removed.

Meanwhile, Pres. Sagasti is facing his first bout of social protests. Agricultural workers along both the northern and southern coasts, where many of the main agro-industrial operations are located, have been protesting throughout the past week. Their main demand is for the elimination of a labour law that allows agricultural workers to be hired under work and pay conditions that are more flexible than under the country’s standard regulations. Congress has taken up the issue and is debating the abolition of the law.

At the same time, protests have erupted around the Las Bambas mine. These have been recurring, although the demands have become more political over time.

To add to the feeling of malaise, Congress overrode a Presidential veto on a law that mandates payouts to all those covered by the public pension system. President Sagasti had earlier forewarned that he would take the issue to the Constitutional Court. The public pension system is a pay-as-you-go framework, which means that payouts would have to be drawn from current fiscal resources. This initiative should be found illegal as Peruvian law establishes that Congress has no authority to undertake spending measures. The Ministry of Finance has stated that the law would bear a fiscal cost amounting to about 2.3% of GDP (PEN 16 bn). The Constitutional Court should be expected to strike the law down, but the Court has also been less than reliable of late.

In other developments, new vehicle sales were up 11% y/y, in November (chart 3). Demand from construction and mining drove both light and heavy vehicle sales. Light vehicle sales rose 10% y/y in November, surpassing pre-COVID-19 levels for the third consecutive month. Demand was particularly strong for pick-up trucks used in mining and construction activities and for minivans used in the delivery of goods. SUV sales, which are mainly purchased by households, also rose. Truck sales performed even better, up 20% y/y in November. Once again, that demand would have come mainly from construction and mining, although sales of heavy-load carriers were also high.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.