Argentina: COVID-19 vaccinations could start this month

Chile: BCCh holds, appears more confident on recovery and inflationary effects of pension withdrawals

Mexico: Consumption growth picked up in September, while monthly investment growth turned negative; auto industry provided mixed signals in November; AMLO to nominate Galia Borja to replace Javier Guzman on Banxico Board

Peru: Agrarian law repealed; Congress and Bank Superintendent lock horns; protests affect Las Bambas copper mine

ARGENTINA: COVID-19 VACCINATIONS COULD START THIS MONTH

Press reports from this past weekend indicated that Pfizer is seeking approval for its COVID-19 vaccine from the Argentine authorities, potentially joining plans announced by Pres. Fernandez on Thursday, December 3, to vaccinate as many as 300k Argentines during December using the Russian Sputnik V shot, with 10 million to follow in January and February, 2021. Health Minister Gonzalez Garcia indicated that vaccinations could be made compulsory for all Argentines in 2022 if the virus is still lingering. This calendar is earlier than our baseline assumption that widespread vaccination would not take hold in Argentina until the second half of 2021 and implies a positive bias to our 4.3% y/y growth forecast for 2021.

—Brett House

CHILE: BCCh HOLDS, APPEARS MORE CONFIDENT ON RECOVERY AND INFLATIONARY EFFECTS OF PENSION WITHDRAWALS

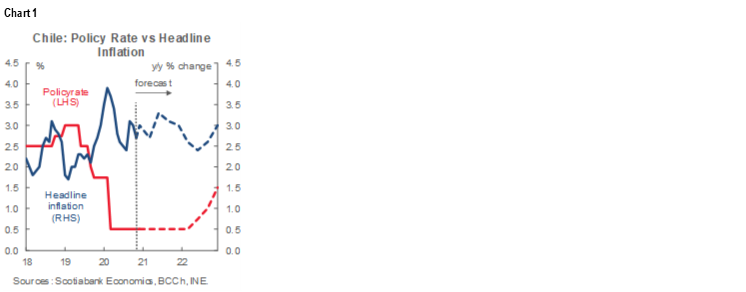

As universally expected, the BCCh Board voted unanimously on Monday, December 7, to hold its key policy rate at its so-called “technical minimum” of 0.5% (chart 1). We had speculated that the Board could alter its risk bias and/or forward guidance to reflect November’s soft inflation print, but it kept both unchanged: the Board reiterated that it expects to keep the monetary-policy rate at its minimum level “over much of the two-year monetary-policy horizon.” It also noted that it will keep unchanged its additional measures: the terms and amounts outstanding under its conditional lending facility will remain steady and the BCCh will continue to hold its USD 8 bn stock of bank bonds constant.

In our view, the statement made for a somewhat more favourable reading of international developments than we had expected, with its particular focus on Chile’s trading partners and the rise in copper prices. Although the improvement in the terms of trade could allow an eventual closure of Chile’s current-account deficit and a move into surplus by the end of this year, the deficit would remain high when evaluated at long-run prices that account for still-weak external demand, large output gaps in non-mining sectors, and the loss of competitiveness stemming from the real appreciation of the CLP compared with its competitors.

The BCCh Board could be underestimating external risks. Wednesday’s publication of the December Monetary Policy Report may provide a more complete picture of the assumptions and pitfalls on the international front envisaged by the Board and the staff of the BCCh.

On the domestic front, the Board recognized the negative surprise in October GDP growth, which pointed to continued lags in the recovery of sectors such as construction, transportation, and services. We anticipate that this will lead to a downgrade in the BCCh’s 2020 growth forecast in Wednesday’s Monetary Policy Report, from the -5% y/y estimate in September to something closer to a -6% y/y drop.

Regarding inflation, the Board recognized November’s downside surprise, but noted that beyond short-term fluctuations, medium-term inflationary pressures remain contained. In our view, although inflation risks are biased downward over the medium term, we could face a transitory positive shock to prices in the coming months stemming from the second round of withdrawals from pension funds. This could explain the Board’s decision to take a pass on moves to shift its risk bias and/or enhance its forward guidance.

Indeed, since the Board introduced its guidance that it intends to keep the monetary-policy rate at its technical minimum for “a large part” of the next two years, market participants have read this as pointing toward an early normalization process. This has reduced the stimulative effect of policy, steepened Chile’s yield curve (as even the BCCh notes), and boosted the real appreciation of the Chilean peso. This is harming the re-absorption of workers into labour-intensive sectors in a context where even the central bank acknowledges that inflation risks are contained. By keeping its guidance and bias unadjusted, the BCCh is missing a chance to introduce a more explicit, conditional, and stimulative stance that would help counteract the recent back-up in yields. We’ll look to the presentation of the Monetary Policy Report on Wednesday, December 9 to assess any subtleties or refinements in the Board’s views.

—Jorge Selaive

MEXICO: CONSUMPTION GROWTH PICKED UP IN SEPTEMBER, WHILE MONTHLY INVESTMENT GROWTH TURNED NEGATIVE; AUTO INDUSTRY PROVIDED MIXED SIGNALS IN NOVEMBER; AMLO TO NOMINATE GALIA BORJA TO REPLACE JAVIER GUZMAN ON BANXICO BOARD

I. Consumption growth picked up in September

On Monday, December 7, INEGI published September’s private consumption data, which showed a small pick-up in growth from August. In sequential monthly terms, private consumption growth accelerated from 1.7% m/m sa in August to 2.2% m/m sa in September, which was still relatively moderate and confirmed that domestic demand remained weak, as we had anticipated. September’s consumption growth continued the ongoing repair in annual terms, lifting the year-ago comparison from -14.4% y/y in August to -9.9% y/y in September (chart 2), still the worst annual growth rate for any September since at least 1994, the beginning of the series.

In the details:

- Domestic services attenuated their annual decline from -18.8% y/y in August to -14.1% y/y in September (versus 1.4% y/y a year earlier); domestic goods softened their losses from -7.8% y/y to -2.8% y/y (versus -0.7% y/y a year earlier); while annual growth in the consumption of imported goods went from -21.6% y/y to -19.0% y/y (versus 9.2% y/y in September 2019); and

- During January–September, the average annual growth rate of total monthly consumption was -12.1% y/y, compared with 1.0% y/y in the same period in 2019—the weakest rate for the first nine months of the year since records began.

We expect domestic private consumption growth to remain impaired during the rest of 2020 given the highly uncertain economic environment and soft expectations for the labour market—both of which should keep consumers cautious in making new spending decisions.

II. Monthly investment growth turned negative in September

INEGI also released on Monday, December 7, data on September’s gross fixed investment (GFI), where spending fell by -2.9% m/m sa after a 5.9% m/m sa gain in August. The negative print in September broke a three-month run of month-on-month investment gains and kept capital spending below levels from a year ago.

In annual terms, GFI moderated its decline for a fourth consecutive month in September, paring loses from -17.0% y/y to -16.0% y/y, which disappointed against our -15.1% y/y forecast, the -14.6% y/y consensus, and the -7.0% y/y rate recorded a year earlier (chart 3). September marked the 20th month in a row where GFI showed an annual decline. Annual growth averaged -20.1% y/y during January–September, the deepest decrease for a similar period in 25 years.

In the GFI components:

- Investment in machinery and equipment cut its annual losses from -20.6% y/y in August to -12.8% y/y in September. Growth in its two major components—spending on domestic and imported goods—improved from August: purchases of domestic machinery and equipment lifted from -22.7% y/y in August to -17.1% y/y in September; spending on imported machinery and equipment rose from -19.1% y/y in August to -8.8% y/y in September; and

- In contrast, annual growth in construction spending fell from -14.4% y/y in August to -18.5% y/y, with the residential sub-index falling from -7.0% y/y to -14.3% y/y and the non-residential sub-index falling from -21.3% y/y to -22.2% y/y.

As with consumption, we expect investment spending to stay weak through the end of 2020 given Mexico’s still-soft numbers on capital-goods imports.

We may see some improvement in GFI in 2021 stemming from the two recently announced packages of public and private investment, but much will hinge on the progress of the pandemic.

III. Auto industry provided mixed signals in November

On Friday, December 4, INEGI released November data for the auto sector, which continued to paint a mixed picture of the industry several months into the re-opening.

- Automotive production growth dropped from 11.5% m/m in October to -10.3% m/m in November, which pulled down the annual comparison from 8.8% y/y to 1.4% y/y. From January to November, production was down -22.5% y/y with respect to the same period in 2019 (chart 4).

- Domestic sales of new vehicles accelerated sharply from 8.4% m/m in October to 13.3% m/m in November, likely reflecting price reductions during the “Buen Fin” shopping event. Even with these sequential monthly gains, domestic sales deepened their annual decline from -21.3% y/y in October to -23.5% y/y in November (versus -7.0% y/y a year earlier). Hence, during the first eleven months of the year, vehicle sales were down -28.9% y/y compared to the same period in 2019 (chart 4 again).

- Growth in vehicle exports slowed from 8.9% m/m to 2.6% m/m, which left annual growth in car exports down from 8.2% y/y in October to 4.7% y/y in November. From January to November, exports were down -23.6% y/y compared to the first 11 months of 2019.

Looking ahead, we expect domestic auto sales to continue to lag exports.

—Paulina Villanueva

IV. AMLO to nominate Galia Borja to replace Javier Guzman on Banxico Board

On Monday, December 7, President Lopez Obrador announced his intention to nominate Galia Borja to replace Javier Guzman on the Banxico Board at end-2020. Ms Borja is currently Treasurer in the Ministry of Finance and has a history with AMLO, having served as his Treasurer in his Federal District administration during 2001–07. Although Ms Borja hasn’t expressed clearly identified, public thoughts on monetary policy, she would replace one of the Board’s more hawkish members and could shift the balance of the Board’s views toward a more neutral stance.

—Brett House

PERU: AGRARIAN LAW REPEALED; CONGRESS AND BANK SUPERINTENDENT LOCK HORNS; PROTESTS AFFECT LAS BAMBAS COPPER MINE

I. Agrarian law repealed

Congress voted to repeal the Agrarian Promotion Law on Sunday, December 6. The Law, passed in 2001 and extended in 2019 until 2031, is credited by many analysts with stimulating the development of agroindustry in the country over the past 20 years. The Government apparently has no intention of vetoing the Congressional decision. Congress acted following extensive protests in agroindustrial regions last week over provisions for greater labour flexibility included in the law. Congress is reportedly working on a new agrarian law that would introduce changes on tax rates and labour flexibility. Finance Minister Waldo Mendoza stated in a press interview published on Monday, December 7, that the best option would be to raise the tax rate gradually over time, lifting it from the promotional 15% currently in place to the standard 27.5% corporate rate. The question of labour flexibility is a much thornier issue. Until these matters are clarified, it seems likely that investment plans in agroindustry may be postponed. To compensate, Min. Mendoza underscored the need to accelerate progress on large irrigation projects.

II. Congress and Bank Superintendent lock horns

Congress has opened up a new front of conflict, this time with the Banking Superintendent’s agency, the SBS. A Congressional committee has demanded access to a broad range of information with regard to banking system clients—both individuals and businesses. In an unusually strong statement, the SBS responded that access to this information could “put at risk the reputation, the security, and, indeed, the life of citizens, as well as the financial stability and the integrity of the system for money-laundering prevention”. In essence, the SBS is questioning the good-faith with which this information is being requested by Congress. The Congressional committee is headed by José Luna of Podemos Perú, a party that is under investigation for using false signatures to register the party in 2018. Luna has threatened legal action, although it is not clear what he could do on this front.

III. Protests affect Las Bambas copper mine

The roads leading to the Las Bambas copper mine have been blocked by protests since November 30. According to reports on statements from company spokespeople, the roadblocks are preventing the mine from sending metal concentrate to ports and personnel are having trouble reaching the site. Spokespeople for the mine have also stated that it is not within the company’s power to answer the protesters’ demands as they fall under the purview of the central government. One demand, for instance, is that part of the income tax revenue generated by Las Bambas should be dedicated to funding local development.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.