Argentina: Peronists show agreement with IMF won’t be easy

Peru: September GDP growth exceeded expectations

ARGENTINA: PERONISTS SHOW AGREEMENT WITH IMF WON’T BE EASY

In a twelve-page open letter to the Managing Director of the IMF released on Sunday, November 15, a group of nearly 40 Peronist Senators took the Fund to task for the “failure” of the 2018 adjustment program agreed with the Macri Administration and attempted to set pre-conditions for the negotiations on a new arrangement currently underway in Buenos Aires with the Fund mission. Some of the Senators demands were more bluster than substance: for instance, their call for a grace period on repayments to the Fund stretched out to 2025 is entirely consistent with the authorities’ request to replace the current Stand-By Arrangement (SBA) with financing under the Extended Financing Facility (EFF), which is a longer-term credit window. However, the Senators’ concurrent request that IMF funds be provided free of conditionalities is simply a provocation when EFF loans are designed expressly to support fundamental structural reforms. Given that Economy Minister Martin Guzman has promised to send any eventual deal with the IMF to Congress for approval, moves such as this letter are set to make that process more fraught and contentious than it might otherwise be. Adding to the drama, Pres. Fernandez appeared to endorse the letter in remarks on Monday, November 16.

The letter and the President’s remarks added further substance to our view that negotiations with the IMF are likely to be drawn out. Despite orthodox moves last week to raise interest rates and initiate pension-system reforms, on Monday, November 16, the authorities extended their ban on firing workers for an additional 60 days and legislation on a hotly-debated wealth tax is set to head to Congress today.

—Brett House

PERU: SEPTEMBER GDP GROWTH EXCEEDED EXPECTATIONS

September GDP data released by INEI on Monday, November 16, showed a positive surprise with a -7.0% y/y print (chart 1), better than consensus expectation of -7.8% y/y and the -8.8% y/y that we had forecast in the latest Latam Weekly. This was the softest annual contraction since the lockdown began in March. As a result, Q3-2020 GDP should be down -9.5% y/y (the BCRP will produce the official figure later this week), which is also better than our -10% y/y forecast. This gives us a little more confidence in our full-year 2020 projection of a -11.5% y/y contraction—although this will also depend on the impact of the political crisis in November on the economy, which we expect to be mild. September’s economic activity represented 1.5% m/m growth from August.

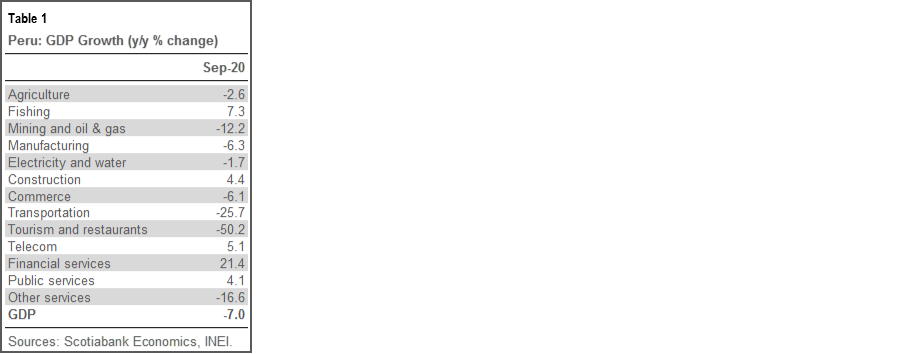

Once again, resource sectors were weak while some domestic demand-linked sectors outperformed expectations (table 1). Agricultural activity continued to be down from a year ago and, at this point, the contraction has persisted for too long to be attributable to shifts in seasonal timings. Mining fell -12.2% y/y compared with September 2019. However, here’s the silver lining: if not for mining, aggregate growth would have been closer to -6% y/y than -7% y/y. In October, mining should once again add to growth rather than subtract from it. The decline in September (as in August) was due to the need to quarantine part of the labour force at key mines due to COVID-19. It is our understanding that these employees returned to work in October.

Construction continued to be robust in September, up 4.4% y/y, as real estate has become a driving force in the economy. Furthermore, although manufacturing and commerce were each down by a bit more than -6% y/y, these levels were much improved versus previous months, which signalled that consumption is rebounding better than expected. Government services, financial services, and telecoms activity growth continued to accelerate.

Overall, the data for September ratifies the perception of an economy that is recovering, but at vastly different paces between sectors. The annual contraction in October should be even milder, as the trend narrows towards our -11.5% y/y full-year forecast. November might provide a bump in the road however, due to the magnitude of political turbulence this month. With the appointment of Francisco Sagasti as the new President, Peru’s political turmoil looks set to calm down (see our note here), and if so, then the tumult will have been too short-lived to have had too great an impact on the economy.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.