Central banks & macro data: Banxico minutes and Quarterly Inflation Report, BanRep rate decision; September/Q3 GDP data

Argentina: IMF negotiations likely to extend into 2021

Chile: Government goes to Constitutional Court to contest second pension withdrawal bill

CENTRAL BANKS & MACRO DATA: BANXICO MINUTES AND QUARTERLY INFLATION REPORT, BANREP RATE DECISION; SEPTEMBER/Q3 GDP DATA

I. Central banks

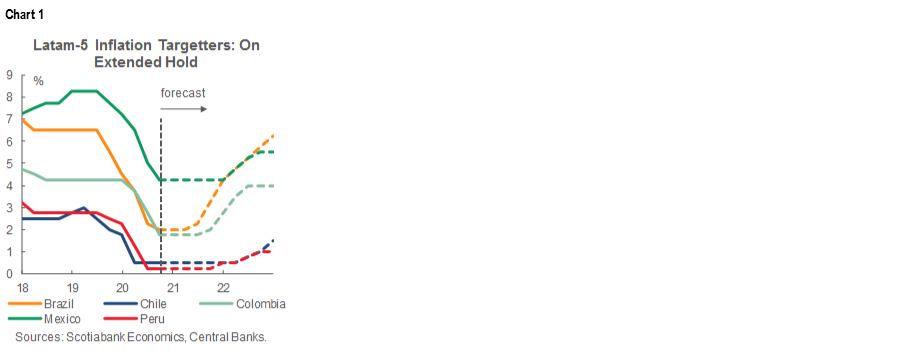

Central banks across the Latam-6 inflation-targeting regimes (i.e., ex-Argentina) have entered what we think will be extended holds into mid-2021 (chart 1). Argentina’s BCRA is the exception, where the recent 200 bps increase in the benchmark Leliq rate could be followed by further ad hoc rate hikes to shore up the ARS, curb monthly inflation that is currently above 3% m/m, and smooth negotiations with the IMF on new financing under an EFF arrangement.

Mexico’s Banxico and Colombia’s BanRep dominate central bank developments this week.

- Mexico. Banxico is scheduled to release on Thursday, November 26, the minutes from its November 12, monetary-policy meeting where the Board voted 4-1 to hold its target overnight rate at 4.25% in what the statement characterized as a “pause”. The lone dissenter voted to continue Banxico’s easing cycle with a further -25 bps cut to 4.00%. About three-quarters of market analysts surveyed had expected a cut, but our team in CDMX saw that meeting as the beginning of a hold at 4.25% through Q1-2021 (chart 2).

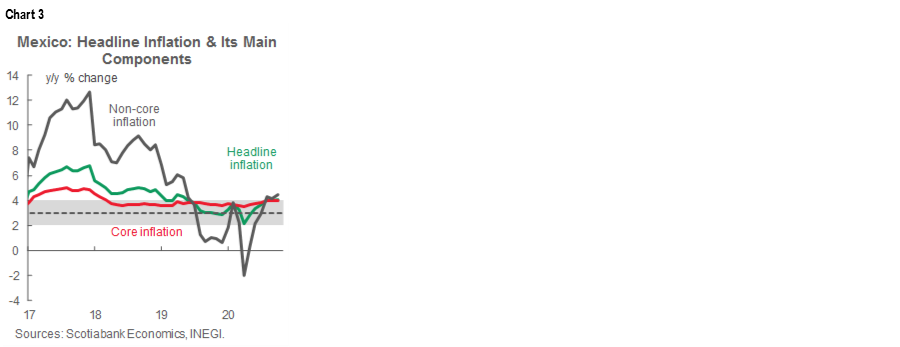

The minutes may give us some new insight on the nature of this “pause” and the conditions—if any—under which Board members could see room for additional easing. In particular, the minutes could outline some extra colour on the Board’s views on Mexico’s above-target inflation (chart 3) and how it expects prices to evolve over the coming quarters.

The minutes will be front run by the publication on Wednesday, November 25, of Banxico’s Quarterly Inflation Report (QIR) and its updated forecasts could give us a better indication of the Board’s thinking than the minutes from its meeting two weeks ago. Although we haven’t had any significant macro data prints since the Board’s November 12 meeting, we will get inflation numbers for the first half of November on Tuesday, November 24, a day ahead of the QIR’s release.

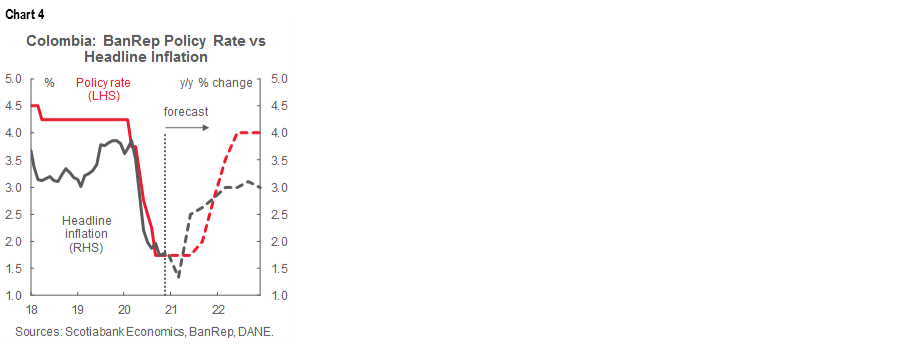

- Colombia. The BanRep Board is scheduled to hold its next monetary-policy meeting on Friday, November 27, where our team in Bogota expects the interbank rate to be held at 1.75% for a second consecutive month (chart 4).

At the Board’s previous meeting on Friday, October 30, members voted unanimously to hold the headline policy rate at a record low 1.75%. The unanimity of the decision underscored a forward-looking message of rate stability after the 4-3 split decision to cut from 2.00% to 1.75% at the September Board meeting. The minority at the September meeting had preferred to stay on hold owing to concerns about the pandemic and the possible evolution of public debt under additional easing.

In the Board’s October 30 statement, members noted that inflation expectations had risen, while fiscal measures, the new re-opening plan, and low interest rates should help the economic recovery. Nevertheless, the Board continued to eschew explicit forward guidance in favour of a continued “wait-and-see”, data-dependent approach, noting that while the 1.75% policy rate keeps the monetary stance “expansive”, it is “prudent to maintain its current posture while waiting for new information on shocks and the evolution of variables that affect policy reactions.” The minutes from the meeting and the quarterly Monetary Policy Report, both published on Tuesday, November 3, highlighted a more favourable forward-looking scenario for growth and an upward revision to the Bank’s inflation forecasts for 2020 and 2021.

Since then, October inflation, released on Thursday, November 5, surprised on the downside by falling further below the BanRep’s target range from 1.97% y/y to 1.75% y/y (chart 5). While our team in Bogota expects level effects to pull headline inflation down further into early-2021, it also forecasts price growth to head back toward the BanRep’s 3% y/y target by early-2022 (chart 4, again) which supports keeping the main policy rate on hold at 1.75% into Q3-2021.

II. Macro data

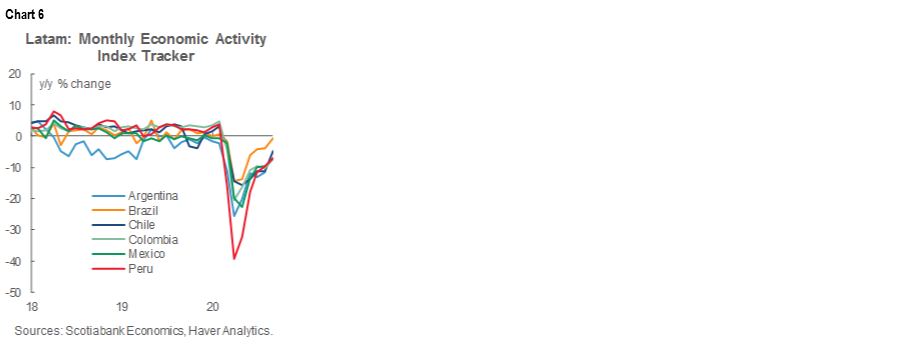

No major data releases or policy announcements are scheduled for today. For the remainder of the week, September/Q3 GDP numbers dominate the data risk calendar. In prints so far, GDP levels compared with September 2019 have ranged from being down only about -0.8% y/y in Brazil to -5.3% y/y in Chile, -6.9% y/y in Peru, and -7.3% y/y in Colombia (chart 6).

- Argentina. We expect monthly growth to accelerate from 1.1% m/m sa in August to 1.5% m/m sa in September in data due to be released on Tuesday, November 24. This additional expansion would still leave the level of GDP down about -6% y/y compared with September 2019 and stuck at levels last seen in mid-2010. October trade data, also scheduled for Tuesday, will likely show a widening in the current account surplus as exports are held back in anticipation of ARS depreciation.

- Brazil. Our Brazil economist expects IPCA inflation for the first half of November, out tomorrow, November 24, to pick up from 3.5% y/y to 4.1% y/y. October current account data, also due tomorrow, are likely to show a smaller surplus on higher imports financed by stronger FDI.

- Chile. The Scotia Economics team in Santiago expects October’s unemployment rate, scheduled for release on Friday, November 27, to head up from 12.3% to 12.8% as returns to the active labour market exceed new job creation.

- Colombia. Retail and industrial confidence indices for October, out on Wednesday, November 25, are the only remaining data prints ahead of Friday’s monetary-policy decision and aren’t likely to have much influence on the BanRep Board.

- Mexico. Price data for the first half of November are due Tuesday, November 24, and our team in CDMX expects annual headline inflation to hold at 4.1% y/y owing, in part, to the possibility of upside surprises from food prices and utility tariffs. The second print of Q3-2020 data, out on Thursday, November 26, shouldn’t present any new headline numbers, but will provide additional detail that could prompt forecast revisions from analysts. The September real GDP proxy, also due on Thursday, should bring the level of economic activity up from -9.5% y/y to -7.0% y/y.

- Peru. On Friday, November 20, Q3-2020 real GDP growth came in at -9.4% y/y, up strongly from Q2’s nadir of -29.8% y/y. This was even stronger than the -9.5% y/y contraction implied in our estimation by the better-than-expected September GDP proxy released on Monday, November 16. No other major data releases are scheduled for this week.

—Brett House

ARGENTINA: IMF NEGOTIATIONS LIKELY TO EXTEND INTO 2021

At the conclusion of its 10-day visit to Buenos Aires, the IMF mission issued on Friday, November 20 a statement that indicated that the Fund team and Argentine authorities had “started delineating the contours of an IMF-supported program.” In IMF-speak, this sets a low bar for progress so far: “defining initial elements of such a program” is really the least that could have been achieved in a week and a half of discussions. The statement went on to note that, “There was a shared view that tackling Argentina’s near and medium-term challenges will require a carefully balanced set of policies”—again, a flag that little to nothing has so far been agreed. Argentine media reported on Sunday, November 22, that discussions on a new borrowing arrangement would likely continue into 2021: Economy Minister Martin Guzman confirmed that we should not expect agreement on a new program this year. These developments are entirely in line with the expectations we set in past editions of the Latam Weekly.

—Brett House

CHILE: GOVERNMENT GOES TO CONSTITUTIONAL COURT TO CONTEST SECOND PENSION WITHDRAWAL BILL

On Sunday, November 22, Pres. Piñera filed a request to the Constitutional Court in which the government asked the tribunal to declare unconstitutional the bill approved last week by the Chamber of Deputies that would allow a second withdrawal of 10% of individuals’ pension assets.

Through a statement, the Executive argued that the bill is unconstitutional, would seriously damage the present and future pensions of all Chileans, and would disproportionately benefit high-income people with unjustified tax exemptions. Pres. Piñera also asserted that “some Parliamentarians are trying to write a parallel constitution, through reforms that introduce transitory articles without amending the current constitution.” The statement added that, “This practice is unconstitutional, violates our legal system and the rule of law, and does not respect the fundamental institutions of our constitutional order, such as the exclusive prerogative of the President in matters of public spending, social security, and taxes.”

The Executive’s request was presented in a context where last Wednesday, November 18, the Government submitted to Congress its own bill that would allow a single and extraordinary withdrawal of 10% of pension assets. The Government’s proposal would not grant new tax benefits to the highest-income segments of the populace, would require that those who make a withdrawal restore these funds to their pension accounts in the future, and would be aligned with Chile’s current constitution.

What’s next: possible scenarios and risks

Today, Monday, November 23, the Senate Labour and Finance Committees will review the Government’s proposed bill. The plan discussed between the Government and the Opposition majority in the Upper House anticipated that the Government’s bill would be dispatched to the Senate today ahead of a vote by the whole Senate on Wednesday, November 25. However, now that the Executive has turned to the Constitutional Court to contest the Deputies’ bill it is unclear whether this schedule will remain in place.

If the Government’s bill is approved, it could provide liquidity to households more quickly than the Opposition’s proposal owing to the Constitutional-Court challenge now underway. That said, the Court could also suspend its proceedings on its own initiative or at the request of the Government in order to speed withdrawals under the Opposition bill.

However, there is also a possible scenario in which the Opposition’s bill is approved in Congress, where it requires a three-fifths majority in the Senate as, in theory, it is a provisional constitutional reform (the Government claims it needs a two-thirds majority since it would indeed represent a constitutional amendment)—and the Government’s bill is rejected despite needing only a simple majority to pass. Under this combination of events, if the Constitutional Court rules that the Opposition’s bill is unconstitutional then no second set of withdrawals of pension assets would be enabled.

It is also possible that both bills could be approved and the Constitutional Court challenge to the Opposition’s bill could fail, in which case it would be unclear how ensuing withdrawals of pension assets would be processed.

All in all, this week will be pivotal in determining if and how a second withdrawal of pension assets could take place. We will be monitoring the Senate Labour and Finance Committee discussions today for initial signs of what to expect.

—Carlos Muñoz

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.