Argentina: Exports curbed by devaluation anticipation

Colombia: Monetary policy preview for Friday’s BanRep meeting

Mexico: Commercial activity advanced in September; external current account registered record surplus in Q3 on weak domestic demand

Peru: Public-sector investment started Q4-2020 strongly; Sagasti seeks rapprochement with Congress

ARGENTINA: EXPORTS CURBED BY DEVALUATION ANTICIPATION

In INDEC data out Tuesday, November 24, Argentina’s monthly trade surplus edged up from USD 584 mn in September to USD 612 mn in October, under consensus expectations of a USD 700 mn surplus (chart 1). Imports came down from USD 4.1 bn in September to USD 4.0 bn in October; exports similarly pulled back by about USD 100 mn, from USD 4.7 bn in September to USD 4.6 bn in October. On a rolling 12-month basis, imports have stemmed the consistent decline they’ve registered over the last two years of recession, but exports have maintained the downward trend they’ve been on since early-2020—which is what has pulled down the trade surplus over the last few months. Even though global external demand has improved from mid-2020, some Argentine exports have been held back as producers anticipate possible windfall gains from an expected devaluation in the official ARS. We expect at least some of this export hesitancy to continue until a new program is agreed with the IMF in early-2021.

—Brett House

COLOMBIA: MONETARY POLICY PREVIEW FOR FRIDAY’S BANREP MEETING

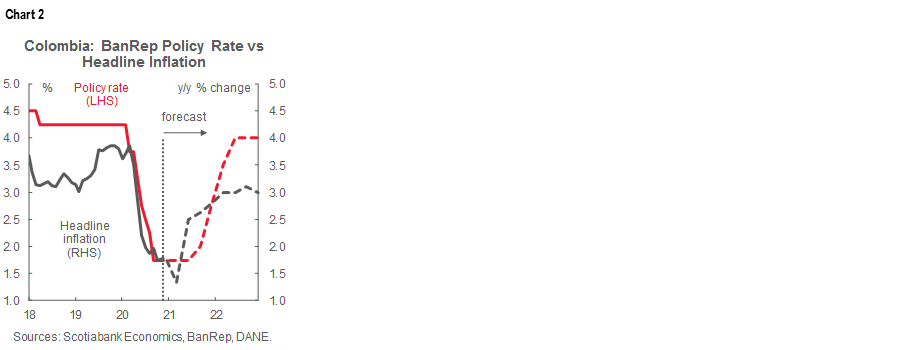

On Friday, November 27, BanRep, will hold its regularly scheduled Board meeting on monetary policy, and we, along with the consensus of market analysts, expect the benchmark policy rate to be held at its record low of 1.75% (chart 2). At its last meeting on October 30, the central bank kept the monetary policy rate unchanged in a unanimous vote. Governor Echavarría, in the ensuing press conference, emphasized that rate stability would continue in the coming months. At that time, the central bank’s staff improved its outlook for inflation and economic growth, noting that its expected monetary-policy-rate path is mildly higher than market consensus; however, the differences between these views were not materially large given the size of recent shocks and ongoing volatility. The market is pricing stability in the policy rate at 1.75% until Q4-2021 when one hike of 25 bps is anticipated.

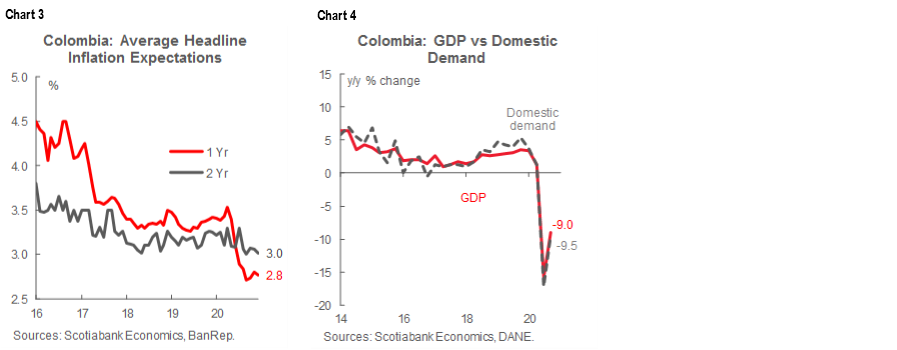

Since the last meeting, the October CPI inflation reading surprised to the downside. The education sector posted a new decline in tuition fees, which led annual inflation to a record low of 1.75% y/y. Nevertheless, November’s economic surveys showed that inflation expectations remained close to 2.8% y/y for end-2021 and closer to 3% y/y over the longer term (chart 3). On the economic activity side, Q3 GDP data indicated that Colombia had overcome the worst of the current crises (chart 4), and the recovery is proceeding in line with expectations. The labour market also improved in September, while business confidence indicators consolidated positive prospects for economic activity.

Even with the downside surprise in October’s inflation reading, recent data add support to our call for a hold at Friday’s BanRep Board meeting. In addition to the rate call, it is worth watching the succession process as Governor Echavarría prepares to leave office at the end of the year. A new Governor could be elected at any moment.

—Sergio Olarte & Jackeline Piraján

MEXICO: COMMERCIAL ACTIVITY ADVANCED IN SEPTEMBER; EXTERNAL CURRENT ACCOUNT REGISTERED RECORD SURPLUS IN Q3 ON WEAK DOMESTIC DEMAND

I. Commercial activity advanced in September

Retail and wholesale activity continued to register gains in September, according to data released on Wednesday, November 25, by INEGI. On a monthly basis, both retail and wholesale sales continued to advance, with retail sales maintaining steady progress (up 2.7% m/m) for a fifth consecutive month and wholesale sales growth softening (0.95% m/m). On an annual basis, wholesale and retail sales were down for a seventh consecutive month, although the gap compared with last year continued to narrow (chart 5) as retail sales went from -10.8% y/y in August to -7.1% y/y and wholesale trade moved from -11.9% y/y in August to -5.6% y/y in September. It will still take some time to return to pre-pandemic levels, especially given the absence of fiscal stimulus to support consumption.

The improved results reported by the commercial sector were somewhat anticipated back on November 11 by the better September data we received from supermarkets, department stores, and the industrial sector. Smaller gaps compared with activity a year ago reflected the ongoing normalization of the economy, the gradual improvement in employment, the strength of salaries, and the favourable evolution of remittances. Nevertheless, commercial-sector sales are expected to remain weak through the remainder of the year.

II. External current account registered record surplus in Q3 on weak domestic demand

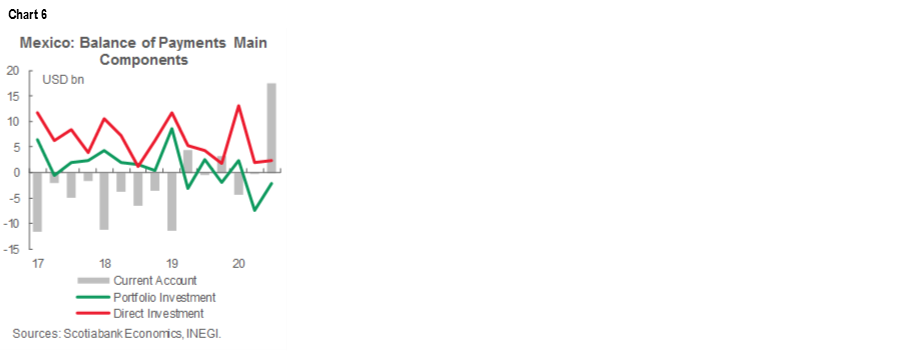

During the third quarter of 2020, the current account of Mexico’s external balance of payments registered a record surplus, according to data published on Wednesday, November 25, by Banxico. Mexico’s current account surplus hit USD 17.5 bn during the third quarter of the year (chart 6). This surplus was equivalent to 6.9% of GDP, a figure that contrasts with the deficit of -0.1% of GDP in Q3-2019. Unfortunately, this was driven mainly by a drop in imports of both goods and services owing to reduced demand from domestic industry. Amongst non-oil goods, exports were down -4.5% y/y, but imports were off by almost -20% y/y.

Banxico’s report also showed that foreign direct investment during the third quarter was down almost -44% y/y compared with Q3-2019. Net portfolio investment flows began recovering from Q2-2020’s big drop, but still remained below levels from a year ago (chart 6, again).

Mexico’s Q3-2020 balance of payments reflects an asymmetric recovery driven mainly by external demand rather than gains in the domestic market. Generalized weakness in the domestic economy is expected to persist for the rest of year and Mexico’s recovery is set to lag the rest of Latam owing to uncertainty around the pandemic and limited fiscal support.

—Paulina Villanueva

PERU: PUBLIC-SECTOR INVESTMENT STARTED Q4-2020 STRONGLY; SAGASTI SEEKS RAPPROCHEMENT WITH CONGRESS

The Minister of Finance, Waldo Mendoza, stated on Tuesday, November 24, that public-sector investment would increase by 18.7% y/y in November (chart 7). This would be the second consecutive month of positive public-investment growth, following 6.6% y/y in October (according to statements by the previous finance minister). This is significant: since the pandemic and lockdown began in March, public-sector investment has been underperforming the rest of the economy, and, thus, has been a drag on GDP growth. Given the figures for October–November, public-sector investment should add to growth in Q4-2020, rather than subtract from it. This is one more reason why GDP growth in Q4 should be significantly better than the -9.4% y/y contraction we saw in Q3.

On November 24, President Sagasti began meeting with opposition parties and members of Congress to forge favourable relations ahead of the vote of confidence in the Cabinet that is scheduled for December 3–4. The results so far appear to be promising. The leader of Alianza Para el Progreso (APP), César Acuña, forcefully stated that APP must behave with greater responsibility in Congress, and that this should include giving its vote of confidence to the Bermúdez Cabinet next week. The leader of Fuerza Popular, Keiko Fujimori, also expressed her support for the Sagasti Government.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.