Argentina: September industrial production showed first annual gain of the pandemic

Brazil: Economic momentum continued in September–October

Colombia: October consumer confidence improved with mixed details; downside October inflation surprise

Mexico: Consumer confidence rose in October to its highest level in six months

ARGENTINA: SEPTEMBER INDUSTRIAL PRODUCTION SHOWED FIRST ANNUAL GAIN OF THE PANDEMIC

September industrial production data, released by INDEC on Thursday, November 5, showed their first annual gains since the pandemic began, while construction activity also neared levels from a year ago. The month’s industrial activity was up 3.4% y/y, a significant improvement from August’s -7.0% y/y (revised up from -7.1% y/y) and the strongest annual gain since the first half of 2018 (chart 1). Construction activity also significantly narrowed its gap compared with pre-pandemic levels as it registered an annual contraction of only -3.9% y/y, much better than the -17.7% y/y registered in August. The two sectors account for over a fifth of Argentina’s GDP and their September numbers represent an unexpectedly solid signal amidst FX-market turmoil and local surges in the pandemic.

—Brett House

BRAZIL: ECONOMIC MOMENTUM CONTINUED IN SEPTEMBER–OCTOBER

The Brazilian economy gained some further traction in September–October according to industrial production and PMI data. On the September industrial production front, data out Wednesday, November 4, showed an improvement from -2.5% y/y in August (revised up from -2.7% y/y) to 3.4% y/y, beating consensus calls for 2.5% y/y and our own expectation of 2.7% y/y. In the Markit manufacturing PMI for October, we had expected a dip from 64.9 in September to 63.9 in October, but the actual print strengthened to 66.7 in the release from Tuesday, November 3 (chart 2). We also saw the Markit services PMI, out Thursday, November 5, improve to 52.3, up from 50.4 in September and better than our expected 49.8 level.

Overall, the Brazilian economy continued to recover quite strongly into the start of Q4, although we do see some risks of a gradual slowdown in domestic demand as the country’s fiscal support softens into the end of the year. The September retail sales print on November 11 will be an important gauge of where the economy is heading.

On the reform front, the BCB autonomy bill has cleared a vote in the Senate and now needs to go to the Chamber of Deputies. The bill was modified to include a dual mandate for the BCB (i.e., inflation and employment); the change was reported to have been opposed initially by the BCB, but the Bank apparently acceded to the modification of its mandate in order to expedite the bill’s legislative process. The bill would establish a tiered rotation for BCB Board members who will no longer be appointed by the President as part of the Cabinet. The full approval of the bill is expected in early-2021. We don’t anticipate much of a market reaction to the legislation as we believe it has been largely anticipated.

—Eduardo Suárez

COLOMBIA: CONSUMER CONFIDENCE IMPROVED WITH MIXED DETAILS; DOWNSIDE OCTOBER INFLATION SURPRISE

I. October's consumer confidence improved on the back of mixed details

October’s Consumer Confidence Index (CCI), released on Thursday, November 5, stood at -18.6 ppts, rising 3 ppts from September’s level (-21.6 ppts). In October, the CCI improved at a somewhat slower pace than in August and September, and showed us a mixed picture on Colombians’ sentiments since the assessment of current conditions remained negative, but the index of expectations about the future stayed narrowly in positive territory (chart 3). Also, at the same time that the overall consumer confidence index remained fairly deeply in negative territory, business confidence is currently positive.

Looking at October’s details, the Current Conditions Index improved significantly to -47.3 ppts versus September’s -57.6 ppts, leading to the headline index's rise. On the other side, the Expectations Index remained just barely positive at 0.5 ppts (versus the previous 2.4 ppts in September). It appears that announced re-opening measures were absorbed positively by Colombian households; however, as uncertainty remains significant, households are still cautious about the future.

October’s consumer confidence numbers improved in the five cities surveyed, with Cali and Bucaramanga leading the gains in perceptions, while Bogota and Medellín saw the poorest numbers. In Bogota, despite the small gain in overall sentiment, there was a substantial increase of 15.7 ppts in consumers' willingness to buy houses, which could be related to subsidies for low-income and middle-income homes.

By socio-economic levels, October’s indices painted an unbalanced picture. High-income earners’ confidence worsened, while, those of low-income and middle-income populations improved. This implies that high-earners face some specific issues since their decline in overall confidence took place even amidst an increase in the willingness to buy houses, up from 5.1 ppts in September to 19.7 ppts in October.

On the other side, consumers’ inclination to buy vehicles and durable goods—such as furniture and home appliances—remained weak, although it improved in the third quarter (chart 4). Low willingness to buy durable goods could be attributed to a change in consumer habits where non-essential consumption is being delayed owing to ongoing uncertainty—a phenomenon that could pose a significant challenge for the economic recovery.

All in all, though, October’s recovery in consumer confidence is good news. However, consumers’ caution about the future is worth monitoring since it could represent a challenge on the demand side. In the coming months, we expect confidence to continue improving, although at a slowing pace, in line with labour market dynamics.

II. October inflation surprised to the downside, falling to a record-low 1.75% y/y

Monthly CPI inflation was -0.06% m/m in October, according to DANE’s data published late on Thursday, November 5. The result came in well below market expectations (0.14% m/m in the BanRep survey) and below our projection of 0.16% m/m. October’s numbers reflected the offsetting effects of higher transportation costs and new reductions in tuition fees by universities and technical colleges. The annual inflation rate fell by 22 bps to a record-low 1.75% y/y (chart 5); core inflation stood at 1.42% y/y (previously 1.57% y/y).

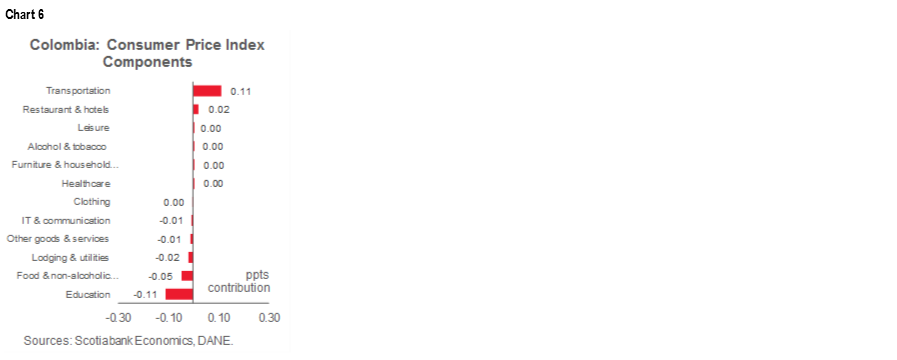

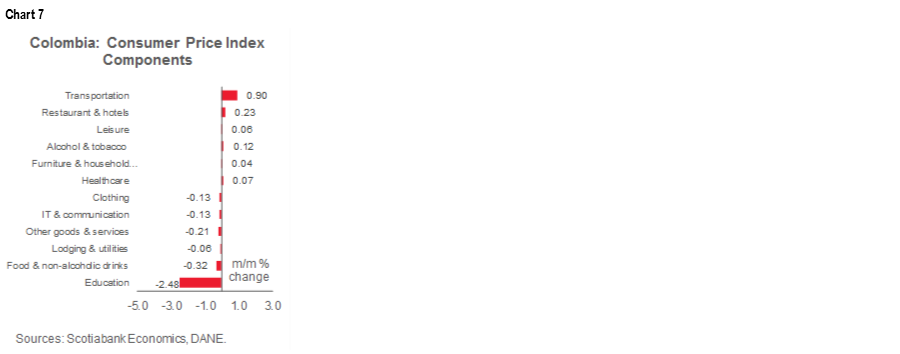

The transport-related sector provided the largest positive contribution (11 bps, charts 6 and 7) to headline inflation in October, due to increases in prices for inter-municipal transportation (19.9% m/m), urban transport (0.36% m/m), flight tickets (5.75% m/m) and vehicles (0.42%m/m). Transport inflation was driven mainly by biosecurity costs and probably also reflected some FX pass-through effects. On the other side, education prices came down -2.48% m/m, which provided a -11 bps influence on headline inflation. Tuition fees at universities and technical education institutes fell -8.96% m/m due to an atypical collection of prices since those institutions haven’t closed their registrations yet. However, DANE indicated that the negative effect of education prices on inflation is over.

The housing-related sector also contributed negatively to headline inflation as utility fees contracted by 0.19% m/m owing to some one-time effects emanating from the Caribbean coast. Rental fees fell in the main cities, especially Bogota, which constitutes a clear signal of weak demand.

Looking at broad categories, goods inflation fell by -12 bps to 1.03% y/y, services inflation fell from 1.75% y/y to 1.86% y/y, and regulated prices fell by -28 bps to 0.92% y/y.

Core inflation measures also dropped: ex-food inflation came in at 1.42% y/y (down -15 bps from the previous month), while ex-food and regulated inflation fell by -12 bps to 1.55% y/y.

Altogether, October’s drop in CPI inflation represented a significant surprise that reflected atypical developments in the data on education fees that are not expected to be repeated. However, we could see further soft price prints in the short term owing to an extraordinary combination of a VAT holiday and some special programs to stimulate household consumption. Base effects could also dampen year-on-year inflation numbers in Q1-2021, but annual inflation rates are expected to begin rising again in 2021.

We still forecast next year’s annual inflation rate to converge to a level slightly below BanRep’s 3% target by end-2021. For now, headline inflation supports keeping the policy rate at 1.75% for the rest of 2020 and into 2021.

—Sergio Olarte & Jackeline Piraján

MEXICO: CONSUMER CONFIDENCE ROSE IN OCTOBER TO ITS HIGHEST LEVEL IN SIX MONTHS

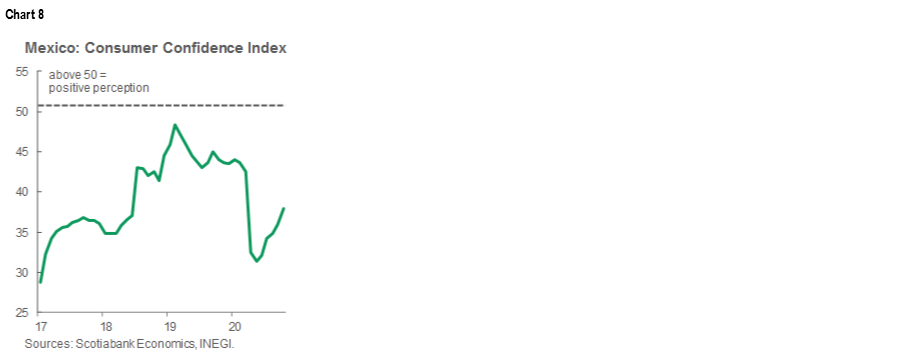

The results of the National Survey on Consumer Confidence (ENCO), released on Thursday, November 5, showed improvements for a fifth consecutive month, but the sentiment index was still not back to either its pre-pandemic levels or those of a year before. The gradual re-opening of various activities has led to a partial recovery in the economy and employment, which has driven improvements in consumer confidence and spending. However, the persistent weakness in consumers’ views, combined with uncertainty about the pandemic, imply a soft dynamic in consumer spending for the rest of the year.

- In October, the Consumer Confidence Index (CCI) nsa came in at 37.9 points, the highest since March, but still lower than a year earlier by 6.2 points—which marks an 11th straight month of year-on-year declines (chart 8).

- Seasonally adjusted, the CCI improved for a fifth consecutive month, by 1.4 points to 37.6, its highest level in seven months.

- The five components of the CCI nsa all remained down on year-on-year comparisons. These include assessments of the current and expected situation of households and the country, as well as evaluations of consumers’ current capacity to acquire durable consumer goods. In contrast, all five components improved again in seasonally-adjusted month-on-month terms.

—Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.