- Peru: Mining investment continues to fall; the start of Quellaveco operation boosts copper production

Mixed signals out of China on reopening versus steeply climbing cases and canceled policy meetings are seeing erratic trading ahead of US CPI data. The USD is trading mixed with US yields in narrow ranges overnight, while crude oil prices are stronger against losses in iron ore and copper (Asia benchmarks) in a mixed reaction to China reopening developments.

US inflation data out at 8.30ET will provide the final piece of the puzzle ahead of tomorrow’s Fed decision that will likely dictate the market mood for the rest of the year.

The Latam backdrop is relatively quiet today as we continue to monitor developments in Peru. Yesterday, Pres Boluarte formally presented to Congress a bill to bring forward elections to April 2024, but this did not materially quash social unrest that is, in fact, worsening as casualties climb from clashes between protestors and police; it’s looking increasingly likely that elections will need to take place at some point next year. Peru’s stock exchange fell ~2.5% yesterday, its steepest decline since Sep 23, although the PEN again held up well gaining 0.4% in its first trading day post-Castillo’s removal.

Mining operations have, for now, not been impacted according to the head of the SNMPE (Peru’s mining and energy society). Late last night, however, the operator of the Cerro Verde mine noted that although production is not impacted (yet), the location is facing delays in the transport of people, supplies, and product. Highway blockages (among other logistical issues) could see mines curtail supply if transportation to/from the mines is increasingly challenged.

Pres Castillo, from his detention cell, accused Pres Boluarte of being an ‘usurper’ and spoke of himself as the legitimate president of the country—certainly fanning the flames of public turmoil. Leaders in Mexico, Colombia, Argentina, and Bolivia denounced the treatment of the former president in a joint statement released last night.

Brazil’s incoming Finance Minister Haddad meets with the BCB’s head Campos Neto and the Fin Min incumbent Guedes later today as we await more details on Lula’s fiscal and spending objectives—aside from the spending cap exclusion for social programs. The BCB published the minutes to its December policy meeting this morning, which highlighted that the bank will resume hikes if needed and whether to hold rates at elevated levels for a long period to ensure inflation convergence.

—Juan Manuel Herrera

PERU: MINING INVESTMENT CONTINUES TO FALL; THE START OF QUELLAVECO OPERATION BOOSTS COPPER PRODUCTION

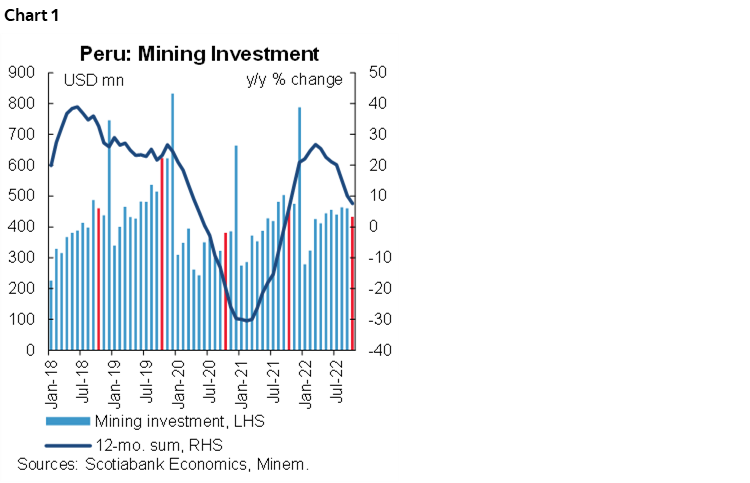

Peru’s mining investment fell 7.1% y/y in October, according to data from the Ministry of Mining (chart 1). In the January–October period, mining investment increased 3.8% y/y. These monthly declines during the second part of the year (H2-2022) align with our expectations of a 4.2% overall drop for 2022. We expect mining investment to fall 11.3% in 2023.

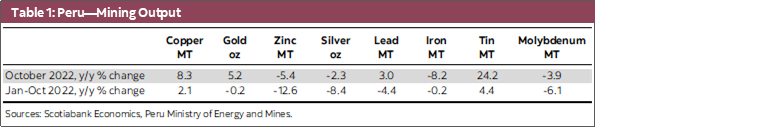

Mining output was mixed across the different products (table 1). Copper output increased 8.3% y/y in October, principally due to the start of Quellaveco operations in September. The mining company started with an output level of around 20,000 FMT (fine metric tonnes) per month. If it maintains the same levels for the remainder of 2022, it will exceed what was projected by the mining company for this year (75,000 FMT). Next year, it should produce at full capacity (300,000 FMT per year).

Gold output also increased (+5.2%), despite the depletion of mines, as did that of lead (+3.0%) and tin (24.2%). On the other hand, the production of zinc (-5.4%), silver (-2.3%), iron (-8.2%), and molybdenum (-3.9%) fell.

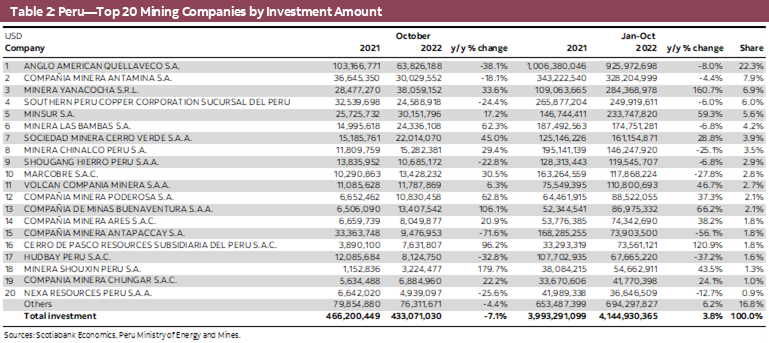

Anglo-American’s Quellaveco project continues to decrease its investment. In October, investment fell 38.1% m/m (table 2) and we expect it to continue decelerating until the end of the year. Meanwhile, Antamina investment continues with plans to expand operations over the next eight years, as does Minera Yanacocha’s sulphide project.

In a press release at the end of October, Buenaventura announced that it would restart works on San Gabriel’s gold and silver mining project (USD470mn). Preliminary work began this year with architectural construction starting in 2023; it is expected to be finished by the end of 2024.

—Katherine Salazar

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.