- Chile: Agreement for a new constitutional process with sufficient restrictions that limit chances of extreme proposals

- Peru: S&P changes outlook from stable to negative amid protests backdrop

Trading was muted overnight as markets mostly hold to the ranges left over from North American dealing after the US CPI miss. Commodity prices are mixed with crude oil firming up in European hours alongside rangebound metals. Singapore iron ore is flat, not getting a hand from news that China will in fact go ahead with its economic work conference side-stepping Covid risks—and may see some additional covid policy or stimulus announcements come out of this. The USD is weaker against most major currencies, still reeling from the ‘soft’ print yesterday, as markets seemingly position for a less hawkish Fed decision this afternoon.

The Latam day ahead will consist of headlines watching, amid no notable data or events, with the situation in Peru of particular interest.

Peru’s Las Bambas mine is quickly exhausting storage capacity as protests and road blockades prevent the shipment of copper ores, which could eventually see the mine shut down production. The country’s Def Min Otarola has said that the military will clear roadblocks and defend airports to prevent economic disruption; the risk of more casualties from more violent clashes with demonstrators should not be ignored.

Pres Boluarte said yesterday that she will attempt to bring forward elections even more instead of waiting until April 2024 as was originally the plan. This is not surprising to us, it seems increasingly unlikely that the country will accept such a long wait and we may see elections occur as soon as is logistically possible.

We also continue to monitor speeches from Lula’s team in Brazil after he appointed Mercadante to head Brazil’s development bank in a move that has been poorly received by local markets concerned with loose lending. Lula accompanied this announcement with a statement that “the privatization drive will end”, and to foreign companies that “don’t come here to buy our state-run companies, because they are not for sale. Come here to invest.”

—Juan Manuel Herrera

CHILE: AGREEMENT FOR A NEW CONSTITUTIONAL PROCESS WITH SUFFICIENT RESTRICTIONS THAT LIMIT CHANCES OF EXTREME PROPOSALS

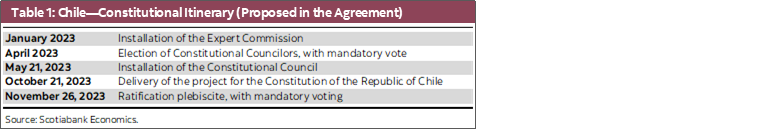

After months of negotiations, the main political parties signed an agreement for a new constitutional process yesterday. The agreement includes the creation of a Constitutional Council whose fifty members will be chosen by Chileans, a 3/5 vote share necessary for proposals to be included in the document’s draft, and a 24-member commission of experts that will draft a preliminary constitutional proposal and draw up institutional pillars that the project must contain (i.e., limits) (table 1).

The constitutional mechanism has sufficient boundaries to hinder the approval of extreme proposals, thanks to the 3/5ths requirement and the creation of the Commission of Experts and the Technical Admissibility Committee. Additionally, in the election of the members of the Constitutional Council, the center-right parties could achieve more than 20 representatives (2/5), which would give them the ability to block any proposal. This has a high probability of occurring since the independent candidates will not go on separate lists, as it was in the previous constitutional process, but within party lists. Furthermore, the center-left parties represent more than 2/5 in both chambers today, so it would be expected that this representation will be replicated in the Constitutional Council.

The details are as following:

- Minimum foundations ranging from the respect for property rights to the consecration of Chile as a unitary and decentralized state with three State branches, and the consecration of certain autonomous bodies such as the Central Bank and the principle of fiscal responsibility.

- There will be 3 bodies in the constitutional process:

1. Constitutional Council: composed of 50 people elected by direct popular vote, with parity and indigenous seats. This body has the sole purpose of discussing and approving a proposed text for a new Constitution, dissolving once the task entrusted has been accomplished. The proposed constitutional norms will be approved by a 3/5 majority.

2. Commission of Experts: composed of 24 experts elected by the Congress; half from the Senate, half from the House. This body will be in charge of drafting a proposal that will serve as the basis for discussion and drafting of the new constitutional text.

3. Technical Admissibility Committee: composed of 14 jurists with an outstanding professional and/or academic career, who will be elected by the Senate. This body will be in charge of reviewing the norms approved in the different instances in order to determine a possible inadmissibility of these if they are at odds with the institutional bases.

—Waldo Riveras

PERU: S&P CHANGES OUTLOOK FROM STABLE TO NEGATIVE AMID PROTESTS BACKDROP

S&P Global Ratings downgraded Peru’s outlook from stable to negative on Monday, arguing that it foresees a tumultuous period for the government. S&P ratified Peru’s BBB rating, but has signaled that this could be revised if more adverse political events were to affect policy or worsen institutional stability.

What S&P is saying, in our view, is that it doesn’t see any clear light at the end of the tunnel, and that political instability represents a large risk for reliable economic policy to continue. The outlook change was announced too late in the day to impact markets on Monday, with little obvious impact on trading yesterday. The news seems to have been largely taken in stride by the markets, perhaps because it was an outlook change, and not a ratings downgrade.

The decision by S&P came amidst a wave of protests and shortly after President Boluarte had proposed early elections to be held in April 2024.

Protests were especially violent on Monday, December 12, when a number of deaths were registered among protesters, dozens of police were injured, the airport in Arequipa, Peru’s second largest city, was taken, albeit briefly, and the Gloria milk processing plant was set on fire.

It is not easy to separate truth from fiction as events are fluid. However, and at the risk of our opinion being overtaken by events, the following public information from police sources is notable. The first is that while protests have been taking place in various cities and have been quite violent at times, they have not been massive. The second is that leftist radical leadership would reportedly be providing financial and logistics resources to protestors, which has given the protests more oxygen. Thirdly, regional “prefects”, which are the regional representatives of the central government and are in charge of maintaining order, were promoting, rather than controlling, disturbances. As a result, they were all sacked by the government on Monday. Note that this cohort of prefects had been appointed by ex-President Castillo and were drawn from Perú Libre and the radical left.

The situation, then, appears to be one in which protests, rather than massive, are very militant and violent, which give them a weight that is greater than their numbers. Wednesday will be crucial to determine whether these groups are able to expand from their support base, or whether their size is manageable enough to enable the police to contain them. The situation is putting Peru’s institutionalism to the test… yet again.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.