This is our last Latam Daily of 2022; our first Latam Daily of 2023 will land in your inboxes on Tuesday, January 3, to kick off the new year.

Best wishes for very happy and safe holidays from all of us at Scotiabank Economics!

- Colombia: BanRep due for 100bps hike; mixed macro data

The risk mood is undoubtedly negative to close out the week as the sting of the hawkish ECB and Fed lingers with no notable overnight data or events to rescue miserable trading sentiment.

The dollar is broadly stronger with only the JPY posting a respectable gain among the majors while the MXN lags after Banxico’s policy decision yesterday. Mexico’s central bank hiked 50bps, as expected, but signaled a possibility of switching to a lower pace of increases as soon as its first meeting of 2023—and thus decoupling from a Fed likely to hike 50bps. See our Mexico team’s Latam Flash for more details.

With an expected 100bps hike, BanRep closes out a busy week for central bankers and markets surprised by the persistent hawkishness of policymakers. With Colombian inflation showing no clear signs of decelerating quickly towards target, the bank can’t but launch another large increase. It will hope that indexation effects—and the spillover from the 16% minimum wage increase agreed yesterday—will not translate into significantly above target inflation for too much longer. See our Colombia team’s preview below.

Peru’s former President Castillo will remain in custody for 18months, as ruled by the country’s Judicial Court yesterday. Tensions in the country have not simmered down after Wednesday’s emergency declaration, with at least nine protesters dead since it was announced—and casualties over the past week totaling between 15 and 20 in total according to varying reports. Congress and the Executive seem to have lost control of the situation, making it difficult to predict with certainty the path that the country will follow—elections sooner or later, but inevitable, with continued turbulence until then.

Developments in Peru will be our focus today and over the weekend, with Banxico’s economists survey at 8ET only a secondary item to monitor ahead of BanRep at 13ET.

—Juan Manuel Herrera

COLOMBIA: BANREP DUE FOR 100BPS HIKE; MIXED MACRO DATA

Monetary policy preview—BanRep will deliver a 100bps hike due to a positive output gap, high inflation, and a wide current account deficit

Today, BanRep will hold its last monetary policy meeting of the year. The central bank is expected to hike its monetary policy rate by 100bps again to 12%.

The background to this meeting includes economic activity indicators pointing to a moderate slowdown but a still positive output gap. In the case of inflation, November showed a new upside surprise, while inflation expectations deviated further from the central bank’s target. Finally, the current account deficit widened in Q3, showing that Colombia is more exposed to external shocks.

After December’s meeting, we expect a final 50bps hike in January to end the hiking cycle initiated in September 2021. The signal to stop the hiking cycle is the peak of inflation which, according to our current macro scenario, will take place in December 2022, with confirmation in February (when we will have January’s inflation reading.

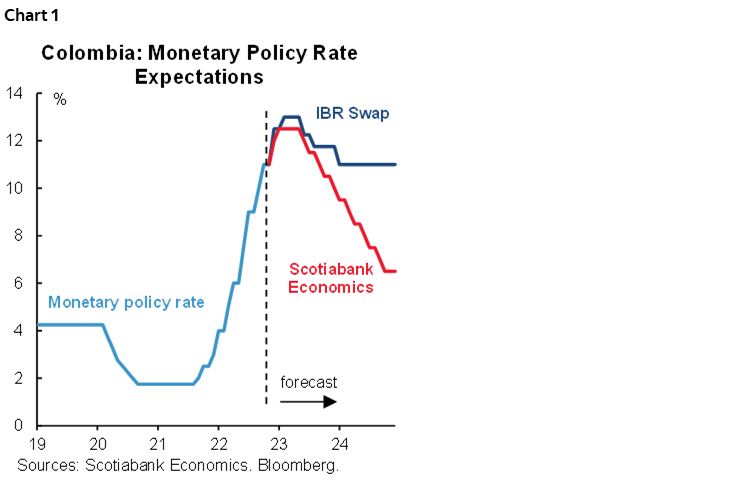

The 100bps hike is well anticipated by the economist consensus, while the IBR market is pricing a 75bps move. Either way, markets and economists are pointing to a similar endpoint (chart 1), which strongly signals that we are close to the end of the cycle.

In the case of the Colombian peso, we discard the possibility of BanRep announcing a program to control exchange rate volatility or intervention through direct USD sales.

Key points ahead of Friday’s BanRep vote:

- At October’s meeting, we had a unanimous vote, which was used by the board as a strong signal of commitment to the inflation target. In the minutes, the board also revealed concerns about fiscal deficit and the deterioration of international financing conditions, which made them turn the vote to unanimity.

- In December’s meeting, we will have only 6 members voting since Alberto Carrasquilla was withdrawn as the BanRep board failed to comply with the female quote (at least 2 women). Olga Lucía Acosta has not been officially named as a board director and can’t participate in today’s meeting.

- Inflation expectations deviated further from BanRep’s target, according to recent surveys. In BanRep’s latest survey, one- and two-year ahead inflation expectations sat at 7.74% and 4.57%. This shows that economists have no hope that the bank will see inflation fall within the target range in the medium term, though this is in line with BanRep’s expectations.

- In this meeting, we will not have details about new macro projections. However, it would be relevant to monitor the balance of risks to anticipate a possible end of the hiking cycle in January.

- The current account deficit in Q3-2022 stood at 7.2%, widening from the previous 5.5% and showing a higher exposure of Colombia to international shocks. The expectation of a greater tightening in external financial conditions will remain an essential issue for BanRep to continue the hiking cycle at a 100bps pace.

- On the FX side, pressure on the COP eased, however, we believe that the currency has a risk premium associated to idiosyncratic risks. Governor Villar emphasized that the floating exchange regime is appropriate, and in recent days we also had a piece in BanRep’s blog explaining why it is not appropriate to intervene in the market in the long-term. All of the above makes us discard the possibility of seeing an FX intervention since we are not having an adverse liquidity event.

We affirm our expectation of a 100bps that leaves the policy rate at 12%, a split vote tilted towards the dovish side could take place, but this is not our base case scenario. In terms of the COP, a 100bps move could be enough to keep the currency calm. The data-dependent approach should continue, but we expect signs of a potential pause to emerge sooner rather than later.

Retail sales and manufacturing production were lower than expected, services sector remains strong

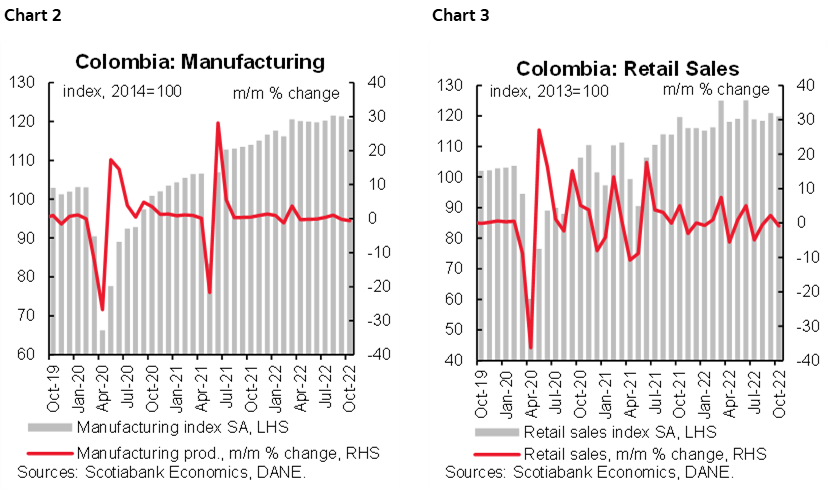

On Thursday, the National Statistics Institute (DANE) released its monthly surveys of economic activity for October. Manufacturing production and sales showed a less strong performance than expected. Meanwhile, services-related sectors remained strong (charts 2 and 3).

Retail sales slowed down in the annual rate of expansion which was explained by declines in durable goods purchases, as the statistical base was high due to the VAT holiday of a year ago. In 2021 VAT holidays were in October, November, and December; this statistical effect will contribute to a more moderate performance from retail sales in forthcoming readings. We expect the healthy moderation in private consumption to continue due to high inflation, higher credit interest rates, and FX depreciation. In the case of manufacturing, the lower expansion was associated with the moderation in the production of some items, which In the past were relevant due to the pandemic-related demand.

Manufacturing production

Manufacturing production increased by 5.3% y/y (below the market consensus of 6.9% y/y), showing a monthly contraction of 0.61% m/m, being stronger than the previous month (chart 2 again). In our view, October’s results show a moderation in manufacturing activity as base effects continue to fade. In addition, some headwinds are still present and have been lingering longer than expected, such as high input costs, lower business confidence around a fiscal scenario for next year with higher tax burdens along with tighter interest rates. That said, we expect this trend of moderation to continue in the last two outstanding records of the year. YTD, manufacturing has grown by 13.1% y/y.

In y/y, the best performing sectors were vehicle manufacturing (+91.6% y/y), bodywork vehicle (61.7% y/y), vehicle parts and accessories (+37.3% y/y) and printing activities (+30.7% y/y), glass manufacturing (21% y/y) and chemical products (14.5% y/y), which accounted for 2.2ppts (41% of the total expansion). On the negative side, the sectors that detracted activity were leather travel goods manufacturing (-14.5% y/y), coffee threshing (-24.7% y/y), precious metals industry (-19.2% y/y), this is explained by pressures on production costs and a possible more moderate demand.

Employment growth came in at 3.1% y/y. On a m/m basis, employment slowed, registering a 0.5% contraction compared to the 0.3% m/m increase in the previous month. This may be a sign of some deterioration in the formal sector.

Retail

Retail sales showed a sharp deceleration to 1.9% y/y in October, below the Bloomberg survey (+3.6% y/y) (chart 3 again), while employment slowed to 3.4% y/y vs 3.6% in the previous month. On a seasonally adjusted basis, retail sales (excluding other vehicles) showed a more deep contraction of -0.87% m/m, returning to a moderating trend and breaking with the previous months’ upside surprises. On an annual basis, the increase in retail sales has a lower base effect, although during the month we had a week of school breaks and Halloween so the moderation was not expected to be as strong, but it is clear that households are already feeling much stronger inflationary pressures and with more expensive credit, household disposable income is increasingly constrained.

On an annual basis, the expansion of retail sales was explained by sales of alcoholic beverages (+12.4% y/y), books and stationery (+25.7% y/y), non-alcoholic beverages (16% y/y), alcoholic beverages (+12.4% y/y) and other vehicles (transportation or cargo) (23% y/y). While the items that contributed negatively were video and sound equipment (-27.6%), household appliances (-25.9%y/y), computer and communication equipment (-10.6%y/y), household cleaning products (-12.3%y/y), explained on the one hand by the replacement of the VAT holiday that took place in October 2021. added to the fact that prices remain high given the pressures on production costs at the international level, together with a greater depreciation of the exchange rate, which implies a lower household demand for this type of goods, which can be transferred to the service sectors. Even so, we continue to expect private consumption to continue to decelerate for healthier growth in the future.

Services & Hotels

In October 2022, most service-related activities showed positive expansion, with the most robust growth in entertainment activities (+40.9% y/y). In terms of employment, computer systems activities recorded the largest change (+14% y/y), followed by telecommunications activities (12% y/y), and restaurant, catering and bar activities (+9.4 y/y).

In the hotel sector, revenues showed an expansion of 15.6.% y/y, lower than that observed in the previous month (31% y/y), but returning to more moderate growth rates due to base effects, and employment growth stood at 21.4% from 24.6% in the previous month. Hotel occupancy was a relatively stable 58.8% compared to the previous month. Business travel continued to show a positive trajectory and was slightly higher than the previous month, accounting for 23.3% of total occupancy, and leisure travel accounted for 30% up slightly from the previous month, as there was a school break week this month.

All in all, there are mixed signals in the performance of activity indicators, as confidence surveys show that companies are more negative about the future of the economic situation amid the impacts of inflation and supply of inputs due to the international context, coupled with expectations of higher tax burdens and higher rates.

Our baseline scenario remains that the economy will continue to show robust performance. Our forecast is for GDP growth to be 8.0% in 2022. With a gradual slowdown in the remainder of the year due to more moderate private consumption as a result of tighter monetary policy. That said, and taking into account recent inflation prints, we expect that the Bank of Japan, at its December 16 meeting, will increase the rate by 100bps to 12% but the end of the cycle will come in January with a further 50bps increase to 12.50%, given the strong indexation effects for next year and high statistical bases in the food item that will lead to keep rates at this level for about six months as inflation starts to show convergence.

—Sergio Olarte, María (Tatiana) Mejía & Jackeline Piraján

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.