- Colombia: Inflation expectations deviated further from target, while the end of the hiking cycle is expected at the beginning of 2023

- Mexico: Banxico up to bat—decoupling in sight, but not yet

Asian and European markets have seemingly read yesterday’s Fed decision as more hawkish than the initial read in North America, where the broad reaction to the hawkish dots and presser was relatively benign. Equities are broadly weaker in Europe and Asia and US SPX futures are tacking on a 1%+ loss to a (relatively small) 0.6% drop yesterday.

The commodity backdrop is mixed as iron ore trades stronger, with Rio Tinto optimism perhaps helping, while crude oil is flat and copper and precious metals record losses of 1.5%+. The USD is the king of currencies today after closing yesterday at its weakest level since June on broad basis (Bloomberg dollar index). The USD’s regional peers, the CAD and MXN are weaker but outperforming among the majors, recovering somewhat from laggards yesterday. Overseas traders may have seen Friday’s market reaction as a misread of the Fed’s decision, where the median projection for the bank’s 2023 Fed funds rate range was lifted by 50bps versus 25bps expected.

Today, the main event in Latam will be Banxico’s decision, where we see a 50bps increase with hints of an incoming decoupling from the Fed. Peruvian economic activity and unemployment data will be important to watch, but by and large local markets are focused on the social/political situation (see below). Colombia publishes retail sales and industrial sector data to help guide our economic outlook for the country ahead of BanRep’s decision tomorrow (see below).

Peru state of emergency

Peru’s government declared a 30-day nationwide state of emergency yesterday as social unrest builds, with rising casualties (nearing double digits) from confrontations between protesters and security forces. Roadblocks, attempts to seize airports around the country, and economic disruptions (including impeding the transportation of mining products) have prompted the announcement. Note that the decree does not include a curfew, which would have likely inflamed sentiment further.

Congress will today debate Pres Boluarte’s proposal to hold early elections, as soon as December 2023; which does not look soon enough to calm protesters. What’s more, Peru’s Judiciary will today decide whether to extend former President Castillo’s pretrial detention to 18 months; the hearing is scheduled to begin at 8.30ET. It’s difficult to envision that his detention will not be extended—in turn, expect more social unrest.

Colombia min wage deadline ahead of BanRep

Today marks the first deadline for minimum wage negotiations in Colombia between businesses and workers groups. Given the most recent inflation and productivity growth figures, a roughly 15% increase seems to be the minimum that will be agreed on. In any case, this will act as a strong upside pressure on inflation and BanRep will consider this at its policy decision tomorrow, where we expect a 100bps hike with hawkish guidance.

—Juan Manuel Herrera

COLOMBIA: INFLATION EXPECTATIONS DEVIATED FURTHER FROM TARGET, WHILE THE END OF THE HIKING CYCLE IS EXPECTED AT THE BEGINNING OF 2023

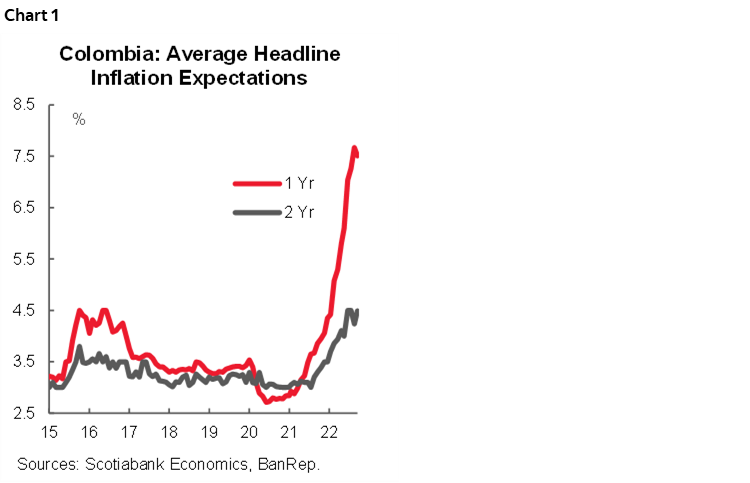

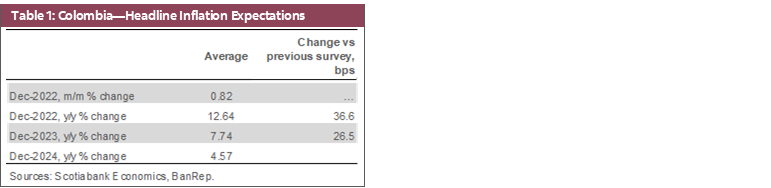

On Wednesday, BanRep released its monthly survey of economic expectations. Inflation expectations (IE) for the end-22 increased 0.37ppts due to the upside surprise in November’s data. At end-2023, the survey showed inflation expectations well above the central bank’s target, at 7.74%. Monthly inflation for December is expected at 0.82% m/m while we project a 0.84% m/m increase to close out the year at 12.66%, and only falling to 7.51% at end-2023 (chart 1).

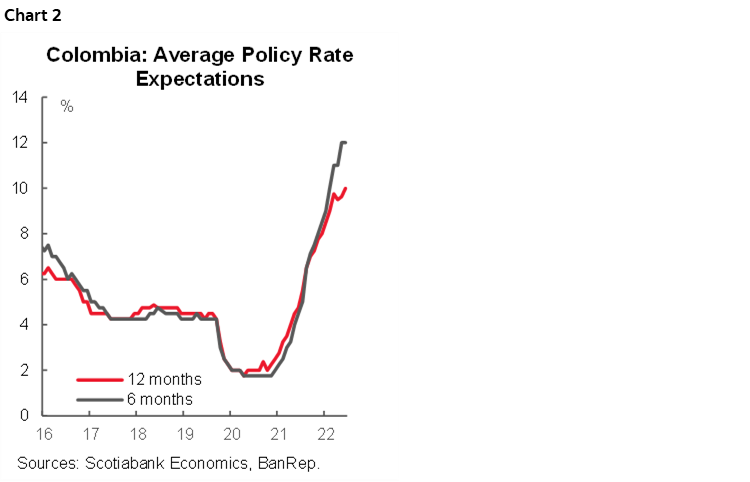

Consensus expects the hiking cycle to continue with a hike of 100 bps on Friday to 12%, with a final 50bps rise to 12.5% in January. Our bias is also in favour of a 100bps tomorrow amid the recent solid performance of economic activity and given that inflation expectations remain sharply off- target.

- Short-term inflation expectation. For December the consensus sits at 0.82% m/m, placing year-on-year inflation at 12.64% (from 12.27% in November), 0.37ppts above last month’s survey (table 1). That said, the potential inflation peak could be seen in the current month’s data. The survey’s dispersion remains high, with the lowest submission at 0.40% mm/ against a peak projection of 1.04% m/m. Scotiabank Economics expects monthly inflation for December to be +0.84% m/m and 12.66% y/y, which we see as the zenith of inflation in the country. In December, we will still observe upside pressure from food, gasoline, tradable goods and utilities prices.

- Medium-term inflation. The risk of inflation not peaking in December is high due to indexation effects in the first quarter of 2023 and a high food prices base that has been the main contributor to inflation. IE for 1-year ahead stood 7.74% y/y (above last month’s reading of 7.70% y/y); while the 2-year-ahead gauge decreased by 0.11ppts to 4.57% y/y, still away from the central bank target.

- Policy rate. The median of expectations points to a rate hike of 100 bps at the December 16 meeting, to leave the rate at 12% (chart 2, from the current 1 1%); Scotiabank Economics is also in favour of 100bps but the end of the cycle will depend on inflation indeed peaking. The market consensus expects the end of the hiking cycle to be in January 2023 with a rate of 12.50%, in line with Scotiabank Economics’ estimates, and the first cut would be in June 2023 to close the year at 10%.

- COP exchange rate. USDCOP projections for end-2022 settled at 4,839 pesos on average (above the previous survey’s 4,796 pesos). By December 2023, respondents think, on average, that the exchange rate will end the year at USDCOP4,748, and in 2024 at 4,595. We believe that the USDCOP will close 2022 at around 4,781 pesos.

—Sergio Olarte, María (Tatiana) Mejía & Jackeline Piraján

MEXICO: BANXICO UP TO BAT—DECOUPLING IN SIGHT, BUT NOT YET

Banxico is walking up to the plate today, set to follow the Fed’s 50bps move yesterday. We expect the Mexican central bank sill match the Fed’s move one last time, before turning more dovish than its counterpart to the north. We think the more hawkish-than-expected message that we got from the Fed yesterday makes it especially important for Banxico to deliver a matching 50bps hike.

The message of a looming decoupling from Banxico was reinforced in the latest Quarterly Inflation Report presentation, where even the hawkish duo (Deputy Governors Heath and Espinosa) signaled they would likely support a tightening deceleration. However, we think that with core inflation in Mexico still not having consolidated its downward trend, we will likely get at least one more decisive hike from Banxico. The latest bi-weekly print showed a decline from 8.14% y/y to 7.46% y/y, while the monthly print accelerated from 8.42% y/y to 8.51% y/y. However, it’s worth noting that data for November is distorted by the “Buen Fin” discounts—Mexico’s version of Black Friday.

We expect that by Banxico’s next MPC meeting, core inflation will have peaked, settling on a gradual descent. However, production-side pressures will likely keep the Mexican dis-inflation process somewhat gradual, with three important wages shocks to monitor: 1) the pass-through from yet another 20% minimum wage increase, 2) the negotiation process of union-bargaining processes that need to meet USMCA criteria by summer 2023, which would see workers having the upper hand as companies will be pressured to comply with the agreement, and 3) the start of the gradual increase in employer contributions to worker pension funds, which will rise from 6.25% of wages in 2022 to 15% in 2030—starting next year.

Once again, we expect a split vote, with Esquivel supporting a smaller hike. It’s possible that this week, or next, we will get a decision on whether Deputy Governor Esquivel (who is regarded as dovish, but is an important fierce defendant of Banxico’s independence) will be re-nominated by the Executive, or if someone else will take his place. If Esquivel is not re-nominated, several names have been mentioned in the local press, including Lucia Buenrostro (who works at Mexico’s banking supervisor CNBV, and whose sister Raquel is Economy Secretary), finance undersecretaries Gabriel Yorio and Juan Pablo de Botton, as well as Banxico career civil servants Alexandrina Salcedo and Julio Santaella. President Lopez Obrador said that if Esquivel departs Banxico, he would be offered another position in the government.

—Eduardo Suárez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.