Canada’s economic rebound remains strong

Q2 GDP contraction was in line with expectations…

…but the Q3 rebound may be exceeding forecasts

The narrative that it will take years to recover is vulnerable

Canadian GDP, June (m/m) / Q2 (q/q annualized), % change:

Actual: 6.5 / -38.7

Scotia: +5.5 / -40

Consensus: 5.8 / -39.6

Prior: 4.5 / -8.2

StatsCan’s July GDP guidance: +3% m/m

Against the depressing narrative that it will take years for Canada’s economy to rebound, it is being achieved in months. Canada’s GDP is up 15% from the low in March and is now 6% lower than the pre-pandemic level in February. That’s still a material shortfall, but the speed of the rebound in just three months has been impressive. To listen to some, it wasn’t supposed to have happened and it cannot still be happening.

Some of this rebound is to be expected as regional economies reopened along slightly varying timelines, but notwithstanding this point, it’s the response to reopening that merits attention. A broad variety of indicators are materially rebounding quicker than the folks who argued against a v-shaped recovery felt would be the case. The down-for-the-count crowd was assuming that consumers and homebuyers would not embrace reopening plans wholeheartedly. Well, they are. They assumed that everyone would don a mask and stick their heads in the sand and never go on-line or step outdoors again. Well, they didn’t heed that advice and they found new ways to nest, spend their money and then some.

Why? Most kept their jobs throughout (16.2 million at the low out of 19.2 million in February). Over half (55%) of the 3 million lost jobs have been regained. There remains serious hardship and struggle aplenty. Regular readers know full well that I’ve said since the pandemic struck that a) it involves terrible hardship that is no one’s fault and requires compassion, b) that this requires governments and central banks to step in with supports including a correct prediction that the BoC would embrace QE, and c) that we don’t want to prematurely reverse stimulus. I still believe all of that.

But we also don’t want to ignore the resilient aspects. Borrowing costs are dirt cheap. The stock market is zooming. Jobs are coming back. There are plenty of forward-looking risks, but the balance of risks is becoming more skewed to the narrative that continuing to pile on stimulus poses risks of a different variety howsoever unappealing that may be to some ears. Reverse it all? No. Ignore the significant part of the economy that is still enduring pain and sacrifice? No, don’t do that either. Keep compounding stimulus? Well, I guess that’s not without its multi-faceted costs either.

The economy grew by 6.5% m/m in June and posted further growth of 3% in July according to StatsCan’s preliminary estimate. The Q2 contraction of -38.7% compares favourably to expectations (consensus -39.6%, Scotia August 3rd print -40%, Scotia nowcast -38.7% (!!)) but is less than the initial flash guidance that StatsCan provided on July 31st (-12% q/q non-annualized). The Q2 figure is also the least relevant figure of the bunch from a market standpoint.

That’s because markets care about rebound evidence and its tracking and that’s where the releases were strong. So strong, in fact, that they suggest preliminary tracking of a 41% annualized rebound in Q3 GDP (chart 1) with important caveats like how it’s based solely on July GDP and Q2 while assuming flat readings in August and September in order to focus upon the tracking effects of what we know so far without imposing arbitrary judgement on the remainder of the quarter. This tracking is also using monthly GDP from a production side perspective whereas quarterly GDP based upon expenditure readings can differ and at times materially so. Still, 41% growth in Q3—if it sticks with further data and upon converting to expenditure concepts—exceeds our expectations for a Q3 growth rate of 33% (consensus +35%).

Equally important is how GDP tracking informs the common narrative that it will take years to recover lost output from the pandemic. Maybe not (chart 2). We’ve obviously not yet recovered in full and will not for some time with significant remaining risks, but years?? Hmph. Not at this pace. Monthly GDP is already up by 15% from the April low. It’s also just 6% lower than the pre-pandemic reading in February.

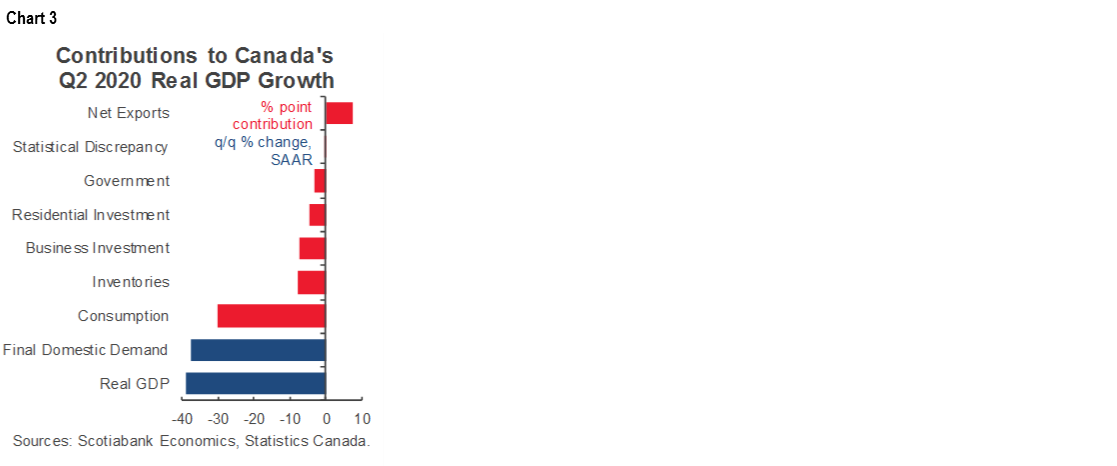

For history buffs, chart 3 shows how GDP shrank so fast in Q2 by breaking down the relative sources of contribution in weighted terms. Net exports added to growth, but perversely so due to lower imports that translate into a weaker GDP ‘leakage’ effect. Not surprisingly, the collapse in consumption drove it. That drop was skewed to March and April such that the rebound in May onward isn’t obvious in the quarterly math but will be so in Q3. Inventory depletion was roughly tied with business investment for second place in terms of weighted drag effects on GDP growth.

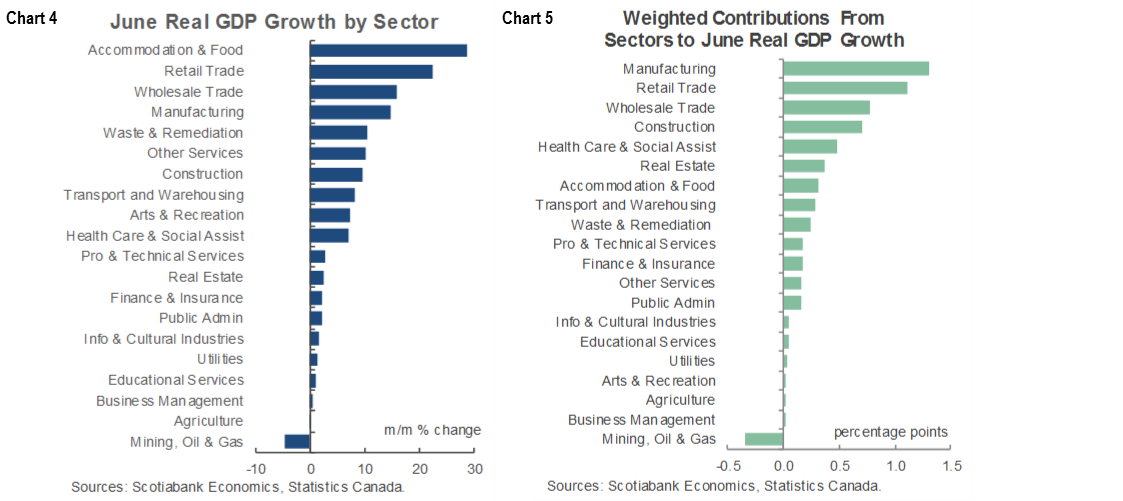

Charts 4 and 5 show the month-over-month growth in GDP during June in raw terms (chart 4) and after weighting the sectors for their relative importance as a share of GDP. StatsCan’s preliminary guidance for July GDP (+3% m/m) noted that it was “primarily driven by manufacturing, health care and social assistance, wholesale trade, construction, and accommodation and food services” with output “up in a number of sectors.”

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.