- Policy was left unchanged as widely expected

- The median participant only sees one cut this year, but the mode is –50bps

- The neutral rate was revised a little higher

- Growth and inflation were revised up

- This was not Powell’s strongest presser and that contributed to the market reaction

Markets took back about half of this morning’s post-CPI rally (recap here) as the full set of FOMC communications worked through. Some of that cheapening occurred in response to the updated projections including the fresh dot plot, but more of it happened during the press conference. I think a reason for the latter effect is that this wasn’t Powell’s strongest press conference.

WHAT MARKETS DIDN’T LIKE

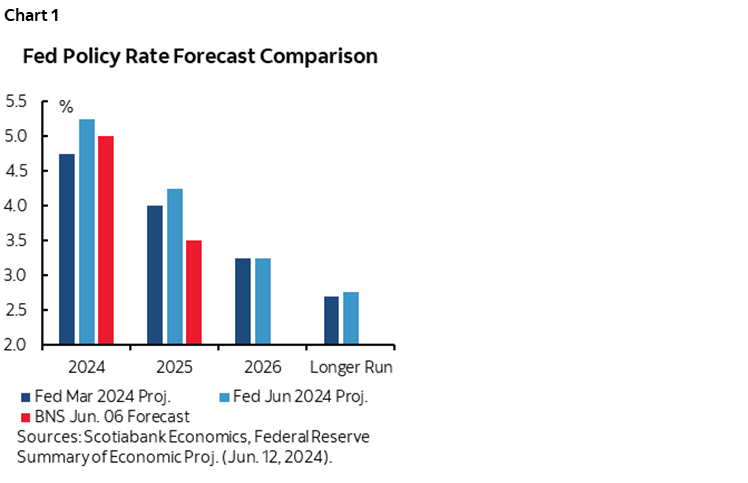

One key is that the Committee lowered its projection for rate cuts by more than most expected for this year (chart 1). The median projection is for only one quarter point rate cut this year and 100bps next year. I’ll nevertheless come back to why there is more to this than meets the eye.

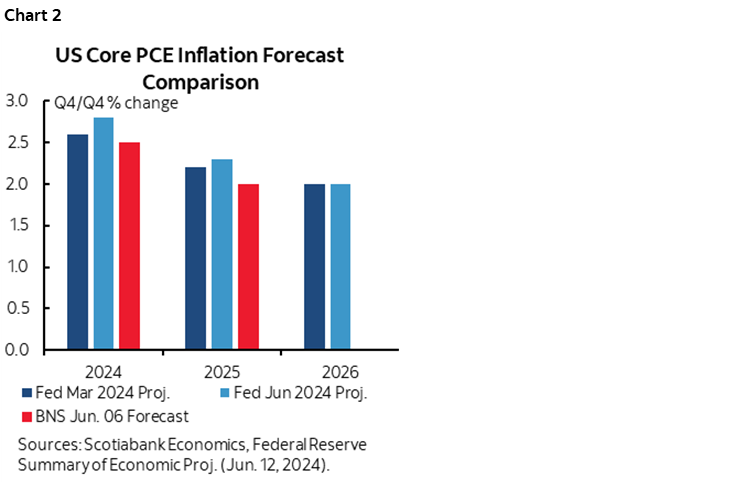

Another key is that they raised inflation forecasts and are above our views, even though Powell gave short shrift to the higher forecast (chart 2).

DOT PLOT—25 OR 50BPS OF CUTS

The median Committee projection now expects one single quarter point rate cut this year compared to –75bps in March, followed by 100bps of cuts next year instead of 75bps of cuts in the last projection, and another 100bps of cuts in 2026 to an unchanged 3.25%.

Having said that, the downgrade to -25bps this year masks a very close call between -25 and -50bps. The Committee’s mode is 8 participants who now expect -50bps of cuts this year versus 7 who expect -25 with 4 expecting no cut. In other words, data could very easily swing that tight balance between –25bps and –50bps in the next dot plot come September but it needs a fair amount to go right by then for that to happen.

HIGHER NEUTRAL RATE

The Committee also raised its median longer-run fed funds forecast to 2.75% from 2.6%. Many would take that as a sign that the Committee may feel policy is slightly less restrictive now relative to a long-run guidepost than it previously thought. That also fed some of the rise in bond yields.

Chair Powell was asked in his press conference whether a higher neutral rate was indeed a sign that the Committee believes policy is not as restrictive as previously indicated and he said:

“The long-run neutral rate is a theoretical construct. It is the equilibrium rate years into the future when there are no shocks. That doesn’t apply to today. The concept of r* is important but doesn’t get you where you need to be in the nearer term. People have been gradually writing it up because they have been coming around to the view that rates won’t go back to pre-pandemic levels.”

In other words, he tried to tell folks to ignore it, perhaps without enough market success. Personally, I think it should be taken with a mountain of salt because estimating the neutral rate is very difficult, more likely to be revealed in retrospect by observing what happens to the economy and inflation, and does not speak to the near- and medium-term path toward arriving at a more neutral policy stance. In other words, raising neutral doesn’t tell us much of anything about whether they cut soon and by exactly how much.

FORECASTS

The Committee raised its projection for core PCE inflation by two-tenths to 2.8% this year, one-tenth to 2.3% in 2025, and left 2026 at 2%. That is higher than our forecast.

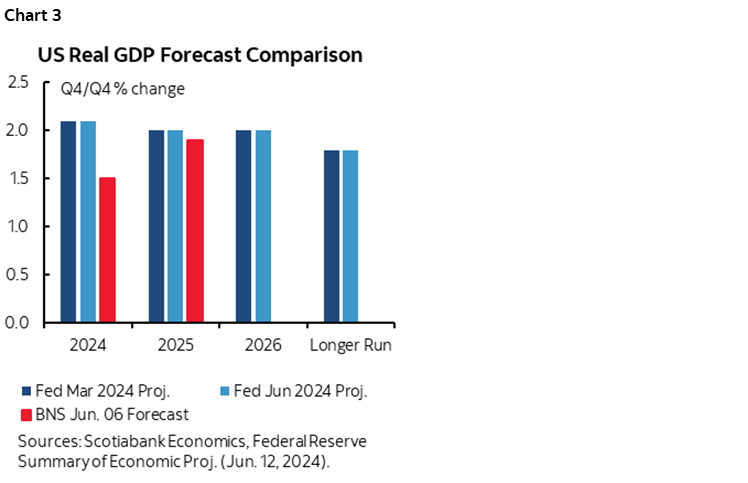

One reason for the Committee being higher than us on core PCE is that the Committee left GDP growth unchanged throughout the projection horizon. The median participant’s projection is for 2.1% Q4/Q4 GDP growth this year, 2% in each of the next two years, and the long-run potential growth estimate was left unchanged at 1.8%. This is above our forecast especially for this year (chart 3).

The Committee sees a little more demand pressure on prices from GDP growth this year than we do.

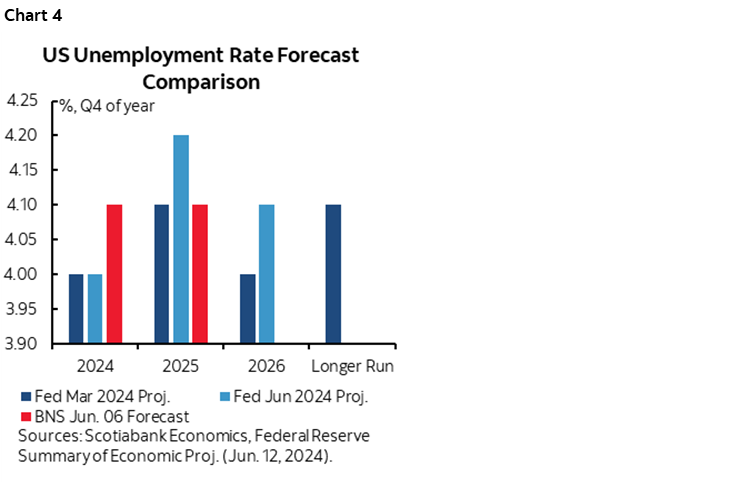

Unemployment rate projections were little changed as this year was left at 4%, but the rest of the projection horizon was raised by one-tenth to 4.2% next year, 4.1% in 2026 and 4.2% in the long run (chart 4). Markets didn’t appear to acknowledge slightly more labour slack.

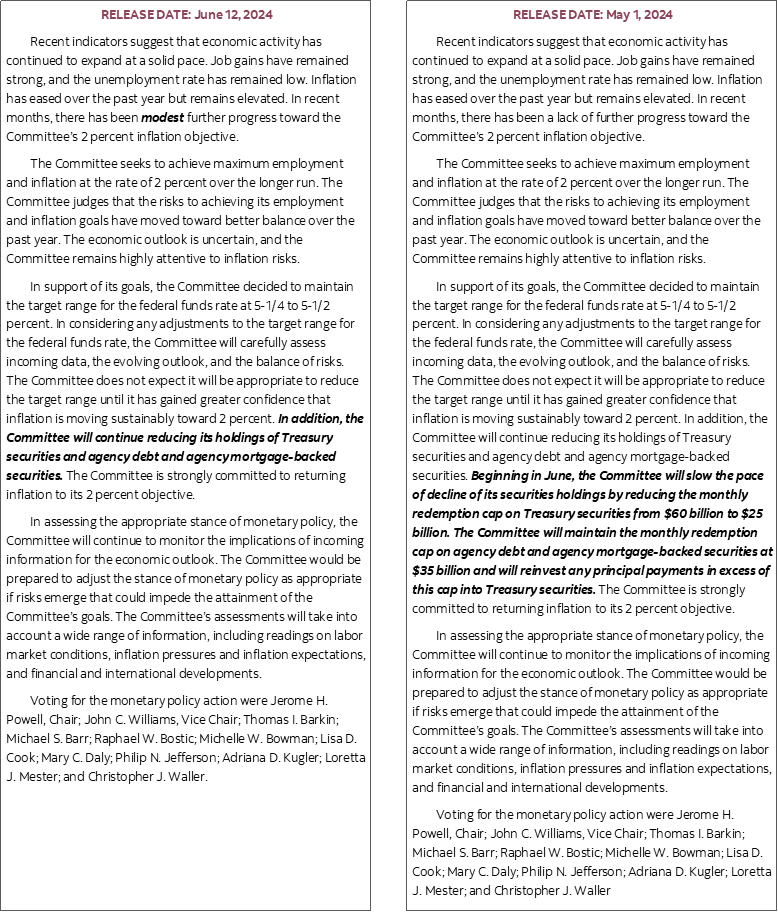

TINY STATEMENT CHANGES

Please see the appendix for a statement comparison. Only one single word changed through the insertion of 'modest' further progress toward 2% inflation. Other than that, the only other change was just to put the QT changes in the present context after they announced them in the prior statement.

WHERE POWELL COULD HAVE BEEN CLEARER

Powell Should Have Been Clearer on Internal Forecast Consistency

The oddest point in the presser was when a few reporters repeatedly asked in slightly different ways why the Committee would be showing rate cuts at all given its forecasts for solid growth and persistent inflation. Powell kind of flubbed the answer in my opinion by dancing around the issue saying that they expect fewer supply side problems, tighter monetary policy to continue working and for there to be less and less excess demand for labour.

What he should have said is that the Committee’s projections for growth and inflation incorporate their estimates for rate cuts. In other words, without such cuts, growth and inflation would presumably be weaker throughout the forecast horizon. That would have been a more directly dovish signa; in other words, absent, say, 125bps of cuts this year and next, the economy and inflation would be weaker.

Instead, his weak answer may have been an added reason why bond yields rose somewhat in the press conference as opposed to bluntly saying that the Committee thinks rate cuts will be needed in order to deliver their soft landing macro projections.

Stale on Arrival?

Where I also thought Powell’s performance could have been better was when he was asked in the press conference whether Committee participants changed their rate projections after this morning’s CPI print. He was evasive and that didn’t help.

What he did say is that when there is an important data print they make sure that participants can update their forecasts and most people don’t. He left me with the impression that he was trying to say that the forecasts fully incorporated this morning’s CPI. The way he answered it and his body language didn’t convince me.

Where does this all leave us? Back to watching the data, or picking petals off daisies as argued in my Global Week Ahead.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.