- Canada’s economy beat expectations in October…

- ...and guidance points to sustained gains in November

- Q4 GDP is tracking above BoC expectations…

- ...as lock downs bite into conditions into near-term prospects…

- ...with vaccines on the way

- Spare capacity forecast to close in 2022

Canada GDP, m/m % change, October, SA :

Actual: 0.4

Scotia: 0.2

Consensus: 0.3

Prior: 0.8

November guidance: 0.4

Canada’s economy solidly beat expectations not only for the month of October but also in terms of preliminary guidance for November. There is obvious downside risk that is emerging from December through the winter months as lockdowns and restrictions bite once again, but it’s important to acknowledge that a) the economy has continued to perform better than many had thought possible right up to November, and b) the earlier than expected arrival of vaccines combined with pent-up demand from the renewed lockdowns should lend greater confidence toward expecting a more sustained expansion.

GDP grew by 0.4% m/m and that doubled StatsCan’s initial guidance that had indicated an advance of 0.2% m/m. Preliminary guidance for November indicates the economy grew by another 0.4% m/m. We had advised that the tone of the November data was looking solid on balance including hours worked as an offset to the late month lockdown in the Toronto area and restrictions elsewhere.

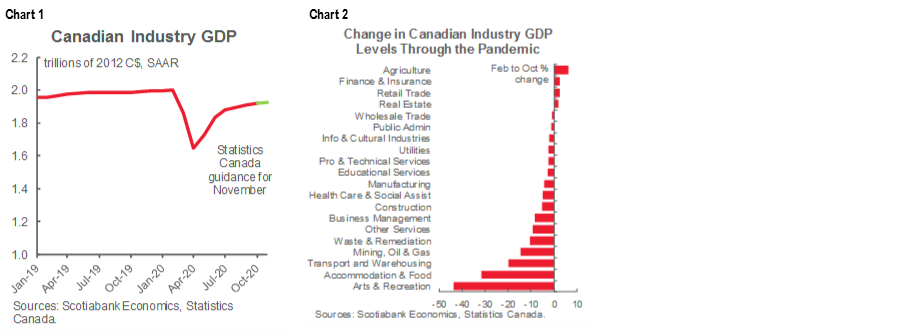

Current tracking for Q4 indicates GDP growth of 6.3% q/q at an annualized rate following 42% growth in Q3 using the monthly GDP figures. After contracting by 18% from February to April, the economy has now recovered 98% of the initial pandemic hit and it took just seven months to do so. We’ll see weaker figures going forward through at least December and January, but put this in perspective by noting that the portion of consensus that believed this would be a deflationary depression that would take a decade to recover from while walloping stocks has been absolutely dead wrong to date. The economy has rebounded faster than anticipated and core inflation remains sticky and just a few tenths beneath the BoC’s target.

Chart 1 shows the progress to date. Chart 2 shows where individual sectors of the economy now stand in relation to their output back in February in order to provide a depiction of the unevenness of the recovery. Some sectors like agriculture, finance, retail and real estate have more than recovered. Some barely remain in contraction like wholesale, public administration, info/culture, utilities, professional services and education. About a half dozen sectors are where the recovery still has a long way to go and particularly arts and recreation, accommodation and food services and transportation/warehousing.

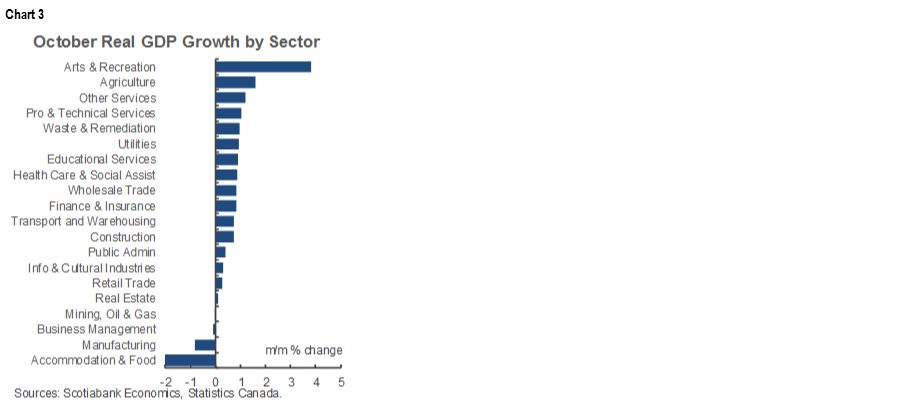

Chart 3 shows a break down of the GDP growth by sector unweighted for their relative importance.

So what does it mean to the BoC? On balance I still think there are greater odds that Canada is on track to close spare capacity earlier than the BoC forecast in its October MPR rather than later as the tracking risks to their forecasts generally land on the more optimistic side of the picture on balance (chart 4).

For starters, Q4 is blowing the barn doors off the BoC’s projection, so far. The BoC had forecast 1% annualized Q4 GDP growth on an expenditure basis and at this point tracking is pointing toward over 6% using the monthlies. There are various reasons why the two GDP concepts may not line up, but they still leave us tracking a material overshoot of the BoC’s expectations.

Second, the arrival of renewed lockdowns will take at least some of that tracking for Q4 downward and set up a weaker start to Q1 which involves taking a step backward. What makes it more like ‘lockdown lite’ this time, however, include considerations like greater adoption of work-from-home practices, heavy tech investment, an accelerated shift to on-line sales and curbside pick-up alongside a vastly different stimulus backdrop both in terms of cheap financing and extended income supports.

Thereafter, however, the earlier than expected arrival of vaccines should buoy optimism as 2021 gradually unfolds. We obviously didn’t have that during the initial lock downs. Overall, vaccines and better Q4 tracking generally offset the resumption of downside risk in between the two effects. Additional forthcoming fiscal stimulus in the winter federal budget is likely to be an added upside consideration.

If spare capacity closes earlier than anticipated, then that may drive some upward pressure toward the 2% inflation target that we forecast to be achieved in 2022H2. Output gaps only go so far, however, as indicated in part by BoC research (here). With core inflation remaining quite sticky at 1.7% y/y, individual sector derived sources of pressure could reinforce the march to the inflation target earlier than the BoC forecasts (more here).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.