- Canadian retail sales are at an all-time record high

- Q3 sales soared by 113%...

- ...but no growth is baked into Q4

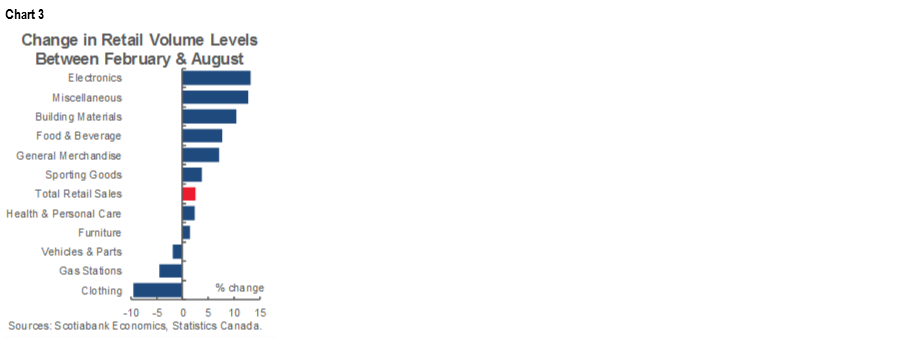

- The full sales recovery has been uneven across categories…

- ...as consumers have sensibly spent less on autos, gas & clothing…

- ...and more on everything else

CDN retail sales, m/m % change, headline/ex-autos, August, SA:

Actual: 0.4 / 0.5

Scotia: 1.1 / 0.8

Consensus: 1.1 / 0.9

Prior: 1.0 / -0.1 (revised from 0.6 / -0.4)

September guidance for headline sales: “relatively unchanged”

Optimists and pessimists alike would both have something to cheer in the latest figures on Canadian spending patterns. The glass half-full perspective would note that Canadian retail sales volumes are at an all-time record high and that proponents of a v-shaped recovery like us have been on the mark. They would point toward explosive growth during Q3 and a full recovery from the pandemic—and then some.

The glass half-empty perspective would flag the risk of stalled momentum and brought forward demand that raises a red flag on where growth will come from in future and particularly through the Q4 holiday shopping season. That camp could argue that stimulus efforts, some freed up income for those who have kept their jobs, and cocooning effects were so supportive of sales that they may give way to a demand vacuum amidst supply side challenges in securing and transporting goods in time for the usually holiday shopping season.

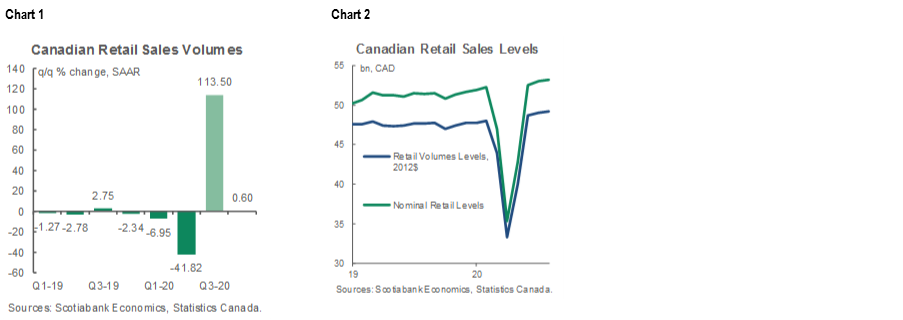

Charts 1 and 2 provide both perspectives. Achieving further retail growth during the final quarter of the year is already behind the eight ball. After a decline of 7% in Q1 over Q4 and a plunge of 41% in Q2, sales volumes surged by 113.5% in Q3 and drove the overall tally to record heights. Based on the quarterly average for Q3 and the way the quarter ended, however, Q4 has ‘baked in’ growth of just 0.6%, or basically nothing. There would need to be sizable monthly sales gains in order to put in a decent overall quarter.

Retail sales disappointed StatsCan’s earlier guidance for sales growth in dollar terms during August that had called for a gain of 1.1% m/m and instead turned up 0.4%. That was significantly due to upward revisions to the prior month’s gain that was taken up four-tenths to 1.0% m/m.

Retail volumes were up by 0.5% m/m in August such that all of the gain that month came through higher volumes as total prices slipped a touch.

Chart 3 shows the varying recoveries across types of retail sales by plotting the cumulative percentage changes in sales volumes from February, just before the pandemic struck, to August. Total sales volumes are up by 2.5% on net over this period. Categories that are up on net include electronics, building materials, food/beverages, general merchandise, sporting goods, health and personal care products and furniture. These are all the sectors that have enjoyed a lift from the pandemic or benefitted from more of a home bias to spending patterns. Categories that are down include autos and parts with the exception of ‘other’ vehicles like ATV/bikes that are strongly higher, gas stations and clothing. This makes some sense; cocooning during the pandemic has driven sales of items used at home much higher and sales for clothing, gas and the overall autos category lower.

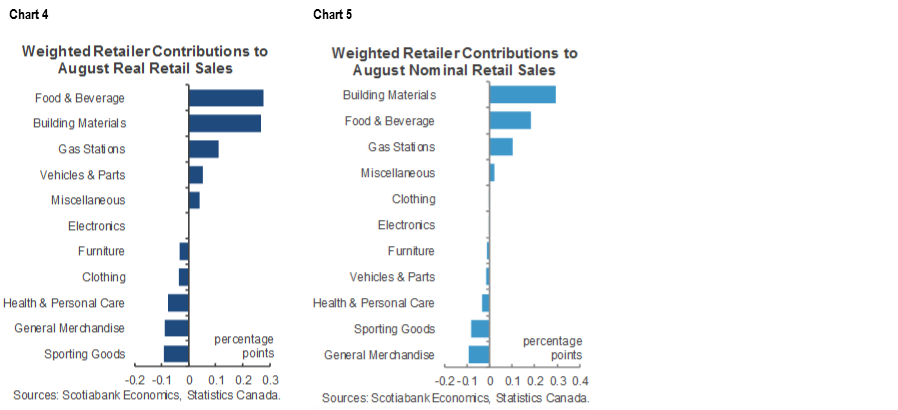

Charts 4 and 5 provide a break down of the weighted contributions to sales growth during August in terms of volumes (chart 4) and in dollar value terms (chart 5).

The Bank of Canada wouldn’t over react to one report on one sector of the economy, but at the margin, the overall tone of these figures is consistent with looking through the initial stages of recovery toward a more muted path with heightened risks going forward particularly as the second pandemic wave unfolds.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.