- Core CPI was hot again…

- …including the CPI analog to Powell’s favoured gauge...

- ....which keeps the Fed on tack for another hike

- Why markets saw it differently

- US headline / core CPI, m/m % change, SA, March:

- Actual: 0.1 / 0.4

- Scotia: 0.2 / 0.3

- Consensus: 0.2 / 0.4

- Prior: 0.4 / 0.5

US core inflation remains hot with no satisfying progress toward achieving the Fed’s 2% inflation target. So why did markets react the way they did, at least so far?

The 2-year Treasury yield fell by about 19bps at first and has cut that to 10bps. S&P equity futures initially spiked 0.9% higher post-data but have reined that in to about half of the initial rally. The dollar depreciated by about ½% on a DXY basis.

One possibility is that markets had been positioned for an even hotter core reading than the hot reading we got and so off-base position squaring swung around in the opposite direction. Another possibility is that traders looked at the wrong number again—like they did with Eurozone figures earlier this year—by reacting to a one-tick downward surprise to headline CPI at 0.1% m/m. I guess a third possibility is that markets are still looking at the year-over-year measure that saw headline inflation drop by a full percentage point to 5% even though the year-over-year core gauge moved up a tick to 5.6% Who knows, maybe traders typed ‘what should I do after CPI’ into ChatGPT and it told them to buy 2s. Either way, I don’t view the market reaction as indicative of how the FOMC will take the numbers.

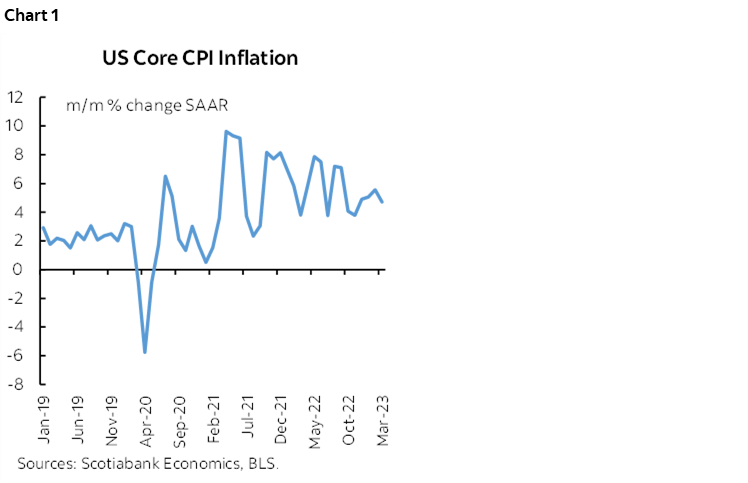

Key is that core CPI excluding food and energy was up by 0.4% m/m and when annualized translates into a 4.7% m/m annualized rate (chart 1). The 3-month moving average is now set at 5.11% which is basically unchanged from the prior month’s 5.17%. Underlying price pressures remain quite firm and way above the Fed’s 2% PCE target.

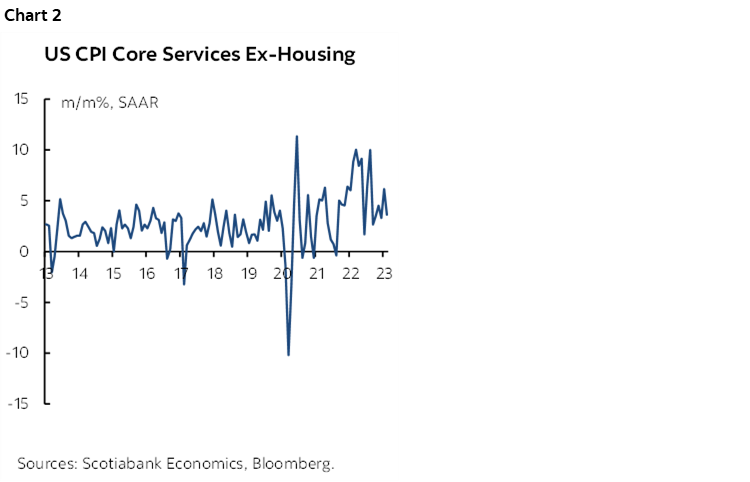

We also see that in the CPI analog to Chair Powell’s favourite measure which is core PCE services inflation excluding housing. The CPI proxy for this was up by 3.6% m/m SAAR in March. It had surged by 6.2% in February as the hottest reading since September so call it cooler if you wish, but the smoothed 3-month moving average trend only ebbed by three-tenths to 4.4% at a seasonally adjusted and annualized rate. The trend remains too hot for the FOMC’s comfort (chart 2).

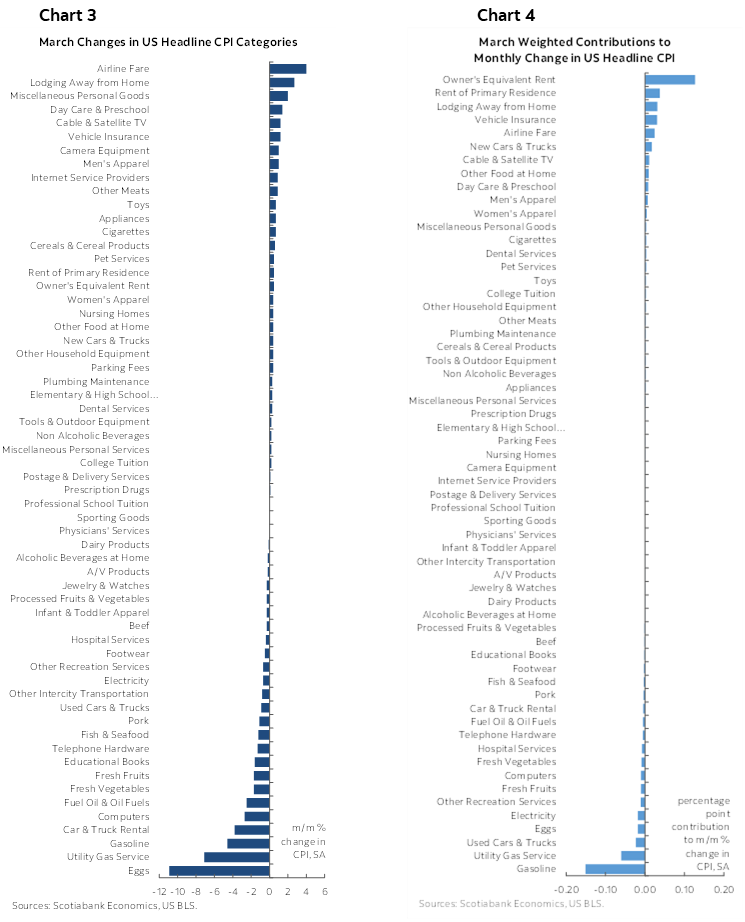

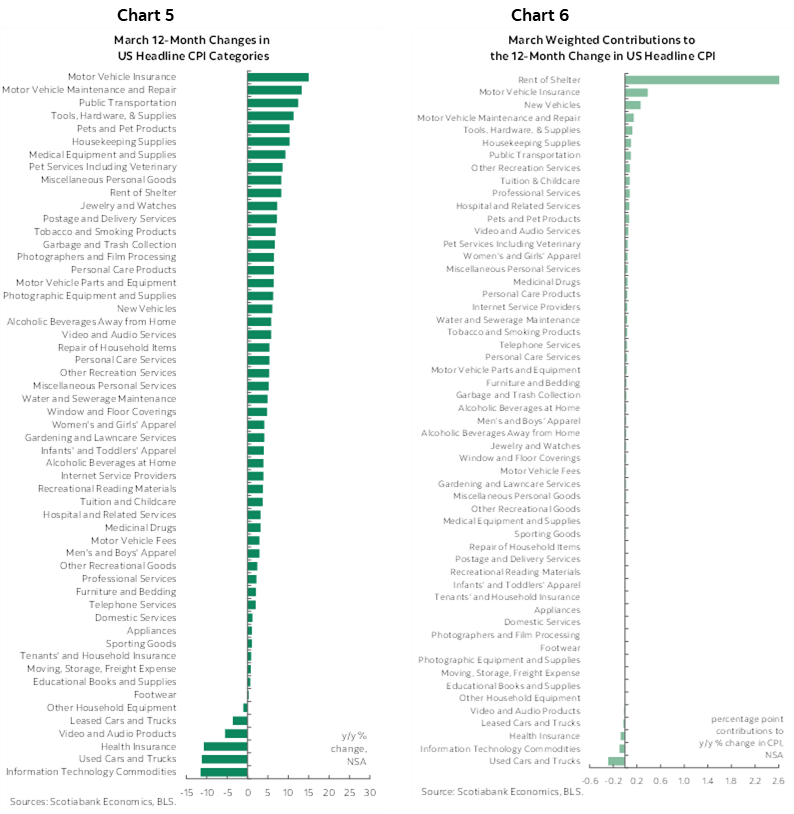

Charts 3 and 4 show the breakdown of m/m price changes by category and the weighted contributions to the overall change in CPI respectively. Charts 5 and 6 do the same things for the year-over-year rates that are more driven by base effects as opposed to the m/m pressures that indicate fresher evidence of inflationary pressures at the margin.

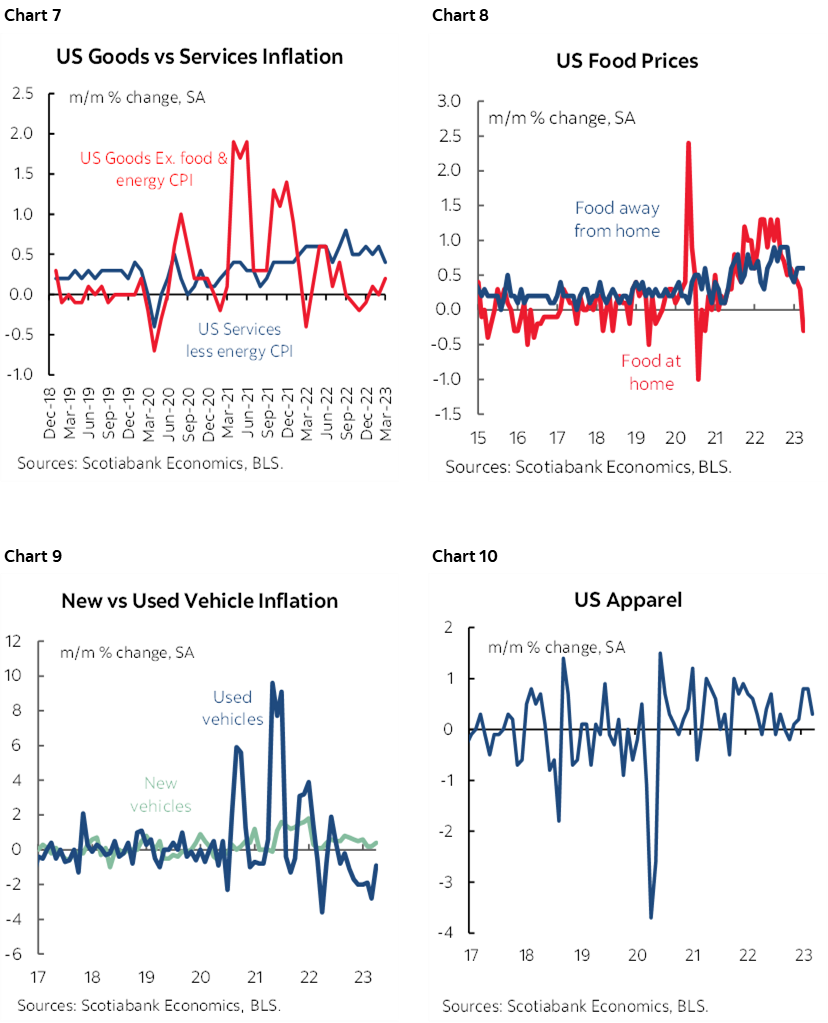

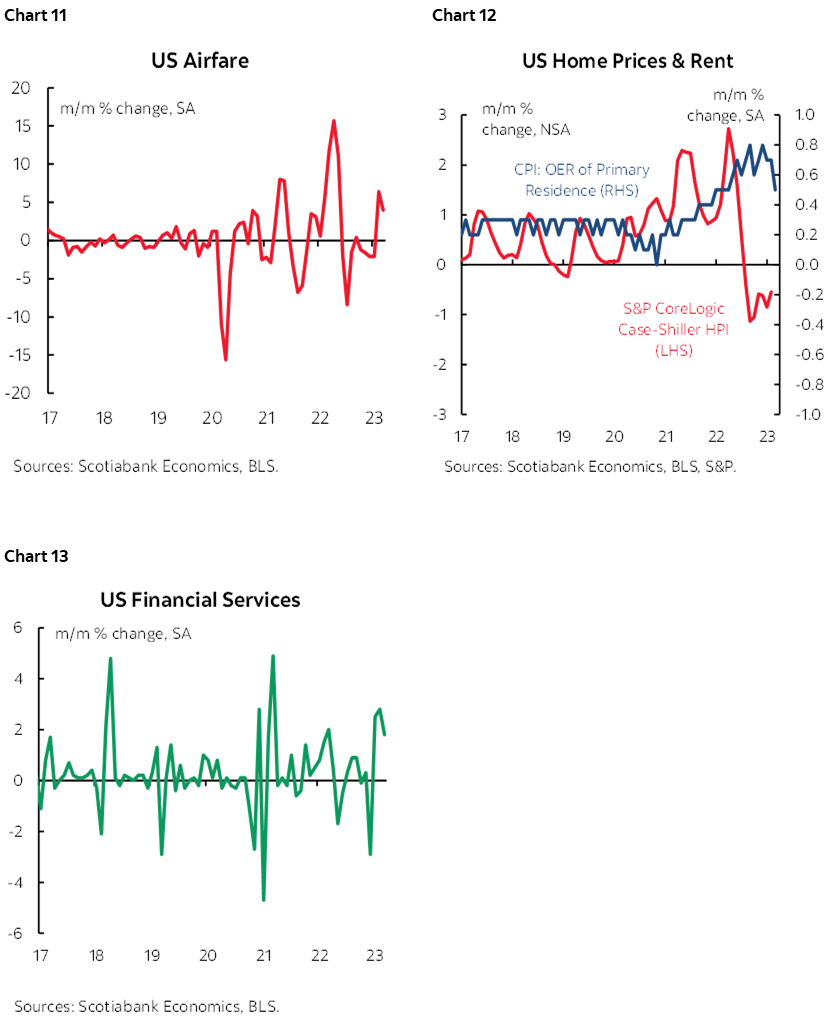

Charts 7 through 13 break down select parts of the basket.

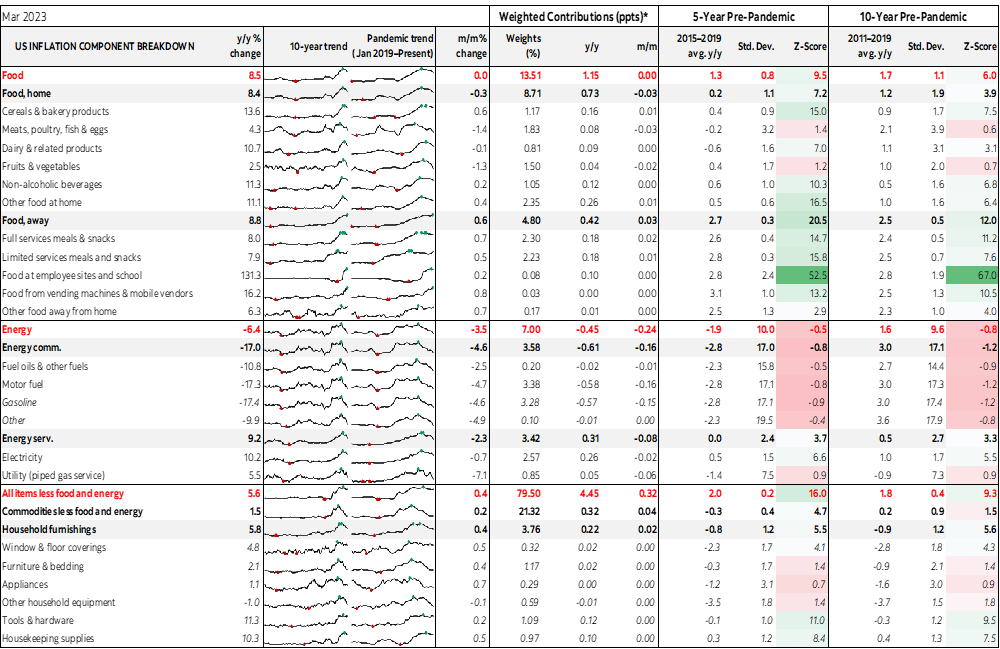

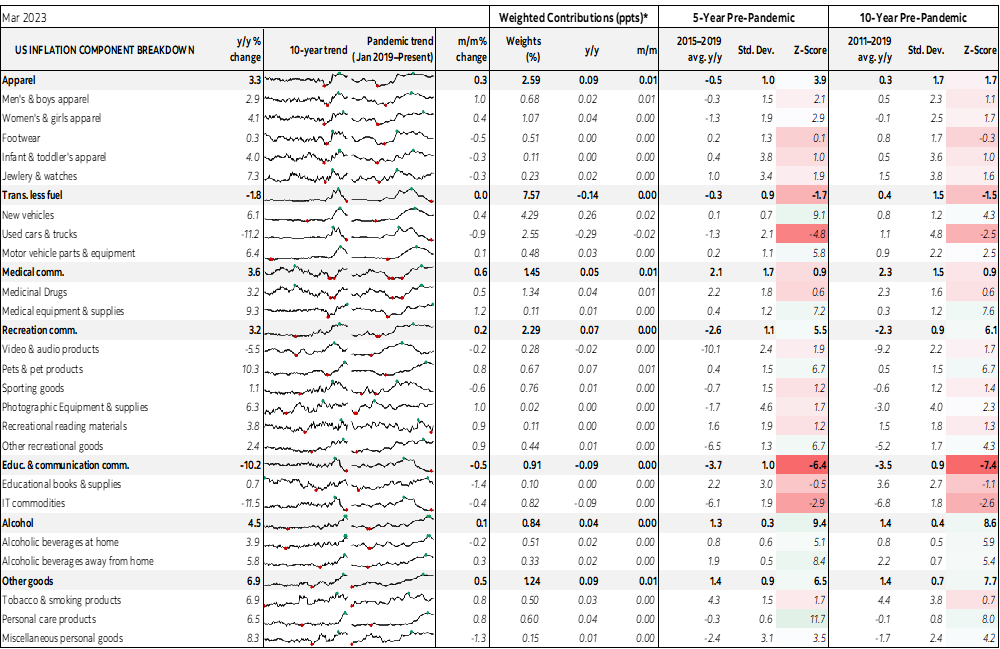

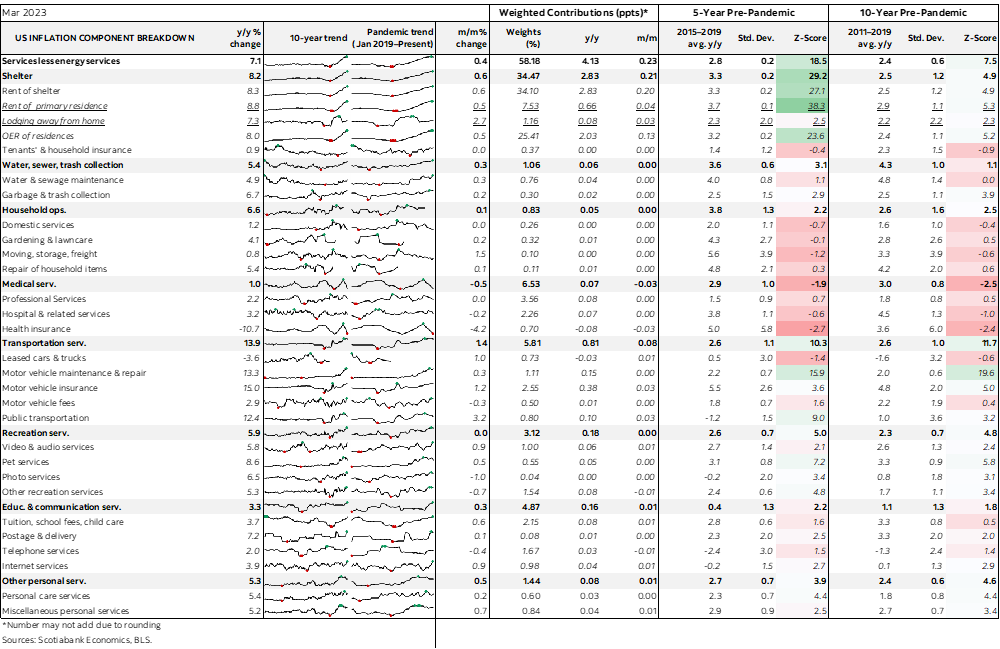

The accompanying table provides a richer breakdown of the basket including micro charts and z-score measures of deviations from historical averages.

Overall we have firm core CPI inflation and nonfarm payrolls and the decision on May 3rd may have enough evidence to go with in support of +25bps. Next up will be Q1 GDP on April 27th and core PCE inflation on the 28th.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.