Canada’s economy ended Q1 with strong growth…

...while baking-in Q2 momentum

Three-quarters—or more—of excess capacity has now been shut

Even if restrictions temporarily moderate the recovery…

...the economy should be on a path to closing spare capacity around year-end

BoC is expected to end GoC purchases by Fall after tapering again in July

CDN GDP, m/m % change, February, SA:

Actual: 0.4

Scotia: 0.5

Consensus: 0.5

Prior: 0.7

March ‘flash’ guidance: +0.9

Canada’s economy remains among the most resilient major economies in the world in the face of recurring COVID-19 risks. This morning’s figures point to strong growth in February, March and the overall first quarter while baking in momentum into the second quarter. Such a performance remains consistent with expectations around the evolution of spare capacity that sees it closing by year-end or early next year. That in turn sets the stage for further tapering steps by the Bank of Canada and ending purchases of Government of Canada bonds later this year ahead of the closure of spare capacity.

The economy has grown for eleven consecutive months and three consecutive quarters. That puts Canada, the US and Australia in a relatively exclusive club compared to the more erratic fits and starts that have plagued other major industrialized countries and regions including the Eurozone, UK and Japan.

THE DETAILS

Whereas February’s growth came in a touch softer than the ‘flash’ guidance that Statistics Canada had provided (0.4% instead of 0.5%), preliminary guidance for March more than makes up for that with the economy advancing by nearly a percentage point last month.

That translates into Q1 GDP growth of 1.6% q/q at a non-annualized rate according to the agency’s preliminary estimate, or over 6½% at an annualized rate which is very similar to the 6.4% Q1 growth rate in the US. The long time kindred spirits are locked in arms in terms of their economies and politics these days.

Canada is now only 1.3% away from a full recovery in monthly GDP back to February 2020 levels. Chart 1 shows this progress including the guidance for March.

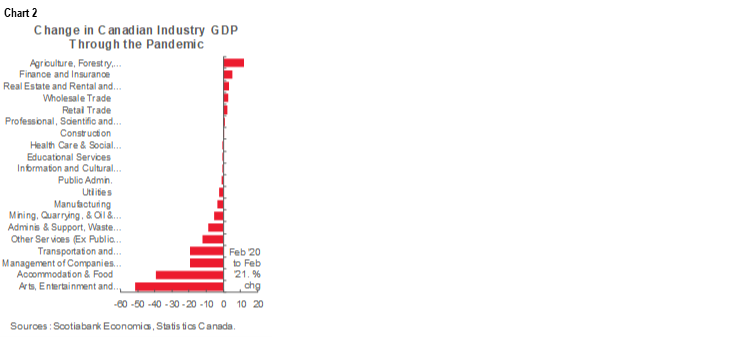

Chart 2 shows the wide variations across sectors. It shows the cumulative percent changes in GDP by sector from February 2020 before the pandemic struck with full force to February of this year (we don’t get the sector breakdown for March just yet). The sectors that are still sharply lower will surprise few. About 7–8 out of 20 sectors still face further material recoveries ahead while the modest majority have either basically drawn even or are ahead.

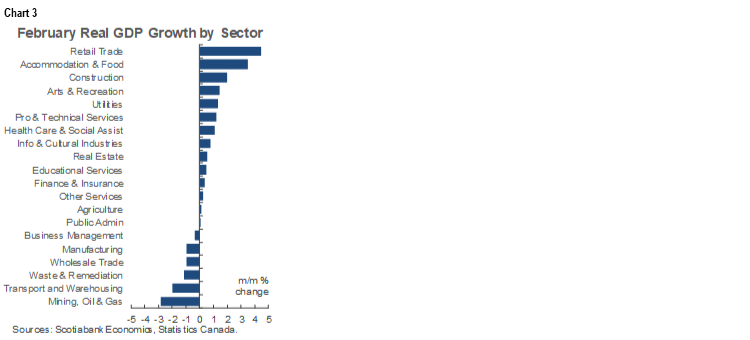

Chart 3 shows the weighted breakdown of February’s GDP reading by sector that had assists from 14 of 20 industries led by retail, construction and the public sector. Contractions were in mining/energy, manufacturing, wholesale, transportation and warehousing.

While we don’t get a breakdown for March, the verbal guidance indicated the biggest contributions came from manufacturing, retail, finance/insurance versus drags from mining/energy. That generally matches other data we have for March including a 303k job gain, a 2% m/m gain in hours worked, housing starts that soared to 335k (276k prior) and advance guidance that the dollar value of manufacturing sales was up by 3.5%, retail sales were up 2.3% and wholesale activity was up 0.9%.

THE HAND-OFF EFFECT

We can also infer what is baked into Q2 GDP growth so far and before getting any actual Q2 data. The way Q1 ended with a strong gain combined with the composition of the figures over Q1 bakes in about 3% q/q annualized growth in Q2. That’s a good starting shock absorber for the second quarter that began with tightened restrictions in the most population dense parts of the country. The start of the quarter is likely to be a set back, but then again, Canada has been resilient and posted economic growth throughout the rolling restrictions and easings.

WHAT IT LIKELY MEANS TO THE BANK OF CANADA

The BoC would likely be neutral toward these figures relative to their stance before hand. Recall the BoC's sharply revised Q1 growth estimate was for 7% so 6½–6¾% or so is in the ballpark of that estimate and won't materially surprise them. Recall they revised from -2.5% in the January MPR for Q1 to +7% in the April MPR and so the big shock to the BoC’s expectations was already incorporated. Also recall that the April MPR had forecast 3.5% growth in Q2 and so with 3% baked-in that too is tracking ok, pending Q2 data.

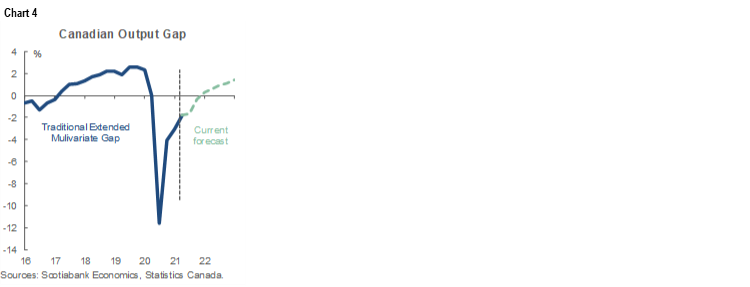

All of this likely means that the output gap is tracking close to -1.8% using the traditional method and around -3½% using the integrated framework method. These two gap measures were at about -12% and -14% respectively at their worst points for spare capacity in 2020Q2. Within just three calendar quarters, Canada has shut between 75–85% of spare capacity depending upon which measure is used (chart 4). That's blindingly quick.

Recall the operating assumption remains that GDP will be fully recovered by Q3 after a temporary restrictions effect and then all spare capacity should be shut by end of the year or early next depending on the measure. That has been the consensus-leading opinion of Scotia Economics for a while now.

What does it mean to the BoC’s purchase program? Recall that Governor Macklem has said he would shut down GoC purchases before spare capacity is shut. If spare capacity is shut by year-end or early next year, then the purchase program should end some time before then. So, in addition to penciling in another taper in July, I would expect purchases to be fully eliminated by Fall after which a reinvestment phase would ensue before hiking the policy rate in 2022. What the BoC 'should' do is another matter. They 'should' have already ended purchases in my view as they are serving no useful purpose while complicating the path out of massive stimulus that was put into place before vaccines and before a massive N.A. fiscal policy overshoot.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.