- What pandemic? Canada posts 10 straight months of growth

- January GDP beat consensus, February maintained momentum

- Q1 is tracking ~8 points stronger than the BoC’s forecast

- Slack is forecast to close later this year

- The BoC faces a major narrative shift at its next meeting

- Resilient growth may be a double-edged sword

CDN GDP, m/m Jan, %:

Actual: 0.7

Scotia: 0.8

Consensus: 0.5

Prior: 0.1

February preliminary guidance: 0.5% m/m

Canada’s economy is sailing right on through the second wave that included full lockdowns in major parts of the country and it is doing so in very resilient fashion. This may serve as guidance that it may continue to do so through a third wave of COVID-19 cases.

January GDP growth of 0.7% landed in line with Scotia’s estimate and above consensus which was skewed lower by multiple shops that curiously went below StatsCan’s earlier ‘flash’ guidance of 0.5%. While modest growth had been likely for February’s flash guidance, the initial estimate of 0.5% was somewhat stronger than anticipated.

CLOSER TO A FULL RECOVERY

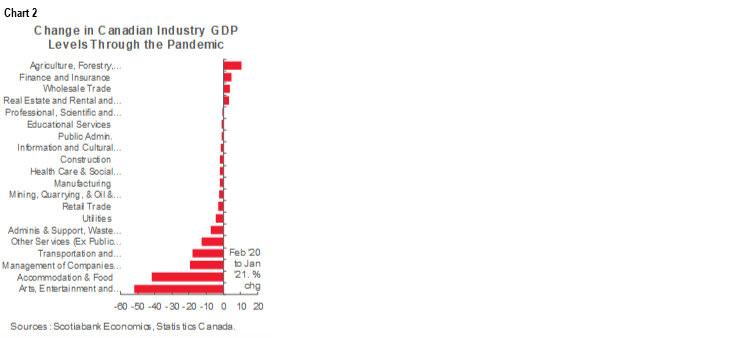

To date including February’s guidance, Canada has now almost fully recovered toward last February’s pre-pandemic economy. GDP is now at 97.9% of where it stood back then (chart 1). A full recovery toward 2019Q4 GDP levels is forecast by 2021Q3. On a sector basis (chart 2), some industries are experiencing overall net growth, many are now relatively flat on net, and most of the shortfall remains focused upon 4–5 sectors and two in particular that are the ones most directly hit by restrictions and lockdowns.

As a consequence, GDP growth during Q1 is now tracking at about 5.6% at a quarterly annualized pace. That’s based upon revisions stretching back to January of last year, January growth of 0.7%, preliminary guidance that growth of 0.5% occurred in February while assuming a flat March in order to focus upon the effects of what we know so far.

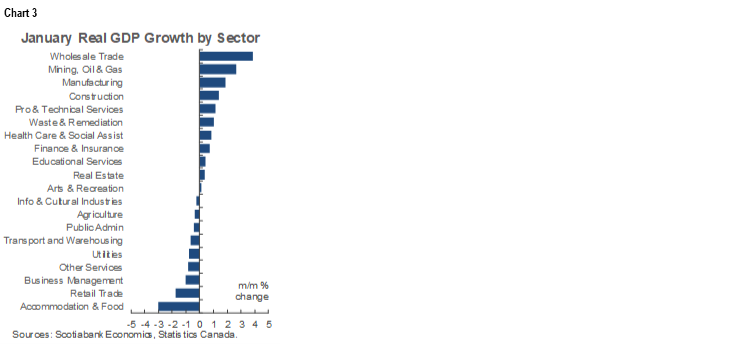

As for the sector breakdown of growth in January, see chart 3.

As for February GDP, we don’t get any firm details behind the flash guidance of +0.5% m/m and have to wait until the next report to get the sector breakdown. Still, there is verbal guidance from StatsCan that retail trade, construction, real estate/rental/leasing added to growth while manufacturing subtracted.

HOW THE BoC PLAYED IT VERSUS THE FED

It’s important to note the contrast between how the Fed played the second wave’s possible effects on the US economy versus how the Bank of Canada played it. By comparison, the Fed made a much better call as explained in the following two points.

- Recall that the Bank of Canada had forecast a Q1 contraction of 2.5% in the January MPR by assuming that the economy would shrivel in the face of second wave risks. They weren’t alone, so this isn’t meant to pick on them, but it is the country’s central bank that sets monetary policy and so therefore it’s their forecast hits and misses that matter to policy expectations. A contraction was indeed a plausible outcome, but the economy appears to have successfully adapted to the virus. It is of note, however, that the BoC’s narrative appeared to change rather slowly since last Fall.

- Fed Chair Powell, however, had noted much earlier that the US economy was more resilient to the virus than expected since last summer, so perhaps the economy would continue to be resilient. Powell therefore sounded cautiously optimistic in that regard and by contrast to the BoC. Given how intertwined the two economies are, the difference in how the relative central bank risks are evolving relates to assessing how the BoC’s chosen forecast bias and policy reaction function have evolved differently from the Fed’s.

PENDING BoC FORECAST REVISIONS

The BoC is therefore facing an upward revision in the 8 percentage point range for Q1—and maybe more—when it publishes a revised forecast on April 21st. There is a difference between tracking based on monthly GDP versus quarterly GDP including, among other things, how inventory and import changes can drive differences, but the general point is that a massive forecast upgrade is in the works on the heels of getting twice what they expected for 2020Q4 GDP growth and much stronger Q1 growth.

What it is likely to mean on April 21st is that the BoC will have to significantly reduce their estimate of slack at present, so unless they play with the potential GDP numbers, they’ll have to bring forward closure of the output gap into 2022 from 2023. We actually get this measure of spare capacity shutting by the end of this year or early next but I doubt they’d go that far.

BoC POLICY

Governor Macklem is still likely to emphasize that durable inflation requires recapturing many of the 600k jobs that are still lost to the pandemic—but probably fewer after next Friday’s figures—and that there remains significant uncertainty over the path the virus might take especially given that it remains just a forecast to get the population vaccinated.

In terms of policy, I expect the BoC to reduce GoC bond purchases at the April 21st meeting, but stick to Gravelle’s guidance (recall here) that even after they end purchases later this year they’ll reinvest for a period before hiking which remains some time away. We have a hike in 2022Q4 and still emphasize the risk of going earlier. My personal preference would be to see this bond program end outright very soon and get on with hiking earlier than we forecast and within the next year, but the BoC is likely to play it more cautiously.

RESILIENCE MAY BE A DOUBLE-EDGED SWORD

Why are we getting resilient growth? Policy helps, but it’s much more than that. Businesses and households have adapted. There has been a much more powerful response to low rates in the household sector than the BoC judged when it rolled out these programs. Beneficial market and policy effects have been imported from elsewhere. Vaccine roll-out—as frustrating as it may seem—is occurring far earlier than anything assumed when heavy stimulus was first put in place.

Going forward, however, resilient growth may be a double-edged sword. It may encourage Canadian policymakers to reimpose restrictions soon as third wave cases rise and that could mean a soft entry to Q2 but a stronger exit. Second, even as vaccine roll-out accelerates, rising cases and renewed restrictions could provide near-term cover for fiscal policy to keep heaping on very heavy amounts of long-lived stimulus in both the US and Canada including within the next Federal budget on April 19th. That’s especially likely if government policymakers have convinced themselves—rightly or wrongly—that they are entirely responsible for rescuing the world economy. The cost to dollops of endless fiscal stimulus should be earlier monetary policy exits, but this could shape up to be a heavily monitored test of central bank independence from government narratives.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.