- Canada’s Parliament is set to resume on November 22nd with a ceremonial Speech From the Throne outlining broad priorities for the mandate ahead. A fiscal update would follow shortly thereafter establishing an economic and fiscal baseline, while also likely delivering on some initial election promises.

- Key priorities for the next mandate have been well-channeled (and some already legislated): $10/day childcare, affordable housing, a ‘just’ climate transition, an already-met ‘one million jobs’ pledge, and a host of other largely socially-oriented spending promises. Recall, the Liberals’ election platform laid out $78 bn in new spending measures offset by $25 bn in targeted revenue measures.

- The government still faces further spending pressures in the context of a minority reign, but these should be relatively contained. Meanwhile, last month’s curtailment of the federal government’s hallmark pandemic programs has removed one element of upside fiscal risk.

- However, the wind-down of these programs is far from a hawkish turn by the Finance Minister. Fiscal policy is still leaning into the wind with much of the Spring’s $100 bn stimulus still in the pipeline and another $52 bn in election promises in the wings.

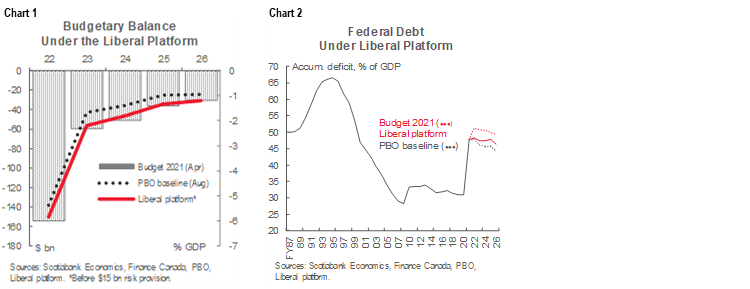

- If and when election promises are folded in, the bottom line isn’t likely to look much different relative to the government’s last update in the Spring despite a stronger nominal growth outlook (chart 1). Debt projections may look only marginally better (chart 2).

- With an output gap expected to close by the middle of next year amid strained labour markets and soaring inflation, the Bank of Canada has recently signaled a more aggressive path to tightening its policy levers.

- The Finance Minister may be wise to pause this Fall as the economy navigates turbulence in the months ahead lest she be seen fueling the flames that could put all the more strain on affordability pressures for Canadians. Expect at least to hear a shift in tone in the weeks ahead—directed at markets—that she is mindful of the risks of ‘too much’ and not from a sustainability perspective, but from one of stability.

- Whether markets listen is another matter. As global bond markets continue to be roiled by developments south of the border, news of Canada’s rather benign fiscal position—with a general government deficit approaching balance by 2023—should fade quickly.

BACK TO BUSINESS

Canada’s Parliament is set to resume on November 22nd. In keeping with tradition, the session will be opened with a ceremonial Speech from the Throne by the Governor General that lays out priorities for the next mandate in broad swathes. Details are often scant. A fiscal update would be expected shortly thereafter—most likely in early December—that would set out an economic and fiscal baseline for the next mandate. The government could also be expected to deliver on some quick wins in what usually amounts to a mini-budget.

A not-yet-convened Parliament has not held back business on the economic front. Finance Minister Freeland was renamed to her post shortly after the elections and ahead of other Cabinet announcements, lending continuity to this key position. She flexed her powers early with an announcement in late October that two hallmark pandemic programs would not be extended (more on this later). Key Cabinet members have also been busy reaffirming Canada’s climate goals at COP26.

A lot has changed since the last federal fiscal update...and little has changed. Since April’s Budget 2021, nominal growth is tracking over 3 ppts higher this year according to Scotiabank Economics’ latest forecasts—boding well for government revenues—though real GDP has taken a hit from supply constraints. More than 80% of eligible Canadians have been vaccinated against COVID-19 now, whereas third waves were surging at the time of the budget. Inflation is now soaring well-above last Spring’s consensus forecasts. A new government that looks almost identical to the last one provides some sense of things to come.

NO SURPRISES ON BROAD THEMES FOR THE NEXT PARLIAMENT

Recent election campaigning suggests there should be no major policy surprises under the next mandate. The Liberals’ economic platform largely focused on unfinished business: implementing the already-announced childcare plan, doubling down on its climate agenda, pushing forward with a plethora of initiatives around its “one million jobs” pledge, advancing a host of measures to address housing affordability, and plugging holes in various social systems. In total, the Liberals had promised $78 bn in new spending measures, paid for—in part—by targeted revenue-side measures ($25.5 bn) for net new spending of $52.6 bn over five years (chart 3). (See Box 1 at the back for a summary of Liberal platform commitments.)

A clearer sense of priorities emerges when dollars are attached to earlier promises. Almost 40% of spending pledges (or $29 bn) would target social supports, delivered mostly through conditional transfers to provinces related to healthcare, mental health, and long term care. Housing measures represented another 20% of the platform commitments (or $17 bn), followed by government expenditures (at 12% or $9.5 bn) spread across an expansive set of priorities, and targeted household transfers (11% or $8 bn)—notably increases to the Guaranteed Income Supplement (GIS) for seniors as well as student loan provisions.

While much may be made of possible concessions in a minority government context, we do not expect the government to unleash major new spending commitments. The previous Liberal minority government was largely able to advance its priorities, while other left-leaning parties no doubt calculate that they can achieve more working with the leading party than without. We are nevertheless watchful of this assumption. In particular, the Liberals had committed to universal pharmacare in their 2019 Speech From the Throne (ramping up to over $11 bn annually according to the Parliamentary Budget Officer), but subsequently walked back from this in favour of a more incremental approach.

FIRST ORDERS OF BUSINESS

A Fall fiscal update should start revealing practical intentions of the new government. It is unlikely to codify all platform pledges—if only pragmatically—given the government is still working on implementing Budget 2021 commitments that injected over $100 bn in stimulus over three years. Its platform, however, did include about 30 new measures with funding implications this fiscal year (i.e., ending March 31, 2022), so this list is a likely starting point.

Any immediate spending measures would likely largely focus on outstanding pandemic gaps. Almost half of the $13 bn of the platform’s proposed spending measures for FY22 would be transferred to provinces ($6 bn) to eliminate surgical backlogs, along with $1 bn for a national COVID-19 Proof of Vaccination Fund. Another $1 bn would extend targeted business supports, while the balance would target a range of other measures from Indigenous housing, assault weapons ban, indoor air quality, firefighter training, plus another 20-odd smaller promises that would see funding going out the door this year.

Revenue measures would likely be more circumscribed. The platform penciled in incremental revenues of $436 mn in FY22, notably from a 3% surtax on banks and insurers with profits over $1 bn, along with a minimum tax rule (15%) on top earners to prevent excessive deductions. These appear likely to proceed. Other big ticket items from the campaign trail—like the Canada Recovery Dividend—must still undergo consultations so it would be premature to expect details this Fall. Closing tax gaps will also take time with high uncertainty on its revenue-generating capacity so the government may be reticent to book (and spend against) income just yet.

RETOOLING THE JOBS PLEDGES

Credit is owed for acknowledging that signature pandemic programs were no longer fit-for-purpose. On October 21st, Minister Freeland shuttered the Canada Recovery Benefit (CRB) program and substantially (re-)targeted wage subsidies through to the Spring, proclaiming success on the “one-million jobs” pledge. The latest job print in October showed Canada had fully recovered lost jobs and then some with labour force participation also back to pre-pandemic levels. Unfilled jobs are soaring, while wage appreciation continues against tight labour market conditions—by most metrics.

There is a gap, but the CRB was no longer closing it. Chronic unemployment has remained elevated with almost 30% of the unemployed out of work for more than 27 weeks. Media has also reported that internal government analysis shows a majority of CRB recipients were “continuous or repeat beneficiaries”. At its demise, there were about 535 k Canadians relying on the income replacement transfer at a monthly cost to the government in the order of $1 bn.

This—along with the reformulation of the wage subsidy—should not materially impact fiscal projections. Both programs were set to expire days later with the CRB having exhausted allocated funds, while the wage subsidy likely has about $10–15 bn in unallocated funds remaining. Refocusing the wage subsidy on hardest-hit sectors including a carve-out for tourism and hospitality should largely absorb its remaining balance along with another approximate $1 bn pledged on the campaign trail (charts 4 & 5). These announcements do remove an upside fiscal risk that programs could have been extended once again as they had been repeatedly over the last twenty months.

There are potential material near-term economic implications of these changes. A critical question is the degree to which the half-million Canadians relying on the CRB are able to secure a job, keep looking for one, or drop out of the labour force entirely (or further complicating the picture, already have a job since earned income was allowed up to $38 k). If they do not find work, the impact would in essence be a negative income shock of $1 bn per month to household incomes—at a not-immaterial 0.3 ppts of GDP (annualized)—if one assumes a high propensity to spend (e.g., a fiscal multiplier of 0.6) according to Scotiabank Economics’ René Lalonde. On the other hand, gainful employment would offset this sharp drop. The most probable outcome is likely somewhere in between but with a net-dampening bias.

The Finance Minister will have one—possibly two—additional job prints before setting out a retooled job plan. The government has already initiated consultations—and set aside funding—for a revamped Employment Insurance program that would expand coverage to those currently without this fallback. It would be premature to see details this Fall, but expect more to come in the year ahead.

More is likely needed to address other structural factors that have led to pockets of persistent unemployment. This includes skills mismatches, mobility, and inclusion barriers where it would likely take very targeted interventions—and not big price tags—to close important gaps. The government has already set out a host of such programs, but it may be time to dust off the earlier ‘guardrails’ concept to ensure a sharp focus on outcomes. And this is only a warm-up as the success of its climate agenda rests, to a large extent, on its ability to navigate “just” transitions for affected workers in the years ahead.

ECONOMIC & FISCAL IMPLICATIONS

Otherwise, policy developments at the federal level over the coming weeks are unlikely to materially impact the economic outlook. We expect some volatility in labour market prints as the fallout of the CRB settles, but our baseline already assumes it will take several quarters yet to see unemployment return to pre-pandemic levels. Any dampened household consumption may be masked by broader supply chain issues and a rotation to services that are already distorting economic indicators such as retail sales. Furthermore, these would likely be offset (with a lag) by promised increases to other Canadian households with a propensity to spend (namely, GIS top-ups to seniors). Childcare and housing supply measures should boost potential over the medium term, but are unlikely to drive our near term outlook. Finally, the small incremental injection of fiscal support expected later this Fall (i.e., $12 bn or 0.5% of GDP) is, in large part, a shift from federal to provincial balance sheets as provinces are expected to bank windfalls for the most part.

The fiscal path should look largely familiar. Budget 2021 projected a rapid wind-down of temporary pandemic supports with the deficit falling from its -15% peak in FY21 to -2.3% of GDP by FY23, eroding very modestly thereafter to just above -1% of GDP by FY26. These were based on a weaker economic growth outlook at the time; if consequent government revenue windfalls were banked, our models suggest this year’s deficit would come in closer to -5.7% of GDP this year versus Budget 2021’s projection of -6.4%. But once an anticipated $12 bn in additional spending is folded in, the deficit would be back up to mid-6% of GPD. Even though we do not expect the full election platform to be legislated this Fall, if (or rather, when) these other measures are incorporated under current economic assumptions, the math would be similar in outer years, i.e., revenue gains from a stronger economic growth outlook would be erased by new spending commitments (chart 1 again).

The debt profile should show slight improvements relative to the government’s last update. Budget 2021 had projected the federal accumulated deficit peaking at 51% of GDP in FY22 (up from the pre-pandemic 31%) before beginning to bend very gradually back down. Since then, a faster-growing denominator has more than outpaced the accumulation of additional spending (and revenue dividends) such that the PBO had been anticipating debt would top-out just under 48% of GDP this year. Election platform promises would erode some of these gains with the effect of slowing the pace of decline. By the end of the projected horizon, debt could be closer to 46% of GDP, about 2 ppts higher than PBO’s baseline (chart 2 again).

A modestly downward debt profile will likely remain the government’s soft fiscal anchor. This has been the case since the Liberals first came to power in 2015. Markets have so far shrugged off official projections putting federal debt just above 50% of GDP for several updates now since the pandemic struck. There is hardly an imperative from the government’s perspective to put binding constraints on its actions now (whether they should is a different question). Given the Fall fiscal update would essentially provide the fiscal baseline against which future developments would be assessed, we will be watching how the government incorporates future spending plans—not yet legislated—into its projected fiscal path such that it can continue to under-promise and over-deliver in subsequent updates.

MARKET MATTERS

Given deficit-financed spending should not change relative to the government’s debt management strategy set out in Budget 2021, this is unlikely to change expectations around supply—in isolation. Revenue improvements would more or less finance incremental needs related to expected spending increases this year at least. In fact, it is possible that the Fall update sheds light on modestly lower supply this year relative to what was laid out last Spring. Scotiabank’s fixed income specialist Roger Quick has been carefully covering government securities auctions where the pace of supply currently falls short of Budget 2021 expectations. There are a variety of factors that could account for this, including highly unpredictable off-budget items (e.g., revenue-side improvements and/or lower provisioning for Crown corporations) that could easily reduce borrowing requirements this year (and possibly next year). This is another assumption we will be monitoring in the Fall fiscal update.

Any implied supply shifts in the quantums that could reasonably be expected should not attract much attention from markets. The Speech from the Throne rarely elicits a market response, while a fiscal update could very well be delivered into markets that may be digesting (or still weighing the likelihood of) another USD1.9 tn in stimulus and/or an accelerated rollback of Federal Reserve purchases. These US developments have the potential to further roil markets with more bear-steepening ahead for yield curves globally that could see governments around the world paying more to finance deficit spending. It is worth noting that the balance of (fiscal) risks in Canada and the US are diametrically opposite: substantial additional stimulus has been on the table in the US for some time—now with a high probability it won’t pass, at least not in full, whereas additional Canadian stimulus on the table (i.e., platform commitments) have a far likelier chance of passing with further upside given the leading party’s history and the coalition context. This differential could matter insofar as it shifts relative expectations around policy rate increases.

In the near term, the federal fiscal position underscores a potentially more aggressive tightening path for the Bank of Canada. The output gap—albeit a difficult metric to pin down—is expected to close somewhere in the “middle quarters” of next year. In FY23 (approx. calendar year 2022), the federal government could be adding around 1.6% of GDP in support including Budget 2021 stimulus, as well as platform pledges (chart 6). A modest fiscal multiplier of 0.3 would imply a 0.5 ppt growth impulse. Meanwhile, a sustained 25 bps increase in the overnight rate is typically expected to dampen growth by about 0.1 ppts. While we don’t expect the Bank to respond one-for-one (including because of the potential offsets from provincial tightening), it clearly adds to the risk of more aggressive tightening, particularly if employment, wages, and inflation overshoot expectations.

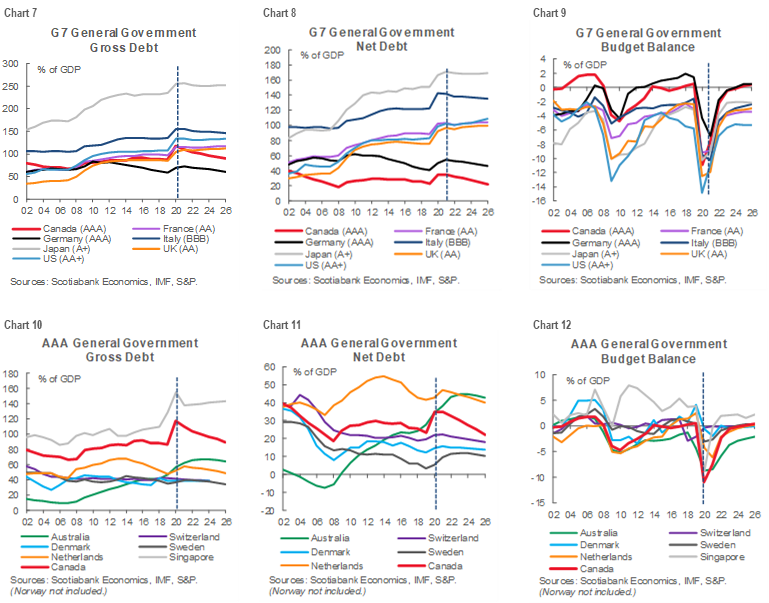

In terms of sustainability and risk premia, Canada’s fiscal stance still tracks advantageously in global bond markets where relativity matters. According to the IMF’s October projections, Canada’s general government net debt (that is, total federal and provincial debt less financial assets) stands below its G7 peers, while it is middling on gross terms...but should hardly be criticized for its practice of funding pension liabilities from a long-run fiscal sustainability perspective. There has been a step-change in debt levels for all sovereigns around the world where—among advanced economies at least—the size of the increase has largely been driven by the fiscal capacity to do so. (See charts 7–12, next page, for comparative debt metrics.)

Rating agencies and markets may differ slightly on the appropriate definition of “peers”. Markets are more likely benchmarking Canada to its G7 peers where bond markets are deep and liquid, whereas rating agencies will be scrutinizing Canada’s position vis-à-vis a dwindling cohort of gold star economies. Canada is hardly defined as a leader of the pack here, but still offers economy of scale—and more importantly—is among the very few in either group that is still offering any decent yield pickup.

Looking ahead over the next few years, the relative trajectory of Canada’s debt should matter more than the level. Canada’s general government deficit path should actually approach balance (within half a percent of GDP) by 2023 and could be in surplus by 2025, according to the latest IMF projections. Germany is the only other G7 peer that foresees a return to balance over this horizon, and even among AAA peers, Canada’s slope looks pretty good. A slightly higher trajectory of federal spending should be more than offset by lower spending among provinces (a case-in-point, Ontario has recently tabled fiscal improvements—amounting to almost $34 bn in two years alone—in what is expected to be a string of good-news stories for provincial finances in the months ahead). It provides some breathing space for now at least until others start embarking on more aggressive consolidation paths.

Nevertheless, the federal government should not rest on its laurels. Pending elections in several major provinces could rapidly shift the landscape, while the longer term picture looks less favourable for provinces given structural factors. It is a matter of when—not if—Canada will face another recession. We’ve learned that having the fiscal firepower to respond can help avoid the worst in a downturn. Hopefully these conversations have been initiated internally, but we are unlikely to see the federal government putting more aggressive consolidation on the table just yet.

READING BETWEEN THE LINES

The biggest potential shift this Fall from Canada’s federal treasury might be one of tone. The Finance Minister has earned credibility in rolling back temporary spending measures, but this should hardly move the dial on the fiscal front as much of the spending is already in the pipeline and is only indirectly—at best—related to the pandemic factors. Election promises—if enacted as expected—are fairly marginal (about 2.5% of GDP over 5 years). While the fiscal stance looks neither excessively loose nor excessively restrictive over the medium term, the near term risks to exacerbating demand-supply shocks and further fueling price shocks are high. The Finance Minister may want to hold off on unveiling additional measures this Fall as economies around the world navigate a few turbulent months ahead, lest her efforts signal that the Bank of Canada is single-handedly charged with managing any fallout.

BOX 1: SUMMARY OF LIBERALS’ 2021 ELECTION PLATFORM COMMITMENTS

Employment

- Pledge to create one million jobs

- Extended the Canada Recovery Hiring Program until May 7, 2022 at a 50 per cent rate (announced Oct. 21st)*

- New Tourism and Hospitality Recovery Program for wage and rent support (40-75% revenue loss) until May 7, 2022 (announced Oct. 21st) *

- New Hardest-Hit Business Recovery Program (50-75% revenue loss) until May 7, 2022 (announced Oct. 21st)*

- New Canada Worker Lockdown Benefit at $300 a week to workers subject to a lockdown (announced Oct. 21st)*

- Extended Canada Recovery Sickness Benefit and the Canada Recovery Caregiving Benefit until May 7, 2022 (announced Oct. 21st)*

- EI for self-employed Canadians ($1.3 bn, consultations underway to be launched January 2023)

- Create Career Insurance Benefit (layoffs when business closes)

- Futures Fund and Clean Jobs Training Centre ($820k)

- Increased the federal minimum wage to $15 (already passed, coming into effect in December 2021)

- Ensure PSW's paid $25/hr

- Enhance the Canada Workers Benefit

- Create the Canada Disability Benefit

- Career Extension Credit for workers over 65 ($2.8 bn)*

Housing

- Build, preserve or repair 1.4 mn homes in four years

- New Housing Accelerator Fund ($4 bn to cities)

- Reduce the price charged by CMHC for mortgage insurance by 25% & increase cut-off to $1.25 mn

- New Rent-to-Own program ($1 bn)

- New Multi-Generational Home Renovation Tax Credit ($500 k)

- Double the First Time Home Buyers Tax Credit ($450 k)

- Home Buyers’ Bill of Rights (incl. to ban blind bidding)

- Ban foreign ownership of new homes for the next two years

- More flexible First Time Home Buyer Incentive

- Ensure banks/lenders offer mortgage deferrals for 6 months in the event of job loss

- Establish anti-flipping tax

Climate

- Committed to reduce greenhouse gas emissions by 40-45% below 2005 levels by 2030 (prior)

- Legislated net-zero emissions by 2050 (prior)

- Established a federal carbon tax, rising by $10 per year ($40/tonne in 2021) to $170 per tonne by 2030 (prior)

- Cap emissions from the oil and gas sector, with five-year targets starting in 2025

- Reduce oil and gas methane emissions by 75% below 2012 by 2030

- Ban thermal coal exports

- Phase out public financing of the fossil fuel sector (including Crown corporations)

- Move forward on Border Carbon Adjustment tax with trading partners

- Expand Net Zero Accelerator Fund (to $8 bn)

- Expand Zero Emission EV rebates and charging infrastructure (to $2.1 bn)

- Clean tech tax incentives ($800 k)

Health

- Additional $6 bn to provinces in FY22 to eliminate backlog in surgeries (for total of $10 bn)*

- $4.5 bn to provinces for mental health services

- Expanded access to family doctors ($3.2 bn)

Child Care

- Continue progress on $10 a day Canada-wide Early Learning and Child Care System ($30 bn over five years in Budget 2021)

- Reduce fees for child care by 50% in the next year

- $2.5 bn for Indigenous early learning and child care

- Build 250k new child care spaces

Seniors

- Increase the Guaranteed Income Supplement ($500 for singles, $750 for couples, $4.5 bn)

- Expanded Canada Caregiver Credit ($2.5 bn)*

Research

- New Canada Advanced Research Projects Agency ($2 bn)

- Reform the Scientific Research & Experimental Development Program

Revenue Measures

- CRA measures to reduce the tax gap ($11.9 bn)

- Canada Recovery Dividend ($5.5 bn)

- 3% surtax on banks & insurers with profits over $1 bn ($5.3 bn)*

- 15% minimum tax rule for top earners*

Sources: Scotiabank Economics, Liberal platform. *Notional funding set against FY22.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.