SITTING ON THE SIDELINES FOR NOW

- Canada’s Finance Minister tabled her first fiscal update since September’s elections gave the Liberals another minority reign.

- The Update broadly met expectations in so far as it largely resisted adding further spending (for now), while adjusting revenue expectations higher owing to a stronger economic recovery since last Spring’s Budget 2021.

- The Update shows an additional $71 bn (net) in new measures over the horizon (FY21–27), with the bulk of this reflecting additional pandemic-related measures or provisions ($31 bn), provisions for addressing past Aboriginal harms ($24 bn net, $40 bn gross), and support for floods in British Columbia ($5 bn).

- Meanwhile, revenue over-performance over this period—at $107 bn—more than offsets this incremental spending, even after a slight overshoot on expenses ($15 bn) is accounted for.

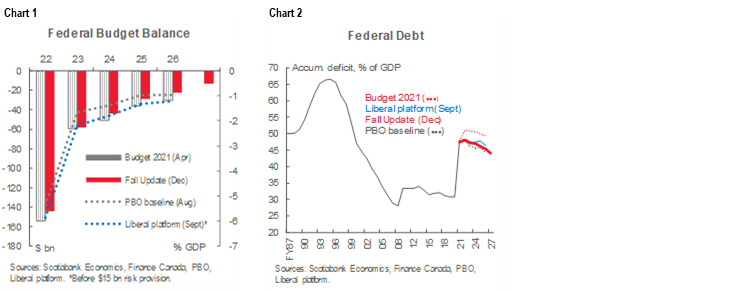

- The net impact is a slightly narrower deficits over the horizon: -5.8% and -2.2% of GDP in FY22 and FY23, then trailing off to -0.4% of GDP by FY27. These are only modestly above pre-election baselines (chart 1).

- The debt profile is similarly tracking on a slightly steeper—but still slight—downward trajectory. It is expected to peak at 48% of GDP this year and decline gradually to 44% of GDP by FY27 (chart 2).

- Our read is that today’s Update is a pause, not a pivot in the fiscal stance. The Minister is likely waiting for inflationary pressures to begin softening—with any hopes—in time for a Spring budget where a suite of election promises would be rolled out.

- There is little overlap in today’s $71 bn and the $78 bn ($53 bn net) pledged on the campaign trail underpinning the spending bias of this government.

- While the potential quantum of additional fiscal support down the road is relatively modest, it signals that the onus is fully on the Bank of Canada to lean against the strong economic recovery underway.

READING THE TEA LEAVES

Finance Minister Freeland tabled an economic and fiscal update today. This was sandwiched in between yesterday’s renewal of the Bank of Canada’s mandate (discussed here) and tomorrow’s elaboration by Governor Macklem on the new mandate (and, perhaps more importantly, a US FOMC policy statement and fresh projections also on Wednesday). The 2021 Economic and Fiscal Update (Update) provides the first official glimpse of the (same old) new government views on the current economic and fiscal outlook since April’s Budget 2021.

You wouldn’t be faulted for wondering what the government really thinks about the current economic conjuncture. By most metrics, labour markets had fully recovered already in September (and continued to steam ahead through November). In late October, Minister Freeland signaled a shift by scaling down pandemic supports, but—far from a hawkish bent—she in fact had to seek modest incremental funds for the more targeted programs (re-announced today). Last week’s statement-only rate decision by the Bank of Canada arguably sent a more hawkish message in finally acknowledging mounting wage pressures. Monday’s renewal of the Bank’s mandate now explicitly incorporates full employment as a ‘consideration’, while Minister Freeland today nevertheless added a bit more fiscal support to the mix, near-promising more to come in the Spring.

Do they or don’t they think that labour markets have largely healed? And, more importantly, what role do they see policy supports playing going forward? Most messaging suggests they believe labour markets have largely recovered (albeit with a lot of nuancing). The government concedes that the number of jobs, the unemployment rate, hours worked, and the participation rate (including among key demographics such as women and youth) are at or above pre-pandemic levels. These were some of the vague “fiscal guardrails” Minister Freeland had suggested last year would guide the removal of fiscal support. However, the Update still cautions “Canada still has ground to make up to reach the strong and inclusive conditions seen before the pandemic.”

The challenge is that fiscal policy tends to be a slow-moving ship that takes forethought to slow, let alone turn-around, once the engines are cut. Even though many countries like Canada have more or less let up on massive injections of new fiscal stimulus, there is still substantial support working its way through the system. Over half of $101 bn added in last Spring’s federal budget is still to be disbursed in the two years ahead. Meanwhile, earlier government support has amassed on household and corporate balance sheets and will continue fueling the recovery over the next 18–24 months, at least, as it is cautiously unwound.

This Update largely met our expectations. Namely, it demonstrates substantial revenue windfalls since the last official update eight months ago, while folding in only a few must-do items as the fiscal year end rapidly approaches (accounting for the six-week Parliamentary recess). The $71 bn added today comes with some caveats. A net $24 bn reflects provisions for on-going negotiations around historic harms to Aboriginal populations, of which a net $10 bn is booked against FY21 accounts finalized today. Two-fifths of incremental support falls this year (FY22), with much of it consumed around Omicron and BC flood-related assistance. Importantly, very little of the $71 bn appears to comprise of election pledges.

Even though today’s update layers only a very modest amount of additional spending, it confirms a dovish bias on the fiscal front. Today was more of a pause than a pivot. We still expect that much of the $78 bn in new election promises (less $25 bn in revenue measures) is still on the table even if it was not laid out today. The Minister has promised as much in communications surrounding today’s release. Unlike other governments (notably, the US), even in a minority government context, the passage of legislation faces a much lower bar in Canada.

Minister Freeland had promised a fiscal anchor “when the economy stabilized”, but fiscal hawks will be left wanting. The Update implicitly relies on this government’s highly predictable soft anchor of a downward debt trajectory measured as a share of the economy. This has given them much room to maneuver with nominal GDP surprises unlocking further headroom—demonstrated today—as both the deficit and debt trajectories are on modestly improved paths without a concerted effort on part of the government. While the level of debt is not particularly alarming (discussed later), the pro-cyclicality of this anchor provides little guidance in adapting to the economic context.

Setting aside the question of whether they should adopt a more aggressive path to fiscal consolidation, this government is unlikely to do so, at least under this mandate. Canada’s labour markets face a challenge of skills mismatch that will not likely repair overnight with unfilled job growth outpacing the decline in unemployment. If the government’s climate plans are taken at face-value, there could be more labour market transitions in the years ahead. All this to say that the government’s inclusive growth agenda likely provides (political) cover to take a more hands-off approach to the fiscal path ahead as long as the growth of the economy outpaces the accumulation of debt.

This puts the onus on the Bank of Canada to continue navigating exits. This should offer some degree of certainty for markets in attempting to anticipate the timing and sequence of next policy steps against an otherwise clouded outlook. While incremental demand support (i.e., that which has not already been legislated) is only marginal to current inflationary pressures, the Bank does not need to hedge against any real risk that its fiscal counterpart could be dampening demand anytime soon.

Markets are expected to largely look through today’s Update beyond confirming the spend bias. For one, its content had been well-channeled via media leaks. Economic and fiscal developments since April have also long-since been factored into street views. Heightened volatility in markets at present is as much about positioning as it is about fundamentals. The Update may bridge Monday’s dovish interpretation of the Bank’s mandate renewal to a potentially more hawkish interpretation of clarifications by Governor Macklem tomorrow. Even more likely, Wednesday’s statement by the US FOMC is likely to lift global short-end curves if it signals a tighter path ahead (as widely anticipated) that would likely overwhelm any domestic developments.

Apart from high-frequency (and highly volatile) overnight developments, broader market trends are largely in tact. Sovereign yields had been trending higher around the world this Fall as inflation premia are increasingly priced in, with consequent policy rate path expectations being pulled forward at home and abroad (chart 3). This has put shorter yields, in particular, under pressure, in a text-book bear flattener. Risk-off sentiment related to the emergence of the Omicron variant has offset this only marginally in bond markets.

THE DETAILS: WINDFALLS AND SPENDTHRIFTS…FOR NOW

The economic outlook offers few surprises. Nominal economic output is about 3 ppts higher this year (and 0.6 ppts next year) relative to expectations in last Spring’s Budget 2021, owing to a stronger underlying recovery (aided by higher vaccination rates) and emerging price pressures (the outlook for CPI in 2022 is a full percentage point higher at 3%). Activity in real terms has taken a hit in the near term from supply constraints, but pent-up demand is expected to fuel a longer tail to the recovery.

Stronger nominal economic growth has driven revenue windfalls. Revenue over-performance relative to Budget 2021 is expected to amount to $107 bn by FY26, with much of it frontloaded this year and next. This is driven in the near term by tax gains that had been well-channeled by earlier provincial updates. Expenditures over this period are forecast to increase by $15 bn. The net five-year impact would have been $91 bn less in primary deficit needs, before accounting for $71 bn tallied in the Update.

This drives a very modest improvement to the bottom line in the near term. This year’s deficit is expected to land at -5.8% of GDP—a 0.4 ppt improvement relative to earlier forecasts—for a 9 ppt contraction relative to last year. The difference narrows over the horizon to -0.4% of GDP by FY27 (again chart 1).

A sharply contracting deficit should keep rating agencies at bay. They were looking for signs that temporary spending would in fact be temporary. Federal and provincial governments are on track to withdraw a combined 10 ppts in deficit spending by the end of FY22 relative to last year and another 4 ppts by the end of next year. The economic impacts of this rapid withdrawal have been softened (if not entirely negated) by the build-up in savings by households and corporates that are expected to fuel a continued recovery through 2023.

The debt profile is also set on a modestly steeper—but still modest—downward trajectory. The federal accumulated deficit is expected to peak at 48% of GDP this year (FY22)—comfortably below Budget 2021’s projected peak of 51% of GDP—before slowly edging down to 44% by FY27 (again chart 2). Debt servicing costs are expected to tick up only very modestly over the horizon from the current 0.9% of GDP to 1.3% of GDP in FY27, still well-below historic highs above 6% of GDP (chart 4).

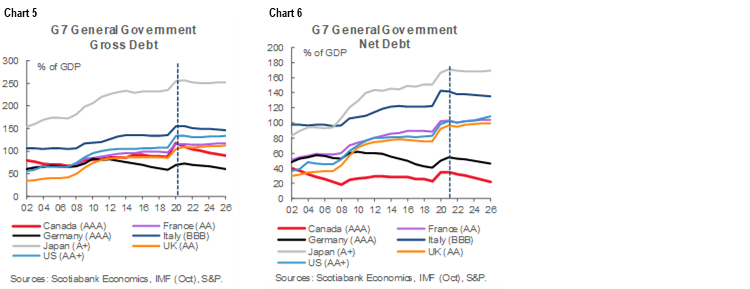

In global markets where it’s all relative—but not equal—Canada’s debt levels are middle-of-the-road. Canada’s general government net debt levels (i.e., federal and provincial debt net of financial assets) confer an advantage over most peers, but its lack of reserve currency status puts a lower tolerance on debt levels (charts 5 & 6). On a flow basis, Canada’s higher discretionary spending (and consequent faster clip of consolidation) relative to most peers places its debt on a slightly more favourable trajectory. Nevertheless, this advantage could rapidly fade if economic growth is much weaker than anticipated, if peers embark on more aggressive consolidation paths, or if more expansive policy shifts take place at home (with elections looming in several major provinces).

For now, markets are not yet discerning much on the basis of fundamentals, particularly in a search-for-yield environment where Canada still offers a yield pick-up. And while Canada may fall shy of gold standards on some debt metrics among a dwindling few of triple rated sovereigns, it offers relative depth and diversity. The appropriate peer group for markets versus rating agencies likely differs in this regard.

BORROWING

Borrowing activity has shifted lower relative to Budget 2021 expectations. With a bit more than a quarter of the fiscal year remaining, the financial requirement for FY22 is now projected at $156 bn—$35 bn less than the Spring projection. The shift flows in equal parts from lower deficit shortfalls, as well as lower non-budgetary items. These developments are broadly consistent with Scotiabank’s Roger Quick who has been tracking a $70 bn shortfall in bond and T-bill fund raising activity since the summer. Gross bond issuance projections have been reduced by $31 bn to $255 bn (of which about 80% has already been issued), while end-of-period T-bill stock projections were reduced by $28 bn. About 45% of bond issuance will be long-bond this year.

Borrowing intentions for next year will only be revealed in the Spring budget, but today’s projected financial requirements hint at very modestly higher than suggested needs relative to prior expectations. The combined changes to budgetary and non-budgetary requirements are projected to be $15 bn higher relative to Spring estimates (mostly highly volatile non-budgetary items). For illustrative purposes only, assuming no change to Treasury bill issuance levels next year, gross bond issuance could be in the order of $245 bn with net market supply broadly neutral relative to FY22 once the Bank of Canada interventions last year are netted out.

TAKE AWAYS

The Update offers no surprises. It offers a slim update that largely refreshes economic and fiscal developments since the last update, with most metrics showing marginal improvements since April’s outlook despite looming uncertainty around the Omicron variant. We interpret this is a pause versus a pivot and expect major election platform pledges to be unveiled in a Spring budget. At this point, inflationary pressures should be showing signs of softening such that a fairly marginal injection of spending (i.e., about 2.5% of GDP over 5 years) only reinforces the current bias of fiscal policy at the federal level that puts greater emphasis on the Bank of Canada to manage a soft exit.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.