TURNING TALK INTO ACTION

- Canada’s Parliament re-convened today with a ceremonial Speech from the Throne delivered by the Governor General.

- The Speech—the third in less than two years—offers no surprises as it echoes the tone and content of the Liberals’ party platform from September’s elections that left the government virtually unchanged.

- A key thrust is “turning talk into action” with a focus on health, affordability, and climate action with passing references to many promises made on the campaign trail.

- The scene-setting script signals more fiscal spending for Canada, but this was largely channeled ahead, so market reactions have been muted—or more likely—eclipsed by other developments.

- The Speech is unlikely to bring the minority government down as it provides plenty of hooks (and too few details) that set the stage for negotiations in the lead-up to a Fall fiscal update.

- With still-choppy waters ahead as economies around the world confront demand-supply imbalances and consequent inflationary pressures, markets will have to wait to hear directly from the Finance Minister how she plans to navigate through them.

BACK TO BUSINESS AS USUAL (SORT OF)

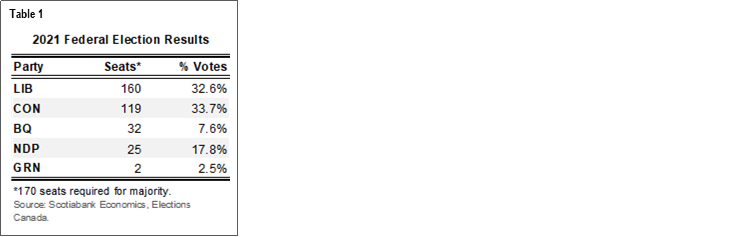

Today’s Speech from the Throne delivered by Governor General Mary Simon officially opened Canada’s 44th Parliament. These speeches traditionally lay out in broad swathes the key priorities that will guide the sitting government’s policy actions (and fiscal spending) over the course of its mandate. This Speech follows September’s federal elections that put the Liberal government back in power with another minority mandate almost identical to the prior one (table 1).

The 26-page document delivered an overarching message of “turning talk into action”. Key ‘chapters’ reflected on health, economic resilience, bolder climate action, safer communities, diversity and inclusion, faster reconciliation, and global security. Economic resilience was couched in affordability terms with child care and housing measures pitched as key pillars of the government’s response. In a sign that some things are going back to normal, talk of “the middle class and people working hard to join it” has returned.

While the Speech provides a first test of confidence in another minority government context, it is unlikely to bring down the government. The Liberals will rely on at least one other major party to sway the vote on spending and legislative matters. For the most part, the NDP is likely to provide this support—much like it did under the previous government—and they would be hard-pressed to find fault with many of the left-leaning priorities laid out today. The government has carefully navigated these waters over the past two years and will likely continue to do so for the next two (though election risk is never off the table in a minority context).

A fiscal update can be expected shortly. With Parliament set to recess on December 17th, a best-guess is that an economic and fiscal baseline would be tabled by the new government in the second week of December. The Liberal party’s election platform promised $78 bn in new measures, offset by $26 bn in revenue-side measures. Only a few priority issues are likely to be fast-tracked this Fall, but it is a reasonable assumption that most platform promises would be rolled out over the course of the mandate with various references throughout the Speech to spend-side measures.

Fiscal pressures on balance likely sit on the upside, but should be relatively contained. There is no shortage of potential pressures: the persistence of the global pandemic, a coalition government with the balance of power on the left, a faster-than-anticipated consolidation at the provincial level, and a leading party with a track record of running modest deficits. On the other hand, Canada’s high vaccination rates, no credible opposition in the wings, resilience in government revenues, and a likely soft fiscal anchor that would see debt eroding over time should provide some counterbalance. We explore these assumptions through the lens of key priorities set out in the Speech.

LIFE AFTER COVID-19

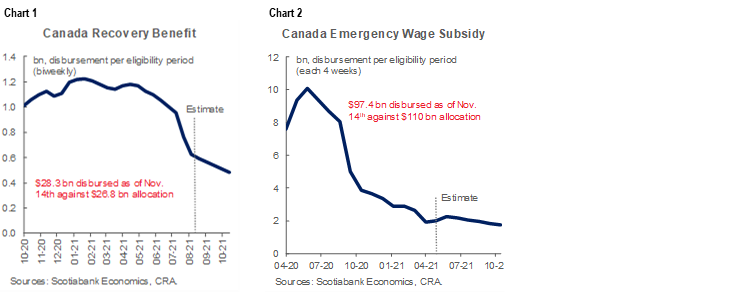

The Speech indicates the government is shifting to a more targeted approach to managing the pandemic. The government had already signaled this last month when the Finance Minister announced victory on the “one million jobs” campaign pledge as job growth surged past pre-pandemic levels. She wound down the Canada Recovery Benefit and substantially refocused the Canada Emergency Wage Subsidy (with smaller, more focused offshoots for harder-hit sectors). The government would still provide income replacement in the event of government-mandated lockdowns, but high vaccination rates across most parts of the country render this unlikely.

These steps likely have minimal impact on the fiscal balance. The programs were slated to expire and had largely exhausted their balances so the wind-down does not provide savings to the bottom line (charts 1 & 2). But it does remove an important upside risk of permanency around pandemic spending, something that rating agencies, in particular, have been monitoring carefully. The NDP leader has indicated he would not support the rollback of these measures, but it would likely receive support from the right.

Otherwise, further pandemic responses on the part of the federal government look to be more circumscribed. The central message today pertained to vaccine roll-outs and mandates, with only a passing reference to recent changes. A nod was made to earlier promises around surgical backlogs, mental health and addiction support.

FURTHER, FASTER ON CLIMATE

Despite a string of strong adjectives, the Speech largely reiterates the government’s well-channeled ambitions on the climate front. By way of a refresher, the Liberals have set targets of net-zero emissions by 2050 and 40–45% reductions by 2030, with carbon taxes carrying the brunt of the effort (topping out at $170 per tonne by 2030 from $40 today). At the recent COP26 meetings, the government reaffirmed its campaign pledge to cap oil and gas emissions with legislated 5-year reduction targets starting in 2025. The party also promised to eliminate oil and gas subsidies by 2023, end thermal exports by 2030, achieve a net-zero electricity grid by 2035, and hit 100% electric vehicle sales by 2035. These targets would be coupled with additional funding for green infrastructure, green retrofits, clean tech investments and tax incentives, as well as transition support for carbon-intensive regions. Funding has already largely been incorporated into the fiscal framework. By the government’s own account, investments in the last year alone total almost $54 bn (and $100 bn since 2015).

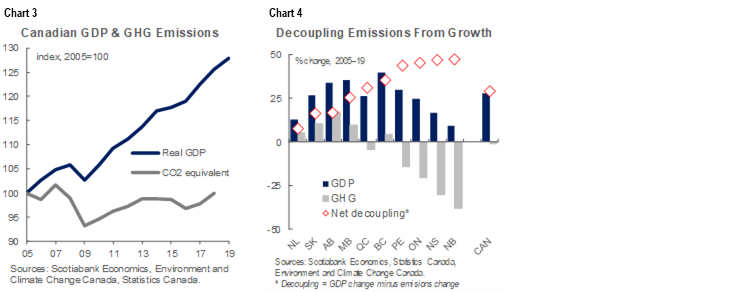

Achieving net-zero by 2050 will require substantially greater decoupling of GHG emissions from economic growth. At a national level, there has already been some progress with GHG emissions largely stabilizing relative to 2005 levels, while GDP has grown by about 25% (chart 3). However progress across provinces is highly variable (chart 4), with a caution that decoupling in some cases has been driven by lower economic growth, not by lower emissions intensity. The biggest gains ahead are likely to come from resource-intensive economies as others would see diminishing marginal improvements over time so any polarization across regions risks progress at the national level.

With the makings of a comprehensive plan on the table, it now comes down to (consultation and) execution for the federal government. There are a host of different pathways to its goals, mostly adhering to the Goldilocks principle: a gradual, inclusive, and credible approach should pose minimal (or even net-positive) economic impacts, whereas a too-fast or too-slow (or otherwise erratic) approach would erode growth. Meanwhile, the appropriate pace will, in part, be calibrated according to the pace of peers. Success hinges more on diplomacy than funding—so this is arguably not a major fiscal risk at this point—but the cost of getting it wrong could be substantial.

Or, in the words of the Speech, it is now about turning talk into action.

ROLLING OUT CHILD CARE

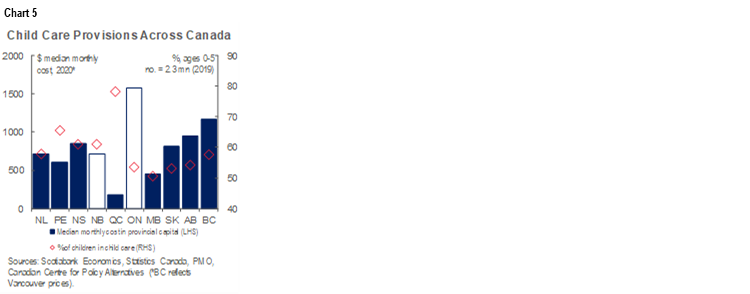

The Speech also touts continued efforts towards a Canada-wide child care plan. Business leaders among others had championed greater support for this issue as the pandemic unfolded last year, laying bare the challenges for working parents. Subsequently, Budget 2021 allocated $30 bn over five years to provide $10 a day child care across the country within five years (with an interim target of halving prices by next year). Since April, the federal government has successfully concluded agreements with eight provinces totalling over $16 bn. Negotiations are well-underway with the remaining two provinces (Ontario and New Brunswick).

This is an impressive feat, but only gets governments to the starting line. Child care costs and funding supports are highly variable across the country from a median monthly cost of $1,578 in Toronto to $181 in Quebec City (chart 5). Negotiated agreements so far across provinces work out to roughly $210 in monthly subsidization per child (ages 0–5). Current provincial (and municipal) spending on childcare is highly opaque, but Quebec reportedly spends $2.7 bn annually on its $8.35 a day child care program, working out very approximately to $550 per month per space. Clearly, more heavy lifting will be required by other provinces where gaps are bigger, even with a federal agreement in place. On the other hand, households with children in these provinces stand to gain more from an affordability boost as early as next year if interim targets are achieved—but this is not going to materially impact inflationary prints any time soon.

HOUSING AFFORDABILITY NOT IMMINENT

It is even more unlikely that promised housing measures would provide near-term relief to inflationary pressures. In fact, housing markets could be stoked at the margins by new demand-side measures including the referenced Rent-to-Own program and changes to the First-Time Home Buyer’s Incentive that would presumably take effect well-before the proposed Housing Accelerator Fund produces more supply.

Nevertheless, the government’s housing supply ambitions are laudable—and essential to a more balanced supply-demand housing environment in Canada. The platform had notionally allocated $4 bn to cities to help achieve an ambitious target to build, preserve or repair 1.4 mn homes over the next four years, which is a vast improvement over its National Housing Strategy which vied to build 160 k new homes. But the past few years highlight federal funding alone is insufficient: the strategy was seeded with $40 bn over 10 years in 2017 with funding commitments growing to $70 bn since then but the policy levers to unlock supply sit largely with sub-national levels of government.

This is yet another part of the Speech where turning talk into action aptly applies.

PROVINCES LEFT COLD

Provinces may be left wanting with this Speech, but this was largely expected. Health care spending is expected to reach $308 bn in 2021 according to the Canadian Institute for Health Information, with provinces shouldering the bulk of these costs. The Parliamentary Budget Officer stresses each year that while Canada’s general government fiscal trajectory is sustainable, the outlook across levels of government tells a different story (chart 6). Premiers have been largely united over the past two years in their call for a permanent increase in the federal share of health costs to 35%, translating into a $28 bn annual increase (and rising) to the Canada Health Transfer which is currently pegged to nominal GDP growth.

The federal government has so far opted for conditional transfers to provinces. This includes exceptional transfers to provinces through the Safe Restart Agreements, fiscal stabilization payments, the new child care transfer, and promised supports for mental health and long term care. Furthermore, the federal government has borne the brunt of the pandemic response with its $335 bn deficit last year versus total provincial shortfalls of $54 bn—almost half of what was initially forecast—giving provinces more breathing room.

While fiscal pressures for provinces may loom over the long term, structural imbalances are unlikely to be addressed any time soon. The Bloc leader has committed to pushing for unconditional structural increases to provinces, but time is likely on the side of the Feds with transfer negotiations often protracted, multi-year affairs. The Speech provides few hooks to kick-start these talks.

ECONOMIC & FISCAL IMPLICATIONS

The Speech suggests no major policy shifts on the economic front. Key policy thrusts focus on structural shifts including child care, housing supply, and climate transitions that should improve growth potential over the medium term, but are unlikely to drive near term activity. And there are still enough caveats around implementation that make it premature to adjust assumptions around the medium term outlook. A host of promised transfers such as the Guaranteed Income Supplement (GIS) to seniors could eventually provide temporary boosts in consumption, if and when implemented, but the impacts on growth would be fleeting.

There is an absence of revenue-side measures in the script. The Liberal platform had largely positioned business as a revenue source, rather than an engine for growth for the most part, for example with a 3% levy on banks and insurance companies. Nevertheless, we expect revenue-side measures are still on the table despite their absence today.

Overall, the Speech reinforces expectations of a modestly looser fiscal position. The Liberals’ election promises amounted to net new spending of $52 bn over five years which would add about 0.5 ppts in net spending this year and next before winding down to an incremental 0.2 ppts by FY26.

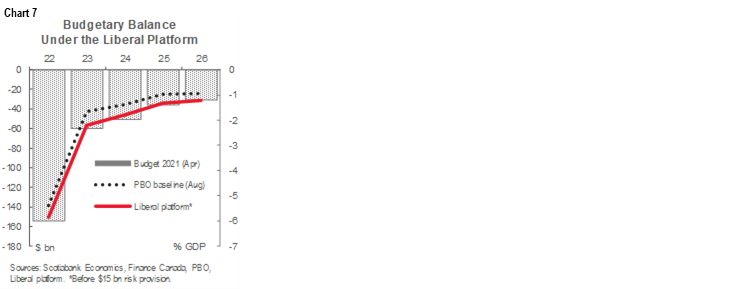

The point of reference matters though: the deficit path may not look much different from Budget 2021. If and when election platforms are legislated and incorporated into baselines, a stronger nominal growth outlook since April would largely offset effects of modestly higher spending. This underscores that the bandwidths around possible shifts in the deficit profile are likely relatively small, i.e., fractions of decimal points over the horizon versus a more substantive deviation. The federal deficit would still be expected to narrow materially this year and next as pandemic programs drop off, landing around -1% of GDP over the medium term (chart 7).

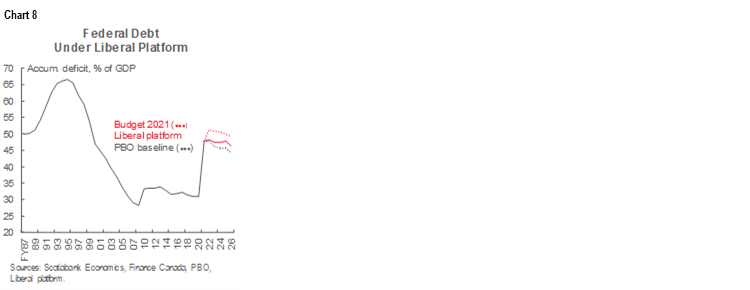

A downward debt trajectory would likely continue to provide a loose fiscal anchor. Heading into the elections, the PBO had been anticipating the federal accumulated deficit would top-out just under 48% of GDP this year—comfortably below Budget 2021’s projected peak of 51% of GDP—before narrowing to 44% of GDP by FY26. Platform commitments would slow the trajectory, but it should nevertheless continue trending downward towards 46% of GDP (chart 8).

The Speech offers few signals that the government would take a more aggressive approach to fiscal consolidation with only an isolated reference to “prudently managing spending”. Admittedly it is rarely the place to signal a shift in fiscal policy, but other signs point to a comfort level with a balance of risk on more versus less fiscal support—even if levels are relatively benign. Markets have so far shrugged off official projections putting federal debt just above 50% of GDP for several updates now since the pandemic struck. There is hardly an imperative from the government’s perspective to put binding constraints on its actions now (whether they should is a different question).

MARKETS PREOCCUPIED ELSEWHERE

Markets are unlikely to put much stock in today’s development. There has been little evidence of sell-off in Canadian bond or currency markets in the immediate aftermath related to Canadian developments. An absence of concrete details today has also likely moderated any reaction as markets have tended to shift only in response to substantive policy announcements, while policy signaling has had no discernable impact beyond reinforcing the directional trend.

In reality, markets are likely focused elsewhere. President Biden’s speech on economic developments today follows on the heels of yesterday’s reappointment of Fed Chair Powell that was interpreted as a more hawkish outcome. Markets are also assessing implications of renewed lockdowns in parts of Europe against signs of higher inflationary pressures, while they are still digesting potential monetary loosening in China. Even closer to home, a simultaneous speech by Bank of Canada’s Deputy Governor on financial stability likely garnered more market attention than the Speech.

Sovereign yields have been trending higher around the world this Fall as inflation premia are priced in. The Government of Canada 10-year bond yield, for example, started the week just above 1.7%—slightly above its pre-pandemic level (chart 9). Unlike this Spring’s bear steepening trends as economies re-opened against an expectation that central banks would stay low-for-long, this Fall’s upticks are bear flattening as markets are rapidly reassessing policy rate paths.

Canada’s divergence relative to US yields has mostly been policy-driven with a lot of volatility around the news cycle. Markets had been pricing in an earlier and more aggressive path of rate hikes by Canada—a position reinforced by the Bank of Canada’s October 27th communications—but developments south of the border since then have narrowed that assessment (chart 10). A more expansive fiscal stance in Canada relative to the US could see that differential open up again, but it would be premature to assume much more spending for Canada, while it could also be premature to write-off additional stimulus in the US just yet.

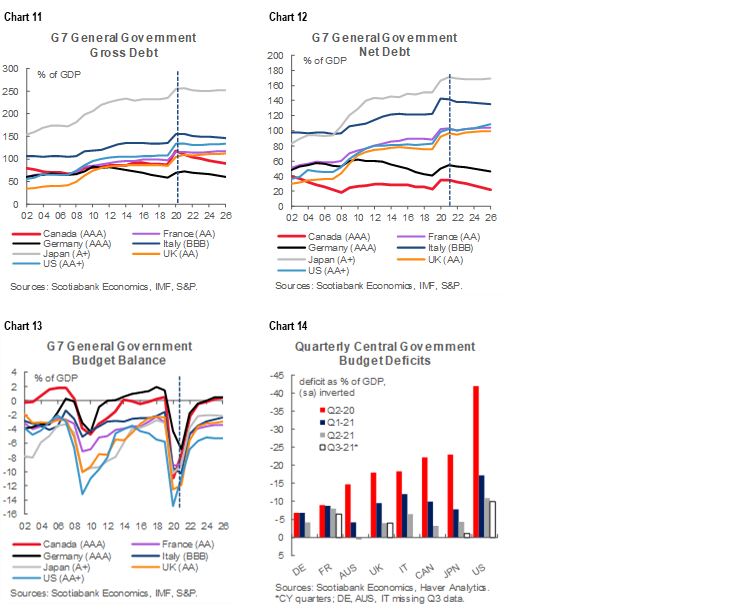

For now, Canada’s fiscal fundamentals still look relatively attractive. As discussed more in depth in our preview, all sovereigns have seen a step change in debt levels. Canada’s general government debt in net and gross terms is unremarkable (again in relative terms), while its debt still offers yield pick-up (charts 11 & 12). Meanwhile, its general government deficit is consolidating at a faster clip than most comparators: the IMF projected Canada should approach balance by 2023—and possibly earlier once recent provincial updates are incorporated (chart 13). Even at the federal level, Canada’s spending is falling back more rapidly than peers; albeit reserve currency status provides more cover for the likes of the US and Japan with the latter about to unleash a new round of stimulus (chart 14).

Nevertheless, the federal government should not rest on its laurels. Pending elections in several major provinces could rapidly shift the landscape, while the longer- term picture looks less favourable for provinces given structural factors. It is a matter of when—not if—Canada will face another recession.

TAKEAWAYS

Overall, the Speech offers no surprises. Priorities had been well-channeled ahead of time, while signature initiatives already have substantial funding behind them. Election promises—if enacted as expected—are fairly marginal (about 2.5% of GDP over 5 years). Markets will have to wait for further details in a fiscal update in the coming weeks, but further upside risks to more spending beyond platform pledges is relatively well-contained in our view.

While the fiscal stance looks neither excessively loose nor excessively restrictive over the medium term (particularly once provincial stances are taken into account), economies around the world including Canada are navigating uncharter waters as sizable demand-supply imbalances persist. With any hope, the oft-wonkish advice to calibrate supports to the economic cycle may carry more weight in these times given the real-world implications. It is a sign of the times when even a speech by the Governor General touches on inflation.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.