Next Week's Risk Dashboard

- How much more confidence will Powell signal?

- ECB to say ‘see ya in September!’

- PBOC to hold ahead of the Third Plenum

- Canadian CPI & the BoC’s next decision

- Canadian inflation expectations likely fell

- US earnings season swings into higher gear

- A big week for BoE watchers

- BoJ hike risk could be informed by CPI

- Are jobs still on fire down under?

- Will Q2 CPI push the RBNZ to ease soon?

- BI, SARB may be inching closer to easing

- US, Canadian retail sales updates

Chart of the Week

The key risk this week might arrive early on when Federal Reserve Chair Powell gets to do a possible retake on his recent Congressional testimonies in the wake of another soft inflation report. With possibly just one little word (being ‘live’), he could set the market tone for the week and beyond.

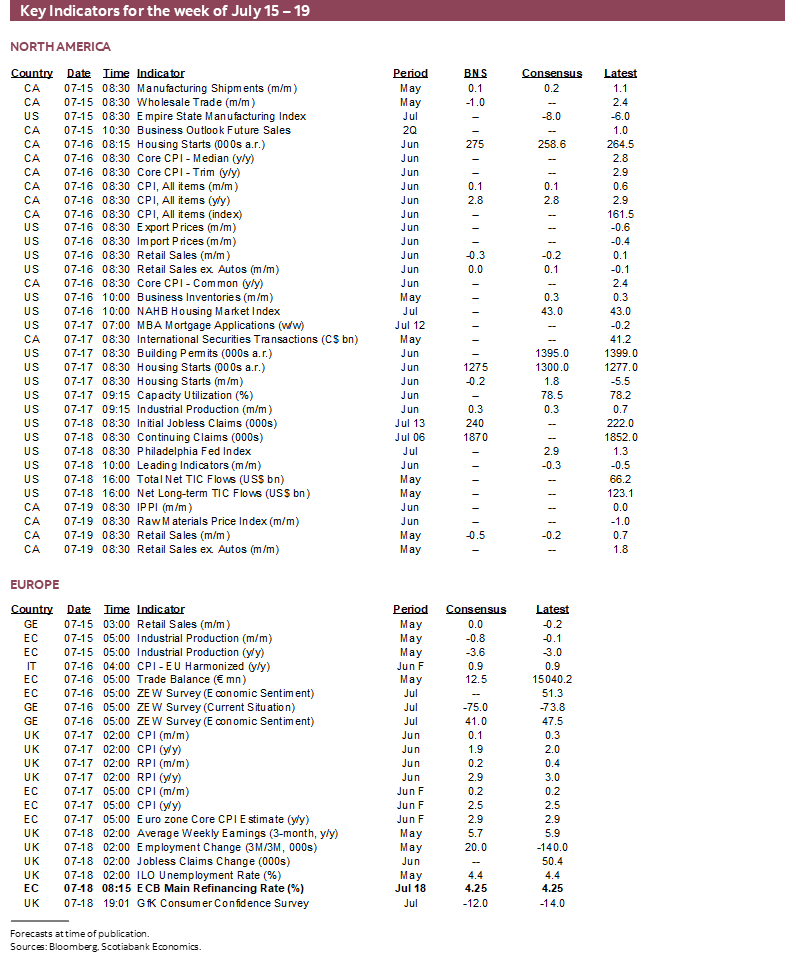

Four central banks will deliver decisions in the wake of Powell’s comments, but none of the ECB, PBOC, BI or SARB are likely to change anything. That means that the rest of the week will focus upon key macro readings across several markets that could be impactful to nearer term market pricing for coming decisions and guidance provided by the Bank of Canada, Bank of England, Bank of Japan, RBNZ and RBA.

Markets and central banks must also keep an eye on rising global shipping costs. They could weigh on relative central bank risks in varying weighs because they are likely to have highly differential effects on relative inflation rates going forward.

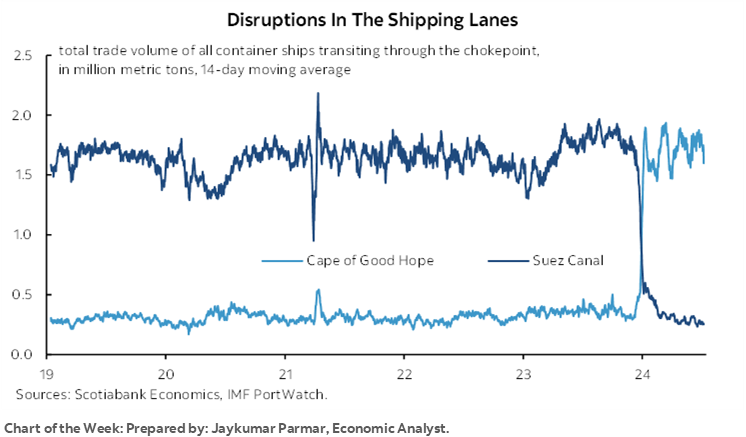

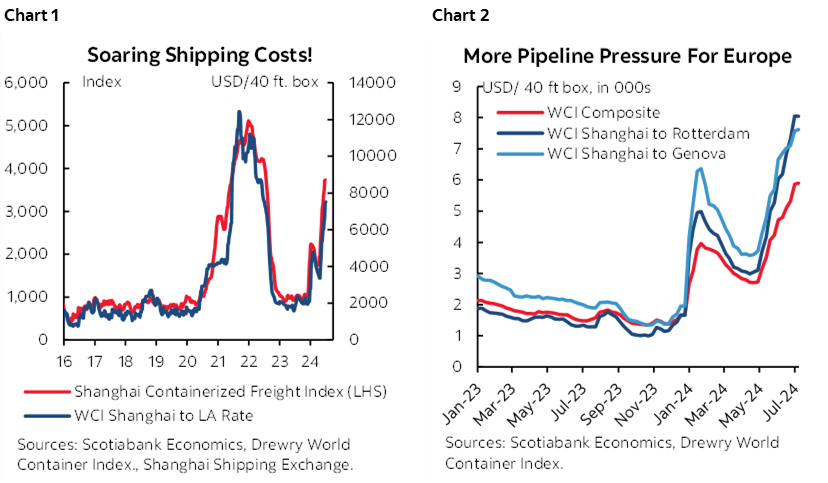

Jay Parmar’s chart of the week on the front cover of this publication shows the magnitude of the trade diversion away from the Red Sea and around Cape Hope so far this year. Ocean transit times have been on the rise once more (here). The longer ocean transit times and higher transportation risks have driven up shipping costs from Asia into N.A. and particularly European ports of entry (charts 1, 2). Narrower gauges, like the Baltic Dry Index that is more aligned with raw materials and commodities, have also risen but not by as much as shipping costs for other goods, namely consumer items.

How this form of geopolitical risk impacts relative central banks is partly dependent upon the degree of openness of their economies, their trade dependence, and the varying risks of pass through into core consumer prices. There is probably small pass through into US consumer inflation (here) that is likely to be dominated by broader developments affecting inflation in the domestic economy. There may be more pass through into regions like the Eurozone, or Canada, both of which have much higher trade dependency as a share of their economies than the US.

DOES POWELL HAVE MORE CONFIDENCE POST-CPI?

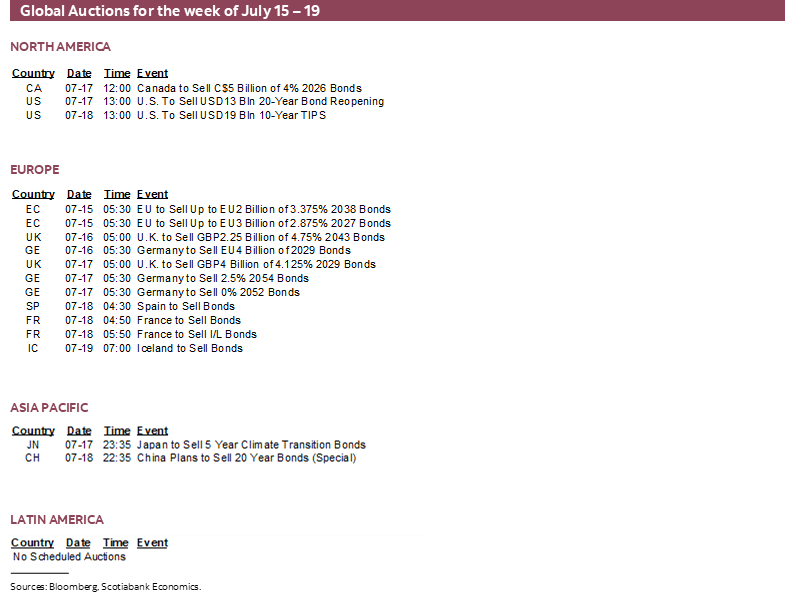

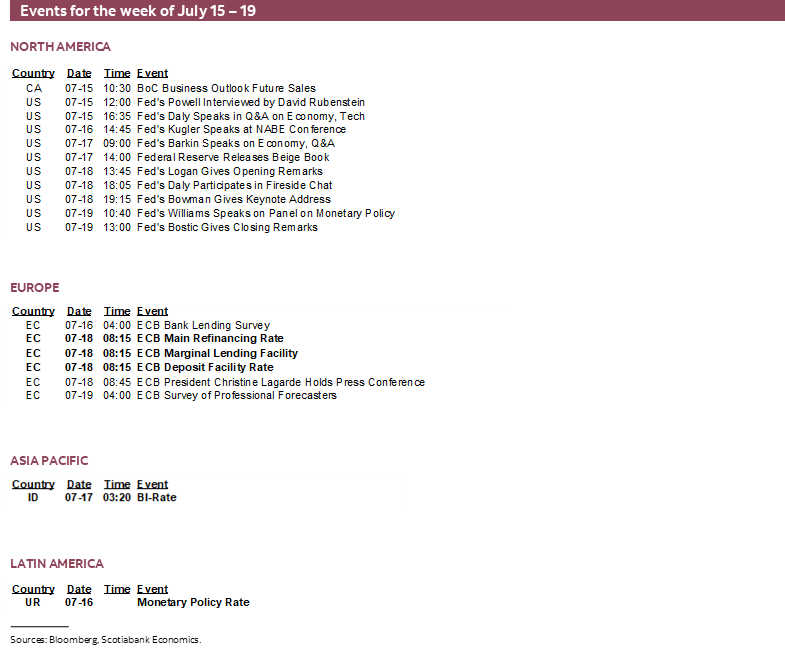

Federal Reserve Chair Powell speaks on Monday, and this could be a key event. He will be interviewed by master interviewer David Rubinstein at the Economic Club of Washington starting at about 12pmET until at most 1:30pmET. I think it will be available here and possibly elsewhere including market platforms.

This event could be key because it’s a chance for Powell to provide fresher insights than what he delivered in two rounds of testimony before Congressional committees this past week before seeing the soft CPI reading (recap here). Those appearances emphasized that the Committee likes the progress it is seeing but wants to see more of it before beginning to ease monetary policy. The CPI reading surprised consensus and markets, sparking a significant rally in Treasury yields and increased pricing for cumulative rate cuts this year.

Key will be two things. Powell could merely say that the recent inflation figures give him and the Committee greater confidence that they are on track toward achieving the dual mandate goals. That would be a dovish signal that would reinforce pricing for a cut by the September meeting and perhaps add to the 50–75bps of cuts that are priced for this year. And yet it may not be sufficient since markets will probably take the comments in stride and then move on to watching two more rounds of CPI, two more rounds of PCE reports, two more jobs reports and a plethora of other developments before the September meeting.

It would certainly be more impactful and aggressive if Powell were to also say that the July meeting will be a so-called ‘live’ one, meaning that the option to cut is on the table. It is not at all priced. It is a tail bet to receive the contract. But this is Powell’s last chance to attempt to influence market pricing before the Committee goes into communications blackout on Saturday July 20th before the July 31st decision.

Powell & Co could alternatively wait until they see the July 26th PCE inflation readings that they prefer. If at that time they feel a need to do so, then clandestine tactics could be used to reach out to major media outlets with a changed message quoting anonymous key Fed officials. This tactic has been previously employed but it is used very rarely.

Our base case is for a first cut at the September meeting and we have greater confidence in this call, as well as greater confidence that a minimum of 50bps of cuts will be delivered by year-end and perhaps 1–2 more. Just bear in mind the risks attached to Powell’s appearance and in the context of the case I laid out in the previously linked CPI note for cutting sooner rather than later.

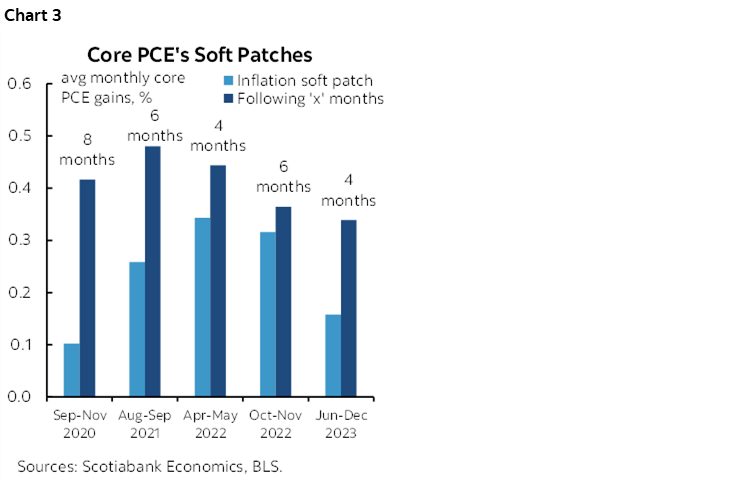

Key is that the fear that this soft patch will give way to renewed acceleration of core inflation measures is probably lower today than in the prior five experiences in the pandemic era given the greater evidence that the US economy and labour market are achieving more balanced conditions compared to prior evidence of excesses. Chart 3 shows these prior soft patches by measuring average m/m core inflation during soft patches of varying lengths labelled on the x-axis and the ensuing rebounds of varying lengths.

CENTRAL BANKS—FED WATCHING

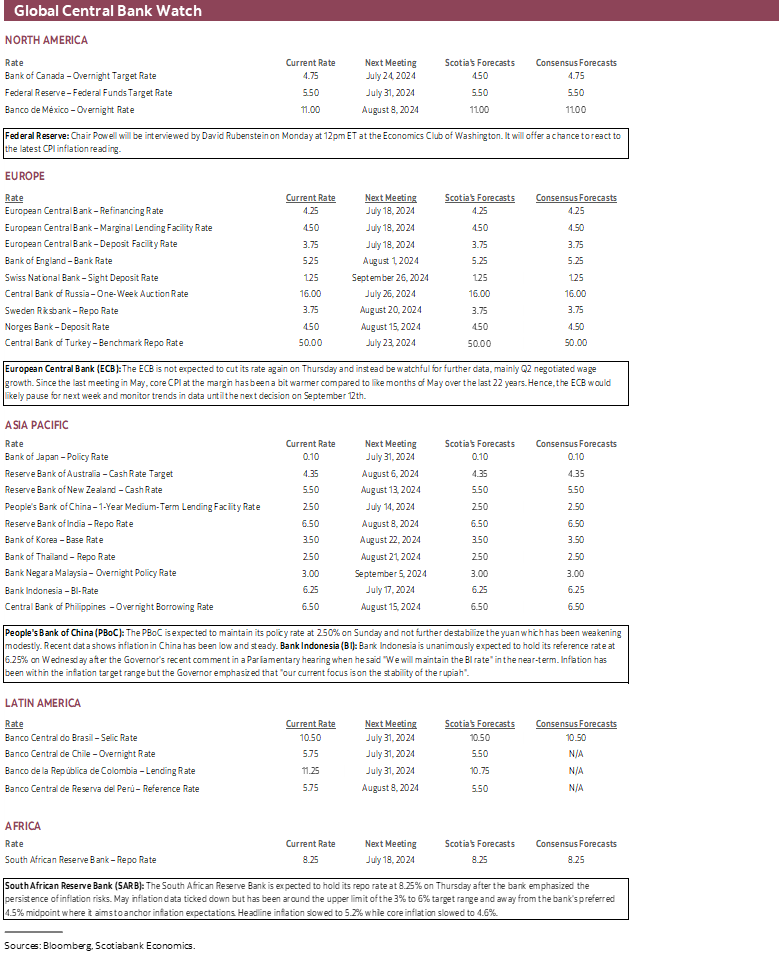

Four central banks will weigh in with decision this week. While two of them (BI and SARB) might be impactful to local markets particularly on any bias signals, the two most influential (ECB and PBOC) are unlikely to do much.

ECB—Enjoy Your Summers!

See ya in September! That will be the main message provided on Thursday when the ECB delivers its latest policy decision and guidance. All of consensus expects no change to the 3.75% deposit facility rate and related rates. Markets are priced for no change at this meeting and most of a quarter point cut at the next meeting on September 12th.

Eurosystem and the ECB staff produced fresh forecasts at the June meeting and the next update is not due until the September meeting. Those forecast updates could inform the ECB’s confidence that further progress toward lower inflation may be justified enough to motivate a second rate cut at that time.

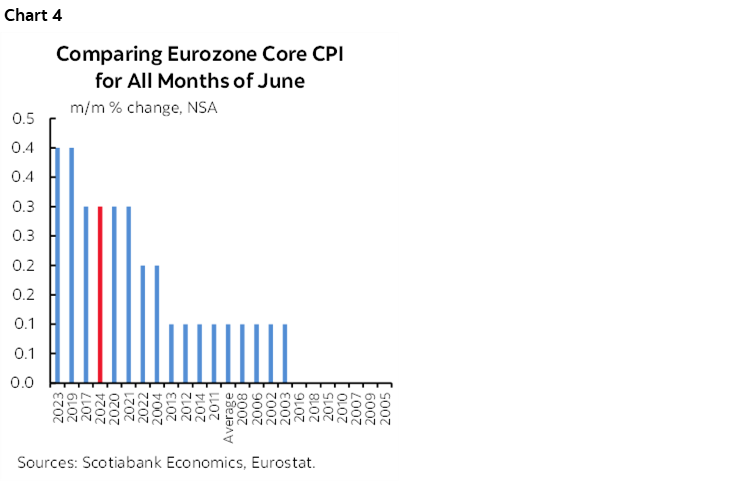

Taking the summer off will give Governing Council a chance to examine two more rounds of inflation before the September meeting. Bear in mind that the pattern—like the UK—has been such that progress toward lower core inflation from early 2023 through to Spring was significantly due to base effects, that such progress has stalled over the past couple of reports, and that m/m pressures remain acute as illustrated by June’s reading (chart 4) which is generally representative of the year as a whole.

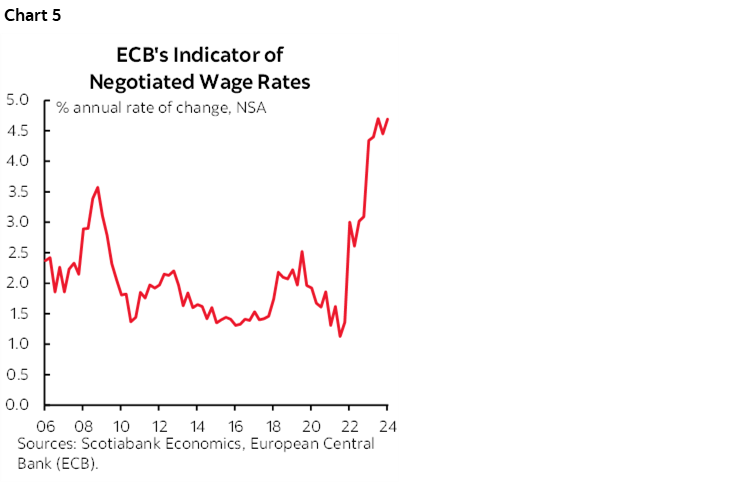

The ECB’s figures for Q2 negotiated wages on August 22nd will also figure prominently in the decision. The pattern to date remained quite hot (chart 5).

Recall that there was widespread sentiment that the main reason that the ECB cut by 25bps in June was, well, because they committed to doing so come heck or high water well in advance and regardless of the merit. The data has not really gone their way since and needs to post material progress to keep the hawks at bay.

PBOC—Credit Easing and Politics to Dominate

The People’s Bank of China is universally expected to hold its 1-year Medium-term Lending Facility Rate unchanged at 2.5% on Sunday evening (ET). That is likely to be followed by little by way of any stimulative policies at a key policy meeting.

The dynamic relative to the Federal Reserve may be shifting in a way that enables more policy flexibility by the PBOC. To date, the central bank has been caught between a rock (very low inflation) and a hard place defined by the potential currency instability if it cut while the Federal Reserve maintains an unchanged stance. If US rate cuts are creeping closer—and depending upon what Chair Powell says on Monday—then there might not be as much danger for the yuan if the PBOC were to show more interest in achieving its 3% inflation target.

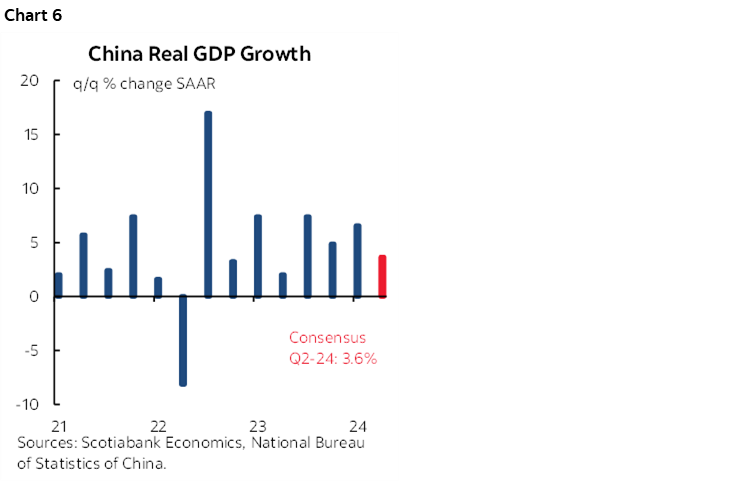

There will also be a batch of key Chinese macroeconomic indicators release on Sunday evening that will be led by Q2 GDP. Cooler growth of around 1% q/q SA nonannualized is expected after three somewhat warmer prior quarters (chart 6). The transition to Q3 GDP tracking will be helped by way of the math behind how Q2 ended for retail sales, industrial production, and investment patterns in June.

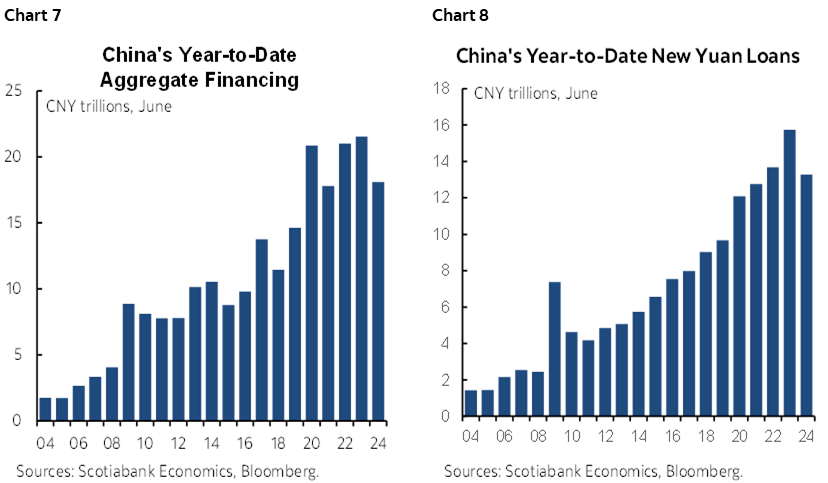

To date, the strategy of relying more upon credit easing than monetary easing has not worked out terribly well. The year-to-date flow of aggregate financing volumes across all lending and market products and the ytd flow for just domestic currency loans have both been materially softer this year (charts 7, 8). Relative to outstandings, there can be no doubt that credit growth continues to decelerate to a rate that would make western lenders salivate but that is relatively slow by the standards and needs of the Chinese economy.

The challenges facing the PBOC could therefore place more policy emphasis upon the Third Plenum of the Chinese Communist Party’s Central Committee’s five-year term from Monday through to Thursday. Watch for announcements on potential reforms amid low expectations. Sparks with China’s trading partners may fly with an agenda emphasizing further investment in cutting-edge technologies and supply chain security as the US, Europe, Canada and others embrace a more protectionist stance toward China.

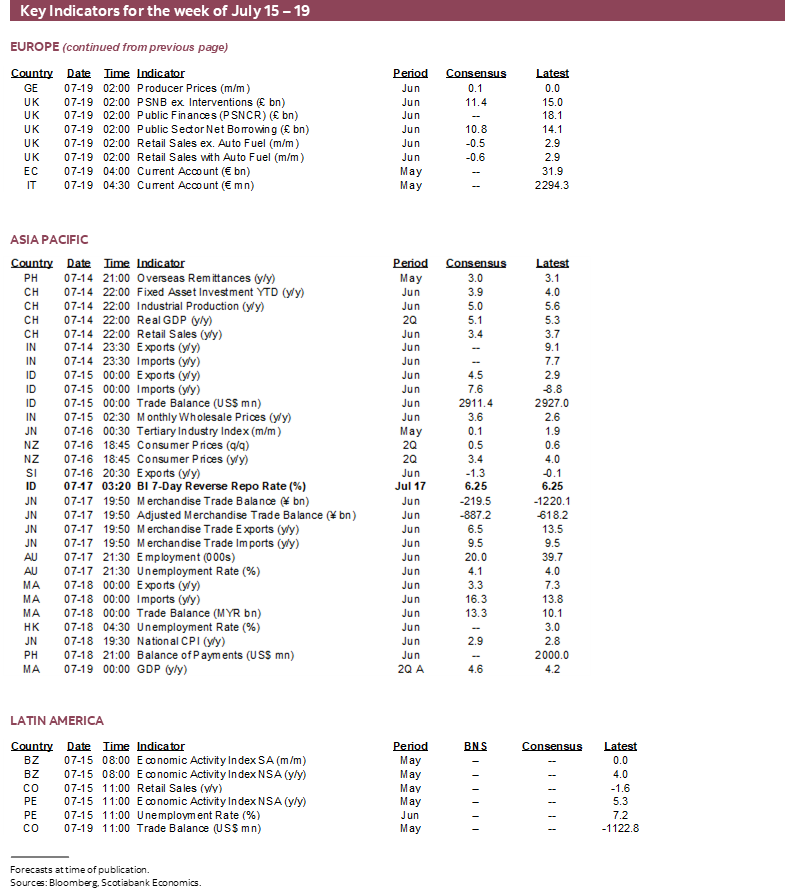

Bank Indonesia—Inching Closer to Cutting?

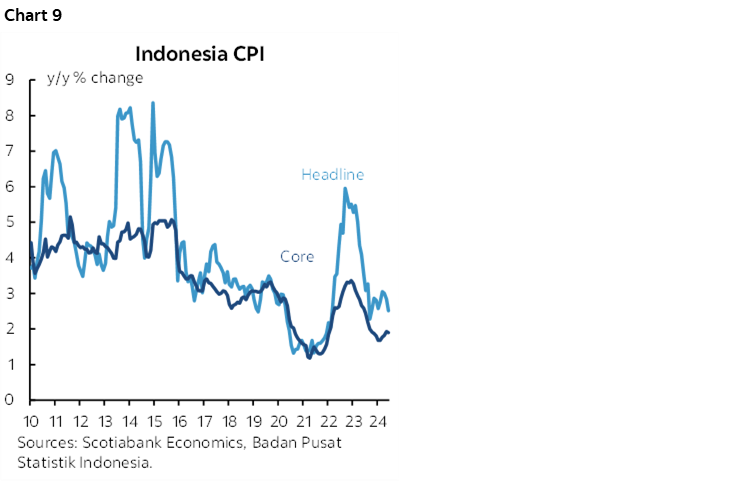

Bank Indonesia is universally expected to maintain its reference rate at 6.25% on Wednesday morning (ET). A factor that has been holding back BI from easing with inflation having now fallen back to 2½% and core at 1.9% y/y (chart 9) has been concern over the potential impact upon the rupiah. Cutting could destabilize the currency and prompt imported inflationary pressures.

That concern may now become less acute. The rupiah has been appreciating to the dollar so far this month as markets have become more optimistic regarding the prospect of rate cuts by the Federal Reserve. BI will probably continue to wait for clearer signals from the Fed, but the story could quickly pivot toward easing.

SARB—Currency Stability Lends Confidence to Future Easing

Most expect South Africa’s central bank to hold its repo average rate at 8.25% on Thursday. Inflation is back within the 3–6% headline target range, but barely so at 5.2% and with core at 4.6%. Progress toward lower inflation has been stymied recently.

Nevertheless, the appreciation of the rand to the dollar since earlier this year as political risk settled down through the formation of a coalition government has offered a mild tightening of financial conditions that could give further confidence toward achieving further progress on inflation in favour with consensus expectations for easing over the second half of this year. A small minority of forecasters think that decision to ease might come as soon as this week.

CANADIAN INFLATION—INFLATION READINGS MAY INFORM JULY CUT PRICING

A one-two punch of inflation readings arrives to start the week and potentially set the stage for the BoC’s decision on July 24th.

BoC Surveys to Show Lower Inflation Expectations

First up will be the Bank of Canada’s Business Outlook Survey, the somewhat more timely Business Leaders’ Pulse, and the Canadian Survey of Consumer Expectations for Q2 on Monday. There are many measures within each survey, but the ones that pop out the most in the present context are the measures of inflation expectations. BoC Governor Macklem consistently has inflation expectations on his short list of considerations to help determine the future path of monetary policy.

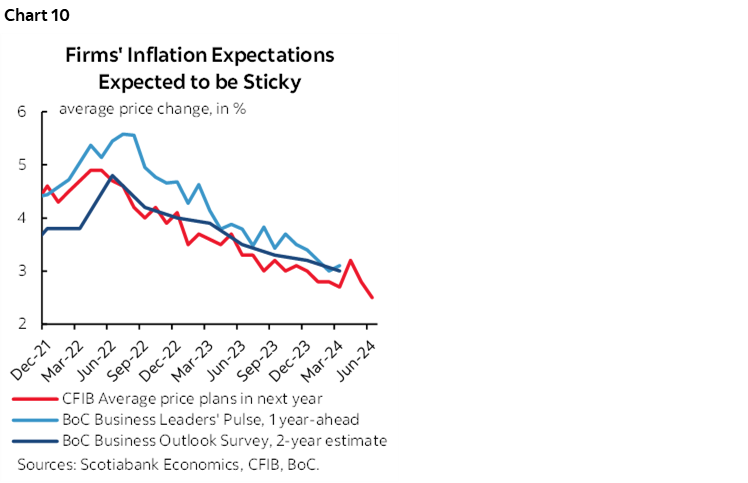

We will probably see these expectations edged a touch lower again. A guide to this is the Canadian Federation of Independent Businesses’ measure of small business price plans. As chart 10 demonstrates, there is a high correlation between the measures of small business price plans and overall business inflation expectations. The BoC’s measures include the 1-year ahead price plans gauge from the timelier Business Leaders’ Pulse survey and the Business Outlook Survey’s 2-year measure. The BoC measures probably won’t fall as much as the CFIB measure did of late because the BoC measures are not quite as fresh.

Still, the BoC’s survey-based measures of inflation expectations could fall to their lowest readings since just before inflation started to really take off in 2021 with both likely to come in under 3%.

CPI: Weak Headline, But Core Will be Key

Then it’s onto actual inflation data when CPI for June arrives on Tuesday. I have estimated little change in total inflation, but the key sensitivity will be what happens to the BoC’s preferred core gauges.

Total CPI is expected to be 0.1% m/m higher in seasonally adjusted and unadjusted terms. Traditional core CPI (ex-food and energy) is expected to be up by 0.2% m/m NSA and 0.3% seasonally adjusted.

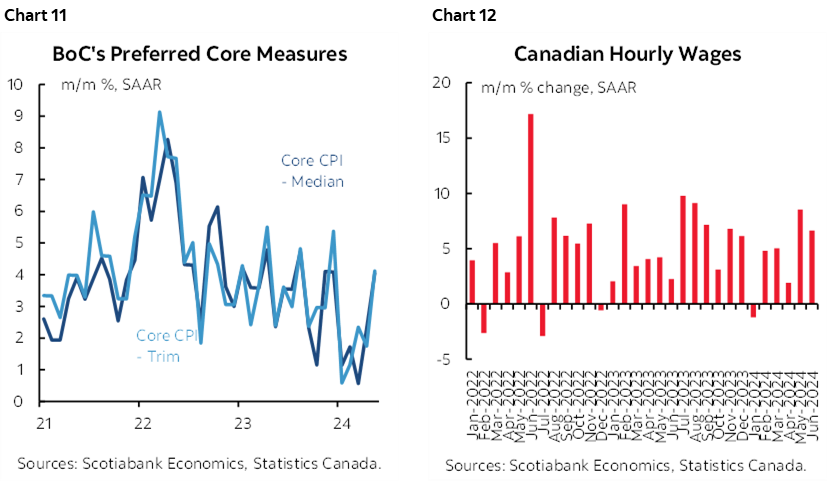

And none of that matters so far. After trimmed mean and weighted median CPI both bounced higher in May (recap here) following a four-month soft patch (chart 11), key will be the July readings. That’s especially true in the wake of strong wage gains in each of the past two months (chart 12).

Unfortunately, it’s virtually impossible to estimate these core gauges in m/m terms which is how to evaluate pressures at the margin that are independent of year-ago base effects.

If it’s another set of the BoC’s preferred core gauges May then maybe Governing Council holds off at its next decision on July 24th. If it’s not, then they could say that core has been soft for most of the year in m/m SAAR terms except for May and carry on cutting.

In a more general sense I think there is a very high bar set against Macklem not cutting again this month. The BoC is convinced that its models will work this time after a rather underwhelming performance throughout the pandemic. They adamantly believe that inflation will durably land on 2% into 2025 and recall that this expectation embeds an unknown and unpublished internal estimate of how much cutting Governing Council could deliver in advance. We’ll see how this unfolds over time, but for now, it is the framework of thinking that is guiding their near-term decisions.

A bigger point is that it’s as clear as day that Macklem is a dove. He lagged on the way up in denial of inflationary pressures while giving speeches on fully inclusive maximum employment and he cut at the first four-month whiff of softening core inflation following a multi-year period of inflation mismanagement. He said it’s reasonable to expect several cuts which he presumably said in reference to the remainder of this year since who knows what next year will bring. He threw caution to the wind on the currency and said the BoC isn’t close to the limit of undershooting the Fed’s policy rate. I don’t believe that and think they are closer than he lets on and that Macklem would get a gusher of a nose bleed if USDCAD climbed anywhere close to some of the most bearish CAD forecasts out there.

So watch data, but be prepared for what the BoC will show in updated MPR forecasts on the 24th, and bear in mind their bias through it all.

RBNZ TO KEEP A CLOSE EYE ON INFLATION

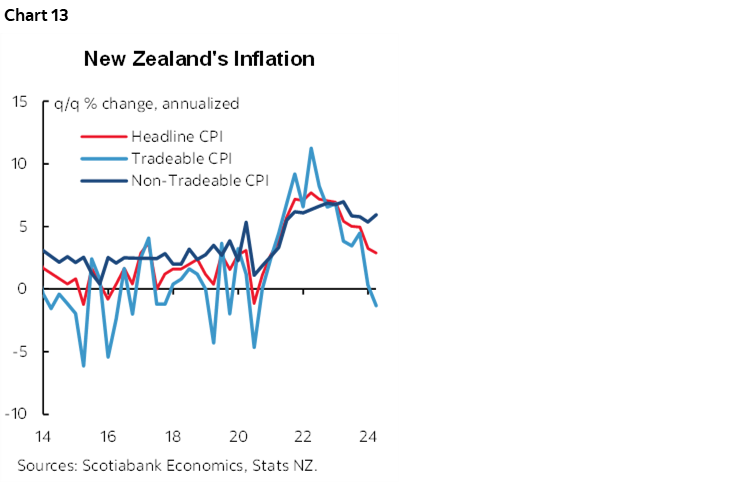

Market expectations for the RBNZ’s next decision on August 14th are bound to be influenced by New Zealand’s Q2 CPI reading on Tuesday. It follows a more dovish than expected message from the central bank this past week and prior softening, though not so much for non-tradeables (chart 13).

That’s when the RBNZ flagged “more evidence of excess productive capacity emerging” aka net excess supply, that they are “confidence that inflation will return to within its 1–3 percent target range over the second half of 2024,” and that “monetary policy is feeding through to domestic demand more strongly than expected.” Words like those drove a rally in kiwi bonds and depreciation of the NZ$.

Should Q2 inflation noticeably decelerate especially in terms of the non tradeable component that is more directly linked to the domestic economy, then markets are likely to more fully price a cut in August when the RBNZ will also update explicit forward guidance. The challenge here is that the RBNZ’s prior explicit forward guidance back in May had indicated that easing wasn’t likely until well into 2025 and so to cut as soon as August would require a sudden, wholesale revision to this guidance. It may be more likely that a softer CPI reading would motivate a change in forward guidance in August that would tee up a cut at the next meeting in October.

IS AUSTRALIA’S JOB MARKET STILL ON FIRE?

Australia updates job growth and related metrics for June on Wednesday night (ET). Their job market has been on fire for an extended period of time.

Australia has created 2.3 million jobs since the pandemic jobs recovery began in May 2020. It is up by 1.43 million jobs relative to just before the pandemic struck. Australia has added 586k jobs since the beginning of 2023 and over 200k in the first five months of this year which puts the country on track toward creating almost half a million jobs this year if the pace continues.

As a consequence, the unemployment rate remains low at 4%, but is a half point higher than the low set in October 2022. That’s because the labour force has also expanded and driven more people looking for work, as measured by the participation rate that remains near a record high at 66.8%.

If the job market remains this tight, then wage growth could also remain strong notwithstanding its recent pullback in Q1 to a still elevated reading (chart 14). Still, the RBA will have more of an eye on Q2 CPI figures on July 30th and then Q2 wages on August 12th with markets pricing little chance of a change in the cash rate until well into 2025.

COULD JAPANESE CPI PUSH THE BOJ TO HIKE IN JULY?

Markets are pricing a decent chance at another Bank of Japan rate hike on July 31st and most of a 10bps hike on September 20th. Thursday evening’s (ET) national CPI reading for June could be impactful.

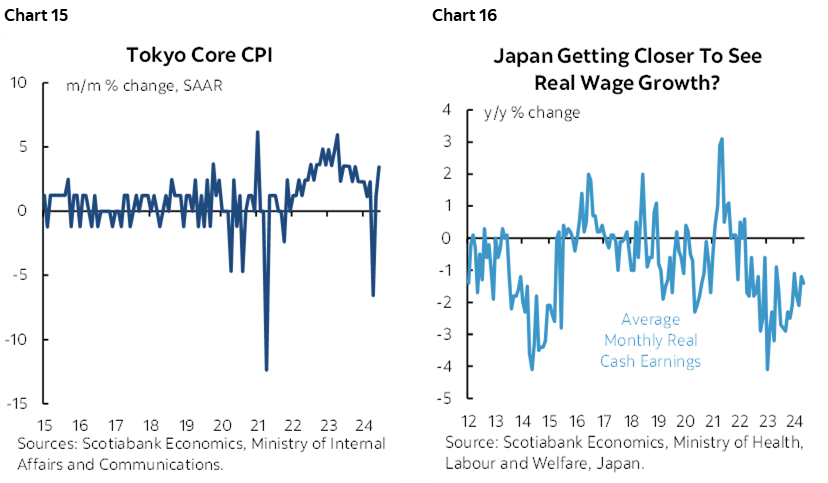

Core inflation had been waning for about a year when measured in m/m SAAR terms, but then popped higher in May’s print. That might not have been just a flash in the pan, since the fresher reading just for the city of Tokyo continued to rebound in June (chart 15). There is also a bit more evidence that perhaps real wage growth is rising (chart 16), although some of that is due to the last two rounds of Shunto wage gains and some of it is due to the prior deceleration in inflation.

A BIG WEEK FOR BOE WATCHERS

The August 1st Bank of England decision has markets on the fence over whether a rate cut will be delivered with about half of a quarter point cut factored in. This week’s figures for labour markets and inflation could tip the balance, but MPC members are not talking as if cutting that soon is likely.

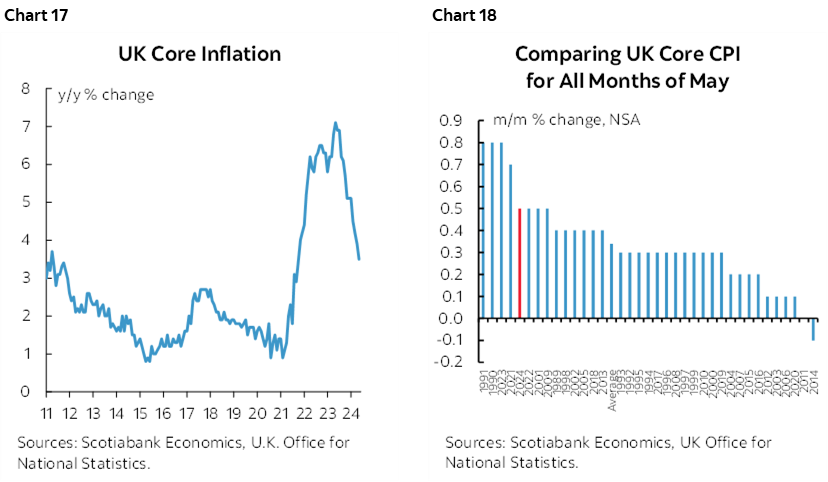

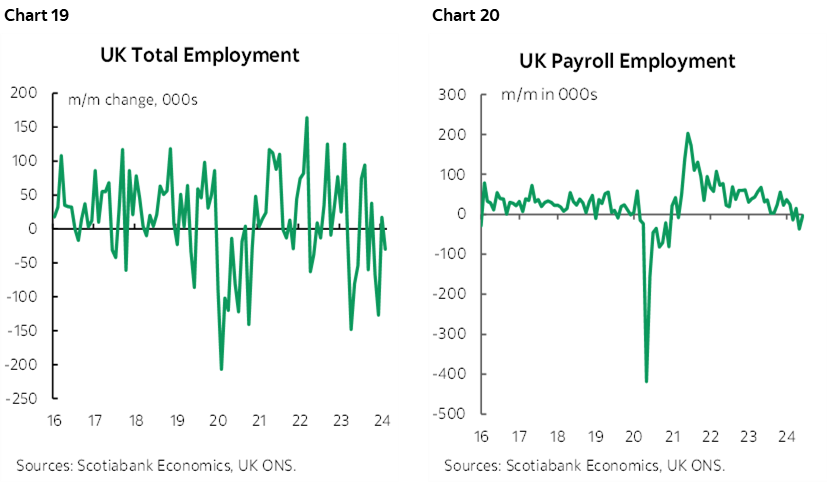

CPI inflation for June arrives first on Wednesday. Core CPI inflation has not been light so far this year. The deceleration in the year-over-year rate to 3.5% (chart 17) has been significantly driven by year-ago base effects. By contrast, month-over-month readings remain hotter in seasonally unadjusted terms than like months in history. May’s readings were an example of this (chart 18), but every month this year has generally followed the same pattern.

There has been somewhat more progress in the job market toward giving the BoE confidence to eventually ease. Total employment has fallen by about 360k since April of last year. About 14k payrolls jobs have been lost this year as the pace has continued to slow since peak hiring in 2021–22. Charts 19–20 show the waning trends for job creation.

OTHER N.A. MACRO REPORTS

Only a handful of other macro releases are due out in the US and Canada this week. More of the attention may be placed upon the US earnings season that continues this week with 45 S&P 500 firms slated to release. The early focus is typically more slanted to financials. Among this week’s names will be Goldman and BlackRock (Monday), BofA and Morgan Stanley (Tuesday), and then Netflix (Thursday).

Retail Sales Rounds out Canadian Indicators

Canadian markets will almost entirely focus upon CPI and the BoC surveys at the start of the week. Only a handful of other readings are on tap.

- Friday’s retail sales during May were previously guided to have slipped in nominal terms, but there is often high revision risk and details like volumes will matter more.

- Manufacturing sales (Monday) were previously guided by Statcan to have been little changed during May and wholesale trade (also Monday, also for May) were guided to have fallen by around 1% m/m.

- Housing starts during June were probably resilient around the prior month’s rebound given the volatile strength in building permits for dwellings so far this year.

Retail Sales Will Be the Key US Release

It will be a light week for US releases as well as most of the focus will be upon what Chair Powell may say on Monday and earnings throughout the week.

- The key reading is likely to be Tuesday’s retail sales during June. They are tracking a little softer given what we know about categories like auto sales and gas prices but core sales (ex-autos and gas) involve more risk around expectations for little change.

- Industrial readings will include the Empire manufacturing report for July (Monday), industrial production during June (Wednesday), and the Philly Fed’s manufacturing gauge on Thursday.

- Housing starts (Wednesday) are generally expected to rise after the 5.5% m/m SA drop in May, but the further weakening in new home sales could extend downside risk.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.