Next Week's Risk Dashboard

- US core CPI may reaccelerate

- French election could impact risk appetite to start the week…

- …as French parties circle the wagons on Le Pen

- US bank earnings season commences

- Powell testimony will be stale on arrival

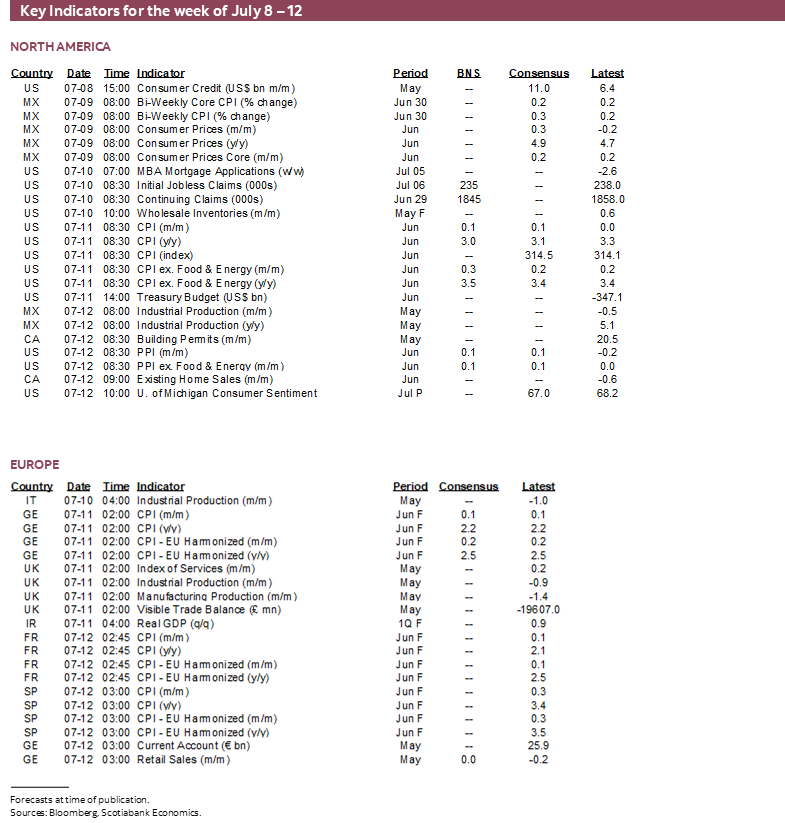

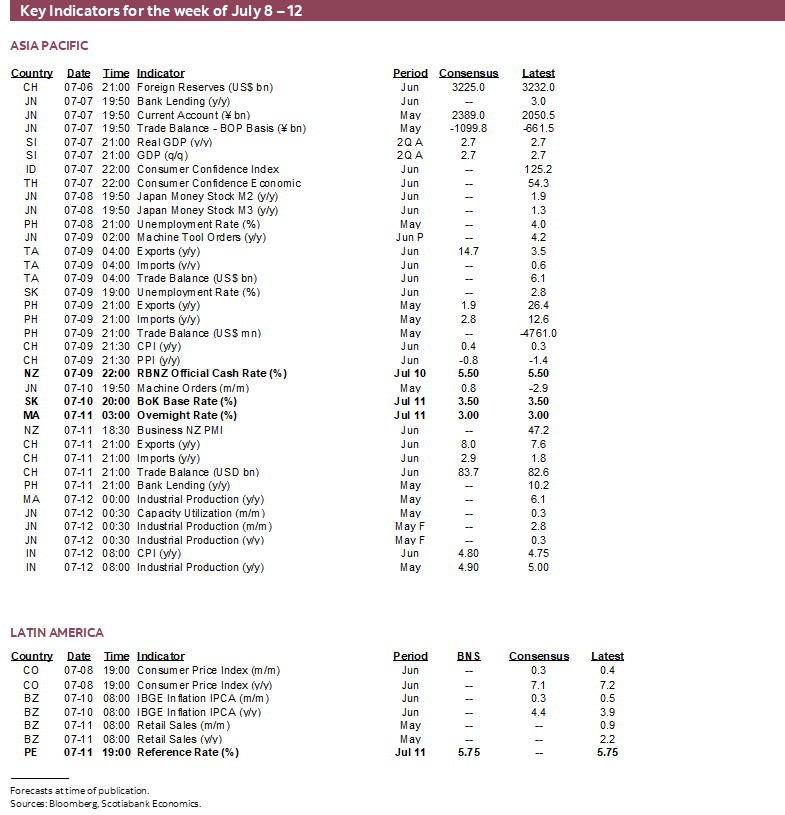

- CPI: China, India, Mexico, Chile, Colombia, Brazil

- RBNZ expected to remain hawkish

- BoK may sound more open to nearer term easing

- Bank Negara likely to remain on hold

- BCRP has a solid case to extend its pause

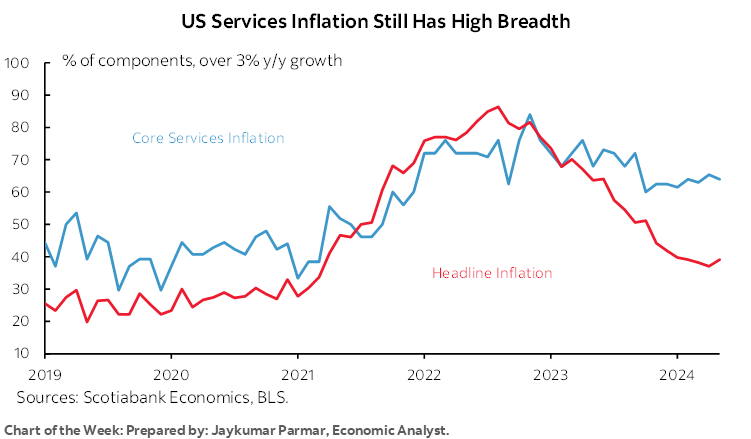

Chart of the Week

The key question overhanging global financial markets this week will be evidence on whether the soft patch in US inflation during May was…dare we say the word…tttttransitory. There is significant reason to believe so. Chair Powell’s two rounds of Congressional testimony could be stale on arrival as they will be delivered before the figures arrive.

Before we get to all of that, the immediate focus to the start of the week will be upon France’s second round elections and the potential market aftermath and now that the UK election is out of the way. If National Rally performs poorly following strategic efforts by other parties to contain its rise, then markets will probably rejoice. If not, then uncertainty premia will rise and it could be a bumpy start for risk appetite to start the week.

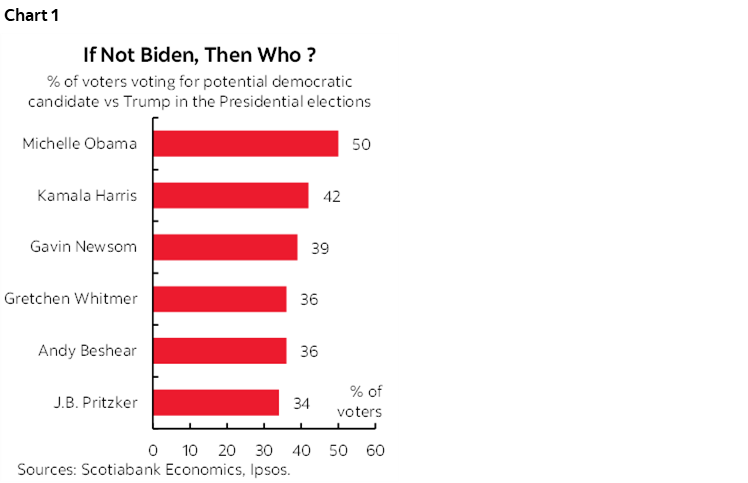

Lurking in the background is ongoing speculation that President Biden may abscond from the race to November despite his recent rebuttals, in which case the polls are showing that only the one Democrat who doesn’t want the job would stand a decent chance at beating Trump (chart 1).

Unforced political errors are therefore looming large over markets. In France’s case, the issue is why on earth Macron called a snap early legislative election after just getting creamed in the EU elections. In the US case, it’s President Biden’s poor debate performance and slipping mental acuity. In the UK, the outgoing Conservatives have made a mess of things ever since the 2016 Brexit vote and before that former PM Cameron’s ill-fated choice to call the referendum.

The start of the US bank earnings season, decisions by four regional central banks (BCRP, RBNZ, BoK and Negara) and macro releases focused upon CPI readings from several other countries will compete for residual attention.

So on we go, tackling the first order concern.

US INFLATION—NOT SO FAST!

CPI inflation for the month of June arrives on Thursday. It could disappoint by pointing to stalled progress.

My estimate is for core CPI to rise by 0.3% m/m SA, or about 3½% m/m at a seasonally adjusted and annualized rate. That’s not blistering, but there is probably more upside than downside risk to this amid high uncertainty given limited advance price signals.

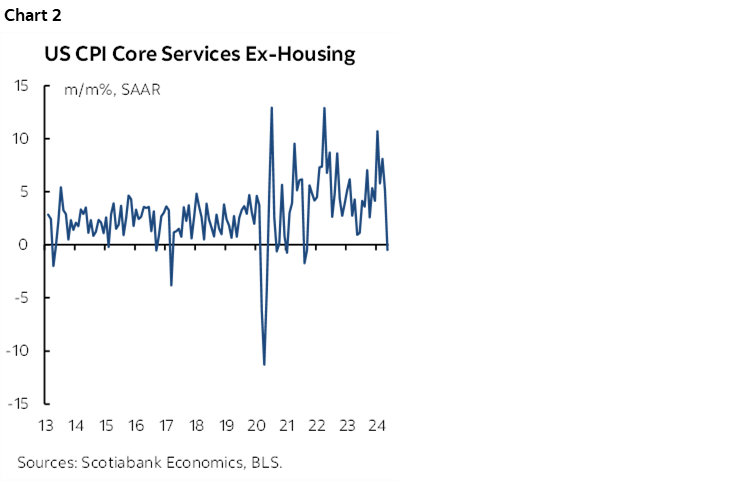

Key is unease toward what will happen to core services inflation. Recall that service price inflation excluding energy services and shelter came to a sudden grinding halt in May when that category fell by 0.5% m/m SAAR (chart 2). That category accounts for about one-quarter of the total CPI basket. When it was rising by 0.4–0.9% m/m SA nonannualized from January through April this category was adding 0.1–0.2% per month to overall CPI and slightly more to core CPI. As the chart shows, this category is very volatile. Sudden large decelerations are commonly followed by large gains.

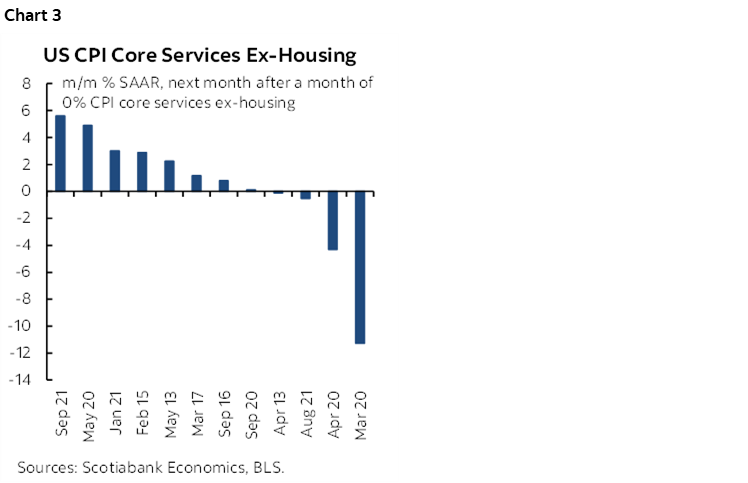

Chart 3 shows what has happened following months when core services CPI ex-housing has landed flat or declined compared to the prior month. It’s not uncommon for the next month to rise from the ashes particularly if the early part of the pandemic is excluded from the sample.

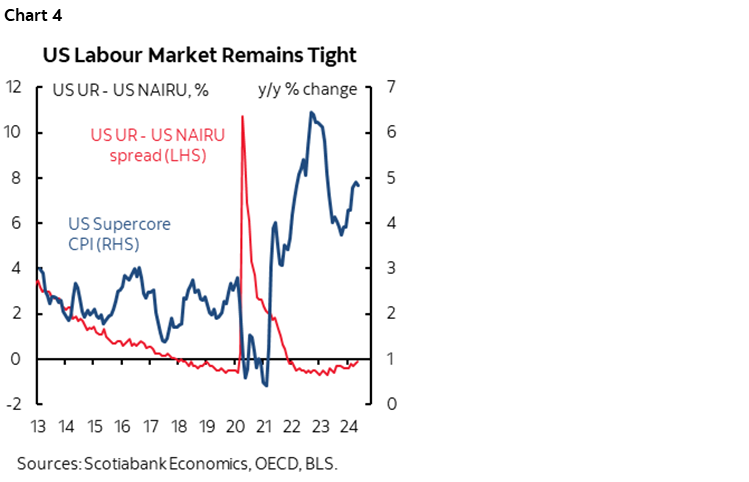

In fact, May’s soft core services ex-housing CPI reading could well have been an anomaly. One driver of this measure of inflation is derived from the labour market that remains tight as indicated by the spread between the unemployment rate and the CBO’s measure of the NAIRU equilibrium unemployment rate (chart 4). Since wages are the biggest component of delivering these types of services, sticky wage growth serves as a significant driver of core services prices.

Other drivers may be more benign. Gasoline prices may knock a tenth or so off of month-over-month headline CPI. Food prices will probably be a benign influence. Ditto for industry tracking of new and used vehicles.

Shelter’s 36% weight in the CPI basket has been a sticky influence with regular monthly advances of 0.4–0.5% m/m SA via roughly equal contributions from rent of primary residence and owners’ equivalent rent of residences. Similar gains are expected this time.

If it’s another cool core CPI reading, then it could fan prospects for late summer easing by the FOMC. A hotter reading would at least temporarily knock back such sentiment, but all would not be lost on the path to the September FOMC. There are two more CPI prints before the September 18th FOMC decision and two more core PCE readings. The Committee would look to the trend while considering the broader suite of evidence that a less restrictive stance may be appropriate if it has confidence that the US economy and labour market are moving away from excess demand imbalances toward achieving its inflation goals into next year.

WHY MARKETS FEAR FRANCE’S NATIONAL RALLY

The second round of France’s legislative elections is on Sunday. I’ll just aim to share some of what I know including by drawing upon numerous sources with a slant toward why financial markets may be worried about the outcome.

French polls close at 8pm Paris time on Sunday night (2pmET) at which point tentative results will be announced. Unlike elsewhere, I understand that these tentative results tend to closely align with final tallies such that the Asian market open into Monday morning should have a very good indication of the outcome.

The key number to watch is that a majority requires 289 seats out of 577. If no party or coalition achieves a majority, then the focus shifts to building coalitions. If the far-right National Rally wins an outright majority, then a hung parliament would result. This could leave Macron with the option of appointing a technical government made up of civil servants perceived to be relatively nonpartisan. It’s uncertain how this would function, but my hunch is probably not very well!

The key market sensitivity is the degree to which the National Rally (Rassemblement National, RN) achieves success. The free-spending and heavily taxing left’s prospects would also frighten markets relative to President Macron’s centrist coalition, but the focus is upon the RN given its performance in the polls. A well written, short piece that reviews Macron’s positive achievements alongside his failure to address fiscal pressures is here and this also provides context for the policy shifts at stake.

Why should markets fear the RN? A starting issue is the wolf in sheep’s clothing perspective. The RN party has a disturbing past traced to its founder, Jean-Marie Le Pen, father of Marine Le Pen who is the current leader. Her father held divisive, xenophobic, antisemitic and anti-EU beliefs. Marine Le Pen previously advocated Frexit—withdrawing from the EU and dropping the euro—but now claims she no longer holds these beliefs perhaps after witnessing the Brexit experience and the resulting political turmoil. She has sought to distance herself from some of her father’s stances and partially re-branded the party. A sense that the apple doesn’t fall far from the tree and the fact that much of the party’s membership and support base hasn’t changed offer cautions against her marketing efforts.

Le Pen has her sights set on the Presidential election in 2027. In the meantime, the RN’s most likely candidate for PM should it win a majority or strike a successful coalition arrangement—unless Macron chooses a technocrat—is an unimpressive, inexperienced 29-year-old Sorbonne drop-out named Jordan Bardella. So-called ‘cohabitation’—when the President and PM are opposed—is a likely outcome. Biographies that I’ve read of Mr. Bardella describe a formative period as an impressionable teen who sought positive reinforcement upon joining the National Front predecessor to the National Rally at the age of 16 and quickly rising within its rebellious ranks.

Bardella’s anti-immigrant stance defies his own roots, as his parents were immigrants who achieved business success in France. An anti-immigrant stance would likely impair growth in the labour force. He is against free trade. He justifies concern for the environment not so much because of concern for the environment per se, but because he points to the associated risk of mass people movement due to climate change which plays to his anti-immigrant bias. He has said he wishes to ‘negotiate’ a cut in France’s contribution to the EU budget. He is inexperienced and lacks a proven ability to work toward a coalition consensus which could mean years of dysfunctional French politics.

RN’s other policy stances would raise risks. For one, it was revealed that Marine Le Pen’s prior campaigns were financed by a Russian bank close to Vladimir Putin and while Le Pen has recently tried to distance herself from Putin there remain legitimate concerns about her party’s Russian ties. One manifestation of this concern is that NR currently opposes Ukraine joining NATO while nevertheless opposing Russia’s invasion.

As The Economist has noted (here), Le Pen’s 2022 Presidential campaign offered over €100 billion in new yearly spending, equating to 3–4% of the economy’s size. A clear campaign update is unavailable, but the party leaders suggest somewhat vaguer nearer term fiscal plans. Recall that in France, the PM has the most control over domestic policy matters whereas external policy is more directed by the President.

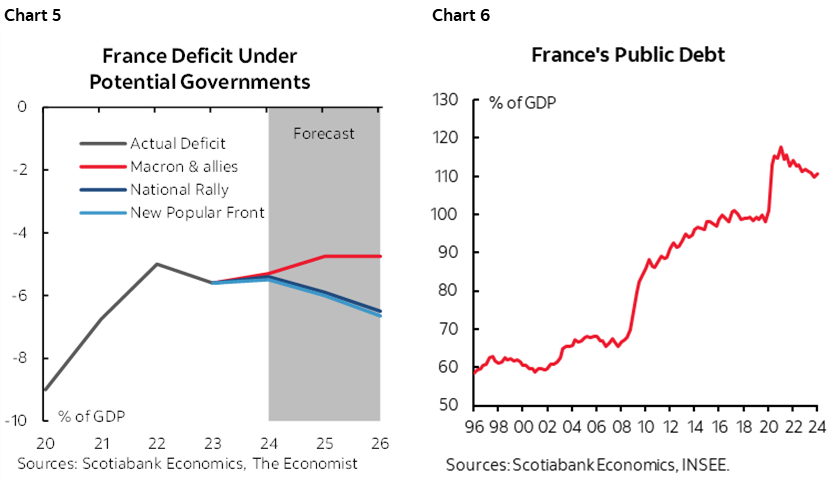

The impact of RN’s pledges on France’s already large fiscal deficits would rival the massive spending of the left wing New Popular Front proving that right and left can be equally ruinous to any nation’s finances (chart 5). NR pledges to cut the VAT on energy to 5½% from 20%. They also seek to cut payroll taxes, reverse pension reforms including cutting the retirement age that Macron had raised in order to address pension funding shortfalls, and with no real plan on how to replace lost government revenues beyond restoring a wealth tax on all assets valued at over €1.3 million. Want to see an equity PM being thrown into convulsions? Just say ‘wealth tax’. Wealth taxes and bigger deficits that add to an already high debt load (chart 6) are hardly music to the market’s ears.

For these reasons, shorting French bonds relative to bunds has been a winning bet since the EU parliamentary elections that started it all. The 10-year spread over bunds has widened from under 50bps before those elections to a peak of about 82bps before recently pulling back somewhat as efforts to rig the election work against a victory by National Rally took root (chart 7). This spread could widen sharply if National Rally achieves an outright majority or even a strong relative majority, but could materially narrow if it experiences a weak outcome and especially if Macron’s party coalition posts a surprisingly strong outcome.

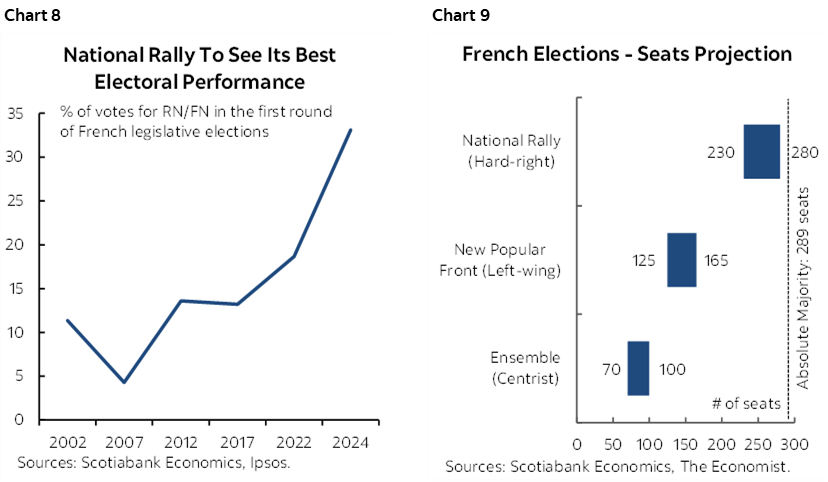

So what do the polls say even if they are imprecise to downright inaccurate at times? After securing the best first-round outcome on record (chart 8) and following strategic positioning by other parties, the freshest seat projections point to National Rally falling short of an absolute majority that requires 289 seats but securing a relative majority nonetheless (chart 9 and here). The ‘Republican Front’ tactic has diminished RN’s chances by having candidates that landed in third place in the first-round elections dropping out in order to solidify support against RN’s candidates. 210 such candidates had dropped out of the second round the last I checked.

CENTRAL BANKS—COULD ONE BOLT FROM THE PACK?

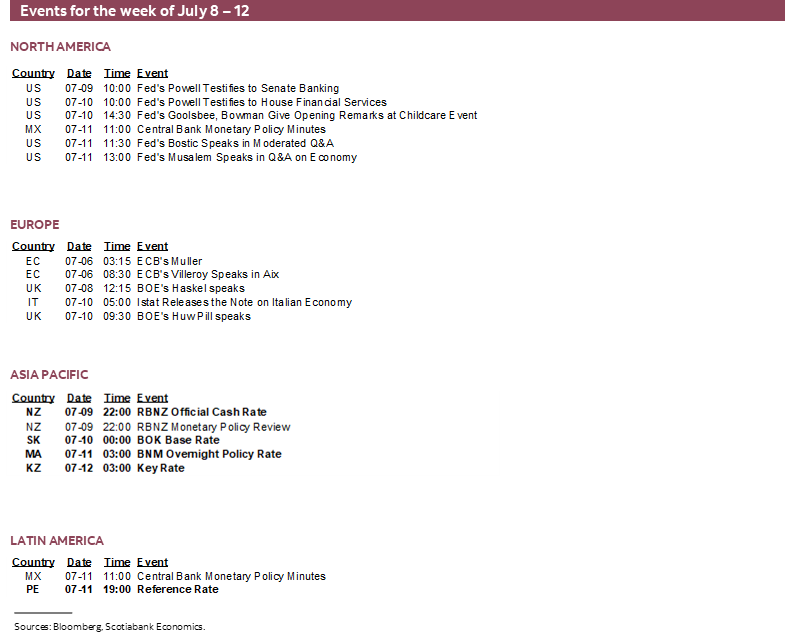

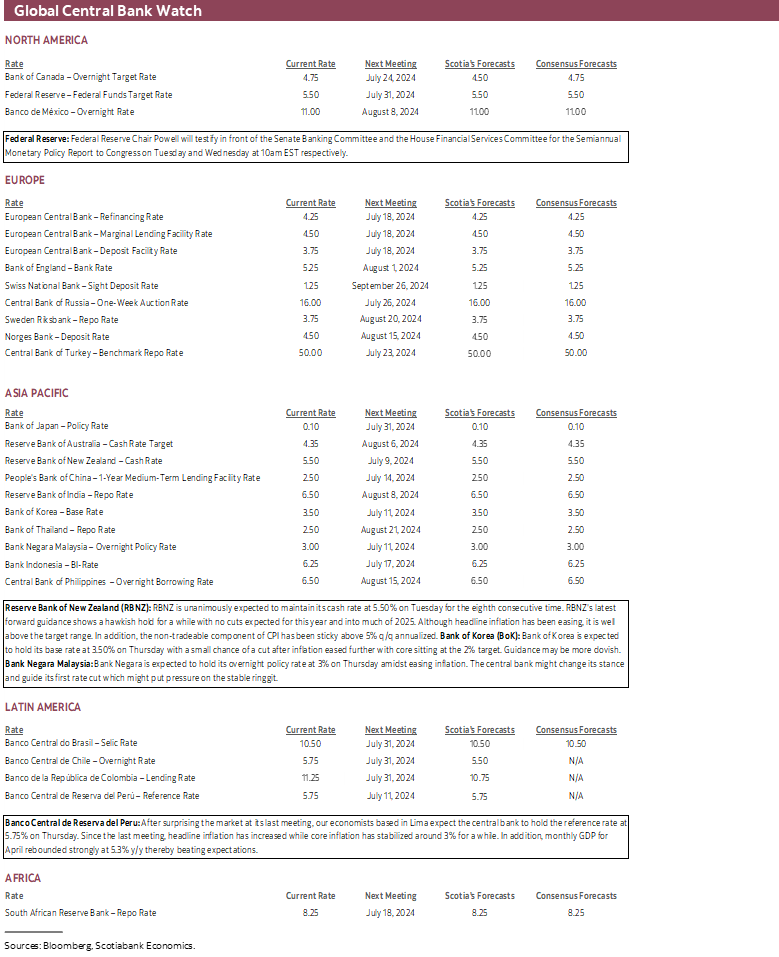

Four regional central bank decisions and testimony from the Federal Reserve Chair will be on display from Tuesday through Thursday. Bank of Korea may be the lone exception in terms of possibly altering its policy stance.

Powell’s Testimony May be Stale on Arrival

Federal Reserve Chair Powell Congressional testimony Tuesday at 10amET before the Senate Banking Committee and the House Financial Services Committee the next day at the same time. The testimony is somewhat awkwardly timed after Powell’s recent comments at the ECB’s Sintra retreat and the minutes to the June FOMC meeting but before CPI on Thursday. Fed communications have made it clear that they are encouraged by recent data particularly on inflation, but that they want to see more of it which means a summer spent watching and waiting. And yet if I’m right on core CPI, then whatever Powell says in his Congressional testimony could become old news rather quickly.

RBNZ—Still a Waiting Game

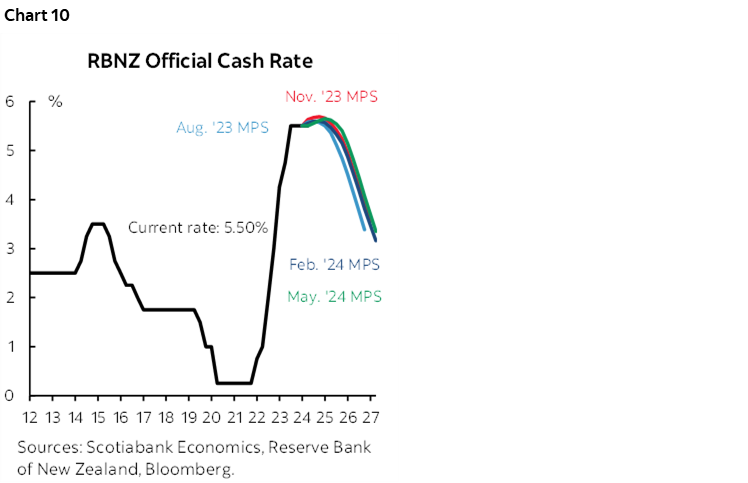

No one expects New Zealand’s central bank to change its cash rate on Tuesday night (ET). Markets are priced for no change at this meeting and only a slim chance at a cut in August before more material cut pricing kicks in from October onward.

This is a market bet against the RBNZ’s guidance not to expect a cut until well into 2025 and at a very modest initial pace (chart 10). The RBNZ’s explicit guidance was provided in the May version of the Monetary Policy Statement but the next update isn’t expected until the August 13th meeting.

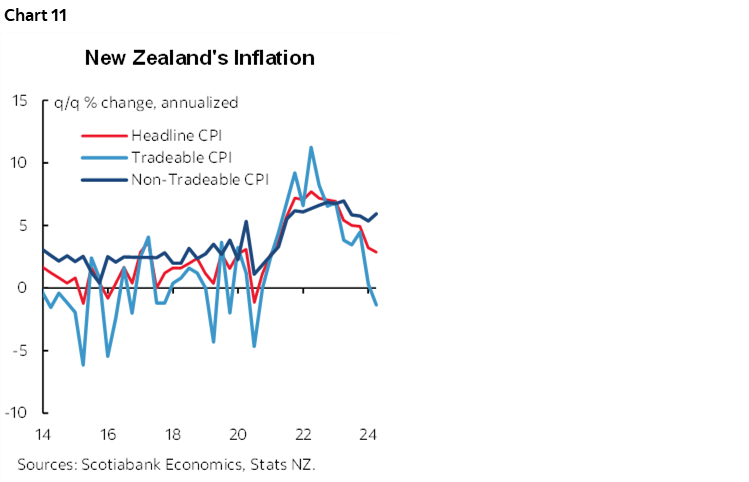

That August meeting will be informed by the July 16th release of Q2 inflation data and particularly the non tradeable component that is more likely to be determined by domestic activity. As chart 11 shows, this measure has not been cooling down to an acceptable rate in keeping with the RBNZ’s overall 2% inflation target.

BCRP—Another Hold

After the surprise hold in June, will Banco Central de Reserva del Peru have enough confidence to resume cutting on Thursday? Probably not is the view of our economists in Lima.

BCRP surprised economists by holding its reference rate unchanged on June 13th. Only three out of a dozen within Bloomberg’s consensus got it right.

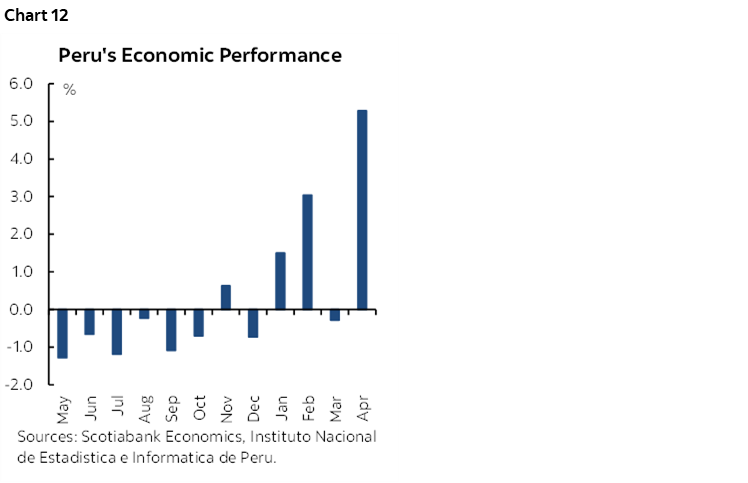

Since then, the unemployment rate fell by a half point to 7.2% in May and CPI accelerated from 2% y/y to 2.3% in June. Core CPI has remained stuck at around 3% y/y throughout this year as progress toward lower readings has stalled. Economic activity has also strongly rebounded of late to the fastest pace since September 2021 which may fan inflation risk (chart 12).

After 200bps of cuts, BCRP may have more flexibility especially in light of mild currency softening since late May and with the Federal Reserve in a data watching holding pattern.

Bank of Korea—Getting Closer

South Korea’s central bank is expected to leave its base rate unchanged at 3.5% on Thursday but with cut risk or at least a somewhat more dovish bias. The BoK has been holding at this level since January of last year. The case for easing is nevertheless rising.

Headline CPI at 2.4% y/y is within spitting distance of the central bank’s 2% target. Core CPI is bang on target.

This is why Governor Rhee Chang-yong noted at the prior meeting that “If there is confidence that inflation stabilizes, the task of normalizing the rate level would need to be started.”

Challenging this perspective is that growth remains resilient. Q1 GDP was up by 1.3% q/q SA nonannualized for the strongest reading since 2021Q4. That pace is not expected to be kept up in Q2 figures with some economists even forecasting a mild dip. In any event, when the BoK revised up its growth forecast on July 2nd, it did not revise up inflation forecasts which signalled that the central bank has confidence that inflation can remain well behaved.

Bank Negara—Riding Along at Pre-Pandemic Norms

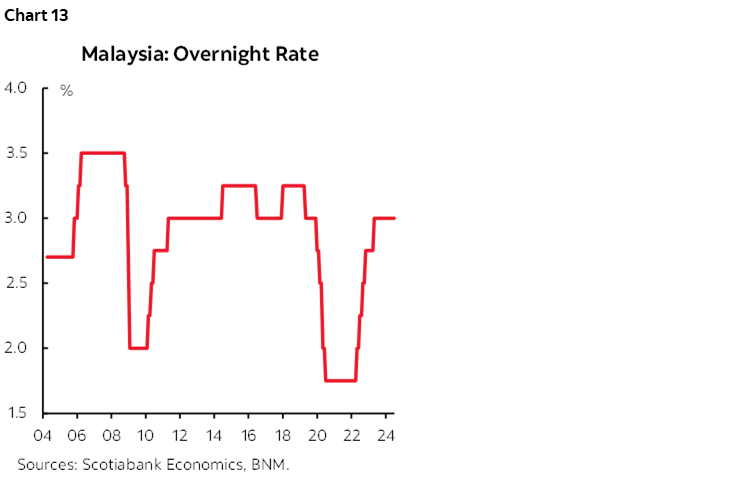

Malaysia’s central bank has been on hold since May of last year and is expected to extend that hold on Thursday. The case for cutting is rising, however, with inflation at 2% y/y and a reasonably stable ringgit.

Still, the policy rate of 3% is not as restrictive as it is for other global central banks. Its present level is roughly in line with the longer-run average since the Global Financial Crisis and more in line with pre-pandemic norms (chart 13). With the Federal Reserve in watch-and-wait mode, Negara is likely to remain nervous about potentially unmooring the ringgit and stoking renewed inflationary pressures.

GLOBAL MACRO—US EARNINGS WILL BE KEY

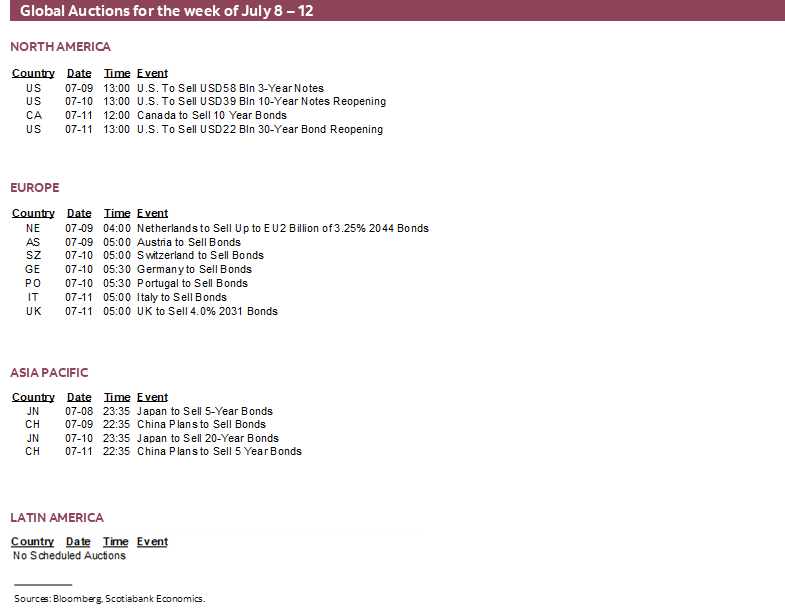

The rest of the global line-up will be rather light this week. Key will be the start of the US earnings season and a batch of inflation readings focused upon Latin America, two of Asia’s biggest economies and the Scandies.

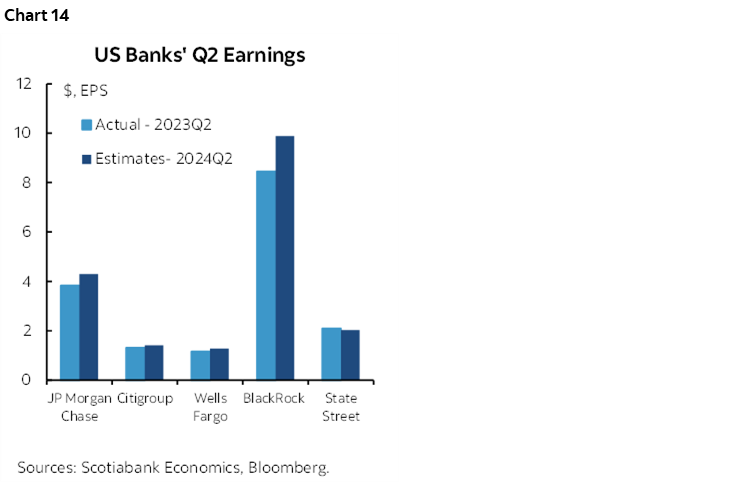

On Friday, several of the top banks in the US will begin the Q2 earnings season in earnest. JP Morgan Chase, Citigroup, Wells Fargo and BoNYM are all due out. Chart 14 shows consensus expectations for earnings per share.

There will be little else for US markets to consider by way of calendar-based risk beyond CPI and Chair Powell’s testimony. Producer prices will extend inflation risk to US markets when June’s reading is offered on Friday along with the University of Michigan’s consumer sentiment reading that same morning.

Canadian market participants itching for some domestic calendar-based macro risk will be left twiddling their thumbs with just existing home sales possibly due out on Friday.

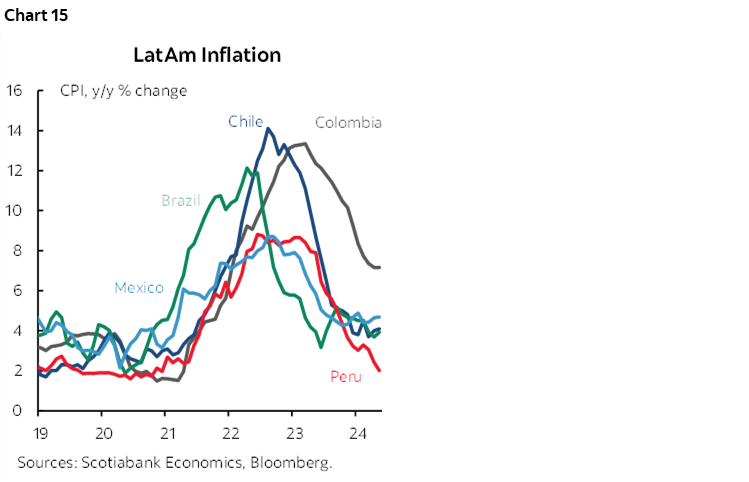

Inflation readings will also come from Chile and Colombia (Monday), Mexico and China (Tuesday), Brazil and Norway (Wednesday), India and Sweden (Friday). Mexican wage growth in June will add to the inflation risk facing Banxico given that it has recently been running at over 9% y/y partly due to policy measures. Chart 15 shows the pattern to date across LatAm inflation readings.

The regular batch of monthly UK releases for May will include GDP, industrial output, the services index and trade all on Thursday.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.